Why is Aldi so successful?

We have previously written at length on Aldi and the threat it poses to the Australian Supermarket Industry. Today we focus on why they have been (and will likely remain) so successful.

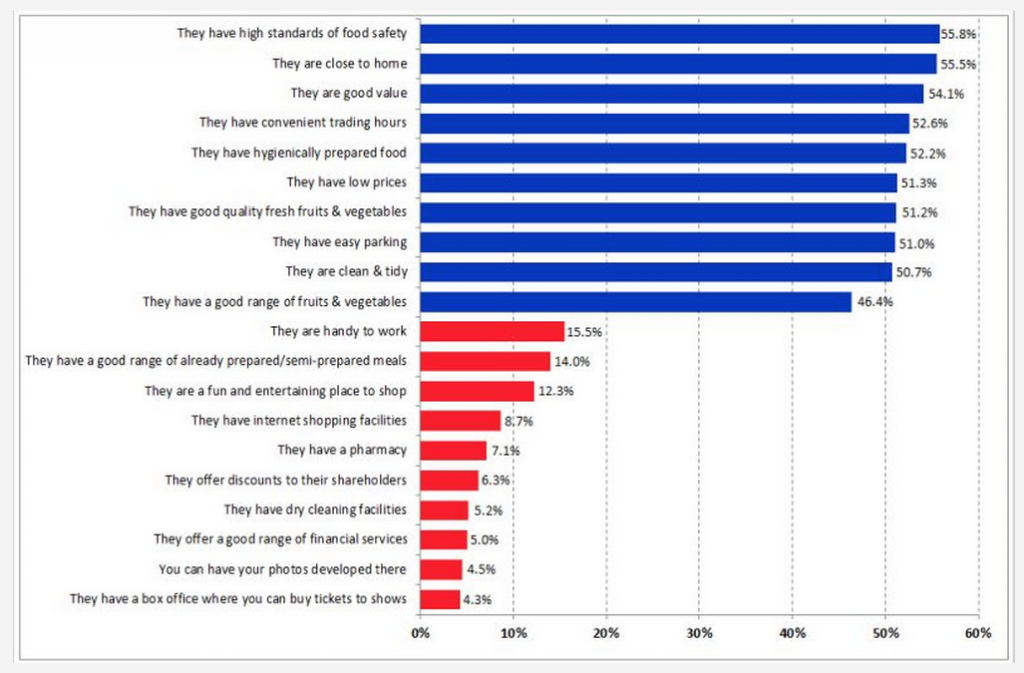

The success or failure of a supermarket depends on its ability to deliver what the consumer ultimately wants or needs. A recent Roy Morgan survey concluded;

“It’s a rare Australian who doesn’t have to go to the supermarket on a regular basis: indeed, last year, more than 12 million grocery-buyers visited a supermarket at least once in an average seven days. This is a huge number, representing an immense opportunity for those supermarkets that offer the qualities so many of these people look for when deciding where to do their groceries”.

Roy Morgan Single Source (Australia), January-December 2014 (n=15,944). Base: Main grocery buyers 14+

Roy Morgan Single Source (Australia), January-December 2014 (n=15,944). Base: Main grocery buyers 14+

Based on this, we believe that the average person will choose a supermarket based on three main factors; Quality of Product, Value and Convenience.

Those willing to take a deeper look into Aldi’s business model (which can be frustrating given their highly secretive nature) will uncover a core strategy which focuses on satisfying these basic needs and wants.

Our original piece on Aldi broadly discussed the Quality of Product and Value pillars. Put simply, Aldi runs a very efficient, low-cost business because its model is standardised and consistently executed. Maintaining a lower number of SKU’s (Stock Keeping Unit) ensures lower handling costs and higher buying power. While Aldi provides a narrower range, the products are the highest quality that they can secure. When efficiency and buying power is reinvested into lower prices, customers will be satisfied on both Value and Quality metrics. Notice how choice is NOT a high priority for many consumers (just think, would you prefer a wide selection of average products or a narrow selection of inexpensive, high quality products?)

In terms of Convenience, we have (rather inconveniently) gone through the White Pages and identified 375 Aldi Stores open today compared to 345 stores in October last year. The company is well on track to open 500 stores on the eastern seaboard in coming years, which means there will be more stores closer to where you live.

Shoppers in South Australia and Western Australia won’t have long to wait for more competition. Aldi is planning to invest $700 million in distribution centres and 120 new stores in these states. These markets are particularly important for Aldi as the major supermarkets have indicated more value-conscious buyers than in the east.

Shoppers in South Australia and Western Australia won’t have long to wait for more competition. Aldi is planning to invest $700 million in distribution centres and 120 new stores in these states. These markets are particularly important for Aldi as the major supermarkets have indicated more value-conscious buyers than in the east.

We estimate that each Aldi store makes $15 million in sales each year, which equates to around $5.6 billion in total sales for the group. The opening of 250 more stores in the coming years could increase sales by $3.75 billion, or 67 per cent. Just consider the lower prices that can be driven with this buying power.

