Threats to Cochlear’s market position?

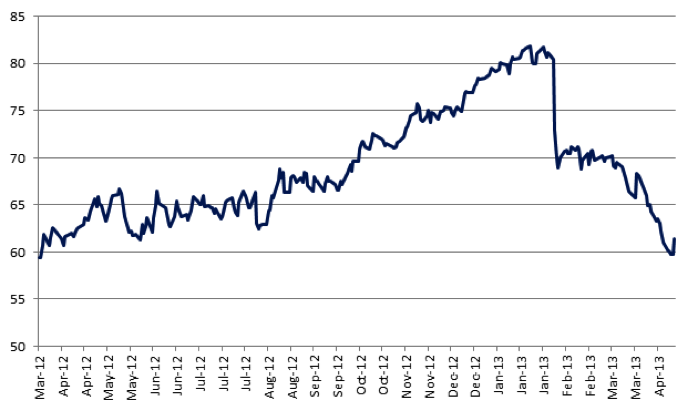

Many readers will have noticed the dramatic fall in the price of Cochlear (COH) shares from above $80 per share at the start of February to below $60 recently. COH is an Australian-based world beater in cochlear implants (note that “cochlear” is both the name of the company (COH) and the part of the inner ear into which cochlear implants are implanted, whether they are supplied by COH or a competitor). At Montgomery, we are big fans of COH, and in the past it has been a significant holding of the Montgomery [Private] Fund. With the recent decline in share price we have again been taking interest in the business.

Part of the recent share price decline can be attributed to press articles highlighting potential changes to the competitive landscape. In particular, a Chinese Company, Nurotron, is said to be gearing up to take market share in the fast-growing Chinese market with a device priced around $12,000 – approximately half the price of COH’s products. Also, government-backed trials in India are said to be aimed at delivering an even cheaper device – around $2,000 per unit. These points were strongly made in a full page article in the AFR on 18 April, under the headline “Chinese Threat to Cochlear”, together with a large picture of Nurotron chairman, Li Fangping, a former property developer/real estate agent.

In arriving at a view on COH, we need to make a balanced assessment of the severity of this competitive threat. To come to grips with this, we have taken a closer look at Nurotron to better understand its capability and technology.

Implant Technology

The technology, processes and IP involved in successfully producing and using cochlear implants is complex, and to date this has provided large barriers to competition. As well as the difficulty of producing an effective product, companies like COH must continuously improve their technology. Even though patients experience a profound improvement to their quality of life as a result of receiving an implant, the performance of the devices is well short of perfect, and there remains considerable scope for further improvement.

Over an extended period of time, COH has developed technology and know-how that competitors around the world have found difficult to match, and it invests heavily in R&D to maintain its edge. This has been a major reason behind COH’s ability to sustain a c.70% market share.

In the case of Nurotron, press reports indicate that it was set up in 2006 after reaching an agreement to use research from the “Centre for Hearing Research” at the University of California (UCI), following discussions with Zeng Fangang, a director there.

A quick web search fails to find any Centre for Hearing Research at UCI, but shows that UCI does have a Hearing and Speech Lab (HSL), with a permanent staff of 9 people, headed up by Research Director Fan-Gang Zeng (we presume this is the Zeng Fangang referred to above). The team is shown below in the image below from their website.

We don’t know a great deal about the work of the HSL, but are impressed and a little surprised to think that the 9 people there would develop the technology needed to challenge an established world leader like COH, which spends around $100m per annum on R&D. This is a challenge that much better-resourced organisations have consistently failed to meet.

We are more surprised to hear that they would choose to license this technology to a Chinese start-up, headed by a former real estate developer, and which at the time had no obvious capacity to commercialise it.

We haven’t been able to find an announcement of the license agreement on the HSL website, and the Nurotron website is similarly unhelpful. Accordingly, we’re not sure if the agreement is exclusive, if it has a fixed term, if it provides for ongoing development, or indeed if it even exists.

