Where else has Value.able been?

It has been a month or so since I last shared with you photographs from Value.able Graduates. These pics are from Gary, who has been travelling through Europe. He wrote “Read the book while traveling through Europe. Have attached some shots you may be able to use in your where in the world has Value.able been? One at the Louvre and the other at a little coffee with the Eiffel tower behind. Enjoyed the book, hoping to pay for the trip with the knowledge, Gary“.

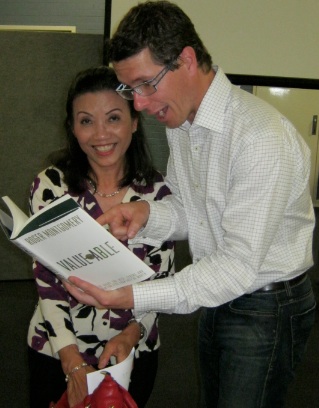

I was in Perth last month to speak for the ASX and Australian Investors’ Association. This picture is from Dan (with his Mum).

I was in Perth last month to speak for the ASX and Australian Investors’ Association. This picture is from Dan (with his Mum).

Dear Roger,

I just wanted to give a big Thank You for your presentation at the Wembley Tennis Club in Perth recently! I wasn’t able to attend because I live 450km North of Perth and have been busy with work, but I told my parents to attend and they said they had a fantastic night! Also, a huge thank you for signing my copy of your book and for taking the time to have a photo with Mum! We all love the book and have benefited greatly from your wisdom. I’m relatively new to the stock market (I’m 26 years old) but I feel as though I have learnt a great deal during the last year. I started getting interested in the stock market approximately 5 years ago, and back then I had the desire to own things that were (are still) considered to be “Blue Chip”, e.g. Incitec Pivot, Westfield, Santos, Babcock and Brown, Virgin Blue, etc. Now I have a far greater sense of how to approach investing in a more rational way, and how to identify companies that are actually of high quality. Now I spend my spare time on focusing only on quality businesses and have done really well using your solid and sensible approach. Thank you for the Value.able education! Maybe one day I’ll have the courage to post a comment on your blog (which is fantastic). I hope to see you when you’re next in Perth for a presentation so that I can thank you in person. All the best, Dan

And whilst Mark didn’t include photos of his Value.able journey, he has certainly impressed me with his enthusiasm.

“Hi Roger, Loved your book. You may be distressed or impressed but I have underlined highlighted and read separate chapters often. Dog eared sections etc. etc. I feel like I’m back in school and I’m 53. Seriously tremendous. Well done. Congrats, Mark”

A little ‘off topic’ was this email from Ken. Thanks Ken…

Roger,

Half the battle, getting started with any sort of analysis is being confident that one is not wasting one’s time going about things the wrong way. You have indeed given me a ‘leg-up’ with a range of aspects of my investing and thank you. My early career (and still a component of my work) involved collecting field data to calibrate and validate a pasture model (I’m still collecting validation data each year – 25 years since starting and training people, although engaged in quite different work now). I have spent years working with this model and with the scientist who built the model. There was never, in the early days, a definitive manual – just a mutual sharing of insights, late hours, passion and pain.

The modelling is now second nature and I’m more concerned with the flaws with the model than anything. But there was a huge barrier to entry – no manual could ever replace that research and effort that I put in to become confident and eventually proficient with what I was doing. It helped though, to have a more experienced person there for guidance – often just pointing out a reference to read etc. In turn I try to help people with their efforts where I can but it is up to the individual to get their own hands dirty, begin their own journey but, in our case, now as part of a ‘college’ of users. You are right in your approach – offering us a generous ‘leg up’ with your book and a means to share insights (your blog). By putting things into practice for ourselves, the keen will learn both the art and the science and, hopefully, slowly, become better investors and more value.able to both you and fellow bloggers. In many respects, this is how our team at work has operated for so long. As a team, we have become well respected both nationally and internationally – the college itself knows no institutional boundary.

In the preface to your book, Simon Hoyle notes:

“By helping to equip investors with the right set of skills, Roger is, either consciously or unconciously, waging a war against those who would seek to profit from the naivety or misplaced trust of others”.

Along the same lines, Alan Kohler, in “Why I started EUREKAreport” states:

“But it’s important to understand that investing is work. It is not gambling, or wishing and hoping, or trying to get the inside dope: it is work; a second job. Nevertheless with the right kind of support, you can do it and you can beat the pros. Eureka Report is the beginning of an attempt to provide that support and to redress the balance – to give ordinary people the tools and the knowledge to become independent and reclaim the control – and the money! – that is rightfully theirs.”

Roger, you are indeed forming an ‘investment college’ and it is good to be a part of it. I look forward to your latest blog and happy for you to reference anything.

Cheers

Ken

Thank you to everyone who has gone to so much trouble to demonstrate just how profound an effect my book has been having on your travel plans – if not your investing plans. I am genuinely encouraged and humbled at the same time by your support. Thank you again.

Posted by Roger Montgomery, 1 December 2010

Gee…I thought I wrote an interesting or at least insightful synopsis on ARB back on the 5th Dec 2010…It wasn’t posted by moderators????? I thought it was very relevant given ARB’s $1000 odd dollar fridges are 20 to 40% cheaper than their only two competitors…

Hi Ric,

That comment did go up. Please empty your cache and refresh your browser!

Hi Rodger,

What are the chances of seeing your book released in audio form?

wayne

I think thats a very good idea Wayne, I have already been thinking about that but I am trying to work out how I might cover the tables and graphs – if at all. What do you think?

Hi Roger,

I’d buy it ,so I could listen while driving (I listen to your ASX podcasts this way).

A simple description of the tables or charts and what learning points you were trying to convey with their inclusion, is all that is needed.

Being not possible to say every number in every table, you could either: sell the audio with a comprehensive paper inclusion of all table charts and charge same price; or as an optional extra with a book purchase at a lessor amount; or sell it as a stand alone item for a lessor amount (my preferred option since I have your book already). This option may also add to book sales down the track.

All this assumes you will be the reader of course.