So if you think the pain being felt by Woolworths is as bad as it gets, we urge you to reconsider. Once Aldi can make it convenient for customers to visit the stores, it will be very difficult for the incumbents to win them back.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

What I would like to know is what effect over time the making of “home brands” (be that Aldi, Woolies special range etc…) has on the brand name value of the supplier.

For example, if Devondale make their premium butter for Aldi under the Aldi label, and it sells at half the price of Devondale under its own name, then in time we all be buying the Aldi version. Yes they will be selling butter to the retailer but what value is left in the brand name which sits as an asset on the balance sheet?

indeed.

I disagree with you about choice not being a major factor in choosing a supermarket. I have found most people have a favourite product or flavour and most of the time these favourites are not found at Aldi. For me it is my favourite type of yoghurt and juice. This may even be a subconscious thing that people may not highlight on a survey.

Also, even though Aldi claim to have high quality products, I have found some of their products to be of terrible quality. It also seems that people who go to Aldi still have to do half their shopping at Coles/WOW because Aldi just don’t have a lot of things that they buy. Aldi have carved out their niche, but won’t be able to make further inroads into market share until their expand their range (except for places that don’t yet have an Aldi).

Hi Joel, we constantly debate and argue against each others line of thinking at Montgomery in order to stress-test the robustness of an argument so Im glad you disagree so strongly.

To re-argue for choice not be an overly big concern, did you see this by Choice?

https://www.choice.com.au/shopping/everyday-shopping/supermarkets/articles/cheapest-groceries-australia

I agree with Lucas’s point regarding excessive choice causing anxiety or paralysis amongst shoppers. But I also had an interesting experience in NZ, whilst shopping at New World, a NZ-only supermarket chain. It had more product lines than WOW, and very little in the way of in house brands. There was an extremely diverse number of micro brands, particularly in the pre-prepared food aisle. Milk and cheese from micro-dairies, artisanal peanut butter, all types of weird and wonderful products – more than you would expect from such a small population. I assume that many of these new products fail, but some go on to survive.

I can only imagine that it is much easier for small start-up brands to be trialled on supermarket shelves than in Australia – this must breed much more product innovation. It also makes for a more exciting experience for the customer – there is always something new to try. It would be interesting to see what market research says about perceptions of the supermarket experience here versus our NZ cousins.

I have noticed the same thing Ed when I was there the last couple of visits.

I purchased from an Aldi store for the first time on the weekend mainly just out of interest at Gunnedah (which also has a Coles and WOW). Aldi has been open here for about six months now.

Can’t say I was overly impressed with product range and layout and the store was almost deserted.

WOW at the same time(Sunday PM) was very busy.

I have no doubt Aldi is very attractive to some customers and do not disagree that WOW and Coles are likely to suffer as Aldi expands however I think each stores success will come down to the socioeconomic conditions of where it is located.

Maybe a bit late to the party on this one.

In 2004 “The Paradox of Choice” basically the thesis was, the more choice that you give a consumer, the more anxiety you are going to give them.

There are too many choices for me to make when I go to Coles or Woolworths. Even online, if you type “Cereal” into the search function, there are 292 results.

It’s very difficult to frame a choice, or make a decision when there are 292. I’d rather not choose one out of a potential 292 products, than one out of 5.

Then you look at the advertising and marketing spend that supports each of those products. Marketing and advertising makes up billions of WES/WOW expenditure, but the products that are on the shelves also advertise. This is a cost of business. Compare that to private labels which don’t advertise and then there’s an immediate saving.

Then you have issues of cut down product lines, requiring shops that are although smaller in size, have similar range. Gives you superior economics. You add to this mix a variety of differing goods that attract you back on a semi-frequent basis – then you’re onto a formula of success. Maybe even 50% of purchases in a shop are entirely planned. It’s not that I am not in favour of discipline, but you remove the anxiety over the number of purchases, increase the incentives to come back and take a look.

I don’t care about going to coles because there’s nothing new in there that I cannot see any day of the week. With ALDI, maybe when I move into my new house I will look at buying a cheap flat screen TV for wherever, etc.

Pricing is superior at Aldi. Pricing is proven to be cheaper in areas where WES/WOW have an Aldi to compete against.

Another interesting thing to view is how Shell / Caltex branded services are now being expanded into mini supermarkets with supermarket style pricing.

I think that WES/WOW have kind of forgotten why we as consumers need them. Look at their expansion into insurance, other lines etc. Universality takes out speciality. I cannot answer the “why” to go to coles, apart from, it may be after midnight and I need to buy wipes / nappies for my nugget.

The one improvement that I would like to see is that the quality of presentation of staff and stores would increase. You’d never see an Aldi in Switzerland or Germany where staff have not ironed and laundered their shirt / clothing.

Interesting line of thinking Lucas. Thanks for taking the time to write and share.

