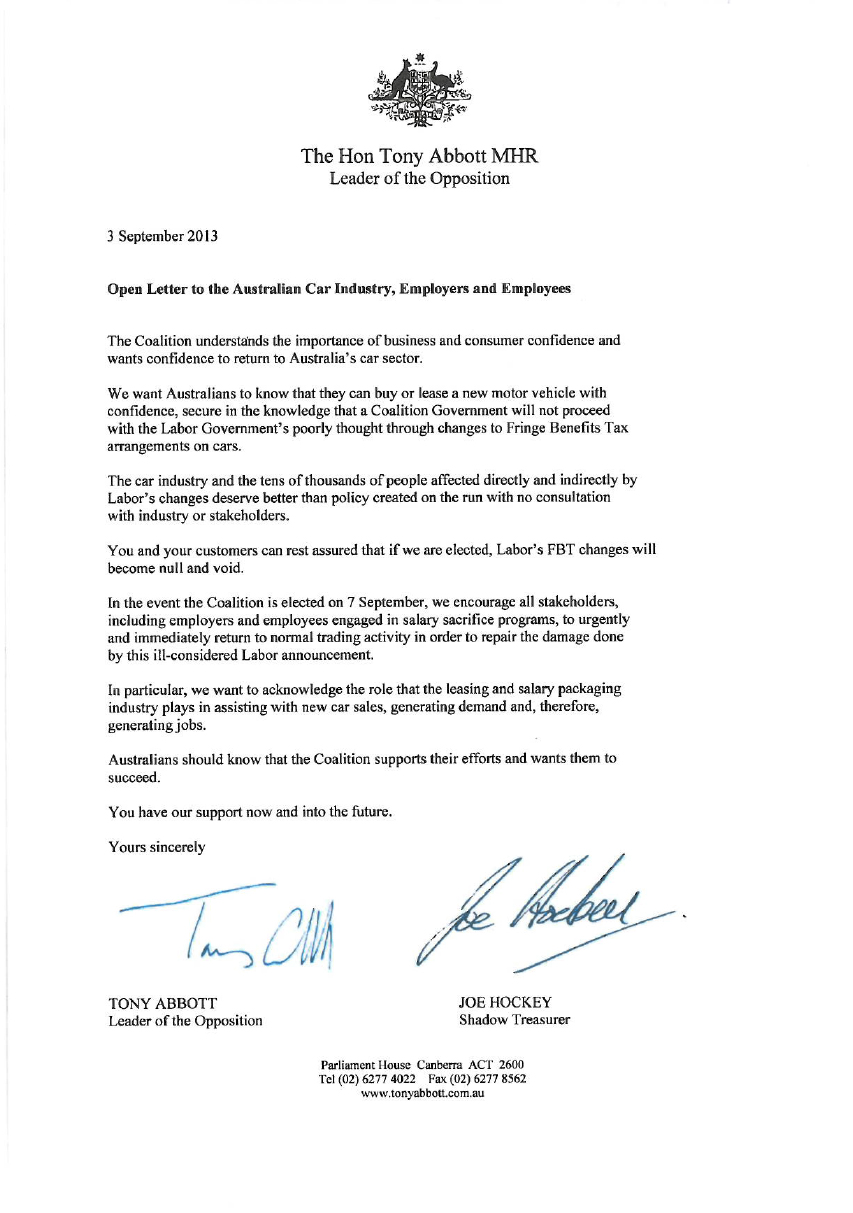

Open Letter from The Hon Tony Abbott MHR

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

guest

:

Good chance to insure your investment at the moment too – most betting agencies are paying $16+ for an ALP victory.

Roger Montgomery

:

If you knew it wouldn’t rain, would you buy an umbrella?

Alan Kennedy

:

Working in the automotive industry I can assure you that when the Liberal party is elected on Saturday business confidence will sky rocket. This will equate to a strong recovery of automotive sector, including automotive finance and accessories sales (like ARB Corporation). MMS shareholders should hang on for the ride.

I fully expect MMS to reap the benefits

Roger Montgomery

:

It might even be bigger for MMS if the competitors have indeed closed their doors and sacked all of their staff. MMS could take more market share.

Dan Baillie

:

So the coalition supports a form of middle class welfare on the basis of propping up an unsustainable industry.

Yet it also supports another form of middle class welfare ie. Negative Gearing on existing property which does nothing to support the construction industry.

Roger Montgomery

:

Indeed Dan. And then there’s the luxury car tax and the list goes on…

Kenneth Beer

:

Great politics but poor long term economic policy. The problem with Australia’s car manufacturing industry are cost related. Taxpayer funded FBT assistance wont stop Australian car manufacturing plant closures. All that will happen is that more imported cars will replace Australian manufactured cars in receiving taxpayer funded FBT assistance. Only a competitive Australian car manufacturing industry will survive long term. Australia is a high cost place to manufacture anything and that is the fundamental reason our manufacturing industry continues to go offshore. Unless Australia changes to a competitive cost place to manufacture eventually only Australian Government subsidized or under the radar manufacturing industry will remain here. A useful first start would be to reduce company tax to 15%.

Roger Montgomery

:

If only. I agree with you too Peter. I mentioned on Ross Greenwoods program that if we want to support jobs in Australia we need to support businesses…especially the small and the start ups for whom employing people is necessary but too risky…

garry peck

:

If the betting company’s are already paying out, than this election is a forgone conclusion, based on Rogers blog re MMS when their share price plummeted and Buffets words of be greedy when others are fearful rang in my ears, I made the quickest $15.000 profit with a buy and sell share transaction, hence a portion of your portfolio must always be in cash waiting patiently for the right opportunity.

Roger Montgomery

:

Thanks for sharing Garry. Hoping the insight blog is proving a useful thought-provoker then! As always be sure to seek personal professional advice.

Michael Sloan

:

Sad day Roger when you’re promoting blatant pork-barrelling disguised as responsible economic management. Is this post based on principle or greed?

Roger Montgomery

:

Information only Michael. We are following the MMS story here from Rudds story-commencement announcement to Abbots story-conclusion one.

Daniel Rosenthal

:

Could be huge…

I imagine there must be a lot of relieved mms shareholders out there.

Still an election to be won though

Does this change valuation at all? or we still thinking $13.50-$14 IV?