China dumping steel is a cause for concern – Part 1

China is expected to produce at least 825 million tonnes of steel this year and the likes of BHP Billiton Limited (ASX: BHP) and Rio Tinto (ASX: RIO) believe this figure will grow at 2.5 per cent per annum over the next decade to 1,050 million tonnes. Some commentators however are starting to question whether China’s steel production has already reached a turning point, and if this is so my advice to our readers is not to get bullish on iron-ore companies any time soon.

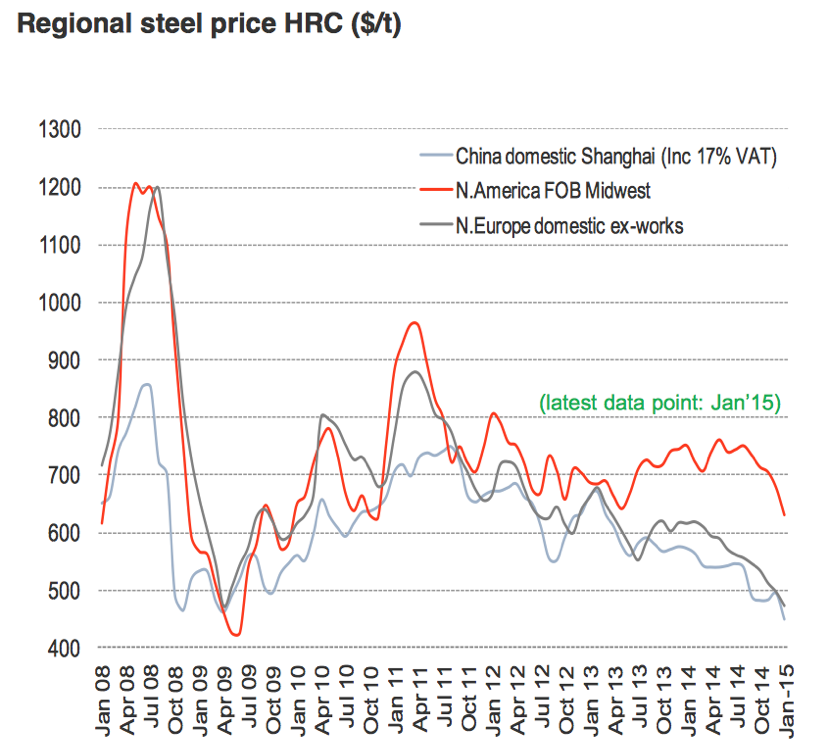

I have just returned from a short trip to India where I met a number of executives from Arcelor Mittal, the world’s leading integrated steel and mining company. Founded by Lakshmi Mittal, Arcelor Mittal employs well over 200,000 people and in 2014 shipped 85.1 million tonnes of steel, and recorded revenue of US$79.3 billion and Earnings Before Interest, Taxes, Depreciation and Amortization of US$7.2 billion. Over the past seven years, the Arcelor Mittal share price has declined from US$100 to just above US$10, demonstrating the operating and financial leverage of this business as the steel price has come back from US$1,200 per tonne to below US$500 per tonne.

Source: Arcelor Mittal

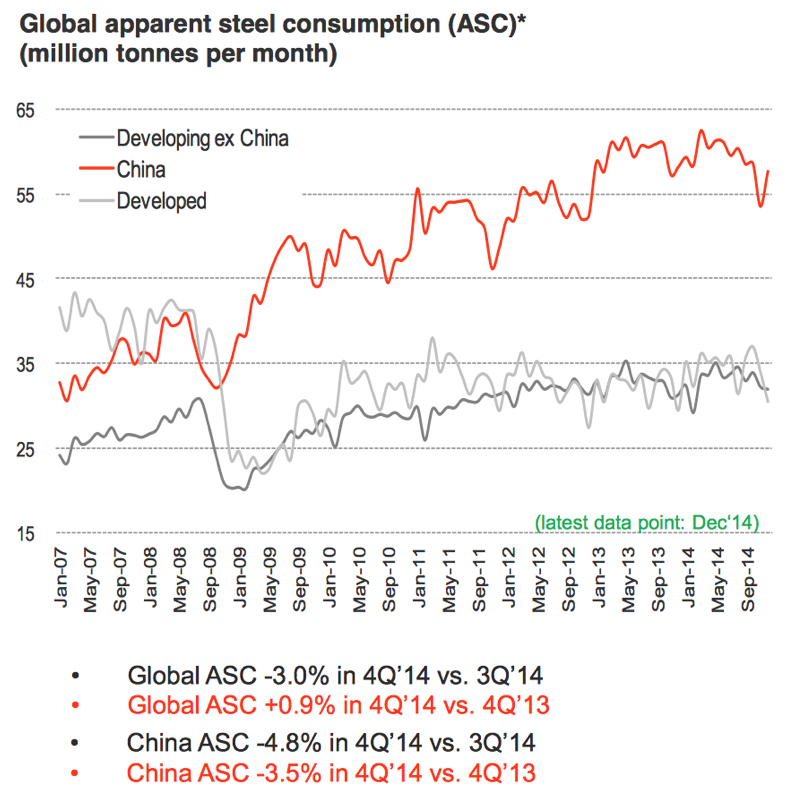

The most significant issue appears to be dumping by Chinese steel-makers. Apparent steel consumption in China has been running at around 57-63 million tonnes per month, or an annualized 720 million tonnes, however Chinese consumption in the December 2014 Quarter was down 3.5 per cent year on year and down 4.8 per cent on the September 2014 Quarter, as confidence in the Chinese real estate market subsided.

Source: Arcelor Mittal

Executives from Arcelor Mittal claim Chinese steel-makers are dumping steel and the rate has increased from 50 million tonnes in 2013 to 80 million tonnes in 2014 to a forecast 130 million tonnes in 2015. Other commentators are more sober than the BHP Billiton Limited and Rio Tinto executives and a recent report from UBS said, “Our analysis shows that (Chinese) steel production has already reached a turning point.”

In conclusion, given the Chinese steel industry accounts for 70 per cent of seaborne iron-ore demand, there is an additional 100 million tonnes of iron-ore supply coming on stream later in 2015 and the comments from Arcelor Mittal executives and other commentators, we believe readers should be prepared to assume the current iron-ore price of sub US$60 per tonne could be with us for quite some time.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Roger

i hope you didn’t think i was implying Montgomery fund had invested on anything but fact. That’s why my monies with you!!

Lots of people must have been getting into the stock based on the wotif the trials are successful. The only thing i have learnt in the past few years is the leave exploration and pharmaceutical to the experts.

Resmed have the problem of convincing doctors to move away from tablets

Dunc

David

This is nothing to do with steel. Hope you got out of sirtex before today?

Anyway. Did you see the article in the Financial review Boss magazine re Resmed? A great piece on how they run their business and what they are looking a developing. When the pull back comes i’ll be looking to add to my holding.

Looking forward to reading your take on Sirtex result. You will have a lot of people in a panic. Maybe it’s a case of investing on fact not speculation?

Cheers for now

Dunc

Facts only. We halved our position recently in one of the funds and are now re-evaluation the new opportunity based on the new price in what could be a very inefficient market.