Second wave of Australian LNG at risk

The second wave of four Australian Liquefied Natural Gas projects, worth $100b, is at risk.

Well publicised cost overruns, at the US$52 billion Gorgon LNG venture for example, have scared the industry.

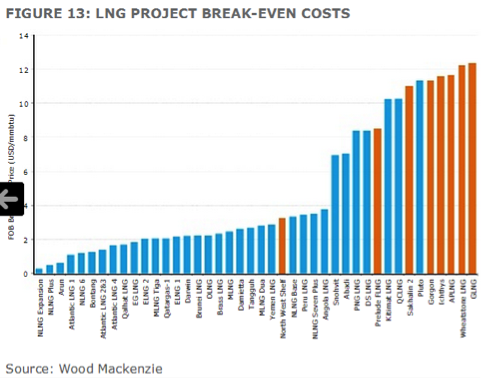

Australian-based LNG projects have an approximate break-even of US$11-12 per million BTU (see graph below).

In addition, the US decided last week to give the go-ahead for a large liquefied natural gas export facility in the Gulf of Mexico.

According to Professor Geoffrey Garrett, Dean of the Australian School of Business at the University of NSW, the US will now become a major LNG exporter, targeting the two top markets for Australian gas: Japan and South Korea.

But Garrett claims that the current cost advantage of US gas production disappears when “the full costs of liquefaction, shipping the LNG through the Panama Canal and across the Pacific, and then regasification, are taken into account”.

While the effective cost of putting US LNG into Asia would be about US$12-$13 per million BTU, the emergence of the US as a significant LNG exporter provides additional competition for Australia.

It has just been reported that Korea Gas did not receive approval from the South Korean Government to take $30b of gas from Gorgon (over 20 years).

Meanwhile, Kogas would not be taking $29b worth of gas from Wheatstone, however Roy Krzywosinski, the local Chevron Managing Director, claims this lost volume has since been replaced.