Will Iron Ore and Base Metals continue to drive BHP?

It has been six months since my last BHP update. With so much smoke surrounding the half-year results, I thought it worth reviewing whether anything – particularly my Value.able valuation, had changed.

It has been six months since my last BHP update. With so much smoke surrounding the half-year results, I thought it worth reviewing whether anything – particularly my Value.able valuation, had changed.

You may recall back on 31 August 2010 last year BHPs shares were trading at $42.30. At the time my Value.able intrinsic valuation for BHP was $45-$50 per share. As I write today the shares are trading at $46.09 (they have traded as high as $47.63). Gains of 8.2% over the past 6 months are satisfying, but not spectacular. Gains in MLD, MCE, FGE and DCG have been more impressive.

Since I shared my insights, BHP has of course announced their half-year results and exceeded all prior forecasts. Fifty seven per cent earnings growth was forecast for BHP and 50% per cent for the resource sector as a whole in 2011. This was eclipsed by 71.5 per cent earnings growth.

Booming commodities and record Iron Ore and base metal prices, which account for roughly half of the group’s revenue (see table below), has boosted their result. Having moved away from yearly pricing to a monthly pricing benchmark, BHP has been able to take full advantage of rapid commodity price appreciation.

BHP’s reported revenue from Iron Ore sales in FY11 was up 109.5 per cent. Given its largely fixed production costs, Iron Ore was also the largest contributor from an EBIT perspective, with a 177.90 per cent increase. This is the happy side of operating leverage, which I have discussed previously. And remember, Iron Ore is China’s second largest import, after crude oil.

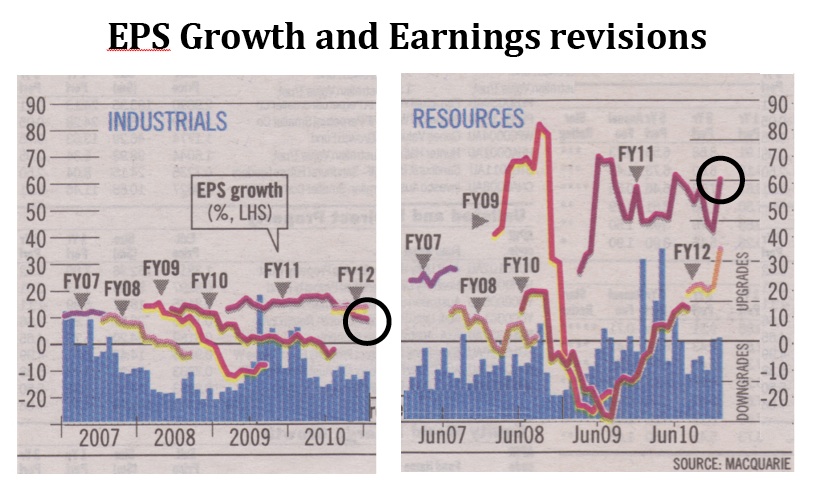

With growth rates and margins of this magnitude, analysts have become even more bullish on our resource sector. Earnings growth for 2011 is now forecast to be 60 per cent (previously 50 per cent) – that’s a 20 per cent increase in just six months. Estimates for 2012 are 30-40 per cent.

Compare this to earnings growth forecasts for the Industrials Sector. The difference of 10 per cent clearly indicates where Australia’s economy will derive its strength.

But can it last? I have said many times that I have no predictive ability. I will leave that for others to determine.

I will however take onboard recent comments from Marius Kloppers, who stated that high Iron Ore pricing should continue for a further 6-9 months. Whilst the Iron Ore market remains in tight supply, I note the many expansion projects currently underway will swell supplies from 2014 onwards – an excellent example of how boom-time profits entice others to enter the market and compete – the very definition of a commodity.

Over the longer-term, BHP’s aggressive $80b growth plan suggests confidence in the markets in which it operates. More importantly, $80b should give investors in mining services businesses cause to celebrate!

With analysts becoming more bullish and being contrarian by nature, I’m more comfortable adopting a conservative approach when it comes to resource companies. So while others continue upgrading their numbers and forecasts based on current market pricing, I will retain my previous AUD $22b profit forecast (hopefully this is conservative enough) for 2011 and my Value.able valuation of AUD $45-$50.

As always, I will also further my conservative approach by seeking substantial margins of safety. There are some A1 opportunities available at present, however they are the exception rather than the rule.

Posted by Roger Montgomery, author and fund manager, 24 February 2011.

ON ANOTHER NOTE… The SMSF Review, along with Alan’s Eureka Report and my team, are delighted to announce an event where 100 per cent of the net proceeds will be donated to those affected by the recent spate of natural disasters. The SMSF Strategy Event – for charity, includes some of the country’s most respected Self Managed Superannuation Fund experts. Tickets are $77 and can be purchased online at www.thesmsfreview.com.au. Click here to view the full event brochure. If you are based in Sydney and manage your own super fund, I encourage you to join me at this very special event.

RE LYL,

I’m with you Ashley I get < $5.50 for 2011

It is interesting to not that India who is the worlds third largest exporter of iron ore has just announced an increase in export duties in order to conserve supply for their own use.

I think the fact that energy (21% of BHP portfolio prior to the Chesapeake acquisition) is likely play an ever increasing role in the future of BHP’s bottom line.

Hi Roger,

Are my valuations around the mark?

