Who’s game to sell CBA?

CBA is the market darling of the Big-4 banks, and the quality of the company has historically warranted a premium price relative to its peers. But some analysts are seriously questioning whether the recent rally of the share price is reasonable.

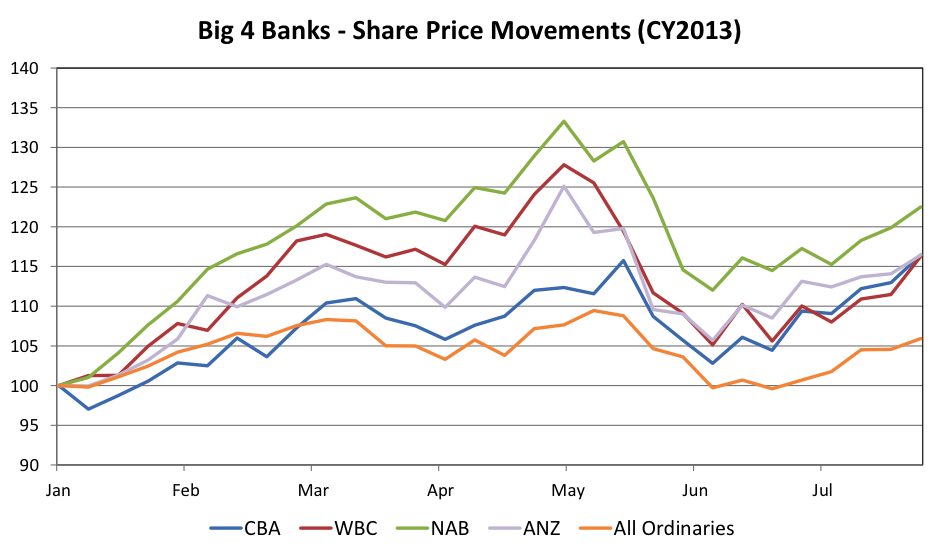

The share prices of the Big 4 banks, namely Commonwealth, Westpac, NAB and ANZ, have appreciated considerably since the start of the year. Excluding dividend yield, the banks have returned over 16 per cent, while the All Ordinaries index increased by around 6 per cent over the same period.

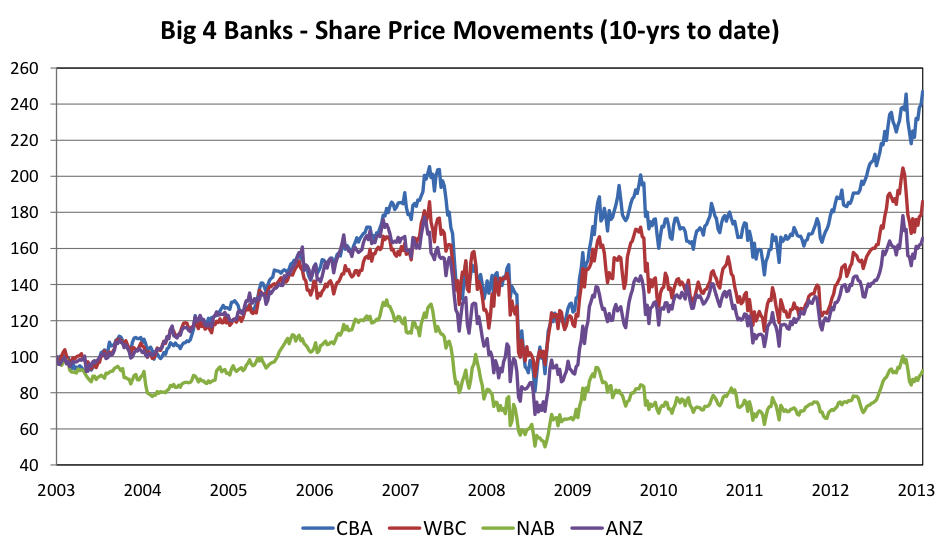

While NAB has outperformed its peers in 2013, its share price remains around the same level as it was in 2003. CBA, by contrast, has seen its share price appreciate by over 240 per cent in the same period. CBA is the market darling of the Big-4, and the quality of the company has historically warranted a premium price relative to its peers. But some analysts are seriously questioning whether the recent rally of the share price is reasonable.

(Source: Bloomberg)

Back in May, UBS branded CBA as the bank with the most expensive share price in the world at around $72.00. While the share price fell subsequently to $65.00 in June, this pullback was temporary in nature and it has since returned to record levels.

