Why idolise the iPad2?

It’s an amazing story… Man creates computer. Man overcomplicates computer. Man strips back computer and creates a brand that has revolutionised the way we are entertained.

It’s an amazing story… Man creates computer. Man overcomplicates computer. Man strips back computer and creates a brand that has revolutionised the way we are entertained.

Did you know Apple has sold over 300 million iPods and iPhones over the past decade? That’s 300,000,000 products. According to the World Bank, in 2009 the world’s population stood at 6,775,235,741. The World Bank also notes that 80 per cent of the world’s population lives on less than $10 per day. Of the remainder, every 4th man, woman and child has purchased an Apple products in the last decade. Not a bad competitive advantage, (postscript: but perhaps not a sustainable one?)

Apple is also infiltrating the way we work. The Montgomery office is all Mac (and for your information, we have never had to call an IT professional to fix anything). Our iPhones are synced with our iMacs and our MacBooks synced with our iPhones.

You have heard the stories of Apple fans setting up camp on the footpath outside Apple’s flagship store on Sydney’s George Street. Australians don’t do that for coal or iron ore.

And don’t forget the accessories market. There’s no special concessions for development partners. Privately held companies that manufacture the sleeves, cases and connectivity devices that enhance our Apple experience don’t get hold of new devices until we do – on launch day.

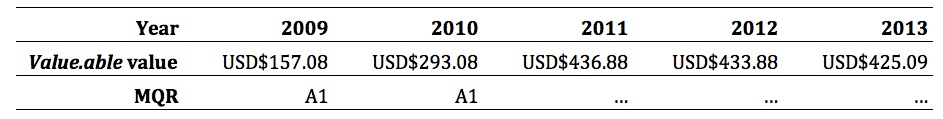

Apple has the X-factor. Its product is unique. Its experience is unique and there is an almost religious fervour toward the brand. Competitors don’t stand a chance. The result? High, durable rates of return on equity and a rising Value.able intrinsic valuation – an A1 business.

Return on Equity is just one of dozens of metrics I uses to produce the Montgomery Quality Rating (MQR). Re-read Chapter Eleven, Step C on page 188 of Value.able for the Value.able ROE calculation.

Who is the Aussie equivalent? The Australian market may be much smaller than the US, but there are a handful of extraordinary businesses, A1 businesses. And its worth finding tem. They may not be listed yet. They may not even have launched yet…

Posted by Roger Montgomery, author and fund manager, 29 March 2011.

Postscript: The data used to calculate intrinsic value is available here: https://www.apple.com/investor/

Pick and shovel suppliers.

Recent TV coverage (ABC) indicate some disquiet in the WA population with engineering work going to overseas competitors and local engineering works working at well less than capacity. Some discussion – I am sure most of you have heard comments that WA’s recent boom times are waning. Is there anyone working in the fabrication industry in WA able to comment?

And the very very businesses are those that are able to raise prices even in the face of excess capacity. generally not true of mining companies, for example…

I have a mate who owns an engineering works in the hub south of Perth at Kwinana.They are doing quire well, but they are in a minority somewhat.There are a lot of businesses that are running very lean for a couple of reasons. They are struggling to hold onto staff, which in turn, makes it difficult to take on extra ork, let alone complete what they have as the mining companies are paying huge money to work in the Pilbara and the most importantly, if they cannot pick up work indirectly for the mining companies, then there is not the work around locally to sustain. I’m in civil construction and we are not spending money on plant/equipment and repairs unless its warranted. There is a very significant gap between mining expendidture and other industries over here in the West. That said, still better to be here than other States potentially

Hi Karl,

Keep posting mate. It would be nice to keep hearing you thoughts

For anyone ‘champing at the bit’ for further information about the Matrix capital raising, go here……….

http://www.matrixap.com.au/files/MCE%20310311.pdf

A great read, thanks for letting us all know Mike.

All the best

Scott T

Thanks for posting Mike, Austock Securities have done a fantastic job with that report.

The company’s growth profile is nothing short of incredible. It’s expansion into new markets, new products, additional service centres around the World to accommodate the expected growth and demand across geographics and an increase in divisional managers to assist with marketing and sales paints a very bright picture for the future for the company and its shareholders. This coupled with the operational savings costs from the new Henderson plant makes for a compelling investment case.

This is a classic Phillip Fisher investment, an absolute standout. Congratulations to the readers of this forum who nominated Matrix as their selection for Roger’s Christmas special, you all showed enviable foresight.

Hi Nick,

I think Mr Andrews from Austock covers MCE the best of all the analysts. From memory he has owned and ran a manufacturing business himself in a former life and understands the business pretty well.

As MCE posts the broker reports on their website it is worth periodically checking to see if a new report is out, particularly after price sensitive info has been released to the market.

Since MCE is a stock that a fair few of the grads and undergrads hold if you find a new report please post it here.

Thanks Roger and fellow blogger, The knowledge bank here is far superior to anything any fund manager could possible generate.

I think the quality of the research is excellent too. One of the perennial issues with any research is the fees that are earned by the ECM (Equity Capital Markets) department of a firm. This is the side of the business that earns fees from capital raisings. When assessing research its always worth askingif they are independent.

Thanks Mike.

Always eager for information, much appreciated.

Thanks Mike – it’s a great read and confirms that they are on the right path.

I think the posts about Apple here really miss the mark on a number of levels. I’ll just talk about Apple’s biggest source of Sustained Competitive Advantage.

Apple isn’t “turning into a software company”.That implies it’s becoming more like a microsoft or adobe or salesforce. Flogging a bit of code until someone else writes something better.

What is Apple is becoming? A (The) platform where other creators of content transact their goods – which creates the holly grail of SCA -the network effect.

For example, no matter how big you are in the music industry, you have no choice but to sell music via itunes and pay Apple every time you sell a song. It’s a network effect market place and it’s size creates a mass that has in effect a “gravity” that sucks in even more content and even more customers into its orbit. A virtual upwards spiral.

Try competing with iTunes. Thousands have tried and failed. It has been a nothing-to-behemoth category killer. (Amazon’s Soundcloud launched yesterday. Let’s see.)

Apple is doing the same in Apps. I was at Adtech Melbourne this week. The story of smart phones: There are 5 operating systems but it’s already an android vs iOS battle. Lots of debate about who is better… back and forth. Likely outcome – no winner both coexist.

Then the clincher for me -angry android users complaining that adtech and other conferences keep providing iphone apps for the conferences but not android. The adtech guys said they had a limited budget and 70% of their customers had iphones… so roi was great for ios and poor for android. So no android app. That says something. they also mentioned it was a big headache to optimise the app for 400+ variant devices running android. iOS has 3 variants.

Then a game developer arrived on stage. Q for audience – “ios or android?” “Ohh that’s easy” he says. No serious game developers want to develop for android – “their users only download free apps” (Even android admit this and try spin it in marketing to “we have more free apps”). But no ROI for developers… Compared to iOS users who will pay $2, and in the millions. So the best games are on iphone and it becomes a reinforcing cycle…

And now Apple is trying to do the same in books.. And with the ipad, potentially magazines and newspapers. Movies too.

So Apple’s SCA is the ownership of content market places. Other people create and sell music, software, whatever on the Apple platform.

If you want to be a retailer in Chadstone or Bondi junction, you might sell something without talking to Westfield, but if you really want to sell big at these locations… you have to pay Westfield. Very last century. Apple owns the monopoly shopping centre for a place called… earth.

Actually it’s even better than that – Apple also owns the payment platform too. Another theme of adtech was about how/when we will ever have fast, secure micropayments. But we already do. Consumers buy apps and music with one click micropayments with their apple account amalgamating these. So Apple is almost like a currency platform too.

That’s their SCA.

oh – and apparently they make some neat computers and phones too.

cheer

andrew

Thanks Andrew,

Really helpul insights. Really!

