Two stocks worth a closer look

As earnings season rolls on we’ve taken a brief look at two smaller stocks that may present attractive opportunities. Retail with excellent management and a logistics company that has set itself up a niche in Western Australia.

Regular readers of the blog know we keep an eye on Nick Scali (ASX: NCK), given it’s a high quality company with excellent management.

Nick Scali is a retailer selling up-market furniture. It’s had a stellar track record in terms of earnings and profitability (circa 35-40 per cent Return On Equity since 2010) and has a steady year-on year rollout plan of new stores.

Like most retailers, NCK is subject to the ups and downs of consumer confidence (as discussed here) which can make earnings a little choppy at times, but overall the business continues to be a premier performer in our view.

Their advantage in a highly competitive space appears to be the ability to design furniture that captures the eye (and wallets) of buyers. This is a skill inherent in the company which is occasionally replicated by others, but as it has been shown, is difficult to do continuously over the long term.

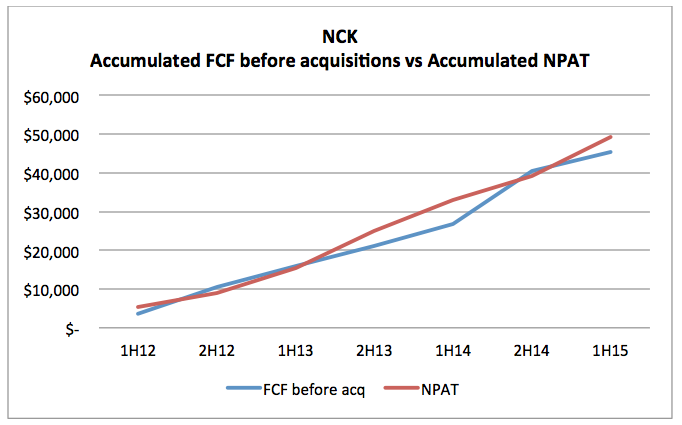

It’s worth of course looking below the surface at the numbers, which underpins the investment story, and with that we note that Net Profit After Tax (NPAT) and free cash flow have been tracking each other closely (a quality development). Not only that, but since the first half of 2012 (1H12), as shown on the graph, both have increased steadily.

Source: Company filings; MIM analysis

Source: Company filings; MIM analysis

However, with the price nearing $3 a share, one wonders if the stock has run too far despite its quality. We will leave that up to you to decide based on an assessment of their future prospects including their reinvestment potential.

CTI Logistics Limited (ASX: CLX)

CTI is another small business that has caught our attention in the past. In general, CTI logistics runs freight, warehousing and distribution businesses and has set itself up a niche in Western Australia which helps protect it from more established competitors on the other side of the country. Its ROE is not as lucrative relative to Nick Scali however it’s well above their cost of capital at circa 15-20 per cent each year since Financial Year 2008.

One wonders if there is a value opportunity present, having seen the share price down almost 50 per cent relative to its high. As we have mentioned numerous times before, one needs to do the work around the businesses future prospects for growth and it’s here we note that on the 17th of December, the company announced that its profit before tax for the six months ending 31 December 2014 will be down 20-24 per cent relative to the same period last year.

The reason for this has been the slowdown in demand for services from the mining and energy spaces and weak demand for warehousing. So if you have an insight into this sector and believe a turnaround is likely to occur at some point in the future, then this may be an opportunity. But for us, our research suggests that there’s still more pain to come – particularly in WA.

Other opportunities for CTI exist in the internet shopping space whereby the continuing shift of demand for products from brick and mortar stocks to websites creates an increase of a lot of freight, which will need to be delivered to each household. When scale is involved, the economics of freight become attractive, i.e. one extra parcel has little marginal cost and hence almost all its marginal revenue falls straight to the profit line. Something to consider.

Please remember to consult your adviser and research thoroughly before buying or selling any listed securities.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY