Are there really five bargains to research further?

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

As you would know from reading Value.able, I am not a fan of the Price to Earnings Ratio. Nothing has changed on that front. Nevertheless, value may just be in the eye of the beholder and not only is the P/E Ratio common in literature about investing and in market commentary, it is, whether rightly or wrongly, in wide use.

Indeed, if you are like many Baby Boomers now on the cusp of selling your business, you will be spending a great deal of time in negotiations and assisting in due diligence to arrive at a simple multiple of earnings.

The humble P/E Ratio may be misused, misunderstood and relied on far too heavily, but popular it remains.

One version of the earnings multiple that is adopted for comparison purposes by private equity buyers is the enterprise model. The enterprise model takes the market value of the equity (market cap) and debt, less cash, and divides the whole lot by the EBITDA (earnings before interest tax depreciation and amortisation). Of course, if you have a company with high operating margins but lots of property, plant and equipment (PP&E) to maintain, you may find the results a little optimistic.

Simply take a standard price to earnings approach, but subtract the cash the company has in the bank.

If you were to buy a business outright, you may take into account the cash the company has in its bank accounts. After buying the business you may be able to access this cash and withdraw it to lower the purchase price. Alternatively, if you are selling a business, in an IPO for example, you may be just as keen to take the cash out before selling it to maximise the return to you and reduce the return available to otherwise anonymous share market investors (this latter strategy is very popular).

The arithmetic result of taking out the cash is a lower P/E multiple. And that is what I thought you may be interested to discuss.

Are there any companies listed in Australia that are trading on very low multiples of earnings once their cash is taken into consideration? The broad based market declines have ensured there are indeed a few.

Step 1

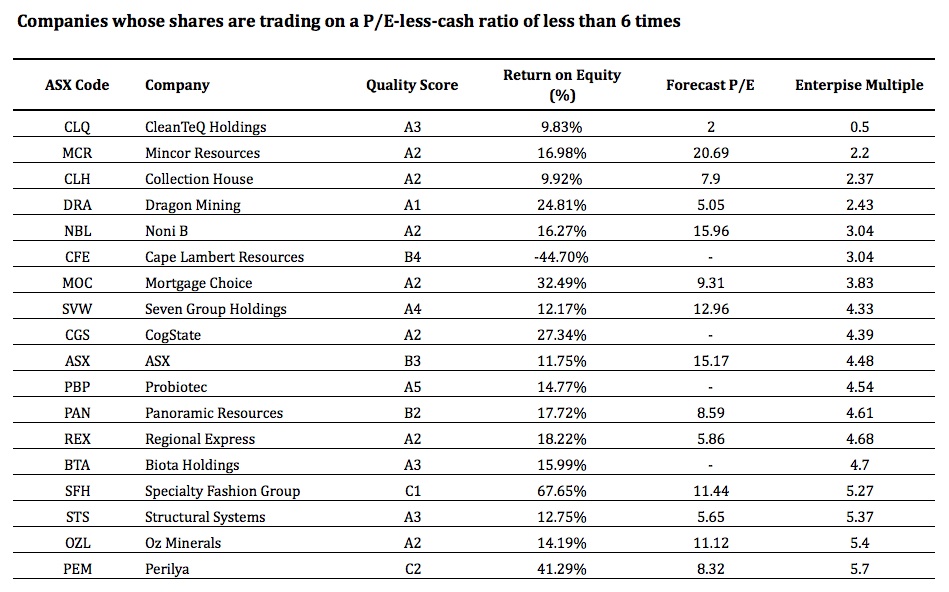

My search began by opening our next-generation A1 service (Value.able Graduates – your exclusive invitation to pre-register is not far away). I applied a filter to discover those companies whose shares were trading at a P/E-less-cash ratio of less than 6 times. From the more than 2000 companies reviewed, there are 18 such companies that meet the criteria today. Keeping in mind some businesses have cash on their balance sheet that would NOT be accessible to a buyer (legislated, regulation or simply working capital needs), here are the eighteen:

