The Great China Slowdown

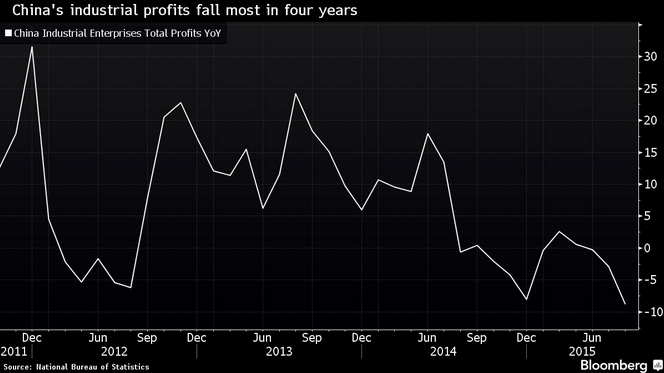

China’s Industrial Profits declined by 8.8 per cent in August from a year earlier, with the biggest fall concentrated in coal, oil and metals according to the National Bureau of Statistics. For the eight months to August 2015, profits from coal, oil and metals companies declined by 65 per cent, 67 per cent and 52 per cent, respectively, on a year on year basis.

Producer prices, or the price of goods that leave the factory hit a six year low in August and with the threat of further possible devaluation of the Chinese Yuan we must consider the threat of China exporting deflation.

Producer prices, or the price of goods that leave the factory hit a six year low in August and with the threat of further possible devaluation of the Chinese Yuan we must consider the threat of China exporting deflation.

We recently wrote about how China’s outstanding debt at $28 trillion, or 282 per cent of its $10 trillion of GDP, had grown by 21 per cent per annum over the 2007-2014 period, or more than double its growth rate. Further “half the loans are linked, directly or indirectly, to China’s overheated real-estate market; unregulated shadow banking accounts for nearly half of new lending; and the debt of many local governments is probably unsustainable”.

Pressure on the commodities complex has seen the share prices of many major resource stocks smashed over the past three months and the likes of Glencore, Freeport McMoran and Teck Resources have declined by 74 per cent, 54 per cent and 53 per cent, respectively.

The Montaka Global Fund is short Glencore, Freeport McMoran and Teck Resources.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Hi David,

Does the Montaka fund maintain a “market neutral” posture (ie short position totally offsets the long position), or does the short position only partially offset the long, and if so, to what extent?

Regards,

Peter

Hi Peter, The Montaka Fund has a net market exposure range of 30% to 70%, and the level will depend on market conditions. The current net market exposure approximates 40%. Regards, David

hi David

does the Montaka fund hold the same long positions as the Montgomery Global fund ?

Hi Carlos, yes the Montgomery Global Fund holds the same long positions as Montaka. Regards, David