A Scenario to Consider

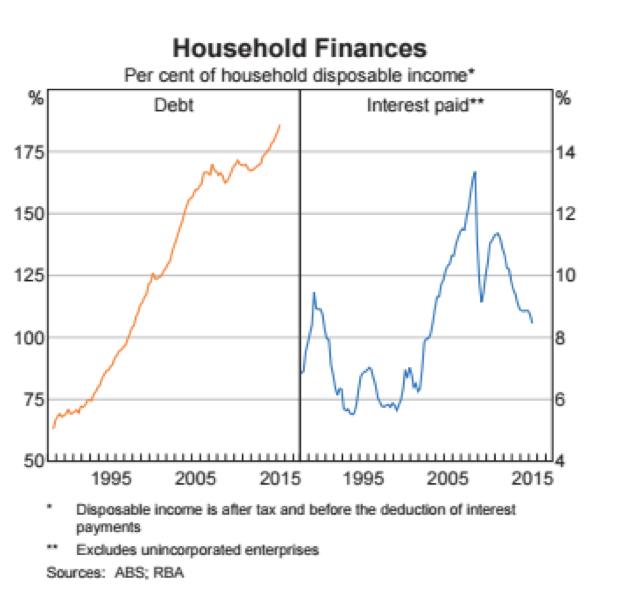

This chart from the latest RBA Chart Pack shows (on the left hand side) the level of debt held by Australian households as a percentage of disposable income. As you can see, debt levels have been on something of a bender for the last few decades. Associated with this, we have seen excellent growth in mortgage books for the big four banks, and a generally chipper residential property market.

Australia’s level of household debt is now very high by world standards, and at some point this becomes a problem. Increasing debt is a tonic for economic activity, but there is a limit to how much debt a dollar of disposable income can be asked to service. Our tonic bottle may not have much left in it.

Australia’s level of household debt is now very high by world standards, and at some point this becomes a problem. Increasing debt is a tonic for economic activity, but there is a limit to how much debt a dollar of disposable income can be asked to service. Our tonic bottle may not have much left in it.

This hasn’t been too pressing an issue for Australian households so far, because the RBA has had their back. Since 2011, policy interest rates have been progressively dropped to a record low 2 per cent, and that has meant that interest paid has actually declined in that time, despite the increasing debt.

Of course, the thing that would cause real household discomfort would be an increase in interest rates – something many commentators consider is unlikely in the foreseeable future.

Their view may be well-founded, but with banks starting to increase mortgage rates in response to regulatory changes, the Australian dollar declining and the RBA observing that the prospects for an improvement in economic activity have firmed, it is by no means guaranteed. Indeed, when it comes to economic forecasts, few things are ever guaranteed.

Bearing that in mind, and as an exercise in prudent financial management, it may be worth giving some thought to a “rising interest rate” scenario, and its implications for your personal finances, especially if your portfolio is built around yield assets that owe much of their current market value to low rates.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

Agree with Steve, there should be some good purchases coming in the near future.

I think the statistics you point out will definitely be of issue, I guess the only question is when. I believe there is still another 2-3 years before we see household debt become a real issue.

A handy calculation I have used over the last 2-3 years to make an investment decision on property is to calculate cash flow from these investments using a interest rate that is 2% higher than the current rate I am paying, If this is sustainable then pull the trigger, I know I have at least a 12 month buffer once the RBA starts hiking before I have even hit my initial margin of safety, by such time my equity within that investment would of further increased and I do not have to rush to an irrational decision should I consider the need to sell.

Thanks Matthew, And no doubt you must also consider the LVR. The higher the LVR the more buffer needs to be put into the rate.

Hold onto your cash,there are going to be some good buys coming.

Sure, it is worth considering a rising interest rate scenario. However the RBA will only increase rates if we have high inflation. And the US Fed is only going to increase their rates significantly if they are comfortable with the USD being a lot stronger. Neither of these things are very likely.

And if bank funding costs increase for some other reason (i.e. not due to central bank decision) the RBA is likely to reduce the OCR to counter this.

Good points Tim,

A reasonable part of my portfolio is invested for yield, enough to cover all expenses. The rest is invested for potential capital gains or held in cash. I am not to worried about my high yielding stocks being smashed by an increase in rates. I have a bullish hypothesis, that if the economy is going well enough for the RBA to increase rates to more historical levels then (at least some) of my yield plays will be able to increase their EPS as well.