Financials taken from Comsec

RIO $116.90 based on E $29.25 REO 24% PR 15% (Dec 2010)

WPL $18.86 based on E $13.93 REO 12.8% PR57% (Dec 2010)

AMP $4.22 based on E $1.42 REO 25% PR 25% (Dec 2010)

PTM $2.85 based on E $0.40 REO 60% PR 94% (June 2010)

I know PTM is a fair way from your valuation

Thank You

John Edwards

i dont know how accurate these numbers are 2010 google nr

even my home country of sweden is contributing iron ore is like andrew said every were and lots of it

World Production, By Country (Thousand metric tons)

1 China 588,000

2 Brazil 318,000

3 Australia 275,042

4 India 160,000

5 Russian Federation 102,000

6 Ukraine 74,000

7 United States 52,700

8 South Africa 41,326.04

9 Canada 33,551

10 Sweden 23,300

11 Venezuela 23,000

12 Iran, Islamic Republic Of 20,000

13 Kazakhstan 18,600

14 Mauritania 11,155

15 Mexico 11,000

16 Chile 8,629

17 Peru 7,250

18 Korea, Democratic People’s Republic Of 5,000

19 Turkey 4,000

20 Bosnia and Herzegovina 3,300

21 Egypt 2,500

22 Algeria 2,339

23 New Zealand 2,300

24 Austria 2,000

25 Greece 1,500

26 Malaysia 1,000

27 Viet Nam 710

28 Colombia 644.15

29 Norway 620

30 Germany 360

31 Romania 300

32 Thailand 264.29

33 Slovakia 250

34 Korea, Republic Of 227

35 Tunisia 200

36 Zimbabwe 200

37 Nigeria 100

38 Pakistan 60

39 Indonesia 20

40 Portugal 14

41 Azerbaijan 11.3

42 Macedonia, The Former Yugoslav Republic Of 10

43 Morocco 9.9

44 Guatemala 7

45 United Kingdom 0.5

Hi Everyone,

i know the hype is all about MCE and FGE and DCG but what about LYL my 2011 valuation is $6.80 so it is still cheap at the moment

Cheers

Hi Keirann

I am a LYL fan too and have owned them for almost a year. The only problem I see with it is low daily volumes. Sometimes there are very few sellers or buyers. Otherwise they have continued to perform well.

Cheers

Jim

HI Keirann

How did you calculate your valuation ?

I have EQPS $1.25, NPAT $15.8m (EPS=41c), DPS 32c, POR 78%, ROE (using ave equity) 35%, and even using a RR of ’10’ I only get $6.01.

Hi Guys,

Using forecasts I have much lower,

The forecasts could be very wrong though

Hi Guys,

I had 2011 LYL at $6.70 IV with a POR of 47% HY10 (EPS 21, DIV 10) and RR 11. What a difference the POR can make !!

As an exercise I thought I might write down why ROE is such an important way to think about a business (I had some paid time on my hands):

=====Broadly/superficially:

1) if you can get a large R from a small E then you should always be excited

2) if you can continue to get larger R’s with increasing amounts of E then you should be ecstatic

3) if you can get a larger R without any more (or even less) E then you might feel faint

=====But why is that significant?

1) most businesses require more E to keep going each year (eg replacement of equipment). If that incremental E does not produce the required increase in R to maintain the same ROE as prior years then ROE will decline with time

a) and why is that important? well, if the business keeps retaining earnings and not giving them to you as the owner, and each of those dollars retained only earns 5% then you should not be very pleased. Not only is every dollar not paid to you earning a return non-commensurate with the risk you are bearing but also eventually all of the equity will be returning approximately 5%…. Surprisingly, there may still be a line of competitors lining up to enter the industry despite these poor economics. The chance the business will magically increase it’s return on equity without some large change is slim.

b) the worst situation is a business that does not generate enough real profit to cover it’s ongoing capital investment requirements – think QANTAS. There is good reason why a company like this is public, it needs to raise money all of the time and if it was owned by a single person it would exhaust them with it’s ongoing requests for capital. The only long term alternative to being publicly owned would be government ownership.

2) many businesses can not increase R each year because of competitive dynamics. ie, they are in a price war, they are in a commodity business, the industry is in a terminal decline etc

=====The caveat?

Little or no debt. Debt skews the above and it also increases the risk. Avoid!

=====The way to ensure the above high ROEs?

An identifiable and difficult to replicate competitive advantage coupled with sensible capital allocation.

Although a non-capital intensive business helps, the above provides mostly for a situation where returns on equity are maintained at a high level. Owners can have confidence that incrementally invested equity can be sure to provide a return that is equal to previously invested capital. Without that assurance owners will end up with a bank account of a business – with greater risk and no govt guarantees.

==== How to be sure of the competitive advantage and capital allocation?

Analysis of the business, the industry, the management and the businesses prior record will give you a very good idea.

Next time maybe I’ll post about cashflow, it is a bit simpler….

Thanks Matt,

Good stuff

Hi Roger and Investors

i found a stock (TOX) from what i can see its a B1 it has been reducing its debt and increasing its ROE i have an IV of $3.07 and its current price is $2.18 so it appears cheap to me its involved in the waste management industry has signed long term contacts i believe it has many competitive and comparative advantages. with its future lookng bright their are alot of signs suggesting its ROE will increase, its not yet an exceptional business but its a good business at a discount to IV so i believe its worth having a look at..

What are all you thoughts,

Kind Regards

Borislav

Hi Borislav,

I have heard Roger say in the past that this business has a competitive advantage,

Can you share with us how you have your $3 IV

Using forecasts I have

EQPS .97

Forecast EPS 14.4c

Forecast DPS 3.6c

ROE = 14.85%

POR = 25%

RR 14%

IV $1.08

I hate to say this but I hope you are wrong as my maths are not normally that far out

ZGL

b1 – IV of $0.60, trading below IV

thoughts ?

Hi Everyone,

ZGL – I get an IV of .60 and roger has stated it is a B1 today opened at .35 seems like a good buy to me ?

coincidently – article on p30 AFR today on solar power!

Buying Gold Silver is not speculating if you have a view on the us dollar and global inflation.. but holding gold for long periods of time say if you bought at the top in the 80s you would be way behind the inflation adjusted high prices. but there is a time to be in precious metals and for me the fundamentals are there now .. us national debt and most of all the unfunded liabilities in the us.. you now have over 1000 billionaires in the world with a lot of paper money .

you have more $ millionaires than ever the gold silver markets are very small compared to currency derivatives like roger said on your money your call only takes small % moves to push the prices higher if you have strong cash flow buying silver and gold on dips is ok but going all in can be very dangerous .

I did use to invest in to companies such as Downer edi but not anymore thanks to ROGER. ……….

