The FSI Is Not Only Going to Impact the Banks

Last year’s final report from the Financial Services Inquiry (FSI) made a large number of recommendations. These included lowering the cap on the maximum interchange fee a bank is allowed to charge on a credit card transaction.

The FSI also recommended that merchant surcharges better reflect the cost of accepting the payment method. The surcharge limits set by the PSB would make it easier to prevent over-surcharging.

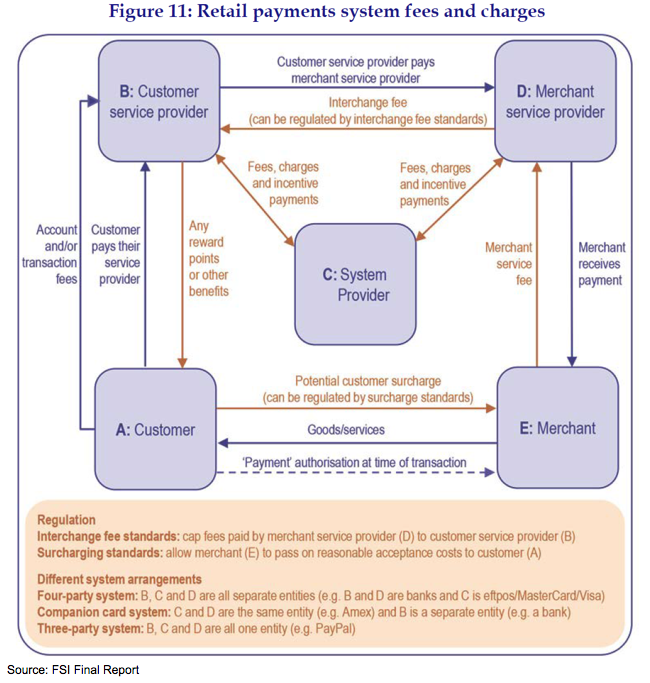

The way the credit card payment system works is that, “for each transaction they accept, merchants (Box E) pay merchant service fees to merchant service providers (Box D), which in turn pay interchange fees to customer service providers (Box B). Customer service providers can then pass some of this revenue on to customers (Box A) in the form of reward points and other benefits.”

Using the example above, the FSI is recommending there be a cap on the fee paid by the Merchant Service Provider (Box D) to the Customer Service Provider (Box B).

Importantly, the FSI recommends that the cap include all payments made to customer service providers. At present, incentive payments and service fees used in companion card and other systems are not captured by the interchange fee caps.

In an AFR article published on 3 December 2015 it was estimated that the total fees banks are paid by merchants on credit card and EFTPOS transactions is around A$2.5bn a year. It also quoted industry estimates that the draft reduction in the interchange cap could cut this figure by A$600-800m. Under the draft proposal, caps will be set at 0.8 per cent for credit card and 0.2 per cent for debit cards (or 15c per transaction if levied as a fixed amount). The cap is to include companion cards and incentive fees as well as any other payments to issuers to prevent circumvention of the interchange standards.

The RBA expects to make a formal decision on the new rules at its May board meeting.

Clearly these caps will have an impact on bank revenue. However, the banks will offset this by cutting costs. The caps will primarily impact the revenue generated by credit cards that provide more generous reward to customers as these rewards programmes are funding by higher transaction fees charged to merchants.

If the fees on high rewards cards are cut, the bank will be forced to reduce the generosity of the rewards programmes. For example, instead of getting 1 reward point per dollar spent, a customer might get just 0.5 rewards points per dollar spend in future. This would reduce the cost of the card programmes for the banks by reducing the value of the rewards the bank needs to purchase per dollar spent by the customer.

So while the caps might reduce aggregate revenue for the financial sector by A$600-800m a year, the impact on profitability is likely to be significantly less than this figure.

But there is another loser from the regulatory changes. The two major Australian airlines have been significant beneficiaries of the growth in credit card rewards through their frequent flier programmes. The credit card issuers are one of the largest purchasers of airline frequent flier rewards points. Caps on interchange fees that force banks to cut their rewards programmes will also result in a cut in the amount of frequent flier points purchased by the banks, negatively impacting the profitability of the airline frequent flier programmes.

