Why it may pay to think beyond the ASX

In recent years, there’s been a growing trend to look beyond our share market in order to generate above-average returns. This is borne out in a report by Morningstar that highlights a noticeable swing to international equities, alternative funds, private equity and commodities.

The Morningstar (Aust.) report notes that the investment management industry in Australia has experienced substantial growth over the past 10 years. In fact, total assets under management have almost doubled from $713.7 billion in 2005 to $1,346.8 billion at the end of 2015. This has been driven primarily by large increases in superannuation assets and positive returns from the underlying asset classes.

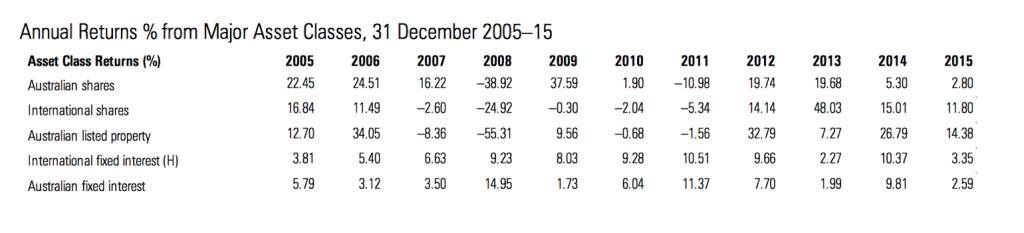

What is interesting is the trend in the allocation within equities over the last six years. As Chart 1 below illustrates, in 2009 Australian equities made up 29 per cent of assets compared with international equities at 18 per cent, but as at the end of 2015 Australian equities had dropped 24 per cent while international equities had jumped to 23 per cent.

Chart 1.

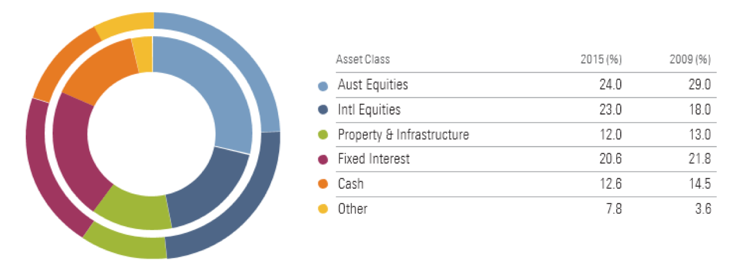

Some of this narrowing between the two asset classes can be attributed to the relative out-performance of international equities over Australian equities during this six–year period. Table 1 lists the calendar year returns from the major asset classes going back to 2005.

Table 1.

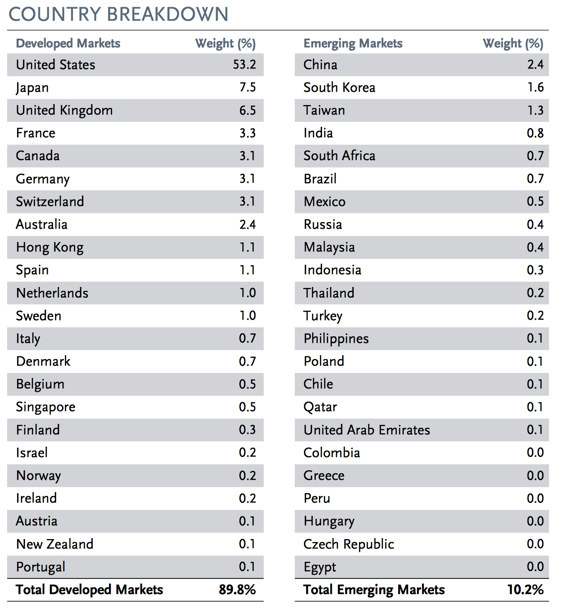

However, a more significant contributor to this narrowing has been the active decision by large super funds to allocate a higher proportion of new monies to global equities. Given the huge inflows into these funds, it seems logical that they cannot continue to chase prices higher in Australia if there exists more compelling opportunities in global markets. When we look at the composition of the MSCI ACWI (Chart 2), which is a market capitalisation weighted index designed to provide a broad measure of equity-market performance throughout the world, we can see that Australia only accounts for 2.4 per cent. Even though we may have a ‘home bias’ and are more comfortable investing in domestic businesses, diverting a higher proportion to international equities would seem a logical investment decision.

However, a more significant contributor to this narrowing has been the active decision by large super funds to allocate a higher proportion of new monies to global equities. Given the huge inflows into these funds, it seems logical that they cannot continue to chase prices higher in Australia if there exists more compelling opportunities in global markets. When we look at the composition of the MSCI ACWI (Chart 2), which is a market capitalisation weighted index designed to provide a broad measure of equity-market performance throughout the world, we can see that Australia only accounts for 2.4 per cent. Even though we may have a ‘home bias’ and are more comfortable investing in domestic businesses, diverting a higher proportion to international equities would seem a logical investment decision.

The other big mover in terms of increased asset allocation over the last 10 years has been the “Other” category, which comprises alternative funds, private equity and commodities.

This perhaps underlines the need for all investors to look beyond our own share market in order to generate better returns.

Chart 2.

Wow, Germany with a population of 81m is only 3.1%, that’s surprising. And USA is 7 times bigger than number 2 Japan.