Thank’s Roger

the profits are coming from solar panels, kitchens and bathrooms only made $500k in the last half, from memory

I agree Ashley, solar is a growth industry, it’s pretty likely there will be some sort of solar generation on most roofs of homes, factories and commercials buildings in the next 10 – 20 years

The problem is the cost to install a 1.5 kw system is something like $10k so it’s being subsidised by the govt via REC’s – of course the govt keeps changing the scheme

AIR came out of Tamawood – I’m a bit of a fan of Lev although I don’t own any TWD, I would bet John Beith is cut from a similar cloth. Their facebook page has photos of him cleaning up after the flood so he’s not sitting in his ivory tower.

It certainly seems cheap, probably has great management but is it a great business and does it have a sustainable competitive advantage?

Anyone looked @ Astivita -AIR ?

If so, any thoughts ?

Hi Brad,

Nice find, they do appear to be trading at a discount to IV. Watch out for the negative cash flow and the massive increase in the payout ratio though. They don’t appear to be operating on very good margins.

Hi Brad,

Yes I am looking,

They are at a discount ATM but that is not the only thing to look at

Lower margins in the last 6 months are a concern.

They will book a big loss due to flooding in in second half but this could be offset by bigger demand as flooded kitchens and bathrooms needing to be replaced.

As the management say this is a very competitive enviroment but they(the management) appear to be very competant.

We just have to remember the rower or the boat arguement.

It is better to have a better boat than better rowers.

Recall the americas cup victory by australia in 1983. They won this because they had a better boat not a better crew despite what they tell you.

They winged keel was a competitive advantage.

I will continue to look because I think solar is a growth industry in the future.

Hope this helps

have to agree with you there Ashley, i think renewable energy in the future is a potential boom area and solar is the easiest and most accessible.

I think we are already seeing in the commercial construction area how much environmental issues will affect the future. nearly every building now is being built green. I know they do it as much for marketing purposes than anything else but the fact it is a selling point is showing that there is support behind it.

it is an area i will keep a pointed ear towards as i think there is a bucketload of money to be made here.

Hey Andrew,

I hope you don’t mind if I play the opposite tack so here goes….

Is there a demonstrated competitive advantage and I don’t count first mover as always a very durable one, bright prospects do not equal high levels of profitability and not all businesses in the renewable energy pipeline (patent holders, manufacturers, distributors, sales and marketers, installers, repairers, consultants etc) will be as profitable as each other

I’m going to paraphrase: “in the early 20th century you didn’t have to be a genius to work out that the motor car was going to have a profound impact on future society, but no investment in a car manufacturer was ultimately profitable”

Also, do they have very significant competition? And what would happen if govt subsidies were removed?

Very right Matt,

You must get in the best Boat and detrimining this ATM is very difficult for the solar sector.

Won’t stop us looking though

Folks I have just been updating my IV for MIN based on the recent H1 results and I have come up with $11.74 for FY11. I would be interested to hear what others are getting? If that is the case then its trading at a premium at the moment, however interestingly my IV 2012 has it ~$20.00 – if that is the case, then considering we are 3/4 through the FY year then it might be worth paying the premium…?

Cheers

Robert

Hi Robert,

My FY11 IV is similar to yours, but I don’t have them rising quite that high in FY12.

It’s an interesting question though, do you buy something expensive that is soon to become cheap? Depends on what other options you have and what you see the market doing. And do you opt in to their newly announced DRP plan?

I’m not against the principle, but for me there is no rush to go out and buy. You could try annualising the figures to reflect 1.25 years and see if it still looks attractive.

Hi Christopher,

Yes, it’s an interesting position to be in – do you buy something expensive with the intent it will become cheap. I have annualised @ 1.25, and it is a pretty good return if my 2012 IV is to be believed. What did you get for FY12?

My workings for 2012 are:

Forecast EPS – 125.3c

Forecast DPS – 53.3c

EQPS = $4.28

POR = 43%

ROE = 32%

RR = 11% – IV $22.01

RR = 12% – IV $19.15

Cheers

Robert

Hi Robert,

FY12:

Forecast EPS – 115-120c (I wonder if some of their 2nd half earnings might be abnormals)

Forecast DPS – use 62.65 (50%, not the analyst forecast of 40%’s)

EQPS – 3.87 (using the most recent Appendix 3B)

ROE – 32%

Using a 10% RR, this would give around $22. However, it also gives an implied growth rate of 16% (even when we increase the payout ratio to 50%). My best guess is management will establish and maintain a 50% payout ratio, which means ROE should be adjusted to lower the growth rate a bit. I suggest a 27.5% ROE, giving an implied growth rate of 13.75%. With a 10% RR, IV is $17-$17.20.

I should add that I’m a huge MIN fan and hold the stock. I also agree that paying a little extra for something that is about to become a great deal is, in principle, sometimes a good move.

For MIN I have a 2013 IV of $18.80 using 11% RR and 50% POR. I rank stocks in my investible universe by their 2 year forward IVs and before investing I consider industry risk and sustainabbility of competitive advantages. MIN currently ranks 9th on my list and I hold the stock. I currently prefer AGO, MCE, FGE, ARP, and DCG, though as I stated I continue to hold MIN.

Hi John,

Thanks for sharing your IV and comments. I agree with you with regards to paying due consideration to the industry risk and sustainability. I personally have mixed thoughts at the moment around how much longer our resources boom will continue.

Would you also be able to share your workings for your IV? It is a little concerning that for 2012 I am coming up $19.95 and for FY13 you are getting $18.80 – I obviously have something wrong.

Cheers

Robert

Nobody has mentioned ASX: RKN recently !

Has everyone forgot about this business ? Or is everyone drunk on MCE & FGE ?

Hi Simon,

I like RKN very much and know this conpany probably better than most. They are likely to have a good year given the new parental leave stuff but just no MOS which is the inportant thing.

There are so much Iron Reserves that are untapped.

Hi Roger,

I noticed that the 2010 letter to shareholders has been posted on the Berkshire Hathaway website.

Regards,

Craig.

