Mining Boom 2.0

The iron ore price has become a barometer for the strength of the mining industry in Australia. Yet, mining investment has actually surged since the iron ore price began its descent in 2013. The real mining boom is only just about to end.

Capital expenditure for iron ore projects pales in comparison to the capital expenditure for Liquefied Natural Gas (LNG). Seven multi-billion dollar projects were commenced at the start of the decade, including Gorgon, Wheatstone, Prelude and Ichthys.

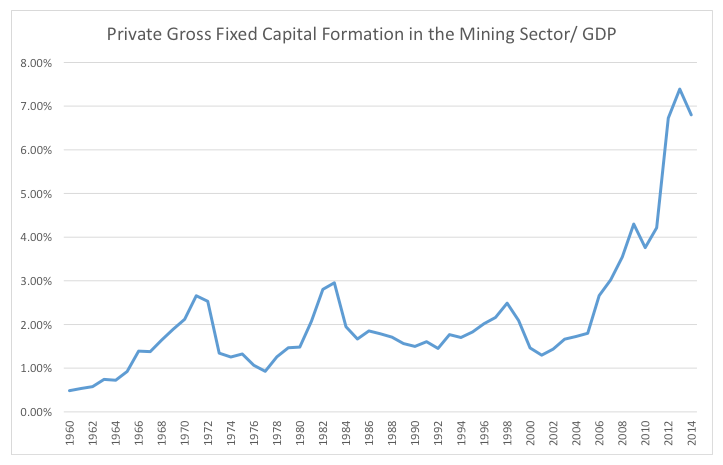

To give a sense of the scale of investment, the following chart depicts Private Gross Fixed Capital Formation in the Mining Sector as a share of Gross Domestic Product (GDP).

Source: Australian Bureau of Statistics

Source: Australian Bureau of Statistics

While the iron ore price peaked in 2012, investment in the gas sector surged ahead. But as these gas projects transition from construction to production in the coming years, the capital and labour demands will fall considerably.

This presents two very important questions: Can the economy fill the void if the share of mining expenditure returns to historical levels? How much of the mining sector boom has indirectly supported investment in other areas of the economy?

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Huge fan of that chart, especially when overlaid with Stapledon’s house price index. The passage of the two previous largest peaks in ’72 and ’83 had a well defined impact on house prices, with a consistent lag of about 4.5 years i.e. house prices topped out on average 4.5 years after the mining peak. Interesting times come 2017 if history decides to rhyme, more so when you consider the fact that this boom puts the previous two to shame. Always a good read Roger, cheers.

Darn it Jimbo, I am sure there are some bargains hunters who were hoping they wouldn’t have to wait that long.

Just wondering what your thoughts are on which other sectors/industries have been indirectly supported by the mining boom and may be ‘collateral damage’ so to speak of the downturn in this sector? Other than mining services? Banks perhaps who have lent money to fund mining projects?

Wondering if the blog community might like to give you some insights Gaveen?

If China keeps growing at 7%ish thats a massive demand on its own.. a doubling of its economy every 14 years…two chinas by 2012+14=2026 is still very substantial demand… our future lies in the outcome of China and to some extent India… If China doubles it GDP by 2026 I can’t see us suffering too much despite a short term correction right now. I recently went to China and the inefficiencies are frightening…people mowing large scale lawns with hand held scissors and doing it slowly. … as they develop the demand may be staggering.

That is interesting, big shocks for us however if growth slows to 4% or 5% while our iron ore supply (and that of Brazil) keeps climbing..

Yes its ironic that the miners and resources that created the boom and wealth, will now have such a detrimental effect on the country.

Mining company’s through increased employment put increasing pressure on wages inturn making us uncompetitive, which helped in the destruction of our manufacturing industry.

Resource prices pushed up our terms of trade, elevating AUD$, putting pressure on tourism and exports.

They created an overnight industry of “mining services” company’s which now has now seen billions$ lost, which has caused mayhem for management, staff and shareholders.

The boom now over they layoff the staff and create unemployment.

And what do we have to show for one off the greatest booms of our time???

You can thank those brilliant planners and strategists keeping the cabinet seats warm in Canberra.

One can never be sure, but the fundamentals of the industries suggest that zinc, uranium, copper, nickel and gold are all potential candidates to fill the gap. I can’t imagine any single one of those could provide the scale of iron or LNG, but if a few of them take off it’s possible.

Plus companies like ORG and STO have bet the house on LNG. ORG’s debt is around $10B which is massive for a company of it’s size.

Solar generation is starting to gain traction and battery storage isn’t far away.

So lot’s to play out in this space beyond just the mining side.

Will be interesting to see the effect this has on housing markets / population movements in resource states, or are we starting to see this already?…

Nice perspective Ben.

It’s already happening SA, NT and WA are slumping. Interesting QLD less so.

Roger, despite popular spruiking to the contrary by the State Government, SA never had a mining boom ! It just didn’t happen.

The State was hinged purely on the Olympic Dam expansion that never happened – mainly because the infrastructure that is needed for it (esp. ports and roads) just isn’t there right now, and even if it was, the sheer amount that it will need just to get it off the ground (in terms of consumables such as diesel, cement, steel etc.) cannot be met from current supply in the State, let alone Australia…once you switch the machine on, you cannot just ‘turn it off’.

Two other iron ore operations in the Far North have now been mothballed and really, were marginal at best anyway.

I put this to you – there was no massive exodus of people to the mines and there was no boom in house prices in Adelaide. Maybe in places around Andamooka / Roxby Downs, but now those places are suffering massive losses and 10% vacancy rates.

Thanks Chris. APpreciate the insights.