The seven months to 31 January 2016

The first seven months of the Fiscal 2016 year has been difficult for investors. The S&P/ ASX 300 Accumulation Index has declined by 5.78 per cent while the MSCI World Net Total Return Index in Australian Dollars fell by 2.24 per cent.

In this context the Montgomery products have done a good job for our investors. On the domestic front, the Montgomery [Private] Fund is up by 10.09 per cent, while The Montgomery Fund is up by 8.32 per cent for out-performance of 15.87 per cent and 14.10 per cent, respectively. And on the global front, the Montgomery Global Fund is up by 0.87 per cent, out-performing its benchmark by 3.11 per cent.

Most pleasing has been the performance of the Montaka Global Fund. This product was originally designed for wholesale investors with a minimum initial investment of $1 million. In the seven months to January 2016, general investors in The Fund received a return of 16.78 per cent.

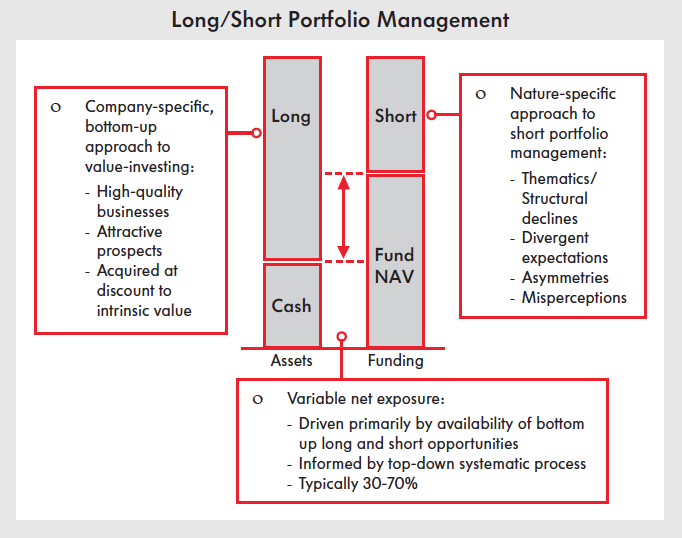

In terms of performance attribution, Montaka’s “short portfolio” has added significant value. Montaka’s defensive attributes have worked very well during this tumultuous period and at the end of January, The Fund had “net market exposure” of 34 per cent, which is at the low end of the typical 30 per cent to 70 per cent range. The mechanism governing Montaka’s long/short portfolio management is illustrated below. During October 2015 we launched the Montaka Global Access Fund for our retail clients. It has a $50,000 minimum initial investment and feeds directly into the Montaka Global Fund. In the three months to 31 January 2016, this Fund grew by 1.86 per cent at a time when the MSCI World Net Return Index in Australian Dollars declined by 7.30 per cent. This came at a time when most funds delivered a negative return for their investors and many indicies have entered a “technical” bear market.

During October 2015 we launched the Montaka Global Access Fund for our retail clients. It has a $50,000 minimum initial investment and feeds directly into the Montaka Global Fund. In the three months to 31 January 2016, this Fund grew by 1.86 per cent at a time when the MSCI World Net Return Index in Australian Dollars declined by 7.30 per cent. This came at a time when most funds delivered a negative return for their investors and many indicies have entered a “technical” bear market.

All returns detailed above are net of fees.

The next subscription date for Montaka is Tuesday 1 March 2016 and new subscribers should have their documents and funds in by 22 February. Investors interested in the Montaka Global Access Fund, please click here. Investors interested in The Montaka Fund, please contact Paul Mason, COO of Montgomery Global, at pmason@montinvest.com or myself on 02-8046 5000.

David, With short transactions, it is the plan that the

stocks decrease in value, however, what happens

when they don’t?

Haven’t short transactions similar downside risk as

do longs?

Could short losses become a problem?

Hi graham,

many suggest that the risk with shorts is much greater than longs. These people say that longs can only go to zero but shorts can go to infinity. The problem is of course that we have seen many stocks go to zero but none go to infinity. Our shorts are more numerous than the longs in the Montaka Fund but their size is deliberately much smaller.

Good result.

Is there an index of active managers that we can assess funds against each other?

There is Richard. We use Morningstar software to compare the funds. It is a subscription based service.

Well done David, Roger & team! They’re a good looking set of numbers. Long may this continue.

Kelvin