Hello Room

I just read comments about Iron or pricing and futhre here wrt BHP’s performance. Having spent more than 10 years in the industry, I thought I will give my 2 cents worth here.

I agree with all that we have been driven by growth in China and India however there is more to it. On analysing the demand and supply forecast, it is widely expected that the tipping point in the Iron ore industry will be around year 2014-2015 where supply takesover the demand and as a result of this, the Iron ore pricing will comedown. Globally, there are few big projects in the pipeline such as Kumba Iron Ore and Sesa Goa and CHIRIA projects in India which will produce in full capcaity in 2-3 years time. As a result of this, it is estimated that the long term future price of ore will be around $85/ton.

Another reason the price of ore $150 can not sustain forever is because both China and India are resource rich countries – however these resources are not minable due to their lower grade. If prices are to continue higher, majority of these resource will become economically minable and demand of Pilbara ore may die.

Jigar

Hi Jigar,

Pilbara iron ore cost of production is in the bottom quarter of the industry cost curve. This is a significant competive advantage for the likes of RIO, BHP and to a degree FMG. Also the low cost of transporting iron ore from Pilbara to Asian markets is the second competitive advantage for these producers. If economic rationalism holds true and there are no trade barriers between countries, then the first to fall off the cliff are the marginal cost producers. Having said that high cost producers may keep going for longer than expected due to cost of shutting down and re-starting plants/ mines. I expect most of these new producers will be in the higher end of the cost curve, unless they have world class resources. By that I mean, good (high) grade, low impurities, having established infrastructure and or closeness of major transport routes , large reserves (as opposed to resources). Government policies may also play an important role (MRRT???). But that still does not change Pilbara producers position in the world (for a while yet to come).

Yavuz

Ash

Very nice reply!

Hi Forum,

I have held Catalpa CAH for a while now and the price has risen nicely. I know resource companies are not favoured by most followers of Rogers investment philosophy however it appears to have a good MOS based on analyists predicted production. The debt to equity is around 50% which is okay. Their sales are hedged at a gold price of $1500 removing some of the risk.

The downside is they often raise capital to fund exploration. They have however found new higher grade deposits which is a plus going forward .

Cheers George

Dear Forum,

Diploma Group (DGX) has disappointed the market with its half year report resulting in a 38% drop in the share price to 16. By my calcs this represents a 85% MOS on a 2010 IV of 1.11. Any thoughts would be welcomed.

Steve

Steve,

I don’t believe DGX is investment grade but could be worth a punt on a turnaround story. I would not put much into a stock like this way too risky.

George

George,

Thanks for the feed back, which raises the question is the company investment grade? Roger can you please provide a MQR on DGX.

Steve

I agree Steve large MOS. As I’ve just witnessed though the expectations of investors are high and bad news is dealt with brutally in small caps like this. Be interesting to see what the new IV is after full year figures. A lot of orders on the books but its whether they can make them without delays and pre-sell a majority of apartments.

After removing the one-off gain in the 2008 FY on disposal of the equity accounted investment, the underlying NPAT for FY 07 to 10 was $1.9m, $2.2m, $2m and $10m respectively.

For 2011H1:

– DGX reported a loss of $0.6m which is significantly out of step from past years results.

– Revenue has fallen from $126.9m to $61.6m.

– Construction revenue was down from $75m to $48m (note 3).

– Development property sale revenue dropped from $52m to $13m (note 3).

– The dividend (1c pcp) was suspended.

– The company announced a buyback plan on 14 Oct 2010 to purchase up to 10% of the common stock at a price not exceeding 45c. After the November rate rise, the company bought back only $200,000 of stock over an 8 day period but no more stock has since been purchased. This was a warning sign that perhaps something was not quite right and DGX has to be watched very closely.

– Note from 2008 AR: For development properties, both profit and revenue is recognised at settlement of the development. (Page 8 of 87).

– Completed development project inventory (at cost) fell from $23m at 30/6 to $20m at 31/12.

– Development project inventory under construction (at cost) up from $23m at 30/6 to $55m at 31/12.

From the announcements, Nick Di Latte, Diploma’s Managing Director said “The business remains in a sound financial position and the Company expects to report a stronger second half. Diploma’s combined construction and property portfolio is in excess of $1.1bn which will complete over the following three financial years. This strong forward order book and Diploma’s diversified operations places the Company in an excellent position for FY12 and beyond.”

“The result has been impacted by a slower take up of completed stock on the Rise development and delayed starts on a number of construction projects. There was also minor contribution from the development division during this period as projects are forecast to complete in the second half of FY11.”

“The Directors expect an improved second half for FY11 with 3 development projects, Zenith, Foundry and Cove expected to settle prior to 30 June 2011. The Group is well positioned for FY12 with record development and contracting work in hand, particularly with the completion of the Eleven78 development in the first half of FY12 which is 95% presold.”

What troubles me is:

– the 100%+ decline in NPAT on pcp with no ASX announcement by management especially after the cessation of share buyback activities.

– the difficulty of (now) determining the profit margin of the business. Do the properties need to be discounted to be sold and if so, will this be at a reasonable profit margin noting that the maximum underlying profit margin was 4.9% in the last four years.

– the lack of a range of full year profit guidance.

– I need to speculate on the above to calculate an intrinsic value.

Normally I would not purchase a common stock with less than 5 years track record but I did enter DGX as an arbitrage position after the buyback intention announcement in combination with the low annual turnover and IV significantly above the price at the time. After the buyback cessation, I held on to them as IV>price but decided to watch the results announcement very closely. Luckily enough, I managed to reverse my position with the first sell order post announcement taking an approximate 20% hit on this unsuccessful arbritrage position but the stock then proceeded to fall a further 41%.

DGX may turn out to be a profitable investment but there is far too much speculation involved for me to continue holding it and clearly it isn’t one of Charlie Munger’s wonderful businesses. For all stocks with a short listed history, there is great investment risk that the investment risks are not well understood (management, profitability etc). For DGX, the biggest risk now is that the property market has peaked which would affect its future profit margins. The slower sales on the Rise development after the interest rate increase “may” be a leading indicator of what is in store.