…and the more entrenched the network effect (perhaps ‘established’ is a better adj. than entrenched) the greater the Switching Costs. One SCA leads to another. For a time of course MS had this too…until Apple got S.Jobs back (thank you Disney for the $7.4b). So that might suggest Jobs may be an important part too.

Just realised that Steve Jobs is the largets shareholder of Disney, didn’t know that. Thinking about Disney, i have noticed a different type of the network affect for Disney. I have wrote about it before on here but thinking more about it i can see a new slant on it.

Their classic cartoons have been around since Walt was alive. Todays adults were shown these cartoons as kids and it touched them emotionally, when they have their own kids they remember how great those movies were and show their kids the same movies. They then do the same thing. Might not be the textbook definition of a network affect and i might not of explained it the best but the concept is there.

It is what keeps Disney relevant and their “products” (i don’t like using that word for disney) such a good company.

Disneys business practices and processes have intrigued me greatly over the past two years which i have read about and incorporated into my own life and work. I have always been a fan of the business and decided to have a go and calculate an IV for them. On a 14% RR i got $11.67. So no doubt big premium to IV at the moment.

They have a ROE of just over 10%, they may not be an A1 company, but some of their processes could benefit any company.

Disney have something very few others have – share of mind.

When I say “Disney” you immediately have a very strong image come to mind. If I say Pixar you will probably have the same response. If I say “universal” or “newline” I doubt you will have the same response. Thats valuable.

Disney does have a special aura and this is why i was/am so interested in learning more about their business processes and i have learnt a lot since i started.

They actually have processes in their parks division which are designed to help facilitate an emotional response by the parks guests to the theme park. The aim is for someone to not just have a fun day but to be emotionally touched in some way that they have long lasting memories about their visit. It is so simple but it has two benefits of going above and beyond what the guest or customer expects and also gives the staff a bit of freedom to create this moment which will no doubt make them happier and makes the service they provide even better.

I can just imagine the power this could have on any company that has a large service element to its operations to have a formal process which is then teached to employees and

Apple (AAPL) closed at USD $348.51 last night. This is a 25% discount to Roger’s calculated IV. PE of 19 and RSI last night was 51, so I disagree with Daniel that it is overbought. Add all this up and with the AUD trading above parity it seems AAPL is a great buy right now.

Hi guys,

To go with my other posts on this topic. I have thought of another company which i think has a strong competitive advantage. It was sitting in fron tof me the whole time.

Its another small business and i am not 100% sure what the competitive advantage is yet but it is definitley there. Another subtle one.

The company is Lucas Papaw Ointments. It is a natural healing product made from papaw. There product is a tropical application for boils, burns, chafing, cuts, cracked skin, gravel rash, splinters, open wounds, insect bites etc. You can find it in all sorts of supermarkets and chemists in an identifiable red tube or tub.

I use it as a lip balm. It pretty much does everything. kind of like a medical WD-40. I have no idea whether it is profitable or not but i imagine it would be.

I have seen so many people use this for all sorts of reasons and it is regular to find very few left in the woolworths area where they keep the products. They are able to charge a premium for its reputation of quality. I think they are also recommended in certain cosmetic circles as well. They will be too small to be the next apple or the Australian version but they do have an advantage which i expect to be due to the differentiation of their product from others by their packaging, quality and reputation for quality as well as the fact it can be used for a large number of ailments making it an affordable product for families who don’t want to stock lots of different pharma goods. It is non-toxic i believe so will not harm children if they get their hands on it.

Just in case anyone was wondering why i posted the above, as after re-reading it it may seem like i am just plugging the product and as we can’t invest in it could be of little use.

I want to encourage people to think more about competitive advantage as i believe in my time from following this blog that it is an area that gets neglected as it can’t be measured by an excel spreadsheet. Understanding these advantages will help you understand the business better than those metrics ever will in my opinion. It will allow you to have a better picture as to what is driving the business and what they do that makes them successful which gives clarity for thinking about their future prospects. The same went for my marigold yum Cha example down below.

Another example of a listed company variety is that David Jones has exclusive agreements with certain brands to be the only department store in australia there products. These are in some cases luxury brands which help re-inforce the image that David jones is the luxury department store and where you go if you want top of the line goods. Also, an example of my theory of competitive advantages protecting and strengthening the brand.

Thanks Roger for the insight re. MCE capital raising. A couple thoughts:

1. It is good that you are taking up the offer – it displays ongoing confidence, but

2. It is always annoying as a retail investor NOT being able to partake in capital raising at the discounts offered to institutions.

There is an SPP (share purchase plan) too. Just remember it is cheaper and more efficient for a company (fewer regulatory hurdles to jump) to raise additional capital from institutional investors. Its not a reflection of how important retail investors are to a company. I concede the impact however is.

Hi Guys

MCE in trading halt,

“The trading halt is being requested as the directors expect to make an announcement in relation to a share placement”

Trading halt will be lifted at the close of business on Monday 4 April 2011.

To paraphrase the guru I am looking forward to this announcement about as much as preparing for a colonoscopy. It’s not my favourite activity…

I thought the share placement was just a group or industrial buyers wanting to buy shares in the company and rather than buy a lot in the market they go through the company? This should just increase the number of shares the company has on offer and should (in the short term) drop the share price.

This one came from out of nowhere.

I’m glad I took some of my gains off the table.

Sounds like Hardin is right – Henderson will probably be the culprit.

I don’t think anyone expected this announcement from Matrix. Ill be eagerly awaiting further details, not sure why they chose to tap the markets as opposed to financing with debt.

Will be interesting to hear Roger, Ash & others thoughts on this one.

Hi Guys,

DISCLOSURE: I have participated in the capital raising which I expect will be conducted at $8.50.

Not much can be disclosed about what a portion of the capital raising is for but I believe a worst case 20% ROE on the total capital raised will be achieved within 18 months. To get that number I have assumed zero percent return on the majority of it. I have spoken with the brokers and to Aaron Begley last night.

This company is in a fast growth phase of its life cycle and I remember when JBH had higher levels of debt to fuel its rollout. In 2002 (yes 2002) JBH debt to equity was 138%. Profits at the time were $6.2 mln. In 2005, the shares were trading around $3.30 and cash flow from operations were negative for JBH. A long term perspective really is needed in investing. The drivers of the business haven’t changed. Henderson will more than double capacity and reduce costs. Nuclear crisis and middle east could continue to keep oil prices supported. High prices and the near term questioning of nuclear power will justify deep sea exploration for oil. Commissioning of and demand for rigs continues to increase even beyond what has recently been forecast. Just my thoughts of course and NOT A RECOMMENDATION FOR YOU TO ACT IN ANY WAY OR IN ANT SECURITY NOR A SOLICITATION TO DO SO. MY OPINION, MY VALUATIONS AND ANYTHING ELSE CAN CHANGE AT ANY TIME AND WITHOUT NOTICE. THE SHARE OF MATRIX COULD DOUBLE OR HALVE AND I HAVE NO WAY OF KNOWING AHEAD OF TIME BECAUSE I CANNOT PREDICT SHARE PRICES. CONDUCT YOUR OWN RESEARCH AND SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE.

Hi Roger,

Many thanks for that info about the MCE capital raising, but can I ask how people such as the brokers you spoke to last night know about this before an official announcement is made by on the ASX?

(Not having a go, just interested in how that works.)

Their running the institutional book build Adam.

Hi All,

I appreciate Ash’s sentiment that these announcements are not fun, but we should use this as an occasion to remind ourselves that no matter how stellar a company, it is a company and not a bank account. Owning a company carries uncertainty and risk, even if it is an excellent company enjoying an excellent period of growth. Bank accounts have ‘absolute’ certainty, not shares. But we invest in companies because the returns are greater, and we seek extraordinary businesses at discounts to their intrinsic value to maximise our returns and lower the risks. We should always be considering the risks, the worst case scenarios. We should be staying in touch with the company first, it’s cash flow, it’s progress, assessing it’s prospects as they evolve. In a sense, many things shouldn’t be ‘surprises’ because we ought to have anticipated the possibility and built that in to our strategy.

