Rough Seas Ahead

Mermaid Marine (ASX: MRM) is one of Australia’s largest marine services providers. The company has performed very well in the last five years on a wave of capital expenditure into the domestic oil and gas sectors. But is this growth likely to continue?

Mermaid Marine owns and operates a fleet of around 40 vessels, which includes barges, tugboats and platform supply vessels (PSVs). The jewels in the company’s crown are its supply base and slipway in the North West Shelf of Western Australia. The asset is a virtual monopoly in the region, allowing the company to service not only its own vessels but also those of third parties (for an appropriate fee, of course).

Mermaid Marine has managed to grow its earnings by 17 per cent per annum since 2009.

A capital-intensive business can predominantly grow its earnings in two ways:

• Increase the asset base while maintaining the rate of return

• Maintain the asset base while improving the rate of return

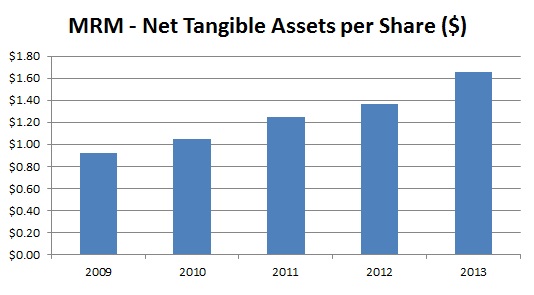

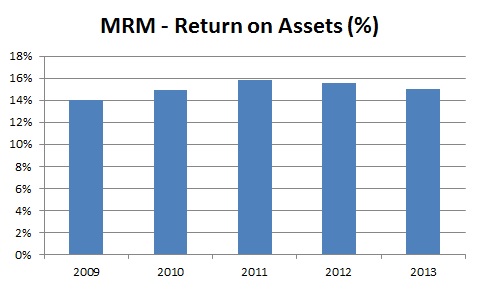

By examining the two graphs below, it’s easy to see how MRM has grown its earnings:

Since 2009, MRM has maintained a relatively stable return on assets while growing its asset base by 16 per cent each year. In order for this growth to continue, the company must continue to either grow its fleet at comparable rates, or deploy its fleet more profitably. In the current climate, however, it seems unlikely that the company will be able to achieve these growth-determining factors.

Since 2009, MRM has maintained a relatively stable return on assets while growing its asset base by 16 per cent each year. In order for this growth to continue, the company must continue to either grow its fleet at comparable rates, or deploy its fleet more profitably. In the current climate, however, it seems unlikely that the company will be able to achieve these growth-determining factors.

Capital expenditure in the domestic oil and gas space is unlikely to grow materially. There are a number of major projects in the pipeline, such as Gorgon, Wheatstone and Ichthys – all of which will support MRM’s earnings – but the company must look abroad for further growth.

Management is hoping to achieve this growth by expanding into Asia, where day rates can be a third of those in Australia. MRM does not have a supply base in the region, which means the company will be faced with the same challenges that their Asian competitors faced when trying to compete in Australia. So while projects should exist for MRM to deploy new vessels, it may be difficult for MRM to sustain its historic return on assets.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Ben,

Good article. I have a similar assessment to you. I learned a few things from your article. Here is my assessment:

I’ve been trying to work out MRM’s long term growth for a while. I’ve looked at the future of the gas industry in Aus. USA has had a gas boom and there is plenty of gas around. Gas needs to be transported as LNG so there are costs involved in transporting. It helps that we are close to Asia. Aus gas exports of LNG will increase. LNG is the 3rd biggest export for Aus, it may be the largest revenue earner in a few years. However, I can’t say for certain if this will help MRM. And I can not make projections of earnings increases for MRM so therefore, I find it hard to evaluate its intrinsic value.

Their supply base is a crown jewel. I compared MRM to Miclyn Express Offshore (no longer listed) and Miclyn perform better than MRM with their OSV vessels because the vessels are cheaper and they do more long term contracts so utilisation is lower. And Miclyn have the advantage of a lower tax rate because they are taxed in Bermuda.

Miclyn also were getting a lot of work in the Middle East and other areas.

I think MRM have more growth opportunities outside of Aus, MRM are more concentrated in Aus than Miclyn was.

But without a supply base overseas, their ROE and ROA will go down.

It is obvious from the reports that MRM do well from their supply bases, mainly the one in Dampier. Miclyn don’t have a supply base.

ROE is good for supply bases.

MRM have some issues with cost. I don’t know too much about it but I know there is an issue. I know someone in the industry and he was laid off for a while because labour costs were too high for Aus workers.

MRM have a number of vessels on order so they do expect long term growth but I can’t evaluate their growth in the future which gives me a big problem in investing in them.

If you reckon airlines are a dodgy business, imagine how difficult the capital expenditure issue would be if they also had to content with rust. I own a boat. You just never stop throwing money at it.