Good luck.

Thanks for your excellent assessment Paul.

Not many here admit to their investing mistakes, and I’m sure it is not because of a lack of examples! :)

I’ve learnt as much and more from my mistakes as I have from successes and now I’ve also learnt from your experience, so thank you for sharing it… I hope you don’t repeat it!

Great assessment, however management has given sound reason to drop off in revenue + expeted increase of 2nd half. If 1.1bn revenue over next 3 years say margins are 4% you get 44 mil. & if the company is selling @ 25 mil, i think this is a very good opportunity (i understand it is not greatest business but it is alright). Past performance of delivering projects in general has been pretty good.

On a side note: directors have been buying recently with most of them holding around 15% of availabel shares. As well as this the comapny has been around since 1976, just listed recently.

Hi Tyler,

Do you have your spell checker switched on? Lets keep the standard high please.

Tomorrow morning the 2010 Annual letter to Berkshire Hathaway Shareholders will be published on the Berkshire Hathaway website at http://www.berkshirehathaway.com

It is guaranteed to be a good read!

Hi Matt,

Thanks for the tip,

As you say it will be a great read

Hi Matt,

I really like the part where Warren mentioned about the letter his grandfather Ernest sent to his Uncle Fred along with the $1000 cash.

Think I am going to print that letter and put it on my work station to remind myself everyday.

I agree, I liked it very much also

There is no doubt Warren Buffett has a particularly well wired brain but this year’s letter further demonstrates how his background has also shaped him greatly. It has given him that emotional/psychological strength so important so as not to erode a rational investment framework

Thanks for the heads up Matt, just had a look at it. I liked the comment on BNSF having an advantage over its competitor (trucking). Great example of a form of competitive advantage and why having it is such an important part of analysis for a company.

Also, had a chuckle when Warren was talking about his trip to Geico as a student where afterwards he made geico 75% of his $9000 odd portfoli and mentioned eh still felt overly diversified.

Owning a lot of companies purchased below IV is never as good as owning wonderful companies purchased below IV and this is another good example of this.

You are welcome

Often the best things in life are free and WB’s letters are no exception – they are full of wisdom

I’m currently valuing BHP at around $52 in 2011. After that it depends on how bullish/bearish you are for 2012!.

What valuatins do ppl currently have on FGE?

Hi Raj.

I and getting around $7.50 to $8.

No need to buy for me ATM but selling is out as well ATM

How about your value for FGE? ;)

LOL

Yes that is my FGE valuation

Not BHP

For FGE I have a current valuation of $7.22 using 35% ROE, 20% payout and 12% required return. For my 2013 valuation I use a conservative 40% POR and get a valuation of $10.57.

Readers of this forum may be interested to have a look at the HY accounts and investor presentation from Resource Equipment Ltd (RQL.) This company designs and constructs dewatering solutions for mines and is growing rapidly throughout Australia, especially Queensland.

Best Wishes to all.

Hi Nick

I had a look and I hope you dont mind If I share my views on it.

Yes it appears to be growing quickly and sounds promising with the new acquisition. There is cross sale opportunity of their services with the new acquisition to existing clients and new clients and hence organically grow their earnings.

However I feel It may be fully priced at the moment. With the 20 mil in Carried forward tax losses, their NPAT is artificially inflated which in turn inflates ROE.

20 mil is a fair bit so they will be able to offset tax for a while yet.

This is one I would keep on the radar and wait for their full year results to asses further.

Thanks for raising it.

Of course I don’t mind Peter. Thank you for sharing your views. I was hoping for some contrarian opinions.

I agree with all you say except our valuations differ, perhaps though I am more biased as I hold shares in RQL.

Still, this company is providing an exceptional service, has a very high quality proven management team in place and has wonderful growth prospects and is currently my top selection.

Hi Nick,

I have looked at this one a few times.

The opportunities look incredible but,

I know we should not look through the rearview mirror but the track record keeps turning me off.

I hope it goes well for you

Ash, I’m not sure what you mean by their track record keeps turning you off. If anything it should be the opposite.

I’m not sure if you’re in the same boat as Roger was last year when I recommended this company for his Christmas special when I believe he was examining the financial metrics for Repcol, (the former debt collection business) which Resource Equipment Ltd backlisted through. This is not the same company so any comparison of their statistics is completely meaningless.

Resource Equipment Ltd has only been listed on the ASX for a year and a half now.

Their main subsidiary Resource Equipment Rentals had been operating as a private company from 2003 until being listed on the ASX mid 2009.

Resource Equipment Rentals performance had been very good and the idea of the public listing was to take it from being a company which had formerly only operated in WA into one which would operate Australia wide and eventually internationally.

I am happy to say this is what is being achieved currently.

Hi Nic,’

Thanks for that

my ertarde figures have negative ROE for 2007 and 2009 which as you say can’t be right

Ash

As a defensive investor maybe you should avoid commodity type company and so do I for ” NOW ” but I want to become a aggressive type of investor like Roger, when I become more competent and confident I will from time to time dip my toe in.

After Listening to Roger on “Your money your call” I realised that even though I have moved forward a long way I still have a long way to go. Great show Roger!

Hi Fred,

Buffet says his defence is better than his attack.

I like this approach best

I was disappointed to hear Roger talk about and learn about his speculative activities on Thursday’s Your Money Your Call using interest rate, gold and oil futures. Roger said he was content with a 15%-20% return and I’m sure he can achieve that and more by holding concentrated positions in common stocks without introducing uncertainty involving long-term price speculation using futures. It was quite funny to hear Andrew Page say “Your speculating again Roger.” Is Roger straying to close to the edge of his circle of competence or is he expanding his circle with confidence? Better to close out your profitable positions now Roger and take a greater ownership in your best undervalued common stock positions. In any case, please keep all speculative positions in the closet on YMYC.

Good luck Paul.

Thanks for your advice Paul. I have been involved in futures for over 20 years. Happy not to share those views again but keep in mind Buffett’s investments in silver and oil (direct and indirect).