I guess I’m trying to say that we should have been somewhat aware that Matrix, in the midst of amazing growth and positioning itself for the long haul, always had this option at their disposal if they feel it is in the best interests of their business. Cash flow in the half year reports should have flagged us to the possibility.

Just because Matrix has been an awesome investment so far, with a rise in share price that may seem unstoppable doesn’t mean that share price will continue to rise uniformly, or that a growing business in expansion mode won’t experience bumps in cash flow or the need to consider strategies that give it the capacity to respond to growth in order to create long term profits. Indeed, it is the growing businesses with bright prospects that have to tackle the issues of how manage that growth; what plant do we build today to lock in return tomorrow? Do we increase the scope of stage 1 in order to capitalise on demand that exceeds our forecasts, or do we wait?

I have a holding in Matrix and a view to the long term. I don’t enjoy these announcements on one level, but I would rather be an owner of a business that has to handle growing pains, than a limp static business with a terminal future. Matrix has been a great investment for me already, but I continue to expect bumps in the road. It’s gonna happen.

There is always the possibility of surprise. We aren’t in the Board Room. Even David Sokol, the heroic CEO who changed Net Jets from a total bummer into a profitable, wait for it…AIRLINE, one day, unexpectedly (had to?) resign. Who saw that coming? Many don’t want to see it coming. But it was always possible. There is always uncertainty, even with the bright stars. Sometimes the bumps, surprises etc. are because the star is especially bright, and getting brighter…

Great points. Any investment involves risk, and you can expect the unexpected. I hold an investment in Matrix, and still expect good prospects ahead. But I don’t get complacent about it, and the future is always uncertain.

Hello David, I agree with much of what you have to say although disagree with you and Ash that that “these announcements are not fun.”

I agree generally, that if you were involved in a limp, poorly manged company the thought of having your holdings further diluted by an inept, greedy management who has overspent and under thought, no, this would not be fun.

Although, if you are part of a great company, with top line managers, prospects for incredible near and long term growth and the shares being issued are close to, at, or above fair value, then this is a great opportunity which should be seized by the company should they need to.

I will speculate that the reasons for this CR are sound and will be used to fund increased near term/immediate growth leading to a further entrenched position for Matrix as the leading quality supplier of buoyancy modules and other supplies to the deep sea oil and gas sector. Because of this, and the reasons I mentioned before, I welcome the CR and the chance to add to my position in the company.

Best Wishes to all.

Thanks Nick – what I was trying to say in so may words!

Hi Nick,

I still very much like MCE but the capital raising has made me poorer.

That hurts a bit but still happy to hang on for the ride.

$8.50 is not much of a discount at all – if that is what the eventual price is. I know you can’t disclose much about the purpose of the raising at this stage, but whatever that reason is, MCE is not having to offer much of a discount to gain support for it.

Hi Greg

This may be MCE’s way of making up for their low listing price! The potential upside here makes the risk worthwhile I think

Cheers

Jim

Hi everyone, first post.

In the Half Yearly report MCE had approx $3m cash. They announced they had around $7m to spend on Henderson post 31 Dec, with $6m from bank facilities. So unless a large amount of cash was expected to come in from acc receivable, well, cash has to come from somewhere. If you looked closely at the accounts/announcements/etc, there was always a high probability of a capital raising being necessary. I was just hoping they were expecting large cash inflows from customers really soon! (I do own MCE) So I don’t think that just because they are raising capital that there will be any major cost blowouts in the announcement. I remember a post by Ash mentioning how due to the nature of their business cash comes in lumps for Matrix. I think they are just at the beginning of a very capital intensive growth phase and simply run out of cash. It will probably impact IV in the short term, but long term the effect should be minimal, and may present another buying opportunity.

Of course if they come out and announce huge cost blowouts all of what I just said means little!

Hi HG,

Thank you Harley for your post and for contributing to the knowledge bank here. I would be very surprised if ‘cost blow out’ rates a mention…

Now you’re just teasing…

Thanks for the update Roger,

This doesn’t seem to be an entirely negative development. ROE will be lower as Roger explains, the issue price is below IV (although the difference isn’t enormous) and once again the bigger players will get the immediate gains.

However, I’m pleased to see they aren’t racking up too much debt (JBH example aside), and taking a 5-10 year view, any increase in the capacity of Henderson is a massive plus. I’m also glad the MD isn’t giving up his blocking stake – the last thing shareholders need here is a takeover.

To those who are wondering why Henderson has cost more and taken longer than initially promised: it’s going to be a little bigger than they had originally planned. Nothing here to shake the faith. Even the most conservative view of where this company will be in 5-10 years is enough to warrant extreme optimism.

“I believe a worst case 20% ROE on the total capital raised will be achieved within 18 months. To get that number I have assumed zero percent return on the majority of it.”

That sounds like a very profitable use of some of the new funds then. Congratulations on being able to participate in the raising. Thanks for telling us what you could Roger, very much appreciated.

All the best

Scott T

Thanks Scott T but everyone must still do their own research and seek and take personal professional advice.

I’ve heard that they’ll be raising around $36 million at $8.50.

Unlike the majority of the contributors on this blog I am very happy about the CR. Perhaps, in an ideal world, everything could be funded from operating cash flow, also in an ideal world Matrix could sell their product at triple the current price and produce the buoyancy modules for a third of the cost.

I’m always happy to participate in capital raisings if, management are astute and capable, future prospects are bright and the shares being placed are above my calculation of fair value.

This CR meets the 3 criteria.

This will be the third CR I’ll have the chance of participating in this year. The others, in RQL and VOC added to the companies value and enhanced their future prospects. I’m going to speculate and say this one will do the same for Matrix.

Lets see how they treat their retail shareholders. I wonder if there will be a retail component……?

There is an SPP (share purchase plan) too. Just remember it is cheaper and more efficient for a company (fewer regulatory hurdles to jump) to raise additional capital from institutional investors. Its not a reflection of how important retail investors are to a company. I concede the impact however is.

Is a rights issue really that expensive and cumbersome?

What does it say about the whole industry that it is now generally acceptable that not doing the fair things is acceptable because it’s cheaper and easier?

The industry is rife with preferential opportunities based on you scratch my back and I’ll scratch yours. When that opportunity is paid for by the dilution and loss of opportunity to existing shareholders, I think those shareholders have every right to question management’s commitment to their interests.

No Gavin, it takes more time. Insto placement = two or three days. Tells you they might need the money quickly.

Hi roger,

If MCE needs to raise capital why did they pay a dividend? Surely they could keep the money and raise less capital.

I will wait to see the SPP document. MCE are offering the opportunity to buy up to $15 000 worth of shares at $8.50 with a target to raise $6M. No idea if the amount you can buy in the SPP gets scaled back if it is oversubscribed.

Wholeheartedly agree and something that has been mentioned to the company and will be mentioned again.

Isn’t one reason that a company likes to pay even the smallest of dividends is to allow the investor to claim a tax deduction on any interest incurred in money borrowed. ATO state that if the asset is not income producing, then no tax deduction can be made. So by paying the smallest dividend the investor can claim the deduction.

Hi Robert.

This isn’t entirely true – interest incurred on money borrowed to buy shares is deductible if it is reasonable to expect dividends will be received from those shares.

So technically speaking MCE would pass this requirement easily as it has consistently paid dividends in the past so it is reasonable to expect dividends in the future. Not paying a dividend in the current year does not mean your interest becomes non-deductible for the current year.

As a general rule deductions for interest on loans used for investment purposes (including margin loans) will be allowed in their entirety & the ATO will not make you go through your portfolio to apportion interest between dividend-paying and non-dividend-paying shares.