Also surprising is the apparent modesty shown by Fan-Gang Zeng. In a 2007 article in The Hearing Journal, dealing with the high price of cochlear implants and its effect on take-up, he wrote:

“…Korea and China have developed a prototype cochlear implant, while India, with the strong personal support of its president, A.P.J. Abdul Khalam, is developing one. Although the shortage of relevant technology and know-how still presents a significant hurdle for these endeavors, competition represents the best chance for a long-term solution to meet this challenge.”

So in 2007, Fan-Gang Zeng seemed to be saying that China had developed an implant, with no mention of a technological contribution either by him or HSL, and that access to technology remained a significant hurdle. Li Fangping (our former real estate agent) is reported as saying that the technology (claiming to be “just as good if not better” than that of COH) originated with Fan-Gang Zeng and his team in 2006. Confusing.

To cut to the chase, we have commented previously on the increasing challenge of protecting the value of intellectual property as developing nations advance. We think that it is sensible for investors in companies like COH to assume that in some developing markets, low cost competitors will emerge, offering products that are very similar to the products offered by COH, even though those competitors appear to lack the R&D capacity to independently develop them.

We think it is reasonable to assume that these competitors will constrain pricing and growth in the relevant markets for companies like COH, but that their impact beyond that will be more limited. This is because:

• These types of competitors are likely to be playing catch-up, and be a generation behind in terms of technology and know-how.

• Stronger enforcement of intellectual property rights in developed markets may restrict the ability of the challengers to compete outside their home markets.

Beyond technology, there are many other aspects of the cochlear implant business that are important, and need to be considered in a thorough analysis, including manufacturing, marketing, sales and distribution. Suffice to say that, at this stage, Nurotron is not well-advanced in respect of these capabilities, and the Indian challenger is yet to establish efficacy in clinical trials.

As investors in Cochlear, we felt that the share price had run beyond intrinsic value some months ago, and we exited our holding at prices above $70. Accordingly, part of the recent fall can be justified as a return to more reasonable valuation levels. However, the most recent step down appears to reflect an element of investor fear, prompted in part by reports like the one in the AFR.

Having looked more closely, we feel that the recent press reports provide an unduly grim impression of the competitive threat from China and India (although it certainly does exist). In fact, we are unsure how the AFR came to devote so much column space to what appears to be an early stage venture with little more than “grand plans”. However, we are pleased that they did.

Whilst not in the hearing industry I do work in the eye industry and compare the chinese cochlear implant to specsavers glasses. Whilst their quality may not be in the same league as OPSM or independents, their marketing is effective, their product is “good enough” and the results are demonstrated by their sales. In a short few years they have taken a huge chunk of the optical market.

Likewise, whilst COH’s product may be superior are tje Chinese prepared to pay for a “foreign” product that may be up to 50% better, when a local product, that is 1/2 the price is better than any hearing aid and local surgeons are incentivized by government to support local businesses.

Its an interesting point Bill.

Hello. I have been a relatively long time investor in Cochlear. My initial purchase was made long before the Sep 2011 Nucleus CI500 recall incident. I’ve held onto them until now. It has certainly been a bumpy ride. However, I’m wondering is it something worth holding onto or should I cut my losses and just exit?

Has your valuation of COH changed after lower than expected half yearly results? The price has dropped to around $54 and you said you valued it somewhere around $70, is this still the case?

That was some time ago. Our most recent valuation suggested we should consider buying around $60 and when it dropped to $59 some weeks ago, we did purchase COH. The announcement today does change our valuation.

I’m not sure I’d buy this. I agree with the other valuation, pegging it around $32 a share. I’d also like to see them retain more earnings, too high a payout ratio for such a high ROE company.

I would go further into saying that the recent price fall is on the back of Cochlear’s main competitor Advanced Bionics (AB) picking up market share esp in USA. They are a much more mature advanced company than the Chinese company listed on AFR.

AB has been acquired by one of the biggest hg aid manufacturers in the world called Sonovo in 2009. I know indeed that AB device is not as superior as Cohclears, HOWEVER, ‘ they Sonova’ know how to market better and have been in the hg business much much longer than Cohchlear. Cohchlear needs to watch AB even closer than in the past given they are tied up with Sonova now. The ball park is different now.