Step 2

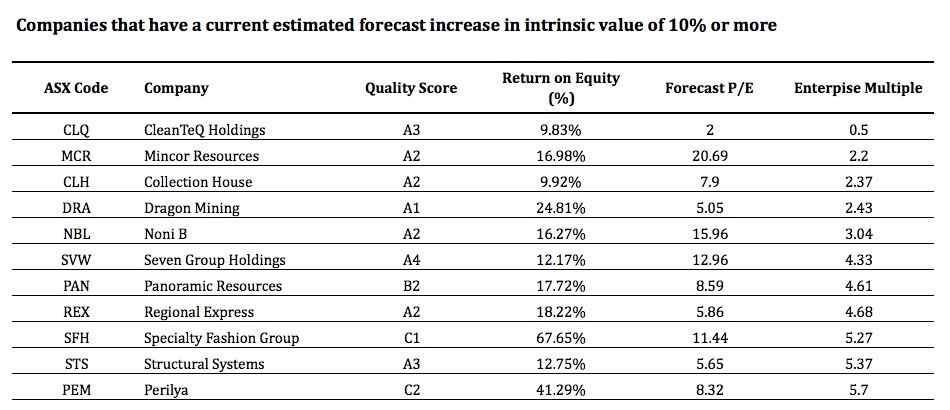

Next, I retained only those companies that have a current estimated forecast increase in intrinsic value of 10% or more. This filter reduced the field to just 11 companies, removing ASX, OZL, CGS, CFE, BTA, PBP AND MOC. Here are the eleven:

Step 3

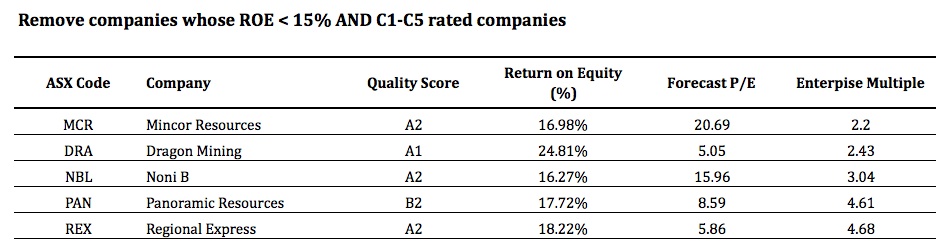

Finally, I removed companies whose previous year’s ROE was less than 15%. I also removed any companies with a C1-C5 Quality Score. Low ROE stocks removed were; CLQ, CLH, SVW AND STS and C-rated companies removed were; SFH AND PEM. That left just five companies. Here they are:

And there you have it, companies trading at enterprise multiples that may be attractive to a buyer who could potentially use the cash on the balance sheet to reduce their purchase price.

Amazing, incredible simple. No manual calculations required (ever again).

Remember, this exercise did not incorporate any of the traditional Value.able investing considerations we usually discuss at the Insights Blog… safety margin, intrinsic value.

For the record, only two of the listed businesses look cheap on the Value.able score today. With reporting season about to begin in ernest, keep in mind the results and cash balances of these companies will all change.

You must do your own research into their prospects and remember to seek and take personal professional advice.

Very soon, finding extraordinary A1 companies offering large safety margins will become simple and even fun. Our next-generation A1 service that my team and I have been tirelessly working on will inspire your investing and re-energise your portfolio.

Value.able Graduates – stay tuned. Your exclusive invitation to pre-register will arrive in your inbox very soon. If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Back to the program… this reporting season, who do you think will surprise with better than expected earnings?

Who do you think will struggle?

And what stocks are looking cheap to you right now?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 29 July 2011.

I’d be interested to know how to use first half results to calculate a valuation.

That has been covered here previously but a refresher from anyone(?) would be great…

I wait with anticipation :D

wish I had the cash to join your well cashed-up fund Roger!…but guess I should have acted & been selling some. A particularly important reporting season so heres hoping for our ivs.

regards rob.c

Remember: Big discounts to IV too.

How are those co’s going for you now???