I have to put my country’s interests at heart here.

Unfortunately this will mean MORE profits going out of Aust in the longer term.

Aldi are getting free kicks in the mass media as woolies are continually being hammered.

Let’s not forget the rumours that Aldi don’t pay much tax here – another of these global players using low tax havens to transfer pre-tax profits.

Longer term, do we really want most of our supermarkets controlled by German interests? And when they have more scale, what’s to stop them from increasing prices after they decimate the incumbents?

Personally I find Aldi an awful place to shop and don’t agree their products are always as good as the brands. They’re very smart in trying to make their packaging and product naming close to the brands.

Plus they have all these no brand appliance and technology products for sale, but what about the after sales service once the warranty ends? Try getting spare parts for their pool cleaners.

But it is what it is and from an investment perspective, woolies is definitely up for a big shakeup and certainly not investment worthy for some time to come.

Just one other thing I want to add.

Local suppliers to the big 2 are also going to be in for a torrid time as a result of this upheaval. The global search for cheaper products will intensify. This is a continuation of the rebasing of our high labour cost economy. Bit like trying to slowly boil the frog.

Yet house prices in Sydney continually defy gravity – until they don’t !!!

Indeed John. Thank you.

It’s a good point John and one we have made here since we started the blog in 2010; there is a mistake in thinking what is good for the consumer is good of the country.

My two cents,

The proliferation of home brands/budget lines and ineffective product mix are killing Colesworths. Folks want to buy Product of Australia, but you never know if you are under our obscure labelling laws. Aldi and its customers don’t seem to bothered by this…

The conduct of the big two in recent court cases has them on the nose with plenty of shoppers I suspect, and they are voting with their feet. For mine , the self serve checkouts are painful to use and frustration felt by customers in the cue is palpable. Again, compare this to Aldi. You never self serve, you know you’ve gotta pack your own goods, but we’re okay with that.

Finally, the advertising. Noones buying Colesworths messages. Aldi seem to treat their customers with a little more intellect than these pair, and they are going to continue to grow. I say good luck to them.

Personally I’m not big on Aldi, though I can see the appeal. I’d prefer to spend the extra money for the quality and range, but not everyone has that luxury. We’ve got a Coles, Woolworths and Aldi at the local shopping centre, Coles is easily the most popular (and my choice).

I think Woolworths is making a mistake trying to compete with Aldi on price. Their focus on price over quality may drive consumers away as they perceive a lowering standard of quality. Woolworths would do better I think to focus their marketing on quality and range. Maybe it’s time to bring back The Fresh Food People?

You might be right Patrick. But I wouldnt hold my breath. Theres a reason Woolworths generates the highest EBITDA margins in the world (thats right in the world) for a supermarket chain – based on our research.

Whilst they might return to their core branding strategy, competition in the industry is enduring (Aldi wont pack up and leave now), so one naturally expects lower prices – which on a high fixed costs base, spells big trouble for those not able to adjust.

Had an(other) Aldi open near us recently. Thriving from day one, and they are the type of local demographic that will likely stick with this budget option.

Yes, there is an element of inconvenience to shopping at Aldi (limited parking, frequently lengthy checkout queues, self-packing), but I suspect Aldi don’t care too much that they won’t please everyone. Their stores seem to mostly avoid the ‘dead’ times that you see at the majors, and I think they are content enough to maintain an efficient utilisation of resources.

For those to whom the savings are material, it will take a significant reduction in Colesworths pricing to entice them back, and they aren’t likely to be fooled by a few high profile specials. Aldi won’t catch everyone, but they will keep white-anting the incumbents.

Thanks Wayne, agree with all of that. Aldi wont be a 30% market share player anytime soon but I think we can agree that is besides the point.

Good post Russell.

I have said this before but it is timely to say it again.

A good way to get information about ALDI is to visit the website https://www.aldi.com.au/en/ I don’t want to waste time providing information which is readily available. There is stacks of stuff on this website.

We have been shopping at Aldi for more than a decade. Apart from some of the fruit and vegetables we have found the rest of the food stock to be as good if not better than provided provided by Coles and Woollies. There is less choice but that makes it quicker to do the fortnightly shop. The Christmas stock of puddings, cakes, chocolates is high class and extensive. The staff are helpful, well paid, content and hard working. Most of them simply enjoy working with the company.

Management of this organisation is superior. For instance staff can sit or stand at the checkout points. Safety is paramount. Staff are well trained and are multi skilled. Its distribution systems work well – they employ their own drivers and have distribution centres within about two hours of their retail outlets. Pricing is the same in every store.

I used to regret not being able to buy a share in the company but realised it pays a financial dividend every time I visit an Aldi store without the need to invest in the business. The returns are high but there is no dividend imputation credit!

With over 150 award winning products “Everyone wins at Aldi” and I have a badge to prove it! Even the profits are reinvested in Australia. There are few share holders so most of the profits can be reinvested.