Regards Greg

It could be sold as a tool to assist witht the book. Or you could include the charts as a lift out. Look forward to it.

wayne

Hi all

When you refer to IV for 2010 or 2011 are you refering to the end of year or the start of year? So IV for 10 relates to june 10? The figures from comsec for 2010 would value the company as of june 2010. Is this close?

wayne

I think someone posted an extrmeley helpful comment about this already but i am having trouble finding it, probably also been discussed numerous times in comments but am having trouble finding a lot of the details as the search only searches through rogers blog posts. So in regards to that i apologise.

The business in question is 4×4 product manufacturer ARB corp, of which i don’t pretend to be an expert in and from all accounts is a brilliant business.

Can someone explain to me the competitive advantage to this company? Are there really barriers to entry in this industry? Are there any major competitors domestically or bigger international firms that could set up in australia?

It just seems on a quick glance that the business is not a hard one to copy.

Also i see a few potential problems although i admit that this is as much me looking into a crystal ball and there for potentially well incorrect.

I think there will be a trend in the future towards smaller, fuel efficient and environmentally friendly vehicles as climate change, fuel prices and other factors remain and increase, specifically in the urban and city areas.

I remember being in London and all the cars there are quite small and would make a ford falcon look huge on the roads. I know they were set up originally for those who want to drive in tough terrain but surely these days the urban 4wd market is as big if not bigger than the ones who specifically want to do off-roading.

If 4wds as a vehicle do fall out of favour than what would that mean to the performance of the company?

It might be completley obvious, but i like to increase my knowledge of great current businesses that i can then build and learn more about with a scope to perhapd investing in it one day.

Just re-found the synopsis of the company and in the “drowning in a sea of complexity” blog. Will give it another read as it seemed a great wealth of information and thanks for taking the time like may have said. Still interested to ehar anyone elses thoughts on the competitive advantage and future prospects of this company.

Hi Andrew,

There are many sources of competitive advantage as you know. A simple process is to write them all down and then ask yourself “could” ARB have this one? Brand, reputation, systems and distribution (speed to market), IP (innovation), are some. The company’s 2009 annual report says: “ARB continues to regard product development as essential and a key element to maintaining the Company’s long- term competitive advantage”. The tricky part is working out whether it is sustainable.

Andrew,

Four wheel drive vehicles represent something like 25% of total vehicle sales in Australia, and the trend is upwards. Further, ARB sell their products all over the world so I wouldn’t think a shrinking market is likely in their future.

Regards, Ken

I am in QLD at the moment and I can assure you, where I am, it seems like a lot more than 25%!

Hi everyone,

I think i am having a similar situation happen to me as another person did with regards to this company where after starting to learn a bit more about it you tend to start seeing the logo’s everywhere.

In the short walk from St James station to Chifley Tower today for work i saw 3 ARB logo’s, this is to go along with the 4 or 5 i saw yesterday. This business does seem to have quite a good reputation and apepars to be the supplier of choice for a lot of people who own these vehicles. Enough to whet my appetite and learn a bit more about them.

As a young gen y male (some would say metrosexual) i have never owned a 4wd or a ute and there for i was not aware of this company. I have recently started learning about this business after hearing some discussions on them and like what i have begun to see.

I still have some concerns about the future for this business as i feel it is extremley levaraged to particular factors like certain commoditie prices, demand for 4wd vehicles etc.

But i will continue my learning on this business and i have a lot of time on my side (I doubt i will be in the market due to personal financial commitments for at least a year or so) and there for have a lot of time to build a great database of company and information about them and their performance to go off when i am ready.

Has anyone looked at Specialty Fashion Group (SFH)?

I don’t quite understand their “accumulated losses” calculations in their balance sheet, but their marketing looks good, +ve cash flow and pretty good ROE. They do have some debt and the moat’s a bit dry, but on balance – maybe?

Mike,

May I offer you advice as an ex retailer. Retail has a number of headwinds in the future (some are already blowing) and whilst SFH are trading well below their IV, their type of retailing is usually the first to feel the pinch in hard times. The accumulated losses probably relate to the Millers chain which fell over a couple of years ago. For my money, they represent an unacceptable risk, but of course you must make up your own mind.

For what it is worth,

Seymour Whyte. (SWL) which just listed about 6months ago seems very cheap. IV is about 80% higher than its current share price. It`s an infrastructure builder. Does anyone have anything to say about this stock. A negative is that the ROE has been dropping the last 3 years 49.4%, 43.5% to currently 41.8%. It has very low debt and future prospects look good at this stage. Thanks everyone for all your comments. KenFraser.

Hi Roger,

An update to an old blog you put up here about the waste management company WSN. I remember thinking at the time as i was reading it “so those are the guys to blame”. I live in Narellan, not that far away from the McArthur Resource Centre i think it is called.

Camden Council has been getting a bucketloads of complaints from people in the area about the smell coming from their depot. We just got letter box dropped a document from WSN apologising and letting us know that they are spending money on upgrades that should stop this problem. So there is some increase capex going to take place that they would not have previously planned for i think.

Whether it works or not, i dare say this particular depot will also be under council pressure for a while as the people around here are fed up with it.

Hi Roger. Just wondering what your view is on the impact of the announcement last week by DWS secretary that earnings will be cut by approx $1.0m . Will this reduce intrsic value ? as you always say that your view has to flexable due to changing issues within a company. The price has fallen off a cliff but do you find this as a good buying oppourtunuty? I am half way through your book ,Chapter 8 hardcopy, so i have got to understand how you determine a A1 company but not to how to value a company. My opinion is that this is just a hurdle as my research into DWS definately fits into your teachings of good ROE, low debt, competative advantage ;great management and senior consultants, and a forward direction , 1, one,14, excellence together. What would be todays intrinsic value post this annouuncement or would it still be the same as prior to this announcement ? Thanks for you insight Roger , Frank.

Hi Frank,

There is quite some discussion about this here on the blog about IT companies, declining margins and economic sensitivity. Have a read through the comments of the last few posts. Importantly, be sure to refresh your browser and empty the cache.