Wow – that one got through! I think it’s very fussy about comment length, perhaps. Anyway, just writing to say that i’m continuing to use the IV spreadsheet i sent you ages ago. Commsec have updated to the point where they round off to more than 1 significant figure, but negotiating the annual statements is still obviously way better. Just not sure on how to get data to do future IV’s or how to massage half yrly data to get updates. In other news, I’m sadly not teaching any bus maths at present, as i’ve rocketed to the lofty status of acting assist. princ. – in charge of timetabling and staffing. Unbelievably busy. Looking very forward to your new valuing tool – i’m sure it’ll be great. Keep up all your great work, Roger – sometimes your logic is the only reason i keep watching the bus channel!

Thanks Mike. I am sure the kids will benefit from your commitment. You are doing important work. Keep it up for their sakes.

Hi Roger!

I’m that maths teacher from Adelaide! (i’m sure there are others but probably not that enthused about your investment methods!). I’ve been trying to submit comments but there are problems with “cookies” and other techno-confectionery. Very frustrating. If this gets through …….. keep up the great work, Roger!

It got through Mike. As I said a moment ago: You are doing important work. Keep it up for the kids sakes.

Re: NVT

Just had a quick look their FY11 result. I could be wrong, but it doesn’t look like an A1 to me anymore.

A3 Peter.

Thanks for that Roger.

Hi Roger and crew,

Just had a look at Navitas’ annual results. I would be surprised if they held onto an A1 rating. Debt has increased quite a fair amount (maybe acquisition of SAE). Don’t think it will slip too far but not an A1 when/if roger releases his MQRs. I have an IV of $2.89 so under current SP. Anyone else see results or as an IV?

A3 Nic. Good spotting. Quite a proportion coming through already with declines in quality, suprisingly because of acquisitions that aren’t measuring up (yet?)… stay tuned.

Hi Nic,

I came to the same conclusion (see post above yours). In addition to their increased level of debt, their cash flow and current ratio don’t look to flash either. Also note that intangibles are approximately 68% of total assets. In fairness, these numbers are heavily influenced by the SAE acquisition whilst the FY11 result doesn’t include a full year’s earnings from the acquisition. My current IV is $2.91 based on 12% RR with both ROE and IV declining in 2012. All things considered, not too much to get excited about at the moment.

Hi Roger

As the reporting season has commenced, where can we start discussing the results ?

NVT reports its Full Year 2011 result today and I want to post my updated IV calculation and exchange opinions with others.

Thanks!

Hi WIlliam. WIll have something up soon. In the meantime throw it up, under the latest post.

In Canberra for work this week – again – and I can report from the Canberra Centre that JB Hi-Fi is packed with shoppers on a Tuesday lunchtime.

Downstairs at Dick Smith there was only half the traffic. Maybe less.

15 bucks?

Hey, Craig. Thanks for letting me know. I am sure everyone else watching will thank you too.

Roger,

I think quite often on the changes to my investing philosophy since reading your book. I don’t necessarily religiously follow everything you say, but I’ve certainly learnt how to value and consider individual companies rather than consider the share price in the market as an indication of value.

The reason I bring this up is the movement in the sharemarket and my reaction to it.

For the past month we have seen our market decline on investor fears of a US debt default. Tensions were high that we would be plunged into a financial nightmare if this happened.

A deal of sorts was done yesterday morning and our market in reaction, rallied by nearly 2 percent. Expectations were high that the ASX would see another 200 points added over the next week or so. Last night the US futures were showing a potential one and a half percent rise on the Dow based on that deal.

When I woke up for work this morning at 4 am, I saw the Dow down nearly 200 points based on poor manufacturing numbers for the USA. At the end of the session, the DOW closed 11 points down because of those new fears in the market. I note our market, up 80 odd points yesterday, has today opened down 35 points and the SPI sees a 62 point decline. It defies rational explanantion and gives you a “what the..” moment.

I’ve previously published on this blog my portfolio which includes ARB MTU WOW,CBA,MND,BHP, FGE,CTD, and others. Of these ARB and CBA (for example) were up one and a half percent yesterday and are now down one percent this morning despite the fact that nothing at all happened to the output of bull bars last night, or the issuing of bank mortgages.