Roger,

I prefer that you do share all your views. This gives me a holistic approach to your mindset and why you choose to invest in certain companies.

I thoroughly enjoy watching you on the Business channel.

Keep doing what you are doing – its working really well.

All the best

If I remember correctly, Roger, you promised a valuation on a company submitted by a caller to YMYC last Thursday to be done over the course of the weekend. How are things going with that valuation?

Its done. It is now in the queue for a blog post. Have a couple ahead of it though.

hi roger,

any thoughts on this company:

Novarise Renewable Resources International

listed last year.

cheers.

what was the code i missed it

Thanks Rob

Rob, I believe the code was UNV, Universal Coal. They are a Coal explorer in South Africa. The company listed in December and are up nearly 100% on their IPO price.

Jimmy

Hi Roger,

Please, please, please keep on sharing all your insights. Especially on oil and commodities.

The more background knowledge, the better in my opinion.

Warren Buffet and Jim Rogers and Roger Montgomery all invest in commodites and futures and are the best three investors that I know.

Everybody must rembember that there is risk in all investments. But if you know what you are doing, investing is NOT risky. I believe wholeheartedly that Roger has done better than anybody else out there teaching us freely, how to reduce the amount of risk in our investments.

You are doing a wonderful job Roger. Thanks a million.

Quote from the most recent Berkshire Hathaway letter for 2010 around investment managers: (Fund consultants like to require style boxes such as “long-short,” “macro,” “international equities.” At Berkshire our only style box is “smart.”)

Such a simple statement but there is some much truth behind it.

I don’t see how putting money into interest rate securities, gold or oil futures is by definition speculation. If you have a solid understanding of the current underlying value and a significant enough margin of safety, I think you could take an approach which is fairly similar to the way in which Roger proposes to investing in quality companies.

Clearly these types of investments require a high degree of competence and experience and are unlikely to safe for the average investor and therefore not suited to all. However they do make the world go around so they shouldn’t not be immediately excluded.

I believe Roger is probably staying true to his value investment approach even though they are outside most investor’s experience.

For example, investing in Matrix requires a perspective of global oil supply and demand and the likelihood of them being able to grow their business with a growing demand. If one has strong enough convictions about supply and demand dynamics and also has an investment framework, investing in oil via the futures market is similar in nature. Therefore there is no speculation involved.

Hi Steve,

Well put and I agree with your comment.

I have also started reading ‘Hot Commodities’ by Jim Roger and he raised the point that commodities Futures are perceived as “speculative” because there are many accounts of people losing money. However, the relative ‘high risk’ is due to how Futures Derivative works (being a leverage product) rather than the underlying commodities prices.

I also believe that each commodities has its own set of fundamentals (i.e. demand and supply). Accordingly, applying Value Investing strategy to buy when price and value are significantly distorted is the same.

It all goes down to your own circle of competence and whether you are interested in broadening that.

Ladies and Gents,

Some assistance if you will.

Common sense suggests that if a “Non-Controlling Interest” has a certain percentage of a company’s equity attributed to it on the balance sheet, then they are entitled to a share of that company’s profits in proportion to that share of the equity.

Is there ever a situation where that is not the case, and in fact their entitlement is greater?

I have encountered such a situation. The financial statements of the firm in question show a distribution of profits to a non- controlling interest of approximately 4 times their proportional equity contribution.

Is this robbery, or do I need to enroll in course called “Financial Statements 101”?

Craig B,

The non-controlling interest (outsider’s equity holding) is probably of a subsidiary which is contributing an outsized share of the total company profits.

eg: Say a company makes $1 from an equity base of $10, and has two subsidiaries. Subsidiary A makes 80c from a an equity base of $5 while Subsidiary B only makes 20c from an equity base of $5. If the outsiders owned half of Subsidiary A, then they will take home 40c from a $2.50 “non-controlling interest”, while the remaining shareholders would get 60c from the remaining $7.50 equity investment.

I know the numbers don’t add up to your example, but it shows how outsiders who own 25% of the equity can take 40% of the total company profits.

You could start by checking the notes to the company’s accounts which should tell you which “controlled” subsidiaries may not be 100% owned, and then try to work out if they are the better performing subsidiaries.

Hope this helps, Paul

The accountants will be able to explain this with more authority, but in the case you describe the parent owns a controlling interest of a more profitable subsidiary

Because the parent has a controlling interest the relevant equity & the profit must be recognised on the parents financials but the owners of the parent (you) have no claim to that external investors minority interest in the equity & profit

Hope that helps

Accountants, please confirm. What would I know? :)

Hi Guys,

Buffet talks about this in one his letters to sharehollders,

I well try to find the one he talkis about it in as his words are so much better than mine.

Thanks Gents.

I can put away my indignation at least, and start working on my further education.

Hi Craig B,

You are ahead of most people if you are considering this.

You are on the right track that a ‘non-controlling interest’ means that the party is entitled to a share of the company’s profit.

My suspicion on your situation is that there could be a distinction between ‘distribution of profits’ vs ‘share of profit’ (think dividends vs earnings). In other words, a company can pay dividends more than the earnings it made for the year. This is possible because whether you can declare dividends is based on whether you have cumulative profits (not just whether you made profit this year).

If you can provide a link to the accounts, I am happy to have a look.

Regards

Joab

Hi Room,

These are just my thoughts and I know it is not the current consensus. And I disclose that investing in iron ore or base metal companies are outside my circle of competence.

I do know that Iron ore is the most abundant commodity on the planet. The high prices are reflective of the fact that we have a shortage of mines.

I also note that all (And I do mean all not most) companies in the business of digging iron ore out of the ground have announced upgrades to future production.

I understand that Rio is the second biggest miner of Iron ore in the world and they have announced a 50% increase in production.

This is not a rare commodity and eventually supply will catch up with demand and when it does price will fall and fall heaps. I don’t know when this will happen but I know with certainty that it will.

Ramping up production is not that difficult for Iron ore. Certainly easier than say Copper.

Jim Roger may say we are running out of everything but Iron ore will be one of the last.