Note this is general advice only & consult your accountant/tax professional for advice re your specific circumstances.

Are we overstating the quality of MCE due to the rapid share price rise? It could be argued that the share price rise is largely attributable to underpricing the float, which is an indicator of less than ideal capital management.

Good point Michael. My thoughts exactly.

Mully

AFR has reported that there will also be a retail share placement. Given the amount of cash burn in the first half, the need for further capital is not a major suprise.

Hi Guys,

Capital raising results for MCE out today. I feel poorer but not by as much as I expected.

Have a look at this analyst report but take into account that is was written to sell the share placement.

http://www.matrixap.com.au/files/MCE%20310311.pdf

Hope this helps

Bit of a suprise today MCE in trading halt due to share placement.

http://www.asx.com.au/asxpdf/20110331/pdf/41xs7f6g1gqm18.pdf

Maybe Henderson is costing more than we thought?

Bit of a suprise today MCE in trading halt due to share placement.

http://www.asx.com.au/asxpdf/20110331/pdf/41xs7f6g1gqm18.pdf

Maybe Henderson is consting more than we thought?

Hi Roger

I just noticed MCE requested a trading halt as it seeks an institutional placement. Will this change your MQR for MCE?

Brand value alone does not dtermine competive advantage and lead to good ROE.

Australia’s best known brand would be QANTAS (arguably – see Rain Man). However, this company is a well known capital eater. It was hard to miss Roger’s view on this compnay in yesterday’s media. And Buffet is known to hate airline investments (despite NetJet).

Despite this, after a profit warning yesterday the share price rose over 2% and many major broking houses have put out BUY recommendations today. Mr. Market is strange!

I agree, i actually think the competitive advantage determines the true strength of a brand. before a competitor needs to overcome the brand they first need to overcome the competitive advantage if they want to be successful.

Qantas’ problem isn’t so much the company itself and any weaknesses it may have, but the economics of the airline game overall. In fact Qantas are probably more profitable than most and you could argue competitive advantages exist (think protected popular routes etc). The costs keep going up as does the competition, the fares keep coming down.

HI, long time lurker and very occasional poster (due to being a very lowly value.able undergraduate).

I find the amount of information on this site fantastic, it has helped to educate me on shares and vlue investing no end and to make me aware of the areas of investing I need to get to grips with (at the moment, forecasting is my bugbear).

I think the FAQ is a good idea, and Ash’s notions on some kind of informal forum.

Excellent work Roger, and to everyone who contributes their ideas and time to the vaue.able community a very big thank you.

Hey guys, just a few questions I’m hoping i can get help with in regards to researching my companies:

1/ How can you determine the cash flow of a business? It may be very simple as I can do just about everything else but I cannot work out the cash flow of the company. Could someone help me out here?

2/ How exactly does the MQR work? What is the difference between an A1 company and an A2 etc etc? I can tell the difference between a good company and a not so good company but I just cant seem to work out and give each company the A1 A2 B1 B2 rating.

Any help would be much appreciated and thank you in advance :)

Hi Kurtis,

First stop, read Value.able Chapter 9.

Yes Kurtis read chapter 9.

Plus you can look at the cashflow statement in the financials. For me cashflow from operating activities is the most important section

Plus mate in my view don’t get too tied up with trying to label a company A1 or C5 etc at this stage. You have said you can tell the difference between a good company and a not so good company and that is the important thing.

Hope this helps

Hi Kurtis,

As Ash said, don’t worry too much about trying to come up with an MQR. This is Rogers privatley held secret and none of us really know what information he is looking at to measure. A good hint though is to read his book, its just about finidng quality companies and as you doing, you can spot them.

You don’t even need a scoring system, all you need to do is find quality companies.

Most of us have have now developed our own scoring systems similar to Rogers MQR to grade companies on investment quality. I measure 4 areas i believe are important (3 relate to quality, 1 is what to expect from the investment) and then weight them on importance to come up with a final score. This is still new so i am still working on it but so far the results have been promising so far.

At the end of the day though, we want the same thing which is to find quality companies trading at big discounts to iv.

The whole concept of value investing is pretty simple really, probably why it never really catches on. Was it Warren who said that humans have a great desire in making simple things difficult.

Avid reader of this blog and it has been very fruitful. i claimed VOC at $1.60 and also made great gains in DCG.I guarantee im not a ramper im considering these stocks and i have done my own research and the ROE on these stocks are good and they may have upside,i remember seeing one of these stocks discussed on this blog section that being LDW.The three others are QUB,AUB and BGL.Iwould be interested ASH in your insightful comments.i hope my contributions are worthwhile.

garry

Hi Gary,

Out of these I have only looked at BGL in any great detail and it is in a very competitive enviroment.

Hope this helps

The name is obviously part of the competitive advantage once it becomes widely known. Eventually some of these become generic words (both nouns and verbs) for the objects they were originally attached to. Examples other than those mentioned previously include Nylon, Hoover, Xerox, Thermos, Kodak, Prozac, Spandex, Tampax, Band-Aid, Viagra, Tupperware, Barbie, White-out, MacDonalds, Walkman, Jeep, Kalashnikov, Aspro, Tylenol, Wettex, Polaroid, Velcro, Sellotape, Teflon, Google, Chapstick, Laundromat, Escalator, Gore-tex, Cling-wrap, Frisbee, Levi’s, Jacuzzi, Beer nuts, Kiwi fruit, and of course, Champagne has been at the centre of an ongoing proprietary wrangle.

Once people go into a store and ask for band-aids or hoover their floors, a critical mass in this respect has been achieved. So much so that it might indicate a very mature business indeed.

Of course none of this prevents the ‘owner’ of the name from ultimately losing the edge and even disappearing!

The name is obviously part of the competitive advantage once it becomes widely known. Eventually some of these become generic words (both nouns and verbs) for the objects they were originally attached to. Examples other than those mentioned previously include Nylon, Hoover, Xerox, Thermos, Kodak, Prozac, Spandex, Tampax, Band-Aid, Viagra, Tupperware, Barbie, White-out, MacDonalds, Walkman, Jeep, Kalashnikov, Aspro, Tylenol, Wettex, Polaroid, Velcro, Sellotape, Teflon, Google, Chapstick, Laundromat, Escalator, Gore-tex, Cling-wrap, Frisbee, Levi’s, Jacuzzi, Beer nuts, Kiwi fruit, and of course, Champagne has been at the centre of an ongoing proprietary wrangle.

Once people go into a store and ask for band-aids or hoover their floors, a critical mass in this respect has been achieved.

Of course none of this prevents the ‘owner’ of the name from ultimately losing the edge and even disappearing!

For those that do not believe in a competitive advantage, I suggest you read Bruce Greenwald’s Competitive Strategy – in it he explains what competitive strategies are in relation to supply advantages and also demand advantages. And yes WD-40 is one of his examples. If after that you remain unconvinced then at least you will have considered the opposing arguments.

Greenwald has stated that he does not see Apple having a sustainable competitive advantage. One would suspect that Buffett would agree. Buffett does not even hold Microsoft which has a better advantage than Apple. I believe the reason why is that the advantage that Apple has is not sustainable. I believe it may have a temporary competitive advantage but there is little by the way of sustainable comparative advantage (long term barriers to entry as discussed by Greenwald). Compare Apple’s current advantage to say Burlington North’s long term advantage (purchased by Buffett earlier this year and used as an example in Roger’s book).

Try to replicate Burlingtons requires a huge amount of money. As Buffett has stated the competitive advantages of rail using diesel over road freight using petrol is very wide. Burlington’s advantage (or barrier to entry) is that no-one is suddenly going to open a competing rail line next door by spending and risking billions on the chance that they will make money from stealing customers from Burlington.Try asking a banker for some money to do that. Thus Burlington has little if any threat from someone copying their railways or from road freight given the future prices of oil and environmental concerns.