Now here’s the point of this rant and the reason I owe Roger a big debt of gratitude. These past few months, I have not found myself at all stressed over the mechanics of the market. I’m annoyed that market sentiment distracts from the fundamentals of the companies I have, but because I do thorough research on each of my companies, I am able to assess whether or not business issues will effect my holdings rather than the buying and selling process of the market. As it’s the research that determines the sale process, the only time I take note of price movement is when a price drops to a MOS that triggers a buy transaction.

I contrast this to a friend of mine who has a SMSF portflio (with reasonable companies) who is tearing her hair out at the moment.

The real value of Valu.Able is that at $49.95 it provides a far cheaper confidence boost than any other narcotic I can think of.

Thanks Roger!

Hi Stephen, Thanks for sharing your insights and experiences. I am delighted you’ve ‘got it’. I call it ‘swapping the microscope for the telescope’. Oh, and make sure your friend gets a copy of Value.able before all their hair is gone!

3 out of the 5 are miners so i wouldn’t bite their. Not a fan of Noni B, their products to me don’t scream out as having a particular competitive advantage.

REX i have always found interesting, alas it is an airline so i would not really want to own it. I was catching REX planes for a little bit to Dubbo when i wasn’t getting the train which i was lucky enough to get free rides on.

I can see some advantages there, they operate out of one gate where customers hop on board a bus which ferrys them to the plane, i would expect this would cut down on costs especially in regards to staff needed. The routes are not covered by a lot of competitors (only Qantas offered competing flights to Dubbo for example) and i wouldn’t be surprised if some were monopolies. The country towns people almost used it as their airline of choice over Qantas which i think they saw as the city persons plane. I think there is equity in their brand.

However, is all of the above good enough to ignore the fact that planes and airlines are notoriously expensive to run and costs only looking like increasing. I don’t think so. It may very well be a good airline however that may also be an oxymoron.

My experiences saw a lot of their flights delayed due to maintenance issues as well. The flights seem popular enough however i was only catching these planes on a Friday after business hours and the last flight on a sunday so i may have been experiencing the peak. The service on board is no frills with only oe attendent so i would not be surprised if the costs are very low for this as well.

I will happily let REX fly through to the hangar and instead focus on others. Some of which seem to be getting popular, if only i had the money to invest, especially when i first found them.

Roger

I have bought your book and changed my way of thinking, wow !

I cleaned out 1/2 my super fund of stuff that didn’t make the grade

and bought stuff that did

what a result

Some months ago I sold $111370 of various stocks, value today had I kept them, $107095 down $4275 ie -3.8%

Ok I know the market has been hammered

but I applied those funds to stocks that I assessed from your book

and that new portfolio is worth $110724, down only $647 ie -0.6%

I’m now awaiting the market to go up, and see in time what the comparison is.

I am sure I am speaking for everyone when I ask: What companies have you selected?

After I read your book in June I re-evaluated everything I had. Some were bought after reading your book, others I’d purchased a few months prior but were kept as they fitted the Value.able criteria, and a lot were discarded.

Kept

FGE

IIN

JBH

LYL

MCE

MND

RIO

SOO

TSM

VOC

Biffed

CDD

CHC

CQO

CQR

DMP

IRE

MQG

SXL

TLS

TOL

UGL

WDC

WRT

Even after today I would have been worse off had I not done this.

Thanks Nigel. Well done by the way.

Hi Roger/Grads

SLR– in good buying zone,dont leaveit too late.

P.S. Own the stock

Cheers

Hi Roger,

JBH and CSL would have to be my two favourites at the moment, they are great quality and both are dog stocks as many people fear a retail slump, and the effects of the high dollar on CSL. MQG is also another stock which has been hit from pillar to post, mainly due to all the debt problems we hear every night on the news. The question I would love an answer to is how big of a MOS can one achieve? if only we had a crystal ball that worked! of course everyone should do their own research.

Just had a very quick look at SFH just to see what makes it a C1…..

Please take into consideration that this is the first time I opened an SFH report and know very little about the company apart from a couple of key ratios as given in the last annual report.

From my understanding I think with an ROE of 63% from 2010 we can see the numerical component to the rating.