Extreme care is needed here if we are investing in Iron ore companies. I think in inflation adjusted terms the price will get to $50 or $60 a tonne and those juicy ROEs will be destroyed

We had a commodity bubble in the 1960’s and early 1970’s driven by the Industrialisation of Japan. Back at that stage Australia was the lucky country with vast natural resources and a seeming never ending demand for these items.(sound familiar)

Unfortunately Pumpkins turned to mice far earlier than the decline of Japan. Supply caught up with demand and Australia got a mouse plague though most of the 1970’s and 1980’s despite Japan powering on at that time.

The current commodity boom due to the industrialisation of China and India will bust one day. Even Jim Roger says this. He is one of the smartest men in the world and has a much better guess than me on when this will happen. He thinks is will continue for a much longer period yet. He is a great historian and given history he thinks it should last another 5 to 11 years.

Due to my ignorance I am much happier avoiding these things entirely. For me the commodity boom in iron ore and base metals will end somewhere between next week and 20 years times.

I will just keep avoiding them despite the temptations.

We can make really good returns without investing in something that even the Guru Jim Roger says will crash one day

Just my view and I know lots disagree with it

Hi Ashley,

Just read Jim Rogers’ Hot Commodities book. Very enlightening read. Like you said, commodites, like other asset classes work in cycles. It just so happens that commodities are part way through a bull market. Often they work in roughly a 18 year bull market then 18 year bear market for commodities. This particular commodity bull market started roughly in 2000.

Even Jim can’t predict when it will end but like you said it should have a while to go yet. Obviously there will be speedbumps along the way.

I agree that pure commodity company plays are risky, just look at the price/value action of ERA in the last 12 months. In a simplistic price vs volume supply/demand view of the situation, the major worry for Iron Ore in the near to medium term is the Chinese housing bubble scenario which would have a significant impact on the supply side. Otherwise, I can see a healthy demand for the next couple of years.

As you duly noted, current iron ore production is being ramped up substantially to cash in on the higher ore prices. I watched the Marius Kloppers’ interview with Alan Kohler that I think Roger is referring to above, and it was blatantly obvious that the supply side of the equation is going to be doing some serious catch up with demand some time in the next year or two. If there is any economists on the blog I would love to hear your views on the Iron ore supply/demand situation.

I totally agree care is needed here.

Oops, in my third paragraph above, “Chinese housing bubble scenario which would have a significant impact on the supply side” should read “Chinese housing bubble scenario which would have a significant impact on the Chinese demand side”.

Thanks for that John

Really good

Hi All

Am enjoying reading this section very much. The other factor here for me is the amount of mining that potentially will happen in Africa. For now, Australia are in the vanguard of countries that can get the iron ore etc to a ship and transport it wherever.

Once Africa get themselves into this position, with the help of the BRICS, then competition will really be on. The Chinese in particular see it as a way of having a lot more influence in pricing policy than they have had. There is some time till this will happen, but it will be well before the end of the commodity boom. I own AGO but don’t expect I will in 5 years.

Cheers

Jim

Hi John,

I am not an economist but I do work for a major diversified mining company in Western Australia.

Rio will increase production of Iron Ore by a lot more than 50% in the next few years. The expansion that they are talking about from 220 mtpa to 283 in 2013 and then onto 333 mtpa (in 2015/16) but I will not be surprised if 333 becomes 350, 360 or even 380 mtpa. They also have an enormous high-grade deposit in Guinea to come on in line in the next couple of years at ~ 70 mtpa.

BHP will bring on their additional tonnes sooner (2013) and Vale is in expansion mode in Brazil. So, there is a huge first mover advantage here. It seems likely that the prices will remain high until the supply/demand balances comes back into check; the forecasts that I have read seem to indicate that wont happen until ~ 2015 – the thing that we know about forecasts is that they will be wrong.

I cant see prices being $50-$60 per tonne simply because the cost to extract is higher. Iron Ore is a simple mining process but cost to build not just the mines but also the supporting infrastructure is high and getting higher. My feeling is that $80-$100 per tonne is far more realistic. Still, ROE will take a huge hit even at those prices.

I enjoy the industry but I now know that it is not how much money you make but how much money you have to put in to make it and the miners here and putting in a lot. If we take a 10-year view (don’t buy a company unless your prepared to own it for 10 years) then these companies are not for me.

On the other hand, the engineering and mining services companies are going to do really well with little exposure to short-term price fluctuations. My opinion of course.

Steve

Hi Steve,

Thanks for this info,

Really good and the reason this blog is so good

Just out of interest do you know what the current marginal cost of propuction is for Iron ore?

Ash,

Different for different mines – my estimate is that RIO and BHP are working with a cost of $55-60 per tonne. Atlas will have a completely different cost structure because they dont have rail costs and their mines are DSO deposits; the Iron ore is literally sticking out of the ground so it costs less to get at it but the deposit isnt as big. That is why companies like BC Iron and Atlas can bring on their mines relatively quickly and with a lot less capital. RIO and BHP mines are typically long life mega deposits.

Should also say that RIO and BHP have a number of JV partners. From memory I think the RIO share of the 220 mt for 2010 was ~ 180 mt. The deposit in Guinea is 50% owned by Chinalco.

Steve

Thanks Steve,

Really good of you

History suggests that when a commodity bubble bursts then the prices comes back to slightly above the marginal cost of production.

All the minnows get gobbled up by the majors or go bust

So my $50-60 pt is too low but not by a lot.

What we should consider is the effect the commodity bust will have on our mining services companies.

The big Miners returns will be lower but their assets will be bigger and as such their influence will be even greater.

At the moment mining services companies are making lots of money and the miners don’t really care because they are as well but the pressure from the big guys to reduce costs when the bubble bursts will be huge.

Given the ROE in this sector they really are making profits far in excess of what is sustainable in the future.

I currently have a lot by dollar value in mining services companies but if the commodity bubble bursts tomorrow then I expect to receive what they appropriately call “Collateral Damage”

Just my thoughts

This is where the concept of Operating Leverage is important – especially for the equipment intensive rather than labour intensive companies.