Now, iPhones and iPads have not been available for that long and there is already competition from others such as android. Whilst you may argue about which one is better, the main point is that Apple can be imitated in a short space of time and face competition. Thus Apple’s advantage may be in the here and now, but consumers are fickle and can be drawn to other products. I suspect that same is happening with JB Hi-Fi whose competition is now not only local but global when you consider you can buy anything you want via the web. They did have an advantage but the web changed that, so their advantage appeared sustainable but things changed and so did their advantage. Oroton will be an interesting one to watch given Greenwald’s argument that all competitive advantages are local. If he is right then Oroton may struggle in overseas markets.

I would also like to suggest that those who think that miners dont have a sustainable advantage and that you can not predict their earnings need to revisit their arguments. It is easier to fall back on the “ah, commodities they go up and down and are not consistent” rather than think we may need to revisit our beliefs because conditions have changed. Both our resource companies and their suppliers have competitive advantages (and thus you can with a large degree of safety predict their earnings just like any other company that has a competitive advantage). In 2010, China used a full 50% of all resources mined. So if China continues to grow at 10% (using the rule of 72) they will consume 100% of 2010 output in 2017 or thereabouts. So do you think that the global miners can increase output of all metals at that rate – enough to supply China alone without considering how or who is going to supply the metal and agricultural needs of other countries such as India, Indonesia and other large populations in the next 7 or so years? Do you think that after all the high quality oil/coal/ore/copper is mined and we are forced to mine the lower quality resources at ever increasing costs of production that commodity prices will stay down for long? If you look at the current and future demand and supply curves for resources then you will understand why Australia is set to receive over $100 billion in mining investment. Even if you disagree, it wont hurt to check and see if your beliefs still hold.

Our mining service companies are a wonderful example and support Greenwald’s statement that all advantages are local. You might be able to substitute Vale (Brazil) for BHP (Australia), but you can’t change Forge for some overseas company. Thus Forge et al are the only ones here that can do the job. Yes others mining service companies can come into Australia and try to set up, try to break long term relationships between mining service and mining companies, risk billions, try to find staff and suppliers but why would they? One can imagine they will be busy enough in their own countries catering to the needs of their mining companies.

My apologies for the length.

Hi Steve,

Great post! Well written too so don’t apologise. If I think a competitive advantage is sustainable I will say ‘sustainable’. In the absence of the word is my thought. Who was it that said; “if the phone’s not ringing, you’ll know its me.”

Jimmy Buffet

Thats my guess anyway

BTW,

I think FAQ idea is very good

Ash,

Given the proximity of the “R” key to the “F” key, congratulations on typing FAQ correctly.

Yeah Jimmy Buffett. … think I have heard that last name from somewhere but I can’t remember where :)

Jimmy could be now a front runner to succeed Warren. LOL!

Certainly he is on a higher ethical and moral plain than some contenders, given that the latter’s first anointed lieutenant, David Sokol, has shown his moral compass in need of some calibration. Now factor recent events into the agency risk that attaches to BRK on Warren’s demise, which on actuarial grounds is a high probability event in the next five to ten years.

Buy and hold at your risk. You have to watch business leadership like a hawk to discern the early signs of the almost inevitable drift of a leaderships’ moral compass.

I’m just picturing Warren Buffet in a hawaiian shirt singing magaritaville.

His quite good on the banjo so might be able to pull it off.

Hey Steve and all,

Just an FYI, in case anyone else goes looking for the books mentioned:

There is a book – Competitive Strategy: Techniques for Analyzing Industries and Competitors which is written by Michael Porter

There is also – Competition Demystified: A Radically Simplified Approach to Business Strategy which is written by Bruce Greenfold.

When I was looking for this book I came across two other titles, has anyone read them ?

1) Quality of Earnings by Thornton L. O’glove

2) Value Investing: From Graham to Buffett and Beyond by Bruce Greenfold

Thanks for the post Steve, something new to read and something new to think about!

May i also put forward another Michael porter book, this one is just simply called Competive Advantage. I started reading it during my course but as i had to wriggle on and finish my course (which should be soon) i had to put it back on the shelf and am looking forward to starting it up again.

Hi Jason, Roger and others

Bruce Greenwald’s book is far more accessible than Porter’s. Porter’s reads like a text book and would be best covered in a class room over a full semester. Greenwald’s is shorter, more focused and tries to emphasise the most salient points. Very readable, very relevant. Barriers to entry folks!

Quality of Earnings is a slightly dated but good read.

I would also highly recommend Value Investing by Greenwald. Very good intro to value investing and gives a ‘3 tier value’ approach to achieving a margin of safety in a stock (‘discount to net tangible assets’, ‘discount to annuity, non-growth free cash flow’, and, ‘discount to ‘growth value” – the latter being a company Roger might typically focus on).

Greenwald has been noted to repeatedly make the point that growth at low returns on capital does not create/is likely to destroy value and is not worth paying up for (an American version of Roger!)

(I know this is your blog Roger and I do like value.able! but…) I think Greenwald’s book considers other opportunities outside high ROE companies (the first two approaches noted above). These opportunities regularly pop up in the market and an investor with a broad skill set can take advantage of them just the same as buying ‘an A1 at a discount’. To ignore these methods and resulting opportunities is to adopt a man with a hammer syndrome i think.

cheers

Justin

Hi Justin,

You have submitted some excellent suggestions. I have seen Bruce present and have friends who have studied under him. By no means should Value.able be seen as the only way to invest. There are many, many ways to invest and Bruce presents alternative methods for discounts to NTA etc. I actually scan the market using a bunch of ratios that include discounts to NTA. ‘Asset plays’ as they are known, however are what Buffett describes as the ‘cigar butt approach’ – one last puff. I am not sure it is ‘better’ but it is different.

Thanks. I’ll add the first two books to my next Amazon order. The second book was on my radar but I hadn’t come across the first.

amazon is a ripoff! only bookdepository.co.uk thats the reason borders went under. and guess what FREE shipping. cant beat that!

Hi Jason,

Sorry, the title is Competition Demystified but the author is Bruce Greenwald. I am temporarily in Osaka since Tokyo is apparently going to be the next Springfield (think The Simpsons) so I dont have access to my books. In the front of the book Greenwald states that he believes his explanation or theory is better than Michael Porter’s because Porters is too complex. I agree.

Value Investing – From Graham to Buffett and Beyond is a good read. Essentially the book is structured into two parts. The first parts deals with the various ways to value a company. First there is the valuation by assets which starts at the top of the balance sheet…cash, receivables, inventory etc. The result is that you can get a liquidation value. I think this is the type used for the Net-Net type stocks that Ben Graham made famous. The second type of valuation building on the first is Earnings Power basically looking at the earnings over a business cycle and gaining a valuation from that. The third is Franchise power which is best summed up as the valuation revolving around the concept of a company’s competitive advantage. Greenwald nicely explains all the approaches.

The second part of the book focuses on the methodologies used by Buffett, Mario Gabelli, Edwin and Walter Schloss and others such as Paul Tonkin and utilises case studies of each investor to show how the various valuation methods are used.

I always believe that getting one new idea or something to consider further makes any book worth the purchase price.

Regards

Hey Justin and Steve,

Thanks for the detailed reviews!

I ended up ordering both books as well as a book called “Creative Cash Flow Reporting” by Charles Mulford because I never did accounting so I’m always on the look-out for more information on this type subject.

I will order Value Investing after I finish these three.

Thanks again guys

The one thing I can say to watch out for is that 70-80% of chinas GDP growth is in fixed infrastructure! This is unprecedented and not sustainable. This is why commodities are in high demand. I also get quite worried when people justify their opinions by ‘this time it’s different’ comments.

Have a listen to Jim chanos and if I’m not mistaken, according to Jim Rogers this commodity bull run began in 1999 and usually lasts around 14 years or there about.