A newspaper article led me to the following page on ASIC’s website that lists the reported short positions on ASX stocks:

http://www.asic.gov.au/asic/asic.nsf/byheadline/Short+position+reports+table?openDocument

Very interesting to see JBH has 8.31% of its stock shorted as at 30 November as JBH’s market price has fallen recently. In James Montier’s “Value Investing”, Montier makes the comment that the short sellers are amongst the most fundamental investors he has met so I’d love to know if they have a fundamentally good reason for shorting 8% of JBH. Another good point Montier made is value investors often start buying stocks months before (I think about 2-4 months) the price bottoms out. It pays to be patient to wait for deep value opportunities or dollar average into them.

It’s worth checking this ASIC document from time to time as the behavior of some short sellers may create great value investing opportunities (providing they are fundamentally wrong at some point).

Paul

I’d really like to take this opportunity to thank Robyn for her seemingly simple request for help with her MCE valuation.

What a discussion it has stirred up. I don’t know the background of the blog contributors but I’m betting that six months ago nearly all of them (including me) wouldn’t have given too much of a toss about forward earnings, order books, dividend ratios, and competative advantage. We would have listened to Brokers, TV shows, and mates tips.

But look at us now, we are having discussions about companies that involve in depth information, forecasting, cashflows, and risk/reward.

To a degree, it doesn’t matter who is spot on with the IV. It probably doesn’t even matter if you’re out by a fair margain. The reality is that to come to the figures, everyone has conducted company research that I bet they wouldn’t have even considered a year ago. You all know your companies so much better now.

The formulae is not the be all and end all. The research you conduct to apply the formulaes is the key.

I have only a moderately sized portfolio, less than 50k. It has just 8 companies in it, ARP, BHP, CBA, CSL, JBH, MND, RIO, and WOW. Some are A1, some are A2, and some are B’s.

Some of them I bought at fair discounts to IV, some at about their IV, and shock horror, one even slightly above its IV. Even though that practice is not strictly by the book, the point I’m trying to make is that I know my investments. I’ve been forced by the book to know them even better now, and I’m as confident in them as I can be. I won’t make the same return as some of you do. That’s okay. I’m an investor and time is my friend.

The value in Valuable is not the formulae. It is the knowledge we gain about the company in question. Way more I bet than what we used to know.

Don’t get caught up on getting an exact IV. Get caught up on taking “ownership” of your company.

Hi all,

Last week IT company DWS an A1 company announced a telco company was canceling its services for the Xmas New year period resulting in a 20% fall in its share price. It will affect the bottom line profit by 1.4mil. is this a knee jerk reaction? & will this affect the IV by the % fall or is it a buying opportunity?

Hi,

Roger has recommended getting your source data directly from the company’s Annual Report. I previously took Comsec’s data as being gospel but having now started to take Rogers advice and actually get my data from the annual reports I have noticed that Comsec is sometimes quite a long way off. In one case Comsec had ‘Shareholders Equity’ as being $76million when it was actually only $68million on the annual report. Obviously if your starting Shareholders Equity figure from Comsec is significantly wrong it will throw your whole calculation out. Thought I would pass that experience on for what its worth….. Cheers

Hi Roger,

Congrats on having your book travel so far around the globe. The way you communicate your ideas is second to none and your passion for the subject is as impressive as your content…Well done.

I have 2 questions for you and if you could consider them this would be great.

1. My first question pertains to something I have heard you say on numerous ocassions, that being ‘Seek and take personal professional advice’…

When you say this what kind of professional do you have in mind? Surely you’re not referring to stock brokers or fund managers, given the methods so many of these professionals use to develop portfolios.

2. What have you found to be the most useful means of obtaining more general information about the businesses you consider investing in, and how much can you rely on annual reports (apart from the financials sections)? I ask this beacause I doubt very much that a company would release a negative sounding annual report – even IF the outlook is indeed negative.

Thanks in advance,

Hi Chris,

Answering the second question first; Industry journals and Google Alerts are very handy tools for understanding a company and the industry it is in. When I say seek and take personal professional advice it means do not trade in any security without first speaking to an advisor who is licensed by ASIC, expert and most importantly, familiar with your personal financial needs, circumstances and risk profile/tolerances.

Hi Roger,

Any thoughts on JML? I have them trading at a discount to their current IV, with IV rising close to 70% annually. That ought to slow down a bit once they start paying dividends though.

Hi Christopher,

My valuation is 58 cents and yes, you can get a very big jump in the next year or two if you maintain the current payout but you cannot expect them to refrain from dividend payments forever, which is what you would be assuming if you adopt a zero payout in the formula in my book.

Thanks Roger,

Also no discernable competitive advantage. The analyst figures I was looking at were suggesting they wouldn’t pay dividends for a couple of years yet. This may or may not be true, but I wouldn’t take it for gospel; those consensus figures often don’t even match a company’s clearly stated dividend policy.

Hi Roger,

Just been re looking at Oroton again as it hit my valuation on friday. The interesting thing is that we now get one analyst forecasts figures through the etrade and comsec data feeds. These figures are as follows.

2010 2011 2012

EPS 56.1 65.5 71.5

DPS 48.0 35.0 38.0

The EPS figures are mildly supprising but the DPS is a big eyebrow raise and it is of course only one analyst guess.

That said could it be that Sally and the Oroton board all purchased a copy of valu.able and are going to cut the dividend to fund expansion.

It is my understanding that the Hong Kong store has gone well so far.

If I use these figures in a new valuation I get a nosebleed from looking up at the sky too much.

A call to the analyst may be appropriate.

Anyway just thought I would put these thoughts down on the Blog

Hi Ashley,

I wouldn’t bet against Sally although I confess I can’t bet here at all. As I know Sally personally, I have elected not to trade ORL at all. Try looking for the fund managers that own ORL (more analysts to talk to). Go to the top 20 shareholders on the register.

Hi Roger,

Is “bet” and “trade” the same as Mark Twain”s “speculate”.