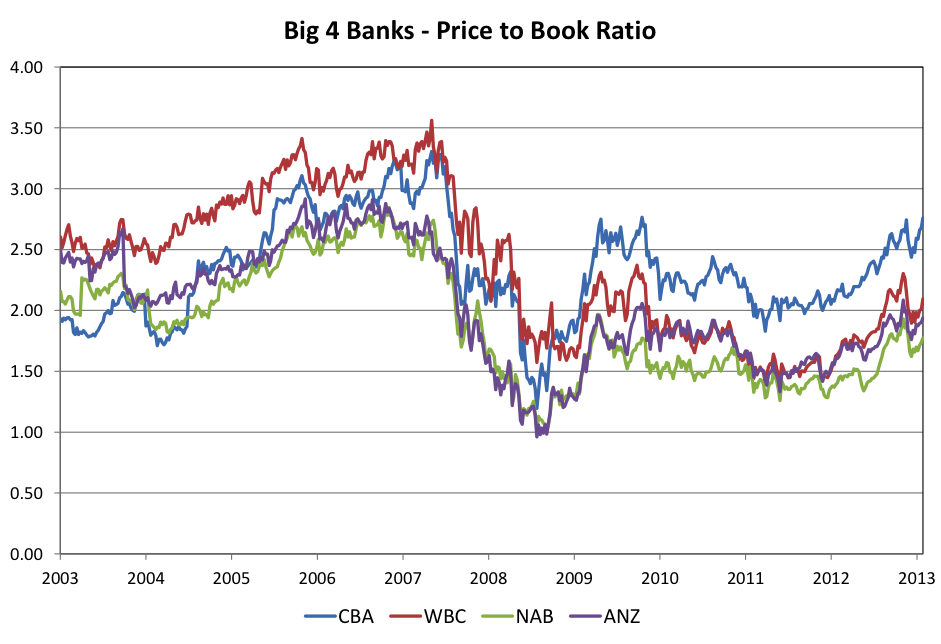

To get a clearer idea of whether CBA’s share price is justified, it helps to see how the share price is trading relative to the company’s book value. In the chart below you can observe the premium that the market has afforded CBA relative to its peers since the GFC. While CBA’s current multiple is below the dizzying heights that were reached in the lead up to the GFC, the recent rally has pushed the multiple into uncomfortable territory.

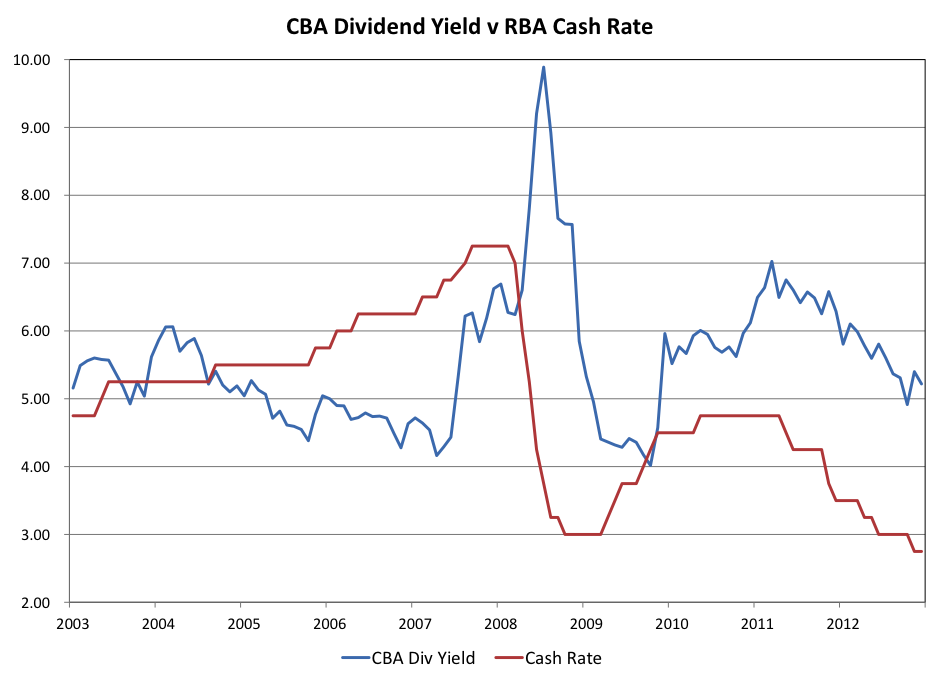

The chase for yield is one common justification for the recent share price performance in the banking sector. Over the past two years the Reserve Bank of Australia has been gradually lowering the cash rate, and this is having the desired effect of encouraging investors to put their money into riskier assets. CBA currently offers a dividend yield of around 5 per cent, and while this is above the rates provided by term deposits (which are around 3 to 4 per cent) it is difficult to justify if this marginally higher yield provides sufficient compensation for the additional risk.

It is important to remember that dividend yield is only one component of a shareholder’s return. The Return OF Capital is far more important than the Return ON Capital – so while a 5 per cent dividend yield may appear attractive, it is highly contingent upon the share price being maintained.

We recently wrote a blog post on how to value a bank, and we highlighted that banks are highly leveraged entities, and as such the bank’s bottom line is highly sensitive to a downturn in the economy or deterioration in customer credit quality. Unlike their term deposits, putting your money into a bank share is not inherently “safe” – like any equity investment, the price should offer a sufficient margin of safety to manage the risk of capital losses.

