McMillan Shakespeare – Part 3

This is the third in a series of articles we have posted on McMillan Shakespeare (ASX: MMS). The first two articles addressed the valuation framework we used to assess MMS in the context of regulatory uncertainty (read part one here); and some comments on how we think about the risks attaching to an investment that may have binary outcomes (either very good or very bad) (read part two here).

In this article, we will round out the discussion with a few general observations and try to respond to some of the comments and questions that have been put forward in response to the first two articles.

Several of the comments that have arisen are in respect of the probability we assigned to a coalition victory at the forthcoming election (one of the significant inputs into the assessment framework we used). We applied a probability of 80 per cent, which several readers felt was punchy, given that opinion polls seemed to be indicating a more even contest.

Our analytical expertise lies in investing rather than politics, so we will spare you any attempt at a compelling thesis for why the Coalition may win the election. However, there are some relevant points that can be made in respect of this estimate:

• Firstly, it is a product of our judgment, which in political matters has no greater validity than the next observer’s. Others may apply a different estimate and arrive at a different valuation outcome.

• For our part, we looked past the opinion polls, which are a reflection of “current intentions”, and thought about how things might develop between here and the election. We also note that it is possible to bet on the outcome of the election, and the odds offered by betting agencies align much more closely with our probability estimate than the opinion polls, so there are others out there with a similar view (and who have probably given the topic some thought).

• Having said that, there is a case to be made for a more evenly balanced probability estimate. A lot can happen between now and the election, and there is more room for an 80 per cent probability to fall than to rise. The world tends to be mean reverting, and it is usually good to avoid the extremes in estimating probabilities.

• The above notwithstanding, the analysis in this case is reasonably robust to the assumption used. Even if you apply a 50 per cent probability in place of our 80 per cent probability, the conclusion is directionally the same: the estimated value of MMS remains significantly higher than the share price.

To summarise, the framework we set out in the first article may be something you find useful, but by all means feel free to apply your own judgement to the specific inputs.

Another point that has been made is the potential for the market to de-rate MMS for a period of time in the wake of the recent experience, due to either an emotional reaction to the recent experience, or a view that regulatory change is more likely in future, now that it has been proposed.

There is some validity to both of these arguments, but rather than dismissing the investment on this basis, investors need to arrive at a considered assessment of their significance.

In the case of the latter, our assessment is that the proposed changes and their potential to harm ordinary Australians were not well thought through by the government, and we note that they contradicted the recommendations of the (rather well considered) Henry Report. We think that the issues have now become more apparent, and that a forthcoming industry advertising campaign may bring them even more clearly into focus. As a result we expect that future government will be more circumspect.

Again, reasonable people may disagree on this and we accept there are limits to our foresight.

In the case of a possible emotional reaction from the market, we are more sanguine. There is little doubt that the market will discount MMS shares, possibly for a period of several years. In our view, that is not a bad thing. As long-term investors we focus on underlying value, and try to view market mispricing as an opportunity rather than a threat.

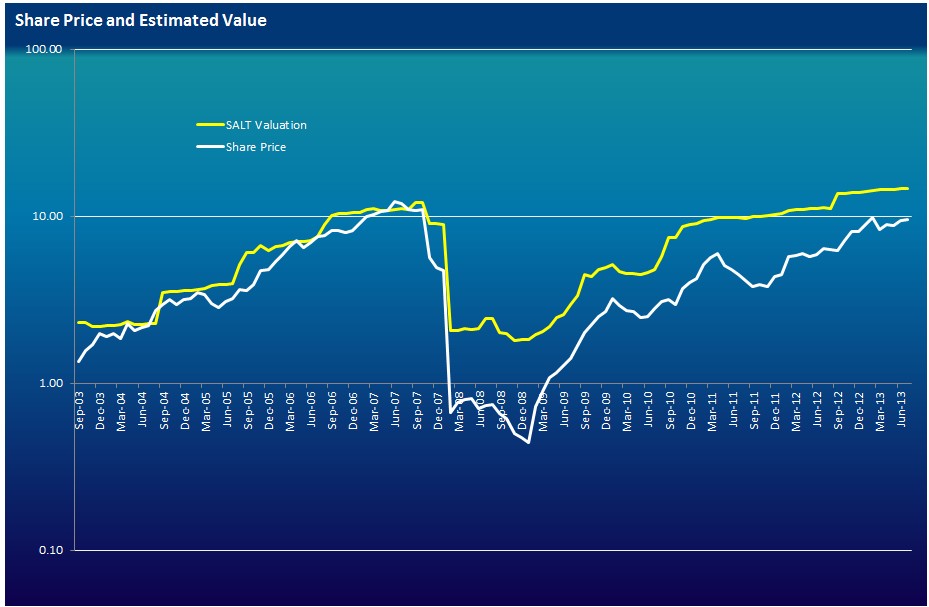

History can teach us something about the emotional behaviour of the market, and the chart below sets out one interesting case study in respect of Credit Corp (ASX:CCP). Some readers may recall that after a strong run over several years, CCP ran into major operational difficulties in 2007 and suffered a sharp fall in profitability. EPS declined to 13 cents in FY2008 from 45 cents in FY2007, and the market’s response was harsh.

In the chart below we have plotted the share price for CCP over a 10 year period, and next to it we have plotted a valuation for CCP shares, calculated at monthly intervals using an automated valuation model, and based on information that was available at the time. There is no human input into these estimated valuations, whereas the share price is very much a function of human behaviour.

We have used a log scale for the chart, which is useful when share prices move over large ranges, because it means that percentage changes always look the same. For example, a doubling in the share price from $1 to $2 will cover the same amount of ground on the chart as a doubling in share price from $5 to $10. This allows us to better see how the percentage gap between share price and intrinsic value changes over time.

Figure 1. CCP Share Price and Estimated Intrinsic Value

The chart indicates that, after tracking quite closely for a number of years, share price and estimated value parted ways when the bad news hit. The initial response by the market was to ascribe a share price well below the value estimated by our model, and in the 12 months following the bad news, the gap was especially dramatic in percentage terms.

Over years, the gap has gradually closed. With new management in place and earnings restored, the market has – over time – forgiven CCP.

In our view, the gap closure is now more complete than indicated by the chart. We think that CCP’s valuation today is a bit lower than calculated by the model, as the business has reached a point where its growth prospects in Australia are now more constrained than they once were. On that basis, it may be argued that the value gap has now substantially closed, although it has taken five years to do so.

The lesson from this analysis is that it may be a mistake to expect a speedy recovery in the MMS share price, and it may be a mistake to expect a smooth ride. However, it also supports the view that, from time to time, there will be opportunities in the market that fall to investors with a reasonably long time horizon and a clear focus on value.

These sorts of opportunities tend to be obvious in hindsight, but difficult to capture at the time. However, if you can look a bit more deeply than others, and apply emotional discipline, there is a fair chance your efforts will be rewarded.

Montgomery Investment Management owns shares in McMillan Shakespeare.

To find out more about investing with Montgomery Investment Management, click here. To request an information pack, click here.

This article was written on 2 August 2013. All share and other prices and movements in prices are to this date.

Great blog by the way – I’ve followed with interest for some time. I sold out of MMS this morning. I considered a few scenarios but came to the conclusion that even on a forward NROE of around 35% and a dividend payout ratio of around 80%, the company was pretty fully valued at almost $12.00. I’ve almost certainly left a fair chunk of change on the table but I figured the risk wasn’t worth the reward. However you cut it, this episode will have re-rated the stock. Value any thoughts.

I wonder how many self managed Superannuation funds hold these shares as part of their portfolios? Playing with fire I reckon but good luck to those who can the punt. It might be a great buy. Maybe the Future Fund should buy up!

Thanks Roger for the excellent MMS debate. It helped me weigh the pro’s and con’s. I decided it is one of the few bargains out there at present. So I opted to buy and am already up 10% in a bit over a week. As to the future, time will tell however I am comfortable with my decision. I sleep well at night, mind you having a lovely wife next to me helps.

Interesting 3 articles, and I agree with the argument based on probabilities. Each person needs to determine their numerical value of that probability. ( I have been a recent buyer). I would like to raise the topic of Time Risk and how that relates to cash flows of MMS. Given the facts that all 800 staff are being retained; Net Debt/ Equity (forecast FY2013) 75%; current Cash from Operating Activities would be reduced at present and into the future due to the uncertainty; cash reserves $55M to ?$70m. Calling the election has reduced some of the Time Risk but how damaging is it to a company having a sudden interruption to cash flow. Even after the election will it be weeks/months before changes pass the Senate (Rudd) or will Abbott take time to confirm his promise to make no change when they inherit the Govt debt? Simply, will they have cash flow problems?

Your example also highlights that broker attention and media noise can distract investors who should not spread themselves into a large number of companies they know little about and don’t follow the herd of brokers and where their focus of attention is at the moment.

Risks from short term government policy changes are not easily assessed; and if tax advantages are a major part of a business model they are a major ‘uncontrolled” risk .

This situation highlights very clearly that an estimate of intrinsic value is just that: an estimate. Whilst in the MMS case, it is very clear that the value derived can be greatly influenced by a single event (the election outcome), the same is true of every other estimate of intrinsic value which is also dependent on numerous factors coming to pass in order for the company to deliver the profitability which the estimated intrinsic value assumes.

Which all goes to show why margin of safety is so important.