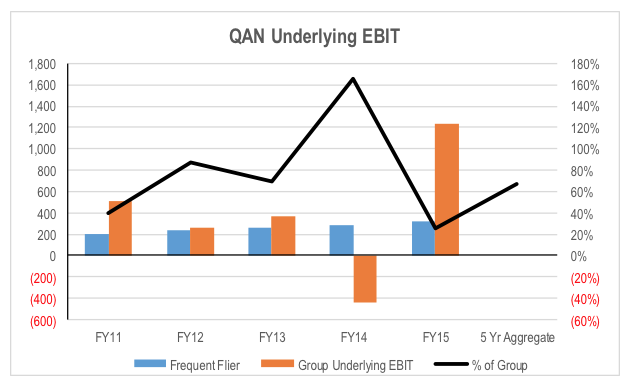

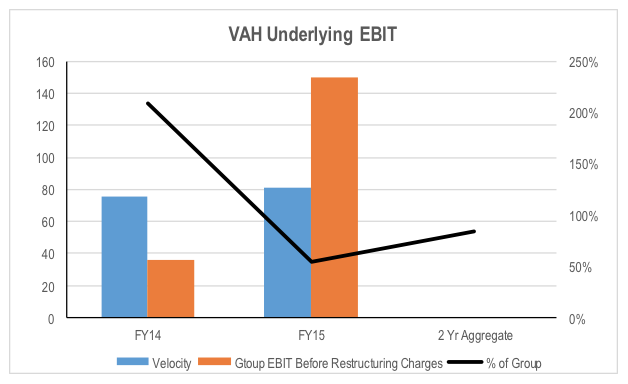

While this might not seem that important, Qantas’ frequent flyer programme has generated around two thirds of its aggregate group EBIT over the last 5 years. Virgin has only been reporting the Velocity Rewards business as a separate segment for the last 2 years. Over that period, it has generated 84 per cent of group EBIT (even when we exclude restructuring charges from group EBIT). We note that Virgin sold 35 per cent of Velocity Rewards to Affinity Partners in October 2014, which reduces its exposure to these changes.

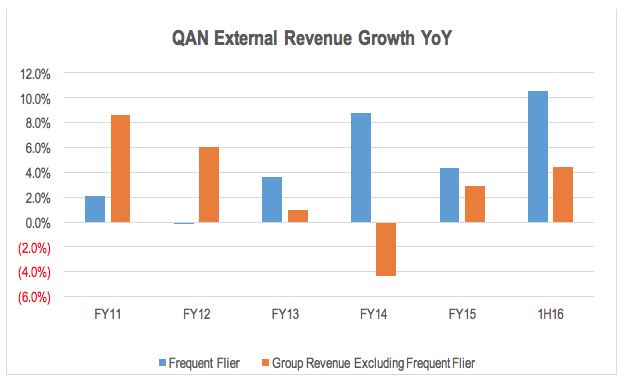

Qantas Loyalty reported A$1.244bn of externally generated revenue in FY15. In the 5 years to FY15, this revenue grew at a compound rate of 3.7 per cent a year. This compares to a CAGR of 2.7 per cent for the rest of the company over the same period. On top of that, externally generated revenue growth has accelerated over the last couple of years.

The frequent flyer programmes of the airlines generate far more stable and higher return earnings than the airline businesses themselves. As a result, they should be valued more highly than the airline operations themselves. Any reduction in frequent flyer programme earnings should also negatively impact the multiple applied to earnings for valuation.

The other issue faced by the airlines is the increased focus on surcharges. Qantas (ASX: QAN) had been operating a neat little model where it got banks to issue high interchange fee credit cards that paid customers high levels of frequent flyer points, and QAN made a nice profit from selling the points to the banks. The high interchange fees charged on those cards were used as a reason for QAN to levy a A$20 fee on any credit card transaction by consumers that purchase tickets. So effectively, QAN was charging a high transaction fee to recoup an interchange fee that was elevated because it was being used to buy other profitable products from QAN. And this is before we even consider the fees QAN charges any consumer that tries to redeem those points for not-so-free flights.

Putting all of this into context, a A$600-800m cut to interchange revenue across the industry is likely to have far more impact on the profitability of QAN and VAH than the banks. This is because:

- There are greater offsets on the cost line for the banks by reducing rewards paid,

- the A$600-800m figure is a much higher proportion of aggregate industry profitability (in the order of A$30bn of NPAT for the major banks Vs A$1.4bn for the 2 airlines) and

- the A$600-800 interchange fee reduction is a large figure relative to the A$1.24bn and A$31m of revenue QAN and VAH respectively generate from external customers in their frequent flier divisions.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Interesting thoughts. Qantas won’t be happy! I don’t suppose you know if Air New Zealand has much at stake with this change?

Tristan

Hi Tristan, Air New Zealand is unlikely to be impacted to any significant impact on Air New Zealand given few cards in Australia provide Air New Zealand frequent flier points. ANZ and WBC have Australian cards that offer Air New Zealand points and you can redeem American Express Rewards points for Air New Zealand frequent flier points. The bulk of the point purchased by the card issuers are likely to Qantas and Velocity rewards points.

Hi Stuart,

Thanks for the interesting article.

What do you believe will be the impact upon American Express from the recommendations of the FSI?

Hi Jason,

Amex is likely to be impacted in a similar way to the banks. Given some of the changes to the regulations are specifically designed to target companion card fees and incentives, the proportion of its Australian revenue that will be impacted by the new cap is likely to be larger. However, the offset to the lower revenue is still likely to come through reduce rewards value for customers, and as such its more of an issue for the value of their consumer offer and marketing than profit margins. You also have to take into account the fact that Australia only makes up around 5% of the overall billed business for American Express on a global basis. Therefore the impact would be negligible for the company as a whole.