I just noticed these are words you dont usually use thats all

Hi Ashley,

bet; verb (used with object)

1. to wager with (something or someone).

–verb (used without object)

2. to make a wager: Do you want to bet?

spec·u·late; verb (used without object),-lat·ed, -lat·ing.

3. to engage in any business transaction involving considerable risk or the chance of large gains, esp. to buy and sell commodities, stocks, etc., in the expectation of a quick or very large profit.

Note the word chance used in the definition for speculate. Betting is wagering, waging is about chance. So ‘speculation’ is a euphemism used in business for ‘betting’.

Hi Roger,

Does this mean you have not excluded yourself from Investing in ORL just speculating in it?

Both Ashley.

Speculation is an effort, probably unsuccessful, to turn a little money into a lot.

Investment is an effort, which should be successful, to prevent a lot of money becoming a little.

– From “Where are the Customers Yachts?”

Nice!

I saw that as well, however i tend to believ it is wrong. I am pretty sure i saw a comment recently (not sure if it was the speech given at the AGM or something else) where it was stated that they expect to keep dividends at around the 80% level. I would expect this to be the case, however with their asia roll out plans maybe they might decide to keep a bit more money in the company to help fund the expansion. My money is on them to maintain their current payout ratio.

Hi Andrew,

I think you are refering to the investor presentation after the results dated 24 September 2010.

About dividends they say.

Dividend policy of ~80-85% of NPAT continues – subject to strategic

growth opportunities.

No real help here I think.

They are welcome to keep my share of the dividend to fund any strategic growth

With five empty coffee cups in front of him, I am surprised that Gary can hold the book steady!

Guys

Thanks for everyone input.

Hi Roger,

I was just wondering what you think of VHA? I’ve just noticed Vodafone are introducing extremely competitive phone plans and look like they are trying to take the number 2 spot from Optus.

Thanks :)

Hi Johnny.

VHA?

That would be Vodafone Hutchison Australia, a non listed company so Johnny is going to find it hard to buy shares in them.

Regards, Ken

I think Johnny means Vodafone Hutchison. As they are not listed as far as i can tell i have nothing further to add however.

V in VHA is Vodafone primary listing is in England (not listed on ASX), HA is Hutchison Telecommunications (Australia) Limited (HTA.AX) currently trading at 11c.

HTA does not make profits (never has – never will???) Vodafone does not breakdown details earning numbers for Australian operations.

My guess it would be similar results to HTA.

VERY high capital intensive industry – something new every year.

Greg

Hi Greg,

Thanks for that. FMCG but with capital intensity and fast changing technology to boot. A tough one indeed!

Hi,

Can someone explain how to arrive at ROTC. Is it equity+debt or equity + long term debt + short term debt or is it equity + liabilities??? or is it something else. A recent example of a company (say Telstra) with all the figure would be very handy.

Thanks

Hi Nic,

Sounds like you are after return on total capital. Equity + LTD + STD for the denominator. Totally different for another ROTC – Return on Tangible Capital.

Hi Roger, business has been to busy for me to keep up with the investment hobbie. i still can,t see why i should buy dcg. its return on equity on the fiquires i have are terriable. am i doing something wrong. The one i like whos fiquires look good is lyl. Could you have another look at both of these. best regards young les.

OK Young Les.

You need to look at the ROE of the continuing operations for DCG as a starting point, Young Les. I figure historic ROE for continuing operations to be 21%

HI Roger and room

Roger, thank you for sharing your wisdom , it has enhansed my investing ability. To Roger and all in the room and families have a enjoyable and safe Xmas and new year .

Well done to all in applying our new found knowledge.

MERRY Xmas to all.

Glenn and Sandra Matheson.

Thanks Glenn,

Happy Christmas to you too and I won’t be far behind you.

Hey Dunc,

I recalculated my IV for DWS and even with the massive drop yesterday in price I only have it around IV. 12% RR, but I don’t have other figures at hand at moment as away from work

Hi Folks

DWS have had a profit down grade due to a customer not needing their service over xmas. The estimate is $1m profit loss. significant i know but surely not that bad considering the type of business? i’ve jumped in and bought more, not quite the $300k some else has but a few. Being a low cost service provider the reduction of $1m in profit shouldn’t really effect DWS’s ability to grow the business at the current expected rate should it? or am i missing something?

thanks

Dunc

Hi Dunc,

A lot of caution has crept back into the economy over the last few weeks. It may be a time that conservatism proves especially wise. No advive or recommendations here and you must seek and take personal professional advice. The valuation of DWS will decline slightly on the back of this unless DWS can replace the hole or the client returns and does it. The statement to which you refer requires scrutiny: “Based on the information available at this point DWS anticipates H1 EBITDA will be in the range of $12m to $12.5m (PCP $13.4) and expects that H2 EBITDA results will be impacted by not more than $1m” . The company is saying that first half EBITDA could be $1.4 million lower and second half $1 million lower. Thats a lower first half but not necessarily a lower second half. “impacted by not more than $1 million” does not mean lower than pcp (previous corresponding period). Estimates for 2011 NPAT (not EBITDA) prior to the announcement centred around $20 million.

Hi Dunc,

I have an intrinsic value of $1.31 based on 2010 numbers and rising to $1.54 in 2011 assuming 13% RR and 0.15 per share earnings for 2011. They pay a high proportion of earnings out in dividends (78% in 2010) and apart from being enmeshed with their clients I am unsure of a big moat around the business as it relies on hiring the best IT guns in town. Maybe someone else can enlighten us on how this competitive advantage is sustainable.

Cheers,

Matty

Duncan,

Below is a little something I posted on DWS a few weeks ago. Repeated here for what it is worth.

“I have been having a look at DWS, and I must say I have mixed feelings about it.

Pros: Zero debt, Good ROE, Increasing revenues.

Cons: Declining operating Margin, Declining ROE, Flat NPAT, Increasing Staff costs.

Despite revenues increasing by 51% over the last 4 years, NPAT has only increased 12% and in that time operating margin has decreased 25% and ROE has decreased 24%.