COH’s historically high dividend payout ratio suggests it could do more to try to widen its moat. That is,cut its dividends, reinvest in its business to try to continue to earn a high rate of return on incremental capital. Can it do this? If so, why doesn’t it? If not, what supply constraints does it face? The high dividend payout ratio can be viewed as a risk of the moat weakening in the future if the next best player does reasonably well financially and reinvests 100% of earnings back into its business.

The product recall event was interesting. It has had a significant financial impact so it is worth factoring into your valuations. It would be less than prudent to call it a zero probability event going forward.

I just find it difficult to pay more than 15 times trailing earnings for any business so I’ll have to exercise some patience with COH.

Great article Tim. Also bought some COH around the $60 mark seeing the market fluctuations as irrational (but please by them). COH is a great business. Might be good to also refer David’s podcast on YMYC re Cochlear in this post.

Also one must take into consideration that Cochlear had a product recall due to moisture during manufacturing, this by a company that had a proven product (to emphasize the difficulty in developing a hearing aid). In the immortal words of Darryl Kerrigan…tell’em they’re dreaming.

I wonder if the basis of the company in China is in fact industrial espionage or reverse engineering which are both common in tech devices. It could be that a former insider at Cochlear has passed IP to this company on the basis of the huge IP investment and the perceived millions to be made. However it could also be the case that a former PhD student etc had done their theses under the wing of one of the Cochlear Professors and they have returned to do their best with it.

To the China doubters I wonder if you have been there and know much about Chinese intellectual capacity? China have been at the front of development forever and the last century of turmoil can hardly be a reference to their ability. Marco Polo essentially returned to Venice with what become in large part the basics of the famous Italian cuisine ‘borrowed’ from his extensive travels in China. Gunpowder etc, anyway I don’t need to labour the point and although Suntech have bit the dust the Chinese PhD who acquired his education under the guidance of his professor in Sydney could be a great example of the basis for this Chinese Implant Maker. Don’t doubt a nation of math’s whiz with a heavily studious culture.

Taking another light though I know of a major car maker in Australia who recently uncovered that an engineer from a Joint Venture partner in China had downloaded years of engineering work onto his laptop before flying back to China after a visit to their Australian offices. With a JV partner like that who needs competitors? The good news is it was uncovered quickly and the better news is that the Chinese consumers are buying a lessor proportion of their locally made cars anyway in preference to better made foreign brands. So as a previous comment pointed out, there is a high likelihood that the surgeon is going to specify the cochlear implant anyway due to perceived superiority. It would only take a couple of failures for the lower cost model to be doomed, and the maker with it, as the ear is such a delicate sense a surgeon is unlikely to want to repeat any procedure to replace dodgy equipment.

Hi Roger,

Nice article and a good example of how sometimes people will act first and ask questions later when investing.

Would it be right to say that another potential barrier for these competitors would be its chances of not being highly recommeded by medical specialists outside of their own countries? I would imagine that an audioligist would have a significant say in what cochlear implant should be used and this is a big advantage for incumbents over new entries. The trust is there at least in some degree.

I know that in the half yearly presentation most of the sales growth came from Asia Pacific so maybe why some people might be a bit worried. However, like you and everyone has said, it seems very unlikely based on the current evidence that this is a real competitive threat at this current time.

Hi Tim,

Excellent article. I also have a strong interest in Cochlear. I was wondering though…. do you place a significant premium on the intrinsic value of Cochlear because of the long history of high quality? My calculations value the shares at around $30 (based on FY12 data, assuming growth for FY13 will be fairly flat), which are obviously much lower than what you indicated would be reasonable valuation. Thanks.

“In fact, we are unsure how the AFR came to devote so much column space to what appears to be an early stage venture with little more than “grand plans”. However, we are pleased that they did.”

Aha! Me too!

Good luck to the Chinese but I can’t see them catching up (or getting remotely close) to Cochlear for a long long time. We’re not talking about rip-off Nike wallets and not-quite-right T-shirts here.

Great insights I am of the same opinion and bought some last week under $60. The article in the AFR was poorly researched but did throw up an oppurtunity for people .Amazing what you can find out these days with google. Pity some journalists dont research as thoroughly as you guys.