Thought that it was very interesting to compare it to Oroton. Some salient features are given below (SFH/ORL):

Net profit margin 5.3% / 15.7%

Intangibles as % equity 19% / 1%

Debt/Equity 13.2% / 33.5%

Payments for PP&E as % Op Cash Flow 45% / 37%

Roger Cash flow -6.2 mill./15.3 mill.

Three years ago the Debt/Equity for SFH was over 400%. It looks like they have paid off some debt recently (seems to be from operating profits??) but also taken some significant write-downs to their equity in the last decade. Some other language in the report such as “Deferred lease incentives” as Non-current liability. Not sure what that means.

Overall I can see the C being influenced by the current profitability of the company in terms of the profit margin and cash flow which puts the risk of a liquidity event in terms of the intangibles on the balance sheet.

Will be interesting to see how SFH (and ORL) report (SFH more so as an educational aspect). Am holder of ORL and can definitely see value in the sector (also internationally, Inditex seems a little overvalued for mine) the way things have been travelling the last week or two. Useful little exercise for me, maybe for some other readers?

P.S. Roger, Great photo by the way. Makes you just want to turn the market off and go walkabout doesn’t it? If only the charts could invert and I can live off capital gains for the rest of my life…

I liked it too.

Where did you get that photo ? India Tourism Bureau would be my guess. I feel dirty just looking at it.

It is indeed India David.

Happy to see DRA here I have owned for some time and my IV for it is considerably higher than current SP.

Hi Steve,

Did you just see their latest quarterly result though. Their cash costs blew out to over US$1500 per ounce. They said that they were clearing lower quality piles but still it’s a worry. They also have earmarked US$35m in the next 20 months on expenditure so much of their cash will disappear unless they can get their cash costs down again. You would want some clarity on their cash costs before you can depend on your IV in my opinion.

Roger,

As a recent purchaser of your book, it has opened my eyes and I thank you greatly for it. I now understand what you are talking about during your Tuesday night slots on radio (which, incidentally, is where I learned your book even existed).

Quite fortuitously, I already owned a book titled “The Keynes Mutiny: How the World’s Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market” by Justyn Walsh sitting on my bookshelf that I had never read. After reading your book, I gave The Keynes Mutiny a crack and it was very interesting to see how Keynes evolved from trying to time the market (and losing a bundle) to becoming a value investor (and making a bundle).

One question I have that you (or another poster) might be able to assist me with is in relation to the 100% retained earnings multiplier.

I understand (I think) how the multiplier in the table in your book is calculated which you write is drawn from Simmons but I don’t understand why/how that formula is constructed.

I haven’t bought Simmons book (so it may very well be explained there), but why is that the formula?

It has me stumped!

Regards

Brendan

The alternative is ‘infinite’ Brad. Thanks for your comments.

If only we could solve the St Petersburgh paradox. We would have the answer

As any cyclist knows riding into a headwind isn’t a lot of fun! Sometimes you just have to take the lead and ride at the head of the pack. So after the last 90 days some of the leading contenders for overall Value.able honors have done just that. MCE – 18.34%

JBH – 20.68%

DCG-28.34%

FGE – 10.61%

VOC – 17.47%

MML – 12.45%

ORL – 12.53%

CSL – 10.66%

WBC – 17.79%

DTL – 2.85%

As you can see having a diverse portfolio of stocks doesn’t provide much protection as one would hope. This reinforces the need of ensuring a significant MOS exists before buying stocks .Here’s hoping that the reporting season will provide these stocks with some much needed cover from the varying headwinds that we all face.

Thanks Simon, These are the declines from their all time highs. They obviously aren’t the declines since they were first suggested!

Obviously, lets keep an eye on them Roger & for the moment at least, stay the course. Thanks.