The chart below plots Montgomery Investment Management’s estimate of CBA’s intrinsic value (white) against its share price (yellow). CBA has a quality earnings profile that has consistently risen through the machinations of the market. By our estimates, CBA’s share price is looking stretched, and hardly presents a sufficient margin of safety that would insulate the dividend yield from capital loss.

It seems that the market is exhibiting herd mentality when it comes to buying CBA shares. No one is game to be the first to exit – even though the share price appears expensive, people fear missing out on further share price appreciation. At these prices, a better place for your money might be in a CBA term deposit, which provides a rate slightly below the current dividend yield. While this removes your exposure to further share price rises, it will certainly protect your capital if the mood changes and there is a rush for the exit.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

komal.pandya.940

:

Carlos,

I would like to draw your attention to one thing…While,Its a very good approach to invest with a long term perspective…one thing to understand is & if you read value managers is “markets”- while it is not right to time the market…one thing that is quite self explanatory is the fact that – Markets are too expensive & real term growth is required for the economy to push further or increase from here on…

I think its time to start making a list of factors that are good for the economy & hence markets And factors that are responsible for a de-growth to Economy & hence market…Once you have made the list – you would know which side is scoring high & have your market view accordingly…

So if you are expecting that markets shall keep going higher than would it be worth holding on to CBA despite its Balance sheet not justifying price rise? Are you happy to loose a bit of upside for the potential downfall…and if that downfall was to occur re-entering or buying back the stock at discounted price?

I work out on the probabilities & make a decision…

Hope this helps…

Dave Hooper

:

Is it really fair to compare a 5% yield with bank deposits without taking into account CBA’s franking credits – which in essence increase the yield to 5/0.7 = 7.14%

komal.pandya.940

:

If I had any I would have exited at 70 or around that mark…its enough of profit booked…

Currently market seems to be increasing mainly because – fresh investors – who never ever invested in markets are entering markets & see that market is increasing every day…so they are getting in the loop of buying conservatively to begin with & than pouring more ans more because of stock broker’s recommendation (probably)…

Secondly – the minimum permissible portion of mutual funds might also be a part of rally…(but i don’t know who would really enter this expensive market)

Cash is the king, while it requires a lot of patience to hold on to it – but it remains the king…

tom k

:

Hi Roger,

Here was my March 2013 solution to the bank/cash choice dilemma back then:

The US dollar > CBA term deposit > CBA shares

Garry Mison

:

Interesting article thanks. I noticed that your estimated value for CBA is much higher than the intrinsic value in Skaffold. What is the reason for this?

Roger Montgomery

:

We are using some of our own forecasts …we also keep an eye on consensus though…

Dennis Bergmans

:

Roger and team,

While not specifically related to the above article, what are your thoughts on the proposed bank deposit levy?

Too big to fail comes to mind. In my opinion it just gives banks a reason to take on extra risk because “oh well, the government and deposit holders will bail us out anyway”. Excessive risk taking is what led to the GFC in the first place.

Wouldn’t you like to have a nice bail out safety net if your business went sour, Roger?

carlos.cobelas.1

:

looking at that chart shows the CBA share price waxing and waning between above its intrinsic value and below its intrinsic value. why should a long term investor care if the share price is now above intrinsic value ? you have often correctly said that it’s too hard to time the market. CBA is a high quality business so why not just hold for the long term, as my father did when he bought them in the 1990’s at around $6 ( his best investment decision ever )

Roger Montgomery

:

Because if you bought telstra, boral, leighton, qantas or Virgin over the last ten years – for the long term – your portfolio may not now look too flash even after a decade.

zoran arnautovic

:

CBA

Thanks Roger for this article on CBA. It doesn’t happen, often but I managed to sell CBA twice in last three months for $73-74/share and looking to pick it up again in low sixties after dividend.(hopefully)

Agree with you with CBA IV and by the way: Thanks a Lot for August Montgomerry White Paper as well( needed reminding) and suggest members read in between lines as well.

Cheers

Zoran

Andrew Legget

:

Game to sell CBA? I think that depends on your portfolio management style. I believe that some companies need to be actively managed and some can be held as long as you bought at a “good” price. JBH for me is an example of the first that needs to be actively managed and Woolworths is the best one i can give for the latter.

CBA to me falls into the latter, even though the price is well above what it is estimated to be worth, unless there were a plethora of better opportunities around (and there does not appear to be so at the moment) i am happy to sit back and collect the dividends as i believe that despite the leveraged nature of banks, that there is unlikely to be a significant shakeup that would warrant a structural decline in value to any meaningful degree.

However if you are a very active investor than selling seems to be a no brainer and it would be hard to argue against this decision as the price does appear to be meaningfully higher than anything in reality.

Andrew Legget

:

In saying all of that about CBA, catching up on some news, if the political parties add extra measures on top of their Basell commitments to make them “safer” then there would obviously be an impact on ROE.

I am a bit cynical though and don’t believe anything either party is saying at the moment, luckilly personal financial commitments and lack of opportunities mean i don’t have to worry about the impact on any existing investments.