In the last 12 months, revenues increased by 8.4% and staff costs (salaries & wages) increased 7.6%.

Asset position is strong with $13.5M cash and no debt, but it looks to me like this business is having trouble growing in a meaningful way. Their costs also appear to be rising at a rate which is out of step with their margins/profits.”

Add that to the announcement today, and I think a little caution is warranted.

Thank for that. Seek and take personal professional advice.

I have the same concerns about the increasing revenue with a more or less steady operating profit. I think this is a sign of the commodity-like nature of IT services, and that despite increasing costs (especially wages), competition and customer price sensitivity prevents DWS (and other similar businesses) from maintaining their margins. I have worked in professional services (not IT though) for a long while and from my experience, this is a normal part of the business cycle for these types of businesses.

At some point, margins will stabilise and then maybe start to expand again. Personally, I think IT services are overpriced in general and competition is increasing, so i think it will be several years before the margin decline ends. In other words, i think it will be a while before IT companies will be able to increase prices at a rate that matches their increase in operating costs. (Though, of course, i could be wrong).

Personally, I would wait to see some stabilisation or improvement in operating margins before i invested in a company like DWS, or otherwise have a very, very large margin of safety. Hopefully, the future will bring a better buying opportunity for DWS and other similar companies.

Of course, all of the above is just my opinion and not personal advice.

Good points Lee,

As I have mentioned, these are the first business to witness a turndown in business confidence and also the second (if not the first) to see a turn up too.

Roger,

Regards OKN, which you rate as A2. I notice that there has been a big drop in price – down to $2.26 today. I have the following figures for OKN

IV 2010 $3.31

IV 2011 $2.52, and

IV 2012 $3.29. which are based on Etrade figures and RR of 10%.

As the price is now well below IV (safety margin of 46%) do you still consider OKN to be A2? Or has something strange happened to OKN that I do not know?

Cheers,

PeterB

Hi Peter,

An earlier downgrade. Interesting that after the significant drop on NPAT between 2008 and 2009, there has been no recovery to pre GFC levels and no current expectation that there will be. Be sure to always always always seek and take personal professional advice as it is not available here.

Guys

I have purchased Rogers book and am trying to apply the knowledge with valuing CBA. I have used the following:

Equity Per Share: 22.73

Payout Ratio: 81%

ROE: 16.8%

RRR: 10%

If I follow Rogers methods I seem to arrive at the valuation at around $37. I have heard Roger say lots of time that the banks are trading at their intrinsic value. CBA is trading around $48-50. What am I doing wrong?

Can anyone help?

Thanks in advance.

Satbir

Satbir,

I agree with your EQPS figure of $22.73.

Payout ratio is 63.3% (NPAT $5664, Divs $3587)

ROE is 17.2%

That will give you an IV of about $48

Hope this helps.

Ken

Hi Satbir,

If I use your figures I get the same IV as you do. So you are calculating an IV which is correct for your figures.

However, I think your figures are different to Roger’s…..

I calculate an average equity per share of $23.07 (prev years equity + this year equity, divide that by 2, then divide that by the number of shares on issue at the end of this year).

I get a payout ratio of 37.94% using the dividend paid from the cash flow statement. This is where you are diverging. A very large proportion of CBA dividends go in to the dividend reinvestment plan, ie they are not distributed at all. Using the cashflow statement figure you can get a more accurate number for the money that has left the balance sheet in the dividend.

Finally, your ROE looks right, mine (an R On average E) is 16.90%.

With a RR of 10% I get $51 with those numbers.

Regards,

Matt

Matt,

Roger has previously pointed out that the dividend figure could come from the Statement of Changes to Equity.

I also think your EQPS figure is out. LY 30922, TY 35047 Shares 1542.090

results in $21.39.

When I was checking this I noticed an error in my database, which is why I was originally agreeing with Satbir’s figure, so it has been useful for me to do this exercise too.

Regards, Ken

Ken

I have read Roger’s book and have worked through the IV process. I am wondering whether the EQPS should be the average of this year and last years equity or should it be only Last years equity. If you talk about a return on an investment it is usually the earnings for that year as a percentage of the commencement value.

I also wonder whether I should use last years number of shares in all my calcs as this years represents the dividend reinvestments.

I have found that by constructing the spreadsheet it has forced me to have a better understanding of all the elements. I still struggle over using the annual reports and getting the “correct value”.

Regards

Michael

Hi Michael,

If a company ends June 30 with $30 million of share capital and the next day raises another $30 million, then arguably they have had those funds for the year as well. As I have mentioned previously, you can weight the capital that has been invested over the course of the year if you are unhappy with a simple approach. Its most important to be consistent.

Michael,

My approach is slightly different. I use the average of LY & TY, except where TY is more than 25% higher or lower than LY. If that is the case, then I use TY, on the basis that this is the figure you will be measuring against going forward in the next 12 months.

This tends to be a conservative approach, because TY is usually higher than LY.

Hi Ken (or Roger),

What is L & T equity?

Nothing important is ever easy, I believe we should use openning equity, but if large amounts of equity are raised & deployed (eg reduce debt) during the year, it must be considered. And timing is important as well, July raising (include) verse June raising (ignore), must also be considered.

Simple average (Openning + Closing Equity/2) is fine for mid year capital changes or stable eqiuty positions but does not solve all the problems.

Time weight average seems to complcated, at first.

Maybe using closing equity in capital raising years and openning equity in capital returning years is the easy conservative approach.

The real answer of course is if during the year, equity changes significantly (eg >10%) then decided each instance on its merits, with a conservative bent.

Thanks Greg

Hi Greg,

Once you have set up the algorythm for time weighting the shares issues, its all done.

Greg,

LY = Last Year

TY = This Year

Standard terminology in retail reporting (old habits never die)

It also sounds to me like you might be over complicating it.

Regards, Ken

Thanks for the reply. I realize that simple is better and heed what Roger advises ie consistency.

