Bubble Watch #10

As you know we prefer to invest with a telescope rather than the microscope.

Getting too close to the action can, and does, lead investors astray as they jump at shadows and ignore the sunshine. Having said that we are always on the lookout for risks to the prospects for companies we are analyzing or have already acquired. More importantly we want you to stay in front of the curve.

One of the observations we can make is that volatility has now been low for a long time and interest rates too. This never lasts.

Lower volatility is a function of optimism and complacency. While there is much to be optimistic about, there is also a growing apathy towards risk.

Read for example this expert’s summation in a promotional email to financial planners; “Globally, the economic risks appear to have receded. The US looks somewhat stronger, with employment rates back at pre-GFC levels, while the European Central Bank recently announced a world first, lowering interest rates to -0.1 per cent!”

We don’t question the content or the conclusions reached by this expert, merely the sanguine tone with which they are expressed. Negative rates may spur asset inflation but what it reflects is an unhealthy economic patient!

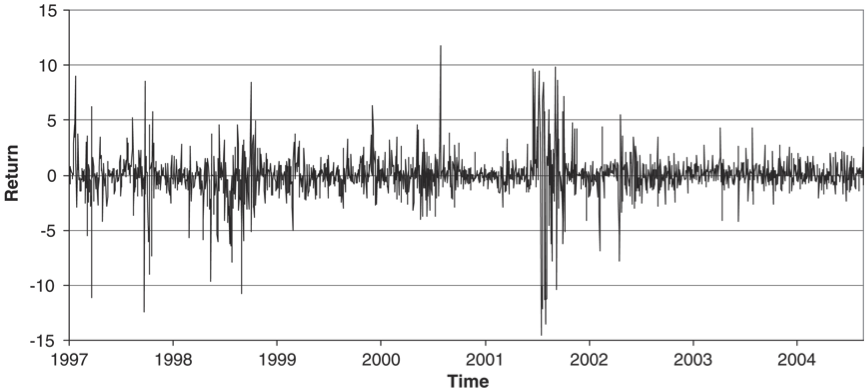

As the father of fractal theory, Benoit Mandelbrot, observed; “trouble runs in streaks” and market turbulence tends to ‘cluster’. While technical charting patterns are “the fools gold of financial markets” Chart 1. reveals an enduring pattern of a different kind; long periods of low volatility are inevitably followed by periods of heightened and frenzied price action.

Chart.1 clustering volatility in stock prices

Markets have enjoyed a long period of low volatility, and spurred on by negative real rates of return from cash deposits, wary investors returning to the stock market after a long period of absence.

(Negative returns occur when, for example, the rate of interest earned on cash, is not high enough to offset the erosion of returns brought on by inflation. If, for example interest rates are 3 per cent and inflation is 5 per cent per annum, the investor has suffered a 2 per cent negative ‘real’ return (equivalent to a 2 per cent loss of purchasing power) over the course of the year.)

As Chart 2, reveals current US market volatility, as measured by the VIX index, is at a five year low. History and Mandelbrot both reveal the situation cannot last.

Chart 2. VIX Index (Source: Iress)

Eventually interest rates will normalise (rise) but while they are low the negative real returns will continue to push investors into the stock and property markets. That’s the theory anyway.

And that brings us to our first warnings sign: Despite the theory-of-negative-real-returns-driving-a-migration-to-stocks, Australian stocks, as measured by the ASX200, haven’t gone up since October 2013. That’s eight months with no capital appreciation and Chart 3, reveals low rates have not been enough to spur a continuation of the migration to equities. Why? Perhaps they are expensive. More on that in a moment.

Chart 3. S&P/ASX200

Another observation is the increasing frequency of mentions I am hearing (this really, truly, is anecdotal) about how the internet and data is going to revolutionise the world. Such jibber jabber drove the price of Amazon shares to a P/E ratio of 1454 times trailing earnings in January this year. Yes the internet and mobile computing will revolutionise the world but so did the car and the aeroplane. And how did the companies that made those game-changing devices fair? The ones that have survived have not done so well and many of the rest went bust. Changing the world doesn’t always lead minority sharemarket investors to an oasis of profit and it certainly doesn’t provide any immunity from shocks.

Separately, China is falling in a heap and Chinese GDP and retail sales are being artificially boosted. Take for example, retail sales. Retail sales are measured when produced goods leave the factory not when they are purchased by a consumer. When consumers lack confidence, they stop spending. But product is still being shipped from the factory and Retail Sales numbers look good. Obviously as inventory backs up in warehouses across the country, there won’t be anywhere else to hide the numbers and Australia could be in for a rude shock.

Consumer confidence in Australia could also worsen when more mining companies (coal and iron ore) downgrade their profits and outlooks, scale back and cut contracts with service providers as commodity prices decline further.

Moreover, a declining iron ore price combined with a strong Australian dollar is terrible news for smaller producers in Australia – their output is relatively more expensive in a period of weakening demand.

A slowing economy however doesn’t automatically lead to lower equity returns. In order for the stock market to decline, investors must choose, in aggregate, to decide that a slowing economy is negative for equities…Sign #2. And of course, the economy needs to slow!

More important is the trajectory for company earnings. Here, there is some disagreement, although many of our peers do believe that consensus earnings estimates are too high in light of recent declines in consumer sentiment and the impact of the aforementioned deterioration in the materials and resource market outlook.

Some disagreement also exists about the pace of US growth but many believe US expansion (despite the bullishly wishful tapering of QE) is not on track.

