An overview of results

Below you will find an overview of today’s results. Particularly, we have focused on those businesses that have above average market liquidity, a measure representative of their size.

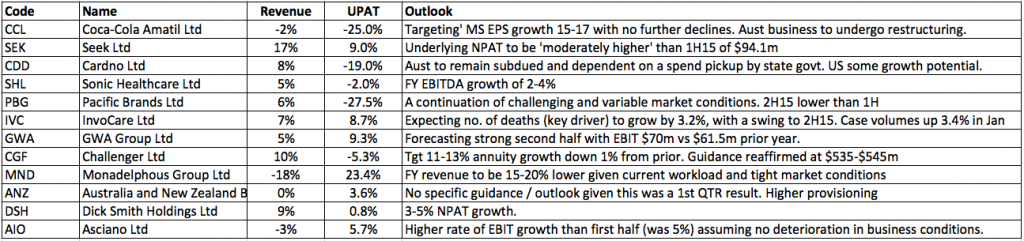

As an overall quick summary, what we have seen to today, across a broad range of sectors including port operators, retailers, banks, engineering and healthcare companies, is generally no or low growth.

On average, of those we have summarised below, this collection of businesses have reported just 4 per cent revenue growth and negative 2 per cent Underlying Profit After Tax (UPAT) growth. That’s below average in our view.

Further, whilst there are a handful of outlook statements that point to a better second half in 2015, many are again pointing to a low growth environment and a continuation of challenging conditions. Which does not bode well for those companies gaining the confidence to go out and reinvest in meaningful new projects.

If the above sample was taken in isolation we could assume that the Australian economy is struggling and that we have gone from a one-cylinder economy (Mining and Resources) to a no-cylinder economy. But that’s a big call to make given such a small sample size, so we will reserve judgment until we have seen the bulk of companies report over the next few weeks.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Russell,

The recent results from the reject shop and seven west also lends itself to the narrative of a no-cylinder economy. I think the hard time being had by retailers was predicted by yourselves already, seems to be coming to fruition. Mining is obviously struggling with the almost universal fall in commodity prices (again predicted by yourselves). Another example as to the strength of the people involved at the Montgomery Fund. Congrats to those of you lucky enough to have these guys as your investment managers.

It will be a very interesting year ahead i think. I expect it will be one where being a “quality focused” investor will likely pay dividends. These companies will likely be the only ones that have the motor to propel itself forward in the current macro environment.

Look froward to any insights you guys would like to share at the end of reporting season.

Hi Russell, thanks. I think this just means that the RBA will continue to cut rates and push up equity yield plays.

Kelvin