Again this could go for a while more but I have never been good at selling at the peak and buying at the bottom. I’m happy to be close enough!

(I have repeated this comment in another post)

Ron,

China’s economic structure is modeled on the Japanese mercantalist model and so in order to maintain a high level of exports and more importantly suppress the natural rise of their currency, they must spend a large an ever increasing amount on fixed investment as the only way to control the surplus funds without having wage increases which will reduce their global competitiveness and an inflation breakout.

My understanding is that the fixed investment is approximately 40-50%. Regardless it is still too high and unsustainable.

According to a paper by the RBA – “Sources of Chinese Demand for Resource Commodities” by Ivan Roberts and Anthony Rush China’s exports are an important source of their demand for resources. I have lifted a sentence as below:

“We demonstrate that, over the past decade or so, manufacturing has been at least as important as construction as a driver of China’s consumption of resources.”

Of course this exposes China’s to external events but I use it to simply highlight that it is not all about fixed investments.

I would agree with Chanos that China is a bubble. Its bursting is simply a matter of when not if. However as Keynes noted, the market can stay irrational a lot longer than you can stay liquid.

I do agree that China is in dangerous territory and therefore one needs to be extremely vigilant with resource investments. Personally I made a majority of mine in 2008 and 2009 with some small top ups in 2010. I will only invest now if there is a margin of safety that is at least 30% and in most cases more.

But over the longer term (approximately 10 plus years) I believe commodities will perform if one is not too greedy. By this I mean there will obviously be highs and lows. But we must remember that for all talk of China, there is India, and others amounting to 3 billions new capitalists to borrow a phrase from Clyde Prestowitz.

There is an excellent paper titled – Facts and Fantasies about Commodity Futures

by Gary Gorton (University of Pennsylvania) and K. Geert Rouwenhorst

(Yale School of Management) which reveals the benefits of investing in commodities.

Robert – Yes I believe Greenwald favours net-nets as a matter of course. It was interesting to see him state that he could not see how Buffett was smart in purchasing Burlington’s. Then after the 2010 Berkshire letter he stated that he said he thought it was a “good” investment but not a “great” investment. Buffett sees things that we mere mortals can not.

I recently started thought that Apple was seeking to move from a manufacturer to a software company (like Microsoft) and in that sense I agree that content is fast becoming king and Apple and Jobs know this so they are repositioning for the change. The fact is that manufactured products are now so cheap that there is little profit in manufacturing directly unless you have a comparative advantage and I believe most of that lies in knowledge not any of the other factors of production. As Greenwald states “eventually everything becomes a toaster”.

Craig – James Montier has written some excellent articles about mean reversion of profits. So yes I agree that you need not see 10 or 20 years ahead, but generally, those companies with high ROE etc are great performers in the short term and the best time to buy is when the crowd become irrational – MMS with the Henry review.

Ben Graham used a “short term” view and I think David Dreman also holds for short periods. In the end it revolves around what the intrinsic value is.

Regards

Steve, Thank you ever so much for taking the time to pen your thoughts and insights. Applying our valuation approach to Burlington, it appears it was already cheap. I wrote about it some time ago. Buffett’s trick with Burlington was revealed more recently. He actually bought it even more “cheaply”!

“March 9 (Bloomberg) — Warren Buffett’s Berkshire Hathaway Inc. took $2.25 billion in dividends from Burlington Northern Santa Fe in less than 13 months of ownership, almost triple the railroad’s payout rate prior to the February 2010 acquisition.

Burlington Northern paid a $1 billion dividend last month, it said Feb. 28 in a filing. The railroad held by Berkshire’s National Indemnity Co. insurance unit paid $1.25 billion last year under Buffett. The $2.25 billion total compares with $772 million that Burlington Northern handed to stockholders in the 13 months prior to being acquired by Buffett’s firm.”

An instant reduction in the purchase price!

Gtreat post, indeed there are two types of competitive advantage. One is a competitive advantage and one is a sustainable competitive advantage. We want the latter.

I agree with the commetns throughout here that although apple has a competitive advantage now, it is still uncertain if this is sustainable and will last. Especially after Steve Jobs leaves the company.

I also liked the buffet comment about Burlington in his letter and flagged it up on this blog when it came through.

This post has put forward some great posts and comments. Lets keep it up guys.

Hi Sapporosteve,

Great post,

I have only really skimmed through one of Bruce Greenwalds books.. he made some great points (like the ones mentioned) but I think (correct me if i’m wrong) he is still a believer in Graham style net-nets?..

On Apple, Lets not forget that it isn’t just about hardware and software.. its about content.. which Apple has stitched up with itunes and the app store. No other company comes close to giving people the ability to easily purchase music, apps etc, and upload to their devices.

Last year I read that Apple has completed construction of the largest data centre ever built (paying for it outright, from the $25 odd billion they have in the bank)… something like twice the size of anything Google has. There has been much speculation as to the purpose of this facility, but most agree that it is for a move to a cloud based itunes (amongst other cloud services). This means that when you purchase an app or piece of music, it will no longer be stored on your computer, it will be stored at this (or other) data facility. The outcome of this can only be to entrench the dominance of the content side of the business… depending on how it is ultimately done.. the content will be hard to move.

Of course, cloud computing relies heavily on network infrastructure.. Ours will be fantastic (and expensive) once (if) the NBN gets up and running.. the same cant be said for other countries.

As far as Australian companies go, I cant think of anything comparable.. But I read that Apple (and nearly everyone else) designs their circuity etc on a program called Altium, which is a product of an Australian company (ALU). But alas, it’s a generally negative ROE company.

Rob

Hi

Just wanted to add one small caveat to Apple’s competitive advantage – Yes, iTunes is hugely popular at the moment, however, it is not touching the massive increase in pirated music. I believe this is already eroding their competitive advantage, and is a problem that has not been resolved by any music publishing organisation or govt.

Interesting observation Steve. Thank you for taking the time to share it.

Good contribution Steve. (I just looked up Sapporo on Google Maps, and if that is indeed where you are, I hope things are ok there. If not, carry on.)

On competetive advantages, I’m wondering if people like myself shouldn’t get too concerned if we can’t identify a true “sustainable” competetive advantage. I say this because at this stage I can only commit funds for periods of between 18 months and 3 years. I don’t have money I can compartmentalize longer term from the rest of my life, and so, if a high ROE is there, along with low debt, good cashflow, and a cheap price, I’m unlikely to get too caught up in whether a competetive advantage is sustainable over 5, 10, or 20 year periods. I’ll be happy enough if the nearer term prospects are good. (Roger, if you read this and feel compelled to issue a warning re investing money you can’t afford to lose then hold your fire. It’s appreciated, and understood, but you’re not responsible.)

Apple and Microsoft – I’ve always thought the reason WB doesn’t invest in these two technology bohemiaths is not that they don’t have competetive advantages, but that he (they if Charlie still contributes) never felt he could reasonably predict the future of technology like he can with other types of businesses, because there is too much change, often rapid change.

Burlington – Although the advantages you state above are those WB himself trumpeted when announcing the purchase, its probably worth reflecting that this isn’t the purchase he wanted to make, it’s one he had to, because its hard to find suitable purchases when you’re looking to put $30 billion to work. I guess you could argue that makes the advantages in this case all the more important.

Bruce Greenwald (Indicentally, a BRK shareholder and vocal critic of the Burlington purchase) – I have a book at home by Greenwald (and others) called “Value Investing – Graham, Buffett and Beyond” or something like that. I can recommend it not least for the 8 or so short biographies of value investors. It’s interesting the different styles that have succeeded. There are some examples of specific purchases (and sales) by the profiled investors. It’s always good to read how the theory is put into practise. I love Walter Schloss. Sat in a small office at Tweedy Brown for 50 years (30 with his son). Virtually nobody on Wall Street knew him, he almost never spoke to the management of firms he was interested in, and he made 20% a year……for 50 years!

My 12 year old tells me that the ipad2 is not worth it;Basically you get a camera and a few extras but he must be in the minority because I hear they have sold out at the apple store in Sydney as well as HVN and JBH .Maybe you are better off buying JBH in spite of buyback and extra expense with Clive Anthony stores. although it is good to hear Richard Uetritz is back on the board. I remember him from Rabbit photo days and he is a great operator.

Terry Smart (JBH CEO) has commented that even if he had 3 times the stock, he could not keep up with the current demand for the ipad2. Lets not forget this process will repeat with the possible launch of the ipad3 later in the year.

I have heard that some retailers (including JBH) actually sell Apple products at cost or at a loss. This is because they get a generous kickback for hitting sale volume targets.

Hi Matt,

Very true retailers receive rebates from suppilers.

This usually takes the form of advertising rebates etc but they exisit and are a big part of competitive advantage.

From experience JBH and BIG W are the best at exploiting this area

Thats the thing about Apple products, people are buying them on mass ebcause they are Apple and they are new. I have seen people who will buy the latest Apple stuff regardless of the fact they have the previous version and the differences as you say are very little.

God knows how many ipods these people must have. But that is another example of the existence of competitive advantage, the customers are buying the product just because it is new and are putting very little thought into the rationality of buying it, its purely an emotional purchase. The people have an emotional attachment to the brand and once you have that then you are in good shape.

Yes Rog it is a typo. A good example here about doing your own research:

If the world’s population in 2009 was 6,775,235,741, then 20% of this is 1,355,047,148. If Apple has sold 300,000,000 products, then every man, woman and child has purchased an average of 0.22 Apple products in the last decade. (Still not a bad competitive advantage.)

A common mistake – same with the guys from Tokyo Electric, was the radiation level 10,000,000 times higher than normal, or 100,000?

Thanks Jonesy,

Will get it fixed.

Hi all,

I was looking at an IPO for a company called Resource Development Group – another one of those engineering businesses – although this one will only have a market cap of less than 20mil. It is due to float in April 2011.

Much of the IPO focuses on a business that RDG is acquiring, Engenium, which will be the driving force behind the growth for RDG.

Engenium has been providing services to the mining industry since 2003 and it currently services some very high profile clients.

A full list of their clients can be found here…

http://www.engenium.com.au/clients.html

In the IPO however the financial statements have been prepared in a format that is foreign to me…it has been described as “pro-forma” meaning that the financial data has been adjusted and presented in a manner that reflects:

• the adoption of AASB 112 Income Taxes;

• the exclusion of certain transactions that occurred in the relevant periods; and

• the inclusion of certain proposed transactions as if they occurred on 31 December 2010.

One thing that looked clear to me was that the profits for Engenium have been going in the wrong direction for the last few years, and yet the IPO doesn’t explain why this is the case.

Is anyone able to offer suggestions as to how this kind of data representation compares to the standard format?

The business is certainly in the right space, however the prospectus managed to confuse me a little.

Cheers,

Chris B

If my memory is correct I think they sold their joint venture business in 07…

Need to double check.

I already mentioned here that ASIC has queried them as they have flagged a capital raising soon after listing.

One to watch….

Hi Chris,

Using the historical data for FY2010 and assuming the NPAT will double for FY2011 from the HY2011 result combined with average equity, RR 14%, 0% POR im getting an IV for FY2010 of 0.02 and for FY2011 rising up to 0.2, coincidentally the offer price for the IPO.

The financials look good for the prior years with a bit of guess work im getting an IV of 0.71 for FY2009 and 0.43 for FY2008. The poor profit result for FY2010 really affected the IV. Due to the fact the profit is so choppy, to me an RR of 14% seems fair and for this reason im happy to sit this one out for the time being.

I agree it is one to keep an eye on however, particularly the full year result for FY2011.

Brent

The Australian market may be much smaller than the US, but there are a handful of extraordinary businesses, A1 businesses. And its worth finding tem. They may not be listed yet. They may not even have launched yet… NWT is one of those extraordinary businesses as it prepares to launch the first of its Jabiru satellites!

Could you please state your investment case for ASX:NWT, laying out the working for your intrinsic value and the competitive advantages you believe the company has.

The posts that are most interesting, and thus discussed vigorously, are the ones that set out this information and invite discussion. Not ones that simply shout out company names and then have no follow up.

I think I did it once in the past and, after I did it, I realised it added absolutely nothing to the blog or generated any incentive for discussion.

Thanks

Hi Simon,

Had a quick look at NWT, only got as far as the net profit line, it has not made any profit in 10 years. This one is not for me

Cheers

Rob W

Hi Guys,

As a much smarter person than me said

In the business world, the rearview mirror is always clearer than the windshield

Given that it would be nice to see Simons model as he obviously has a much better unerstanding of the business than the rest of us do.

Would be nice to see what you are coming up with Simon?

As at the end of the Octoberl 2010 quarter, NewSat’s monthly financial revenue earned has grown almost 70% since the beginning of the 2008/2009 financial year. This increase has turned NewSat’s bottom line result around substantially during the same period, as the increased sales are now converted into month-on-month positive cash-flow and profits.

NewSat has also recently announced that plans to launch Australia’s first locally owned satellite, Jabiru-1, are on track, with a 2012 launch date scheduled.

NewSat aims to leverage its valuable teleport assets and a range of other financial instruments in order to own up to 100% of the equity of Jabiru-1. Revenues from the satellite are predicted to exceed US$1 billion over its 15 year life span, and profits are expected to exceed US$500 million.

Expected profits and actual profits are two different things. There are many companies on the ASX with “expected” profits that never appear. Until NewSat reports a profit, I’ll be avoiding it.

I have looked at this one. Their story is interesting and the guy running it has won several awards in his industry.

They will need to raise couple of 100m in the next year or two to prepare for the satellite launch in 2013.

A similar company that is listed in the uk market has gone from 100m market cap to 1billion by successfully launching their satellites and making money out of it,

NWT is currently valued at 60m.

Assuming all goes well this one may be what’s called a ten bagger, but unfortunately at the moment it’s valuable value is ZERO.

If I were to make a punt and back somebody in this industry it would be the guy running this company.

Maybe u can buy some shares and give them to ur kids and when they grow up it might b worth something….

One to watch.

What happended to investing, not speculating? This is one where people will ring up Your Money Your Call and someone will get a chart out and say “If it gets above 1c, buy it. Put a stop at .6c, I wouldn’t want to own it if it goes below there”.

Michael,

don’t forget that when this company start earning profits it will no longer be called speculating!

currently its worth zero, but u must watch companies with future potential as to be alert to their progress.

as an example… CSL, Cochlear, Fortescue, Atlas Iron, etc…

I agree with Chris’s post above. Since I first subscribed to this blog I noticed a big increase in users and posts spruiking stocks almost at random with little or no analysis or reasoning behind why. I indeed thought that the blog has started to degenerate into something less informative than it was previously. If I wanted to read such gossip I could go elsewhere. Hopefully one day I can figure out the ValueAble method for valuing companies and make some more worthwhile contributions. Please keep the great standards of before held high Roger!!

I feel certain that Apple’s advantage begins and ends with Steve Jobs. When one looks at Apple’s ascendancy back in the 80’s it was driven and created by him. Then he was basically forced out of the company in ’85 (a very interesting story in itself), and the company went into gradual decline almost to the point of failure.