Hi Steve,

Thanks for the info. Always good to hear thoughts from someone from within the industry.

Strong points you make Ash about the future of iron ore, and its widespread availability. One thing we should bear in mind about BHP is their financial strength and what it meant during the GFC. Due to the strength of their balance sheet BHP was able to continue to invest in the vast number of projects that they have across the globe while their peers battled to refinance and keep their heads above water. This has enabled them to bring on significant volumes to market at a time when demand is outstripping supply. While this may not endure, we should also consider that BHP’s financial clout has also allowed the company to invest in major long life projects (e.g Olympic Dam). These large projects with massive infrastructure demands are important as they enable the company to lower its marginal cost of production. This outcome could be compared to the likes of JBH I guess, who also sell readily available commodities, but have a lower cost of doing business (for JBH this means no warehousing, limited advertising and buying strength). Food for thought in any case!

A few thoughts on iron ore and future supply/demand scenarios,

If the price were to drop dramatically Chinese production would be the first to be wiped out (being high cost and low grade.)

If BHP and RIO are to achieve their growth ambitions where will the workers come from? Hiring people to fill specialised mining positions is not the same as finding someone to work in the local deli. As it is, the mining industry is facing labor supply problems.

Has anyone read in detail about the logistical (not to mention political) nightmare that Simandou (Rio) is currently facing.

India last year become a net importer of iron ore, not as previously a net exporter.

India trails China significantly in terms of their infrastructure and urbanisation process. If they eventually catch up what effect will this have?

I hold a few shares in Atlas Iron although do not currently view this as a 10 year hold.

Roger,

I am very much in your camp on this subject.

No one has been talking about Peak Iron Ore for one of the most common substances on the planet, rust! Yet the China growth story is proffered as an excuse for the fact that this time it will be different for long run iron ore prices. I don’t buy it.

And we should remember that the much heralded move to quarterly pricing that has paid of handsomely on the way up, will have an equally dramatic consequence on the way down. The result is that we should expect greater than ever volatility in BHP earnings, with far greater risk to the downside as higher operating costs are locked in on each upleg of the iron ore price.

Regards

Lloyd

I am fairly new to value investing and am still building up knowledge about how to value stocks. The book Valuable is a great help. I was interested in finding more information that can be helpful. I use Comsec for financial information and i see that it varies from some of the information that I have seen in some examples. Also, it doesn’t go back as far as the examples that I have seen Roger use. Roger where do you get your financial information with regard to forecasts?

BHP is cheap on the numbers and India and Chia are almost certain to grow but who know’s where to from here for commodity prices.

A worked as a futures broker in a previous life and I have not met anyone, ever, despite their claims, who can predict prices and price direction.

Less risky play is to sell the miners “picks and shovels”: DCG, FGE, MIN, MCE, SWL etc…

Australia’s competitive advantage, after all, is resources.

Lloyd, Thanks for that on SWL. I`ve sold so will just watch it for now.

Sorry Roger, I am going to miss the SMSFreview event. As it is on a Tuesday, I have that whole run business, look after clients thing to do. I wish some of these things were on a Saturday.

All the best

Scott T

Hi Scott,

Or in regional Qld,

We have a lovely conference centre out here.

Might add to the costs though

Might add to the costs though – call it flood recovery assistance!

Roger you forgot to mention the impact of the share buyback, whatever the scale back will be it will return a 22% return to SMSF retired investors because of the impact of franking credits even if you tender at a 14% discount add this to the 8% and it looks great.

Not as great as the MCE Oroton Decmil etc but nice just the same.

Love your insights and am learning daily.

Hi Kent,

Yes the tax advantage are great for A SMSF in pension phase.

I am just guessing but I think the scaleback will be huge (my guess is 90%) and if you tender below 14% your scale back will be 100%

Still a good deal though

Agree with you 100% again

Hi Everyone

I’m not sure that anyone above the 15% tax rate will benefit in any other way than a potential increase in IV due to fewer shares. For those with an SMSF in pension phase it is a terrific windfall and an opportunity to buy A1’s at a discount .

Cheers

Jim

Hi Jim

Even Marginal of the 15% tax payers I think. 14% discount plus 15% tax is 29% and you get a 30% franking credit to compenstate.

May be useful if you need to generate a loss though because the capitial return is low so the artificial loss will be very high.

Seek and take professional advise

SWL result was dissapointing but I think most of us would have done ok on our buying price so IV method is working.

Not so much IV as MOS. Its not called a margin of safety (MOS) for no reason! IV’s bounce around as does Mr Market, so the MOS is the most paramount item of the value investment game.

Ken,

The old trade off …. money tomorrow vs money today….. as noted in the SWL interim filing the outcome was was mainly the consequence of “increased operating costs mainly related to future work winning activities resulted in reduced NPAT performance” with the future consequence that .. “as at the end of December 2010 the forward order book held $399 million of contracted work on hand.” Not too shabby when considered in this light! … and a rising IV path as a result!

Regards

Lloyd

Hi Lloyd,

Yes I did not think it was just too bad all things considered.

Good cashflow too

I also thought CAB was good as well just no cheap enough

I agree Ashley. At first pass I was disappointed with the result, but on further inspection the pipeline has swelled to $399 million and cash flow is fine. Additionally, works have not started flowing through for the rebuilding of infrastructure related to the natural disasters. SWL already has a favourable tendering record with the government, so the next 12 months could show a continued improvement. I have IV still rising, although current price is above my IV. I will beh appy to hold for now and see what happens with their end of year results.

Hi David,

The next 6 months are likely to be BAD,

Lets hope it gets totally bashed

Excellent selection for discussion Roger,

Tthere are a lot of discussions in the press on the future of iron ore prices. I shall devour the contents of your blog tonight. I had purchased BHP at much lower price levels (although not necessarily as low as others may have done).

Yavuz

Hi Roger

Thanks again for the great oil. I’m assuming that you are using an RR of 14% for your BHP IV as it is a commodity stock.

Cheers and looking forward to seeing you on the NSW Central Coast soon

Jim