Simon – a lot of the stocks you mentioned were already trading at discounts to intrinsic value even before the recent declines. Many of the A1 and top quality stocks have been hammered hard… most of them more than the rest of the market. So even ensuring you have a big MOS may not be enough in times like this. But, as is often said, value investing is not about the short term and I guess (I’m hoping) in the longer term, we will once again see the benefits

Graham wrote that the owner of equity stocks should regard them first and foremost as conferring part ownership of a business. With that perspective in mind, the stock owner should not be too concerned with erratic fluctuations in stock prices, since in the short run, the stock market behaves like a voting machine, but in the long run it acts like a weighing machine (i.e. its true value will in the long run be reflected in its stock price).

Hi Roger,

Don’t like any of them except Mortgage Choice.

Pros: strong balance sheet, low capex, high dividend yield (yes i know what this does to capital growth but this company needs to pay it out).

Cons: speculative property market growth, growing number of loans in arrears will affect trailing commissions.

Also does anyone know if debt management companies serve as a good hedging tool against a recession?

This is a very interesting blog post, very big thanks. This is an investing principle that I have applied myself a lot, but I use it in a different way to you- I use it to justify more risk (ie if liquidating value is greater than the share price, you can be assured that you will get your money back somehow). I feel like the problem with using the value.able approach to these companies is that if they have such a good return on equity it shouldn’t make sense to build a cash balance. In that case you cannot assume that you can achieve an incremental rate of return on retained profits, and therefore cannot utilise the growth premium in valuing them. In most cases these companies have a reason they are holding on to the cash, and it is not always obvious.

The problem with filters is they don’t pick up a whole lot- and nothing beats trawling through reports yourself. Eg. there are a lot of companies with listed investments that don’t get picked up in the analysts balance sheets. Some miners have significant sellable assets and are trading below the value of the PP&E. Look at what the owners of IDG have managed to do since they bought it some years ago (asset strip very successfully).

Here are some quality companies with significant assets on the balance.

EZL (50% market cap in cash/investments)

MLX (>50% market cap in cash/investments)

CGX (25% market cap cash/investments & I believe listed investments carried on balance sheet at cost price and not current price- though will have to confirm)

ABY (market cap <NTA)

MAQ (25% market cap in cash)

DCG (20% market cap in cash)

There are others but I will leave it to others to find.

Thats great Mal. You won’t hear any disagreement for me. Multivariate stock selecting doesn’t beat reading the annual reports which is why you haven’t ever seen such a post ever before.

Nice to see what lists your service can produce Roger,

I have had a quick look at these and will let them go through to the keeper.

Good to be tantalised by what your new service can do though.

Keep up the good work

Thanks Ash,

It was however a genuine attempt to see what the sell may be throwing off for those who follow the enterprise multiple method – private equity for example.

Hi Guys

I read the book a couple of months ago So still pretty much a newbie. I would like to contribute to the blog but still don’t have a grasp of the market yet to be confident in publishing my thoughts.

I will still take notes of the savvy ones out there. The learning curve has been pretty acute.

Could someone please let me know when the reporting season will be in full swing.

Cheers

Mike

It all starts next week and the week after in ernest.

excited for JBH’s and BHP’s earnings :D

Hi Mike, and welcome to the blog.

Don’t be shy, even if you are asking for help about a concept. Sometimes you might be able to spot particular things the rest of us who have been here for a while might miss because you are new to it.

A new set of unbiased eyes contributing their thoughts are sometimes the best thing for raising new information. I have seen it myself where someone will be looking at something for a long time and can’t find what they are looking for and then someone new comes in and finds it in 30 seconds.

Look forward to hearing more from you Mike.

I’ve been watching Credit Corp (CCP) for awhile and at $4.27 seem good value. I have them at ~ $6 (12%RR) for 2011 and ~$7.50 for 2012.

Net debt at 35% in H12011 has been reducing and cash flow is also good. I also like the management and they’re reporting style.

Would like to hear other opinions on CCP.

Regards, Matt

I have CCP and also see it at a good discount; some have reservations due to their previous problems and current litigation. It could be a positive for the share price once that’s resolved.

There are informative previous posts which go into it in detail.

Hi Roger

Well you have given me something else to think about! Don’t know whether I can keep up! But what is ‘Enterprise multiple’ in the last column? And how do you get the forecast P/E Ratio (which is more than 6 in many of your cases)? Sorry these may seem like dumb questions, but I’m not an accountant.