Here is a snippet from wikipedia discussing Apple in the early 90’s. I think most would agree it sounds nothing like the advertising and marketing world leader it currently is:

“Apple’s response to the PC threat was a profusion of new Macintosh lines including Quadra, Centris, and Performa. Unfortunately, these new lines were marketed poorly by what was now “arguably one of the worst-managed companies in the industry”.[25] For one, there were too many models, differentiated by very minor graduations in their tech specs. The excess of arbitrary model numbers confused many consumers and hurt Apple’s reputation for simplicity. Apple’s retail resellers like Sears and CompUSA often failed to sell or even competently display these Macs. Compounding matters was the fact while the machines were cheaper than a comparable PC (counting all the things built in which had to be added to the ‘bare bones PC’) the poor marketing gave the impression that the machines were more expensive. Inventory grew as Apple consistently underestimated demand for popular models and overestimated demand for others.”

Enter Steve Jobs again in the late 90’s, and off they went again. It was a re-designed imac which was centred around a “streamlined, translucent plastic body” that got Apple back on the map. The focus on asthetics that Jobs introduced, and I think clearly launched the company into the Stratosphere it now dominates.

It may be a simplistic view but without his obvious genius I doubt whether the company would be where it is today when one looks at it’s history. And we are not at the stage of cloning yet where another company could make a copy of Steve Jobs. So it’s a competitive advantage exclusive to Apple!!

I will indeed keep the standards high. Thank you for your encouragement. And if you feel you are seeing something that you don’t like, 20,000 eyes are better than 2, so let me know. There will be no unsubstantiated tips or “hey check out…” and I will not accept anything that is judgmental or simply unfriendly or unapproachable.

Ok, have had a chance to think more about this.

Before we go any further lets discuss competitive advantage. This to me is like what new accounting standards are to Ashley i think. Sorry Ashley, cheap shot i know :P.

A competitive advantage does not mean no competition. Instead it is something which gives you an advantage over your competitors and reduces the risk of new competitors coming in and taking market share away from you.

In my opinion, the competitive advantage comes first and then a powerful brand can be created around that. This obviously can then change as your business creates different advantages as it grows. A brand without a competitive advantage backing it up is just a name, a slogan and some colours. If JB Hi-Fi stops being the cheapest place to buy all the products they sell then one of their competitive advantage has gone and they are at greater risk of a competitor overtaking them.

There are a few different ways you can look at competitive advantage, porters five forces and generic principles are good starting points but not complete.

A very simplified way of saying it is If you can do something better, cheaper or both and build a reputation on it then you have a competitive advantage. It gives the company a headstart and can set the tone that its competitors must follow. This includes decisions about pricing.

For example, JB Hi-Fi has in place the systems and processes to operate as roger says on an oily rag, this means that their costs are low and they continually look to make them lower, they can then offer products at the lowest prices in the market and sustain as well as raise their profitability. Their competitors then have two choices, they either match JB and risk a hit to their margins or they leave their prices where they are and lose market share to JB.

I don’t think a business exists in Australia that has a competitive advantage as strong as your cokes and Apples etc. Population is one cause of this but also i think an element of the laid back lifestyle has led us down the path of relying to much on digging and not on making stuff. We tend to import these products from overseas and market them.

In this regard, the strongest companys for me from a competitive advantage viewpoint seem to be more in the services and retail sector. Sometimes, however, these companies are owned by companies you wouldn’t invest in.

Some examples i have thought of:

-Bunnings

I think Bunnings has an element of the google effect, i think it has almost become a term for hardware shopping in itself. I have never seen a bunnings that is quiet in a major populated area. Woolworths/Lowes ahs a fight on its hands here.

-JB Hi-Fi

I went through this above.

-Coles/Woolworths

Think Coke and Pepsi. Both are basically each others competition. The other players don’t really have much of an impact. They both use cost leadership to set the prices accepted by the market and the local grocers can’t compete as they can’t match the logistical and economies of scale advantages these businesses have. I have only been paying attention to business for about 5-8 years but i can’t remember a more aggressive fight for control of the marketplace and market share than the one Coles is waging on woolworths at the moment.

-Seek, REA

These two companies are undisputed market leaders and i believe are way out in front of their competitors. They are an absolute must for anyone who wants to make sure they get the best return for a job ad or property sale. This keeps entrenching their competitive advantage as this makes them the most visited which there for makes the suppliers more reliant on advertising on these sites. They also appear to be the most innovative and add on of additional services keeps putting them in front.

-Oroton

Oroton has such a huge following by females in all sorts of demographics. They offer a quality product at an affordable price. These are well designed and identifyable in the marketplace. Some stores you need to line up for, most stores are always busy. This isn’t a coincidence.

Marigold Yum Cha-

This one is a smallish business not listed on the stock exchange but most people in Sydney probably have heard of it. In haymarket on the weekend the Marigold Chinese restauraunt runs a Yum Cha concept for lunch over two levels in their building. You almost have to fight your way into the lifts to get up there and then have to wait in a long line. This is organised chaos but just sit down there on level 5, eat some prawn dumplings or mango pancakes and watch with a Value.able eye around you. You will see about 50 tables if not more packed with people (Yum Cha is usually a group thing so there is only about 5 tables for couples), you know the same is happening on the level below. There is still a long line up waiting to be seated. People order a large number of meals, eat them quickly, pay, get out and before they get out the door to leave the table has been turned over and a new group is sitting down doing it all over again.

If you want to learn more about identifying competitive advatages i have a couple of exercises which helped me.

Ask a group of people to name the first company they think of, or would go to, to purchase a specific product or do a specific thing. If you get the same answer by most of them and find out why you will find a potential competitive advantage. Now you can focus your analysis on working out why that is the case.

Think to yourself, what business would you get excited about and drive to the other side of town to use or buy their product.

Also, think about some companys you know have a strong brand. McDonalds and KFC are good examples. Remember that the competitive advantage protects the brand so ignore the brand name and try to think of why they have been able to create such a strong brand. What do they do, or do so good that they are so far more dominant than others in the same space or same food court.

If anyone has trouble with needing to line up at oroton, go to the North Ryde store – you will probably be the only one there.

Video killed the radio star

Hi Roger,

I couldn’t agree with you more on Apple’s A1 business ranking and I have stated this to you once before on your facebook wall.

With the Ipod- they revolutionised portable music players.

With the Itunes store and $1 tracks they revived the music industry .

With the Imac and Macbooks they revolutionised personal computers and Laptops.

With the Iphone they revolutionised the mobile phone.

With the Ipad they have re-invented the tablet.

With the App store they have just about dominated all online digital media.

The one obvious area that Apple has yet to conquer is the Television and to me Apple TV is not the holy grail yet. So i’m expecting that Apple will try to do something about this soon.

My own estimates of Apples IV are similar to yours and its interesting (but scary) to note that brokers have a unanimous buy rating on the stock, with a $429 consensus target price. So who is left to buy the stock if everyone is already long?

Last week I estimated IV for Warren Buffet’s latest acquisition (Lubrizol). With a 14% RROR I arrived at an IV of about $133 USD, which is where the current share price quickly arrived. Prior to the takeover bid it was trading at a 30% discount. Although BerkShire bought at a 30% premium to market value, it was still fairly priced on a 14% RROR using your Value.Able system. You mentioned that Zicom reminded you of Lubrizol. My broker doesn’t offer coverage for Zicom. Can you offer the name of any good firm that covers stocks at this small end of the market? I’m not fussed about the costs. What I’m looking for is a way to scan the entire market for future estimates. At the very least, I expect software capable of attaining future estimates of companies with ROE greater than 20%. What can you suggest?

Also, have you ever considered buying into the likes of Colgate Palmolive or Kelloggs, which at current prices offer about a 14% RROR on your Value.able system. I think that given the stability of earnings for both these 2 companies and even lubrizol, it would be reasonable to estimate IV using a lower RROR, such as 10 or 12%, in which case they all look pretty cheap. What’s your opinion?

Kind Regards

Salv

Hi Salv,

This is an easy one to solve. Give Zicom a call and ask who covers them. On US companies, there is some terrific value offshore at the moment.

BTW, nice application of the approach to Lubrizol. Very helpful and a similar result with Burlington purchase