One other thing that has been trobling me is the issue of debt. The book does an excellent job of explaining the effects of debt, but if a company has ROE of 20% and high debt, then a better indication of its “true” return on investment would be to add the debt back into the equity and use that as the ROE in the calcs. A 20%ROE might turn into 10% if the debt was added back in. I realize that what we are interested in is ROE but adding the debt back in might reveal how much the company’s is earning for the amount of “investment”.

Regards

Michael

Hi Michael,

If a company has a high ROE but a lot of debt, my analysis is over.

You are right, I was wrong with that EQPS.

$21.39 is the correct EQPS to use.

Thank you for pointing that out.

I’m glad my mistake was helpful to you… in fact, I hope every one finds their mistakes helpful to others. We can learn a lot that way.

A note to everyone, and this might be obvious to the accountants, but the equity/profit figures to use are the Majority or Controlling Interests figures. In the CBA report the equity figure is called “Shareholders’ equity attributable to Equity holders of the Bank”.

As public shareholders we do not have claim to the minority equity or profits. This can make a difference to valuations of companies with partly-owned subsidiaries.

Thanks again Ken

Just for a another point of view. i get my dividends usually from the statement to changes in equity report and the notes section under dividends. I disagree with the above about dividends being re-invested are not distributed. They are distributed however they are then re-invested into the company. I know it sounds like a case of semantics but it is the viewpoint i share and i think we can’t discount any dividends that might be re-invested.

I will use the figures i have been using from a consitency point of view as well, but would be interesting to see other peoples views on this area as well.

Hi Andrew,

I treat them as a capital raising.

Which is exactly what they are.

Hope this help

BTW some companies have a policy to buy back the reinvested dividends on market so that the number of share on issue does not change.

So you have to look at this as well.

Hi Ashley,

Are you referring to the practice of share buy backs to offset the shares issued under a DRP? Its a crazy situation engaged in by any company that has a buyback and a DRP (Dividend Reinvestment Plan) running concurrently. Have a look at this…

Follow the cash:

1) A company pays a dividend.

2) Because it needs the cash (and is only paying the dividend to promote the share price) it then implements a Dividend Reinvestment Program.

2a) It issues shares in return for dividend recipients giving their cash back to the company.

3) Then the company uses that cash to go and buy back the shares that were issued – effectively giving the shareholders back the money they originally received by a dividend and spending the cash that it needed and for which it implemented the DRP.

I think there are indeed companies that do this but for obvious reasons they don’t articulate it, because it is crazy. We should put a list of companies together that have a DRP and a buyback running at the same time. Perhaps someone would like to do that over the break? Any volunteers?

Hi Roger,

Yes this Is Exactly what I mean..and you are right it is a crazy situation.

Trying to be all things to all people.

I will help compile the list

Great stuff Ashley! Thanks. We’ll make something value.able of it.

I know CBA is starting this – to let small shareholders build their holdings and then buying the same amount back on market

Hi James,

I have already strarted to have a look at this and this list so far would suprise most people.

Hi Ashley and Roger,

Some companies like WOW have a DRP with a 0% discount. I guess, WOW are just providing a service to those shareholders that like DRPs even though they dont need the capital, and that WOW is not really crazy.

WOW is one company has a buyback and DRP.

The banks have all reduced the DRP discounts to normal levels (eg 1.5%) now they have all the capital they need, at the moment.

The list should include DRP discounts to guage how much a company needs capital.

Greg

Hi Greg,

You are right WOW is not crazy. The concept of paying divs, issuing shares to fund a div and simultaneously buying back shares remains crazy but as you correctly note, it is a matter of degrees. I agree with your suggestion about discounts. We should also add the quantum and safety margins between the buy back prices and intrinsic value to determine who is destroying the most value.

Hi Roger,

You are a very hard teacher. My holiday homework just got harder….LOL

Hi Roger,

We should add to this list compmaies that have a underwritten dividend(That is all dividends are supplied by issuing new shares to a party or parties)

Now that a real shocker.

Agree Ashley!

I got an IV of $48.42.

The biggest difference would be down to Pay Out Ratio, I got a POR of 63.75% with a total of 3621 being paid out as dividends against the NPAT of 5680.

All up my figure was worked out as the following:

EQPS- $22.97

Payout ratio- 63.75%

ROE- 16.95%

ROE used- 17.5%

RR- 10%

Every other input you have is extremley close to mine, so you have done a good job. The difference is pretty much down to payout ratio. Where do you get your dividend details from? The annual report? If so where abouts? Or do you get your details from a comsec or other broker research function?

Hope this helps.

Andrew

I am using figures from Comsec. I think I am better off going to companies website.

What do guys think?

Cheers

Satbir

Hi Satbir,

Whenever you can, go off the companies annual report which can be downloaded from quite a few sources including the companies shareholder internet page as well as the ASX when it comes up.This is where you will find the audited information which is a lot more trustworthy than any figure that Comsec comes up with.

It takes a bit mroe time obviously to find the details but nothing replaces the real information and as you get used to it and know where to find all the details you will have no problems and learn a lot more. Calculating values from these details is easy, the important and hard part is interpreting the information to see if it is worth valuing.

Hi Satbir

You have calculated the IV for June 2010. I think Roger would be referring to 2011 IV’s.

To calculate 2011 IV’s you need forecast Earnings & Dividends and you have to forecast Equity. Roger explains how to calculate ‘Forecast equity’ in his post ‘How do Value.able graduates calculate forecast valuations?’. http://rogermontgomery.com/how-do-value-able-graduates-calculate-forecast-valuations-2/#comments

“Take the last known equity per share figure, add the estimated profits, subtract the estimated dividends, add any capital raised through new shares issued and subtract any equity paid back to shareholders through buybacks and you have it.”

6/10 earnings per share less dividends paid out should be added to the equity per share: 22.73 + 0.674 = 22.40. This doesn’t “solve” the gap but at least closes it.

