Some Small Cap Names to Consider

Regular readers will know that at Montgomery Investment Management we try to take advantage of technology to improve our investment process. One of the ways we do that is with machine learning algorithms. In simple terms, we gather large amounts of historical data and using that data we “teach” a computer system to distinguish between good investments and weaker ones by finding relationships between the historical data and subsequent investment performance. Our experience with these systems leads us to think that they have a useful role to play in sorting the wheat from the chaff.

We also find that this approach has particular power at the smaller end of the market, where lack of analyst attention can more easily result in interesting opportunities going unnoticed for a while. However, the very small end of the market is problematic for funds managers who need to invest at scale.

For individual investors though, it might make very good sense to pay attention to the micro end of the market. The smaller companies tend – on average – to be a little more dubious in quality, but some of them will turn out to be exceptional performers, and if you can identify a few of those at the right time the rewards can be very substantial.

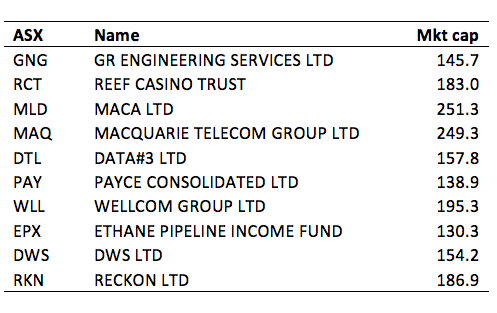

With this in mind, we have run our Australian machine learning model over the $50-$300m market cap section of the ASX. Due to their size, it doesn’t make sense for us to focus a lot of attention on them, but you may be interested in the results.

A couple of caveats are in order: Firstly, the machine is only interested in what works in a statistical sense over a limited forecast horizon. It does not implement our long-term philosophy of only investing in the highest quality companies, and so will sometimes go places we would not be willing to follow. Secondly (and as I’m sure you know) there are no “sure things” in this business. This approach can shift the odds in your favour, and some of these names will likely do very well, but several of them will also likely burst into flames some way down the track. There is no substitute for doing your homework.

With that in mind, here is the list of companies the system currently identifies as the strongest investment candidates in the nominated universe.

If you have insight into the prospects or quality of any of these names, add your comments to the discussion. A combination of human insight with machine power can be a potent investment cocktail.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

Payce always looks good but mgt run it like a private business that happens to be listed.

Good luck with PAY. Haven’t read the news but last trade i can find is 3/12/15 .And last months turnover was a fat 0.0

Of all the stocks on that list, Wellcom is the only one I would even consider buying. A great well run business but I think it is a little bit expensive at current price.

I’m quite happy using Skaffold as my search tool, it has served me well for many years, and I understand how it selects promising targets.

Like Nigel, I rely on the power of Skaffold as a tool to assess quality and value of opportunities I come across, or as a firs- cut filter for good quality businesses at reasonable price. None on this list seem to make the quality grade in a Skaffold scan, except Wellcom. But as mentioned by Andrew, that company seems well bid up in price by market in 2015-16, way over and above its corresponding earning performance (value).

Hi David,

That’s because Tim has presented the list that results from a totally different and completely independent model that uses a variety of unique variables. There are millions of way to make money in markets and we are presenting the results of a variety of them now.

Yes Roger, I understood that, but no matter how I looked at the economics of these companies (past and projected earnings growth, ROE, balance sheet etc) few if any seem to offer any quality? But the article is thought provoking and of interest.

Thanks Tim. I am not sure over what time frame the computer is projecting positive returns? But I used to own RKN until my accountant told me that he thinks they are losing share to MYOB and Zero. He says that the young accountants are all used to Zero now and this is likely to flow back into the SME’s accounting software preferences.

Hi Greg,

I don’t have a precise answer to the timeframe question. The machine is trained using three month intervals, but much of the data is fundamentals that changes on a yearly cycle, so something in the order of twelve months is probably a reasonable guide.

Hi,

have you guys looked at FRM – Farm Pride? Our only listed egg producer and one of the 3 biggest ones nationally.

They had very troublesome 5-7 years which ended back in 2013, since then under new CEO Bruce, they have completely turned the business around.

They will be completely debt free by the end of H2 (August), plus massive OCF ( will be 15 mill after FY’16) , have recently finished adding lot more free range egg capacity.(higher margin)

Share price still trading below IV, which I believe, it won’t after FY 2016 result. Yes, chicken is a risky proposition, but as FRM is very well managed with experienced management who all have been in egg industry for over 20 years, I think the risk isnt that high.

Thanks

Shawn

It’s not one we’ve looked at, Shawn

Thank you for this insight. Is would be great to understand even generally what criteria the machine considers?

MACA is the only one I’m familiar with. It’s been on my watchlist for quite a while as it seems to be one of the better operators in the mining services sector, but to date, I haven’t felt comfortable taking that plunge.

It’s remained profitable throughout the cycle and has kept a strong balance sheet, making acquisitions at reduced prices. They’ve continued to get a high return on equity and returns on invested capital, despite many of their competitors posting large losses. The business has a large amount of operational leverage and operates in a very cyclical industry, so it’s comforting to see a conservative balance sheet with net cash and well backed by tangible assets.

They’re exposed to gold mining, which seems to have turned a corner in Australia, but also to junior iron more miners, who are likely (in my view) to be experiencing many more years of pain. The big unknown at the moment, in my view, would be lithium. If they can pick up substantial business here, it could make up a lot of their lost business in iron.

Personally I’m not entirely convinced that mining services have turned a corner as a sector. The recent rally in commodity prices seems unsustainable, and has pushed up equity prices of companies in the area. The outlook has improved, yes, but it has not improved as much as the price. I would need to see a lower price given the current outlook, or a better outlook without a higher price.

Beyond the very skilled management who seem to have done a much better job than their competitors at getting through the downturn in mining, the company has no real comeptitive advantages. Without a strong view on the outlook for mining services, it’s hard for me to justify an investment at current prices. I’m happy to sit on the sidelines for now and watch closely to see if everything does align itself at some point in the future.