Eagerly anticipating your new A1 service.

Cheers

Liz

Hi Liz,

I have deliberately kept the post light on calculation but think of a P/E ratio but use market cap instead of price and then subtract the cash before dividing by the earnings number you are using.

Bargain, alas if had spare cash…

I reckon the following stks will ‘surprise’ the mkt next month when they report strong EBIT and EPS. All are good buying still in my opinion. In addition the macro/qualitative criterion are also favourable. I’m sure Roger fancies a few of these.

DWS….. IT stk with big recent gains into finance and govt sectors

IMD…. strengthening sales and margins into mineral/energy exploration fields

RQL… servicing strong demand from opencut & UG mines requiring dewatering.

WOW… we all eat, drink & drive. Dominant with pricing power.

DTL… just announced 38% jump in EPS. Now fully priced imo.

EHL…. watch this ‘surprise’ mkt in late August.

CRZ…. IT stk with dominant position in car sales.

MIN…..ASL boosting both top and bottom lines.

XRF…. micro-cap with excellent niche mkt share. Just announced EPS leapof 10x(900%)!!

WHG….. low growth stk but on track to pay divs+franking credits of an incredible 26.3% over next 13 months!! (16cffr on a SP of 86c)

It’s been a very tough FY11 and mkt remains relatively expensive. But still some bargains waiting to reveal themselves in August reporting season.

Good luck.

Can’t wait for Roger’s software to hit the shelves.

Hi Mike,

Solid list there, thanks for taking the time to contribute.

I think the only earnings upgrade I can forecast with any certainty over the season is Black Caviar.

Jokes aside, I like FMG.

Quality at value.

There are many different approaches to investing, and I have used a rough rule of thumb successfully in the past, that is similar to the method outlined above by Roger. The rule is to buy companies with dividend yields larger than their PE ratios.

But really, the investment tree grows from the roots of Quality at Value

Thanks Tony.

For mine, CAB, JBH, OZL, PAN, DCG, MCE, PNA and ORI are trading at IV discounts (and getting cheaper).

Three of them at 13% and 14% RR.

I’ll get to it :D

The Bega Cheese IPO may be an interesting opportunity. At 1st glance it seems to be at a discount on listing.

Matthew,

The only discount there is the discounting of your contribution if you buy in. They are effectively asking you to pay $35M to wind up with $27M of equity. Who knows what NPAT has been over previous years ? Who knows what it is going to do to shareholder value when they issue a bundle of shares to pay for the 30% they don’t already own in that other business ? (can’t remember its name).

This one looks worse than QRN to me.

bahahaha!!!! i didn’t do a full analysis

just a quick one

i’m not interested at all in it

I’m sorry Matthew, my first glance was the line which said Price/Pro forma earning per share at 16.9x which was enough for me not to look any further. I think MCE listed at a price/earnings forecast of under 10x. I can’t see where you see the discount on listing but as I said I didn’t look much further. Normally, floats are that friendly to those buying in and if they are then most people won’t be able to get any stock as the brokers keep them for their best clients.

also take a look at recent capex and projected capex vs recent and projected income for Bega…and what’s their competitive advantage?

To be honest I don’t have any experience valuing IPOs.

I was testing my knowledge. Don’t care if I was way off cause I wasn’t interested anyway.

I know how to value listed companies so that is more important to me.

Although Structural Systems (STS) didn’t make the final list, it’s definitely worth a second glance. With their division mix moving into higher margin areas (from civil/construction to mining services), and loss making operations just about wound up – they are in line for a major intrinsic value re-rating over the next couple of years.

Disclosure: It’s one in my portfolio. Please do your own research.

Thanks for the suggestion Michael. And everyone should take your advice to do one’s own research. Seek and take personal professional advice too.