Hi Satbir,

I’m certainly no expert but here’s my take…

The value you have calculated is spot on, considering the figures you’ve used as input. However, I question the figure you have used for ROE. Which in turn means you’ve used 15% as a selected ROE to read the tables. I think the ROE is closer to 18% (ie. NPAT of $5,617M / Beginning Equity of $35,047M). If you then selected 17.5% to use in the tables IV would be approx. $44. Note also that this is the value based on 2010 results, rather than the value looking ahead to 2011. For what it’s worth I have an IV for 2011 of $49.68, and 2012 of $54.16 (assuming analysts forecasts hold). Hope this helps.

Does this seem reason.able to anyone else?

Cheers,

Bruce.

Bruce

Thanks for your input. I really appreciate it.

cheers

Satbir

G’day Satbir,

I have used the CBA annual report for my figures, and the Commsec website for forecast EPS an DPS for future intrinsic values.

I have used the following:

Equity Per Share: 22.98

Payout Ratio: 79.26%

ROE: 16.9% – but I have used the closest value on table 11.1 of 17.5%

RRR: 10%

Forecast EPS

2011 4.13

2012 4.40

2013 4.69

Forecast DPS

2011 3.18

2012 3.42

2013 3.56

My Intrinsic Value for 2010 is 44.92

Forecast IV for 2011 is 47.28

Forecast IV for 2012 is 49.04

Forecast IV for 2013 is 51.77

Hope this helps

Hi Guys,

I am a little like Satbir in that I have almost finished Roger’s book and trying to appy his methods to current shares I own.

I am currently doing Origin and not sure where I am going wrong working on 2010 financials.

I am getting an IV of just $6.14.

Figures I am using are

ROE 5.0% (5.18% but used 5% on table)

Payout Ratio 60%

RRR 10%

Equity Per share $12.99

Can anybody help me?

Stuart,

My IV for 2010 is $3.46 using 14% RR. If I use 10% I get $5.06.

Equity per share is $11.50 (Shares 880.669, Equity $10003/$10249)

Payout ratio 71.7% (Divs $439 Profit $612)

Saw this and thought i would have a little look at it for you. The below is a very quick calculation.

I got a NPAT of 612 (all figures are 000,000 except i don’t bother with that in the input)

Equity of 10,249 and 10,003 for a ROE figure of 6.04% but i think using the 5% ROE figure on the table would be the right one so lets use that

Dividends of 439 for a 71.73% pay out ratio

880.6 shares on issue for EQPS of $11.64

Using your figure of 10% RR i get a value of $5.11.

The above is just a quick calculation but it apepars your at the right amount. Sometimes and the good thing about what value.able teaches us is that perhaps it is our perceptions that need to be changing towards a company. This is why it is important that we can get a good picture of the business through the information in their reports etc.

Please seek and take your own advice.

Stuart

I am just starting out as and I have used the following figures.

I have used ROE as average over 10 years: 8.9%

POR:63%

Equity Per Share: $11.51

RRR: 10%

I have used 10% from Rogers tables and the IV comes around $11.51.

Please comment.

Cheers

Satbir

Hi Satbir,

Using the ETrade information, and RR of 10%, I have the following results:

CBA

Year 2010 2011 2012

Intinsic Value $38.68 $46.73 $49.74

Book Value $22.73 $23.31 $24.67 (Equity)

EPS 357.4 412.6 439.9

DPS 290 318.1 342.2

For 2010, your IV and mine are reasonably close ($37 and $38.63)

Hope this helps

PeterB

Hi Roger & room,

I hope you all have a safe and happy Christmas and hope to see you all in the new year, starting my holidays a little earlier this year. I really would like to thank you Roger for all your help this year and wish you and yours all the best.

Thank you!

Thank you Fred. I won’t be far behind you. Happy Christmas.

Hi Fred,

Have a happy Christmas and look forward to hearly from you in the new year

Roger,

In a previous post, Robyn asked for everybody’s IV’s on MCE. Nine people responded with 2011 figures, and they were as follows;

$5.20

$7.00

$7.14

$7.87

$8.43

$8.50

$9.30

$11.24

$11.57

What concerns me about this is that some of these (or maybe all) are way out, and investment decisions may be made on the basis of these numbers. I realise that the RR% used will have an effect, but I think this points to a need for you to CLEARLY explain the correct source of the 5 numbers used to arrive at an IV.

If the 2010 base figure is incorrect because somebody has used the wrong dividend figure, for example, then their 2011 estimates are going to be wrong too.

In my opinion, it is not enough to outline a valuation method in your book without explaining how & where to extract the figures. A couple of months ago, I had a crack at it, but it would have more impact if it was the subject of a post by you.

Regards, Ken

Hi Ken,

I thought that previous post was very good and I think the above range is a function of the fact not everyone has seen it. I will publish some ‘homework’ for the holidays.

Hi Ken/Roger

Maybe having a post on a business where there are big changes in the forecast ROE/NPAT over the next three years. Have examples on the ways to choose a sustainable ROE for this business. Acrux (ACR) is one that comes to mind that has been mentioned many times on this blog.

Good suggestion Pat.

Hi Ken

I hear what you are saying Ken I use a different formulae to valuable (similar but different enough for the inputs to be different) I use a before tax formulae which with a few changes I can convert to the valuable formulas. I have been using this for awhile and am confident in them. The end result is not too different to valuable. Interesting that you have $8.50 on MCE and I had $8.60 before the recent analyst upgrade.

Very close

So I am happy to post me valuation Ken but the inputs will be meaningless.

BTW Ken you’re very thought provoking comments have made me made an adjustment to what I do so that is very much appreciated.

Thanks for that. Keep up the good work

hi everyone,

regarding matrix, its a wonderful business but you must watch out for their order book for fy12 onwards (as roger mentioned), this company lives and dies by it!!

i definitely think some of you are quite optimistic with your IV.

these are mine:

current $5.66

fy11 $9.01

fy12 $9.47

so again still a good safety margin, but watch out for the order book…. good luck!

Ron.

Thanks Ron, That order book is it!

And what do you suppose will come first – public disclosure of the order book or market price anticipation by those truly in the know.

MCE looks good to me from a valuation risk point of view and the balance sheet risks looks O.K at the moment but it has heaps of earnings risk as can be evidenced from the 3 times beating of prospectus forecasts in just a few odd months. It may have been on the positive side but it is a stark example of earnings risk.

