Stuck

While the world tries to guess when the Federal Reserve will increase interest rates, we thought one of the more eloquent illustrations of the conundrum facing central banks is a recent speech by Andrew Haldane, the Chief Economist of the Bank of England. The speech is aptly entitled, Stuck.

Stuck is themed on the children’s book of the same name, which is a tale of trying to solve a problem by throwing things at it.

One of the key considerations of the speech is that “…it is better to err on the side of over-stimulating, then course-correcting if need be, than risk derailing recovery by tightening and being unable then to course-correct”. Roger Montgomery has written extensively about the Federal Reserve’s views on this issue – central bankers don’t want to withdraw stimuli too early and threaten the economic green shoots.

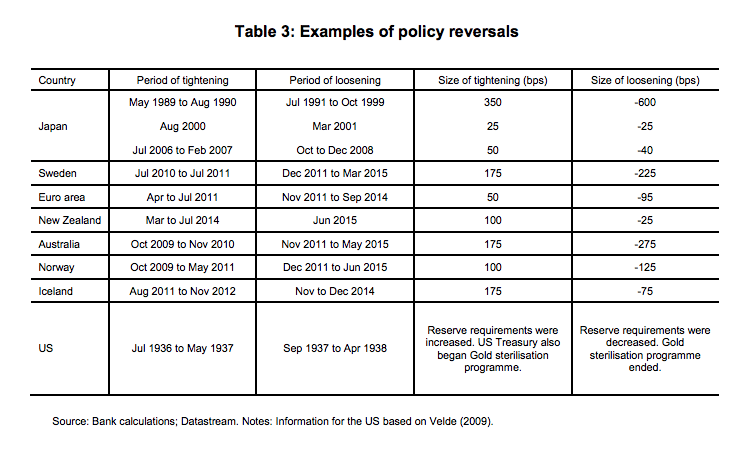

Stuck provides some grounding as to why this is the case. The speech references those countries (in the table below) that have tightened monetary policy during a post-crisis recovery, only to loosen monetary policy shortly after. In many cases, the subsequent loosening was greater than the tightening. Haldane’s speech goes on to say, “…a policy of early lift-off could be self-defeating. It would risk generating the very recession today it was seeking to insure against tomorrow. In that sense, the low current levels of interest rates are a self-sustaining equilibrium: moving them higher today would run the risk of a reversal tomorrow. These self-reinforcing tendencies explain why the glue sticking interest rates to their floor has been so powerful”.

Haldane’s speech goes on to say, “…a policy of early lift-off could be self-defeating. It would risk generating the very recession today it was seeking to insure against tomorrow. In that sense, the low current levels of interest rates are a self-sustaining equilibrium: moving them higher today would run the risk of a reversal tomorrow. These self-reinforcing tendencies explain why the glue sticking interest rates to their floor has been so powerful”.

So what policy actions are likely? Well, the speech concludes with the following passage:

In Stuck, the boy’s attempts to unstick his kite from the tree come, well, unstuck. The cat, the gorilla and the ocean-liner, along with assorted other objects, get stuck up the tree too. In trying too hard to unstick his kite, the boy makes a difficult situation worse. Eventually, with the passage of time, the kite comes free of its own accord.

Trying too hard to unstick interest rates, or doing so too quickly, also runs the risk of making a difficult situation worse. It runs 1937 risk. That is one reason why the glue holding interest rates to their floor has remained so strong. And it is why I feel no immediate need to loosen that glue.

Stuck is well worth a read, and relatively light on technical jargon (both the speech, and the book).

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Ben,

This is a terrific analogy. And reminds me of the other child’s story/analogy, The Wizard of Oz. Supposedly, the name Oz came from the abbreviation for Ounce referring to Gold, as of course, did the yellow brick road. And the other major symbol was the Emerald City, being the Federal Reserve and their control of ‘greenbacks’. Have to get the DVD out to refresh my memory.

Warren

Appreciate the feedback Warren, and thanks for sharing!