For those who may be interested in STS, good information available on the companys website:

http://www.structuralsystems.com.au (part link removed)

NPAT has been impacted over the past 2 years by discontinued operations. But these should be done and dusted by 2012 leading to a big jump in earnings. The mining services division (ROCK) appears to be the best part of the company and growing. Currently trading around NTA value (78 cents). I have IV in 2012 and 2013 higher than the current share price (considerably higher in 2013). Warnings on this stock though:

1. Past history of problems with discontinued operations may be one off, but history does have a way of repeating itself…

2. Do not use the earnings guides in comsec / etrade (you will get very excited and do something you may regret later!) – the eps do not take into account abnormals from discontinued operations.

Exactly!. If history repeats its not a one-off.

Hey Guys,

I have looked at this in the past and management has a history of over promising and underdelivering.

While the current management are in place I will never own this…

In my humble opinion one of the golden rules are broken hear……….Competent management

ROE in the low teens is never very enticing for a high risk contracting business. there are much better ones out there with no debt and high ROE. cheers.

Resource Equipment Ltd (RQL) will surprise on the upside this reporting season although broker’s EPS estimates have already been revised upwards so not to the extent it would have previously.

I have fair value at 89c so currently around a 25% margin of safety (on my calculations.)

This years results and outlook should put the company on the radar of all serious investors across Australia, easily the standout in the mining services sector.

Good stuff Nick. One to watch. An A2 company and my current valuation is 59 cents but if you are right and it surprises to the upside, that valuation will rise. My valuation is based on a $12.7 mln profit for 2011 and around $14 million for 2012.

My forecast profit for RQL in FY12 is 19.1million. Company installed a massive number of water pumps in 4QFY11. Whilst this quarter will probably be an all time high, RQL will continue to find new customers. Hence, i expect pump installations in FY12 to only exceed those in FY11 by some 15%…. revenue from maintenance contracts will be very strong. I have no doubt RQL will become an A1 stk on Roger’s list after final results released in August.

Lets keep an eye on it Mike. Thanks.

Hi Roger/Nick

I have 2012 NPAT of over $17m and a 2012 IV of 75 cents. I will keep an eye out to see if my numbers are way off. Note: I do not own RQL.

Pat and Mike, if this years reporting season puts RQL on the map I reckon FY2012-13 will propel it to A1 status. The DSA acquisition and massive capital expenditure this year on equipment (instigated by continuing strong demand and the company’s geographical expansion) will see huge growth in revenues and profits and I am not brave enough to make an estimate as to what their future profits may be. In this instance though I am very reluctant to use analyst forecasts.

Roger, your current valuation and mine are about $72 million apart, a huge difference for a company this size, it will be interesting to see how things pan out.

Best Wishes to you and thanks for the continuing great work you do on this blog.

I think this company was missed on the list. RCO. Mkt Cap $20m. Cash/Liquids $15.2m. Profit 6-7m. EV multiple of around 1x. However, profit may not grow 10% next year.

Great post.

One that might have made it on to the step 1 list was LMC. Cash $16.4m ($1.84 per share). Mkt Cap: $32m ($3.75 per share). 8.6m shares on issue. EPS est. of 40c. Enterprise multiple of around 4.6x. However, profit will not increase by 10% this year so wouldn’t make it to step 3. The main reason is currency. One to watch when currency turns favorably as they are increasing sales and have shareholder friendly management.

Thanks for that Richard. Appreciate the suggestion.

Richard, I’d appreciate your thoughts on what constitutes ‘shareholder friendly management’ ie how do you measure that?

Hi Chris, I’ve owned the stock for a number of years. The management are honest to the shareholders. They admit when they have mistakes. Also, when companies which they have purchased don’t perform they are willing to sell them (i.e their Molescan business). The company has been pretty disciplined so far with the large cash they have had i.e. they haven’t rushed into an acquisition just to use up their cash. They’ve been patient waiting for the right opportunity. Look also at how much they’ve returned to shareholders through buybacks and dividends over the last 5 years (also most $2 in dividends; a large capital return and significant buybacks). Basically I trust the management as they treat the shareholders as part owners. So in answer to your question, the above things you can’t measure like ROE, but these qualitative aspects put together clearly show management as shareholder centered rather than CEO ego centered.

Great so these are Roger’s takeover targets!!!!

I think JBH and CBA will do well. Currently own JBH and has work in financial industry