I don’t know enough to be in front of any public announcement of earnings so this company carries too much risk for me.

One thing I have learnt, is that if there is high earnings risk and you are not in the know, than the share price has normally already moved a long way before changes are spelt out publically.

Oh the pleasure and the pain I have experienced before I really comprehended why you should invest in your circle of competence.

If you hold MCE’s and its earnings risk are within your circle of competence to manage than happy investing.

This comment is not directed at anybody – I have written it for my benefit, to reinforce my discipline – the siren’s seem to keep calling me to make the same mistake over and over again.

Hi Gavin,

I think the order book can be on the upside or the downside…

For what is worth I think just watch it (the order book) don’t worry about it…..

This is a good company just let them do their thing.

The parameters used for MCE:

Year 2010 2011 2012

EPS => 29.4 46.8 62.9 from Etrade

DPS => 4 11.4 15.5

Book Value 2009 => 0

2010 => 0.86

RR => 10%

gives me an IV of $7.19.

As the number of book values is small (only two) I am unable to estimate the book value for the next two years. I normally use all bookvalues to plot a trend line an extrapolate for following years.

Therefore, I only have the current IV estimate.

However if I use the same Bookvalue, I get an IV of $14.87 next year and $24.82 the following year.

Cheers

PeterB

Hi Peter and everyone else,

I see two issues. First future book value should be last years book value + next year’s profit – next year’s dividend. You can do this forever if you like. Secondly you need to see that based on your numbers the company will be generating a 48.7% return on equity in 2012 and have a 24.6% payout ratio. That implies a 36.7% earnings growth rate ‘forever’ which is just not going to happen. As I mentioned in an earlier comment, if a soldier from Ancient Rome invested 1 dollar/dracma 2000 years ago at 4%, he could not claim his return today because there’s simply not enough cash in the world to go around. If a thousand trillion dollars is $1,000,000,000,000,000 our roman soldier’s heirs would have $11,659,464,315,023,100,000,000,000,000,000,000. So a ‘profitable’ and conservative solution (for example a utility function) needs to be applied. I talk about implied growth rates in my book.

Roger,

Many thanks for your advice. I will have another look at my IV calc method for years 2011 and onwards. I would really appreciate your future IV’s (2011, 2012) for any company so that I have something to check against my method and calculations.

On a lighter note, it’s a pity that the USA and the PIGS did not chuck in the odd Dracma 2000 years ago!!! Then they would not be in their current financial state.

Merry Xmas

PeterB

FYI my MCE Values:

Current 2011 2012 2013

$10.51 $9.02 $11.80 $11.08

I used a RR of 10%. In case you wanted to compare some more.

Chris.

Interesting excersise because not all information is available for 2009 and you have to work out some of the values obtained under “Company Information”

I use only the 10% table values and then I may put a risk factor on it. By using the same values all the time for a proper IVCompany you get a better handle on things and know if you in the right ball park. Than look at the future risks.

For MCE I get IV for 2010 – 10.36 2011 – 21.72 and 2012 – 29.06

With so little information on the comp. I would put a 50% factor on the risk

Hence, values of 2010 @ 5.20 2011 @ 10.50 and 2012 @ 14.50

Seems to fit in with above

Regards, Harold

Hi Everyone,

I’ll go by Christopher now as there are a few Chris’.

Remember that MCE raised capital a couple of times. For this stock, average equity over a two year period might not be the best way to determine ROE. If your average equity figure is too low, you will imply a growth rate that is too high, not only in the Roman soldier sense Roger describes, but also in that it doesn’t accurately describe what happened in that year. This will (very) significantly inflate your intrinsic value calculation. My valuation certainly changed once I considered what had actually been going on in the business!

Roger cautioned against blind application of the formula and tables. I had wanted to blindly apply both to every listed company and then devote more attention to those that were interesting. This was a big, big mistake. If you don’t generate an accurate description of the actual cashflows of a business, you’ll be way down the wrong track to start with.

The best way to save time is not to cut corners!

Excellent comment Christopher. The book is working!!! Forward estimates of equity and profits will also help to moderate excitement by showing whether ROE is deteriorating.

Hello Ken,

I enjoyed reading your email to Roger. It sounds like some interesting work you are involved in.

For what little its worth I think Matrix is a good buy up until $5.50 (that is having already incorporated a margin of safety.)

I have no idea what I would value it at next year, I’ll have to wait till next year. I do not like to use brokers earnings forecasts (and if I do always use the most pessimistic) and would never try and ‘work out’ a company’s value for next year using them. The World is not such a simple place.

Instead I simply ask, can this company be significantly larger in 2-5-10 years?? If the answer is yes I investigate further.

Best Wishes,

Nick

P.S I own a small amount of shares in Matrix.

Thanks Nick,

I am struggling to keep up with all the stocks and all the Kens! I have previously written about two things; 1) the importance of understanding whether, based on the most conservative estimates, the intrinsic value is rising at a sufficient clip, and 2) the tendency of analyst estimates to be optimistic, particularly at the start of the financial year.

Hi Roger and Nick

Interesting to see the forecasts are being coming down already.

I dont have records on this and it is just a total guess but my gut feeling is that initial forecast have been on the low side once or twice in the last 10 years.

Of course they are very accurate in May and come september all the talk is companies have meet or beaten forecasts.

All the forecasters give themselves a pat on the back saying werent we good.

For what it’s worth I use theforcasts in september but make sure I have a very very big Margin for Safety

Hi Roger or other students that can help

I am half way through the book and had a question for anyone that can help. It states to use the Beginning Equity in some of the tables that are drawn up…..so in that case, if I have annual reports that I am looking at for G.U.D. holdings and want to do some figures on the last two years 2010, and 2009.

Would the beginning equity start off by looking at the 2008 annual reports Equity because that is from the last day of the financial year (beginning of 2009). Then go from there with the table that is used such as on page 75. Or do I use the 2009 annual report Equity figure to start it off. Just want to make sure I am doing this correctly. Any help would be great.