Can Richard Umbers Turn Myer Around?

There has been quite a bit of press recently about the untidy start to Richard Umbers’ stint as Managing Director of Myer, and whether investors might expect better times to come. Confidence took a hit this week when the company announced a disappointing half year profit, and indicated full year numbers would be below expectations. And this just weeks after assuring the market that consensus forecasts were on the money.

Investors are now questioning what faith they can place in Myer’s board and management, and as plan B, whether an overseas acquirer might provide a get-out-of-jail free card as Woolworths SA did for David Jones.

We haven’t thought much about any of these questions, because Myer is a business that holds very little interest for us. Yes, it has strong brand recognition, a difficult-to-replicate portfolio of properties and a $3b sales line, but what about its prospects?

Over a long period of time, department store retailers have held a declining share of the overall retail market, and in many countries the rational response has been industry consolidation to cull the herd and keep competitor numbers in line with the shrinking market.

The problem seems to be that while your parents might have been loyal Myer customers who were happy to commit to a single retail brand, your kids aren’t. They are better informed, have more choices and are more demanding. As a result, the demographic profile of department store customers paints an alarming picture. The market is taking a while to fully appreciate it, but the customer base appears to be a dying breed.

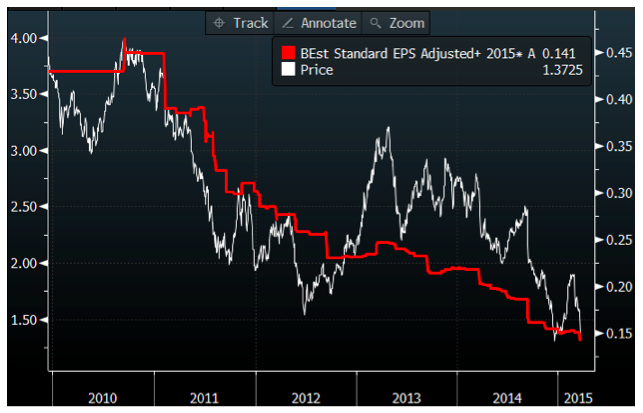

For us, the picture below is a neat summary. It shows how consensus broker forecasts for Myer’s 2015 EPS have evolved since 2010. The trend has been monotonic and relentless, and we can’t see any reason to expect it to change.

Accordingly, while we may still tip some money into the Myer cash registers from time to time, we won’t be making an appearance on the share register.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To learn more about our funds please click here.

The department store format is old, you want to pop into a shop, look around and leave quickly to go to the next one. In department stores there is a lot of walking.

Buffett owned a department store in the 60’s (I think) and found a lot of competition so he knew early on that it isn’t a good model.

DJ’s under McInnes had no growth in sales or revenue, they borrowed to pay dividends and the shareprice doubled in about 3 years before coming back down to earth. People love dividends and didn’t look at the business dynamics.

Department stores do well at Christmas time when people rush to do their Christmas shopping. A huge % of sales is in the Xmas period.

Online may be the key to department stores but then again, they are competing with lots of websites that are like department stores, lots of categories. Being able to order online and pick up in a store would be an advantage over solely online.

The PE owners (TPG) of Myers made more than $1 billion on Myers within a short amount of time then floated it to gullible investors. The writing was on the wall for decades that department store is an old model. But the PE company was lucky to get out and make a huge profit, many PE companies in Australia made losses on various acquisitions, most notably the ones who bought book shops.

Can Richard Umbers Turn Myer Around?

No.

No one can. Just as the establishment of Myer 1900 was a game changer and many incumbents fell by the way side.

The market has turned full circle.

All the best

Scott T

Another great turnaround story brought to you by private equity (PE) – NOT.

I can still vividly recall the fanfare during the Myer IPO. This is after PE sold the best Myer properties, huge cost cutting exercise and had mass clearance sales which raked in the cash from excess inventory. And then the pumping exercise to flog the business. ‘The profits were growing and so why not buy?’ was the catch cry.

The niche operators (both online and bricks) will continue to take sales away from them. Plus they always seem to have issues with regards to positioning the brand – either upmarket, mid tier or combination of both,

That last point is something i have always believed. They felt stuck in the middle. Not quite luxury, not quite edgy, not quite affordable. Just little bits of everything which meant that it was mostly never the first place you thought of when it came to wanting to buy something.

What do with a problem like Myer???

To me it is a company that is under fire in its most important product lines being run by a management team which for a long time has led me to believe they do not really understand the market. Whilst similar companies all over the world were making changes both Myer and David Jones seemed to take the great australian attitude of “she’ll be right”.

I think the time for them to make the changes they needed to make has since gone. There is still a viable business, just not a particularly valuable one.

I actually think it is a shame that David Jones has been sold to South Africa and Myer appears to be spluttering along without any real strategic direction as i think they had potential to actually grow a decent market overseas as well as here and could have been quite good businesses, David Jones always having that slight edge. I just can’t see that potential being reached now.

I think however the former CEO summed it up when he reportedly said something like “we have become irrellevant”.

Hi Ronald,

You may be experiencing the results of a cost reduction exercise – one of the tools available to a management team that wants to arrest declining earnings. However, reducing costs only works if the underlying problem is an excessive cost structure. It doesn’t address declining support for the business model.

Unfortunately their service is so poor that customers going into the store will walk out empty handed (no cash into their register !).

My wife & I walked around for 30 minutes (in Chadstone Myer) without anyone even looking our way. We approached a sales person for help & was told “Sorry, I don’t work in that department”….- b4 turning away without a second glance at us and not a hint or direction as to who we can approach.