At the same time earnings in corporate Australia are being revised lower, at least in the retail and resources sector. Typically these downgrades coincide with weaker share prices. So are there further downgrades ahead? Investors also believe that interest rates aren’t headed higher any time soon as 3 year bond rates have fallen 40 basis points (0.4 per cent) since November.

Meanwhile US 2yr interest rates are rising (go figure) as are UK 5 year bond rates (Gilts). This is telling you that market participants (they are often wrong) believe cash rates in those countries will be rising in the foreseeable future.

Pressure on the Australian dollar would be the logical conclusion but one shouldn’t expect markets to behave rationally. If however the Australian dollar does capitulate, that would put another nail in the coffin for Australian retailers.

The final point is that not only is there not an abundance of value, there’s a complete absence of it. As a result our process produces a relatively high level of cash on The Funds.

The combination of deteriorating earnings and economic outlook for major Australian industry sectors, along with the rising interest rates offshore (at a time of deteriorating growth) and an extended period of very low volatility make me increasingly convinced that now might just be the time to be insuring.

That could mean selling the most expensive stocks in a portfolio but it could also mean not deploying additional cash. In both The Montgomery Fund and The Montgomery [Private] Fund a relatively large proportion is already parked in the safety of cash.

While I contemplate the above, I cannot forget we manage a portfolio of quality businesses and we try to buy them at attractive prices and hold for as long as the prospects are good. It’s just the prospects part that I am becoming increasingly concerned about…

Michael Shapiro

:

Thanks for an informative piece Roger. All the “smart” money saw the 5 year old bull market and lowest volatility on record and the tapering. They responded by taking money off the table early just in time for the usual seasonal correction and eventual bear market. However the market won’t drop while everyone is aware of what is coming. Seeing Hedge Funds throwing the towel and re-committing to bullish bets could actually be the catalyst for the reversal. In other words the reversal can only happen when there are no buyers left at the top of the market.

Greg McLennan

:

And then you see today’s market action, up 80+. Good times must be here to stay! I’m happy to be watching them (largely) from the sidelines at present.

Wayne A

:

An outstanding piece thanks Roger. This reinforces the benefit of employing a fund manager with the flexibility to retain significant amounts of cash. As stewards of other people’s money it is reckless for any manager to keep deploying money because a mandate dictates they must.

In general, people underestimate the detrimental effect of a significant loss on their long term wealth accumulation. If your call is not spot on, who cares. I’d rather live to fight another day than be seeking a 100% return to recover from a 50% loss.

Your approach demonstrates a sound approach to developing a funds management business, and a healthy attitude to the considerable responsibility of acting as caretaker of others’ limited capital. Keep up the good work.

Roger Montgomery

:

“human beings don’t like to remember unpleasant things. They gird themselves with the armor of wishful thinking, protect themselves with a shield of impenetrable optimism, and, with a few exceptions, seem to accomplish their “forgetting” quite admirably.” Rod Serling

Peter Murphy

:

Hi Roger,

Thanks again for your insights into the market. Your analysis covers a broad range of topics and is always first class.

Co-incidentally I had this week dusted off my copy of The (Mis) Behaviour of Markets to again read over Mr Mandelbrots ideas. As I’m sure your aware he lists the concept of valuation as number 10 of his ‘ten heresies of finance’. Whilst he cites the example of Cisco’s PE at the height of the tech bubble as why the concept of “value” has limited value in financial markets, I think if he had read more Benjamin Graham that he may have been less critical!

I agree with all your comments and note the recent use of the term ‘complacency’ in the financial media. I believe that this ‘complacency’ is exactly what central banks want and that is the only way that the current debt markets around the world can possibly survive. Whether it is Japanese, French or Spanish sovereign debt, Chinese or American company debt or Western private debt in general – this amount of debt (I recall a recent figure (not sure how accurate) of total World debt/GDP around 420%) can really only be serviced with the prevailing low interest rates. If or as you say when interest rates rise there will be pain and the actual ramifications will likely be felt far and wide given the interconnectedness or markets. I understand that there are many commentators who believe that the current path is sustainable and will continue for a long time. Thus the clash between the bulls and the bears as I see it is simply the amount of faith in central banks & governments in their encouragement of debt accumulation given their theory of asset price rises being good for the economy.

Timing is always the issue and I note that some large US hedge funds have recently gone long the markets after long and frustrating stretches of underperformance. My own personal view is nothing more than a gut feeling that the current trajectory which has been unsustainable for a long time is getting closer to its day of reckoning.

However I’d like to say on a positive note and say I am very bullish optimistic about the future in general as I understand a company in China recently 3D printed a house, that Google and Facebook are talking about covering the globe in wifi with ‘hot air balloons’ and advances in biotech will mean new cures for disease and longer lifespans! I think the pace of change in the next 10 – 20 years will surpass anything in history. Unfortunately though, I don’t think it will be enough to allow some governments to pay their future liabilities!

Regards,

Peter

Roger Montgomery

:

Ben Graham and Buffett et.al solved the puzzle of predicting long term share price performance: simply own extraordinary companies able to increase their intrinsic value at a satisfactory rate. Benoit was trying to work out what tools to use to predict short term share prices. He found a tool but perhaps no-one has yet worked out what to do with it.

dean

:

how secure is cash you may get a haircut

high inflation low interest rates will prevent government default but wipe out the cash players a black swan event with oil will be the spark that starts inflation

then it will be 2007 all over again $150 a barrel of the black stuff

its all about the spice (oil)and we all know how that movie ended