Is LNG the next disappointment?

In the past decade, Australia has attracted considerable global investment in Liquefied Natural Gas (LNG). Yet the Wall Street Journal has reported that many of these projects have run considerably over-budget, lowering the incentive for further investment in the region.

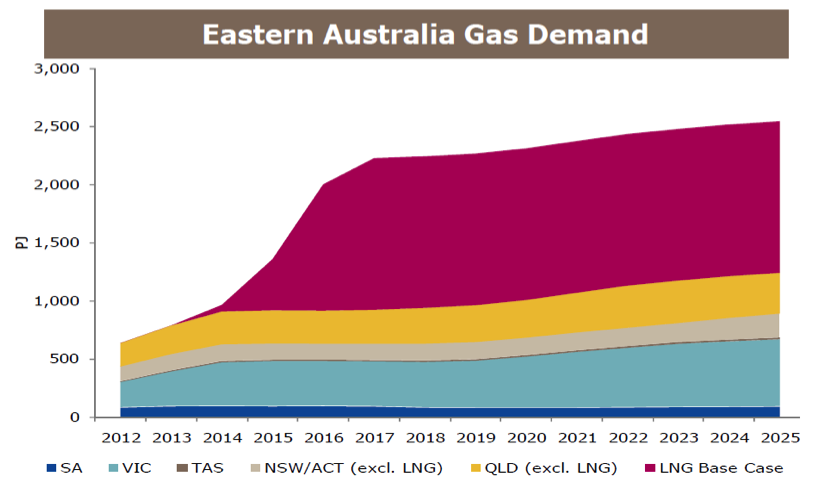

Australia was one of the first countries to demonstrate the commercial potential of converting methane trapped in coal seams into liquefied natural gas. With considerable LNG reserves and strong global energy demand, Australia attracted considerable foreign investment in projects which are due to commence exports in the coming years. Below is a graph from AGL Energy (ASX: AGK) that illustrates the magnitude of demand associated with these projects.

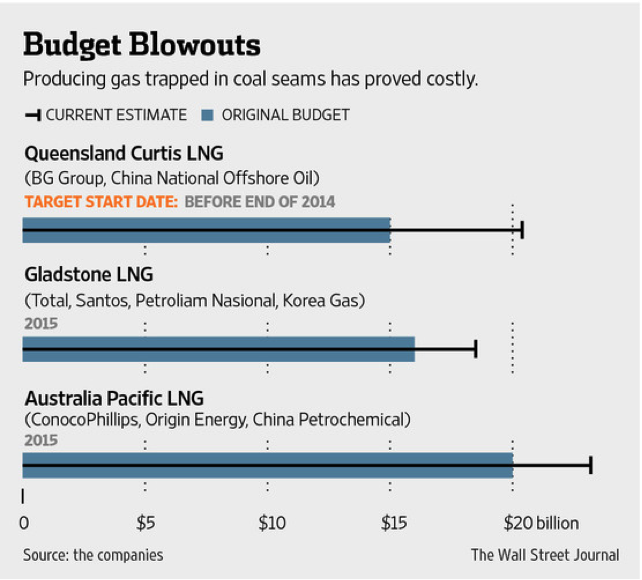

The Wall Street Journal has reported that three major LNG projects have run considerably over budget due to labour constraints, the adoption of new technology, conflicts with landowners and unfavourable currency movements.

The projects are secured by long-term contracts, so when investors are forced to commit extra capital it decreases the rate of return, which can discourage further investment. Credit Suisse estimates that the return on the Gladstone LNG project has fallen to 7 per cent as a result of cost overruns.

Returns are likely to remain subdued as technological advancement unlocks dormant energy reserves. This is particularly the case in America, which is experiencing an investment boom in shale oil. America’s reserves are likely to have a significant impact on global energy supply, with the International Energy Agency projecting that the US will become a larger producer of oil than Saudi Arabia, while McKinsey expects the country will become a net exporter of energy by 2020.

A recent Bloomberg article discusses the current exuberance in the US shale oil market:

“How high is demand for welders to work in the shale boom on the U.S. Gulf Coast? So high that “you can take every citizen in the region of Lake Charles between the ages of 5 and 85 and teach them all how to weld and you’re not going to have enough welders,” said Peter Huntsman, chief executive officer of chemical maker Huntsman Corp …

Worker scarcities are already evident in the unemployment rates of Texas (5.7 percent) and Louisiana (4.5 percent), both below the national average of 6.7 percent, according to the Bureau of Labor Statistics. The lowest jobless rate of any area in the U.S. in February was 2.8 percent in Houma-Bayou Cane-Thibodaux, Louisiana, because of offshore-oil exploration in the Gulf of Mexico.”

Doesn’t this sound remarkably familiar to the Australian economy before the GFC?

It seems that Australia has lost its competitive advantage in the energy market, and it will become more difficult to attract investment as global supply increases.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY