Diverging results in Australia’s major banks

We have just come through another bank reporting season, so in this blog post we will provide an update on how we saw the results.

In summary the results were generally a bit softer than expected, with quality weaker than the reported numbers would otherwise indicate.

If we look at the performance of each of the stocks between 26 October (ie the last trading day before the first result was released) and 10 November (adding back the final dividends for NAB and ANZ), there has been a clear divergence in the performance of the major banks. ANZ and NAB have underperformed post results, while WBC and CBA have outperformed slightly.

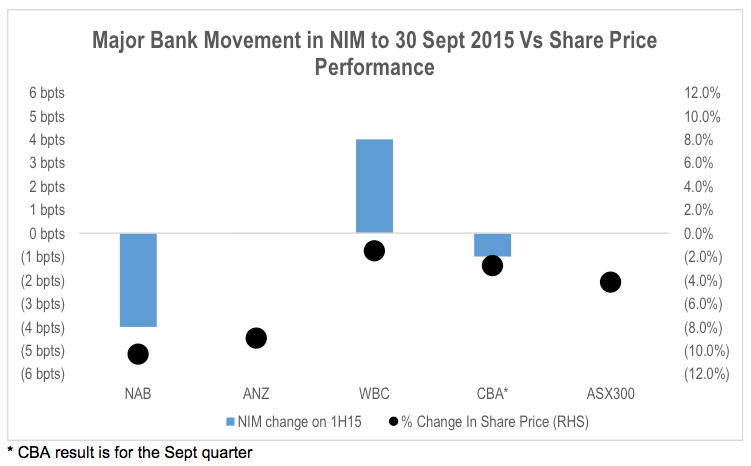

One of the major points of differentiation between the major bank results was the performance on net interest margins or NIM.

WBC’s result showed a positive outcome on NIM relative to expectations, increasing 4bpts on the first half average. CBA’s 1Q16 NIM was down slightly on 2H15 levels, but flat excluding Treasury & Markets.

While ANZ’s average NIM improved, this was largely due to a fall in the loan balances of the company’s low margin Asian operations. NIM in Australia and New Zealand both fell on 1H15.

The largest fall came from NAB, with a 4bpts reduction relative to 1H15, primarily as a result of a 10bpt fall in business lending NIM. In general, business margins were under pressure, while retail margins were more stable helped by improved funding costs.

Going forward, the market will be focused on the bank’s ability to retain the benefit of out of cycle mortgage rate increases announced over the last few months, as funding costs are likely to go from the benefit to a headwind for NIM. This will be an important test of the bank’s market power and the ability to pass on the cost of increased capital adequacy requirements to consumers.

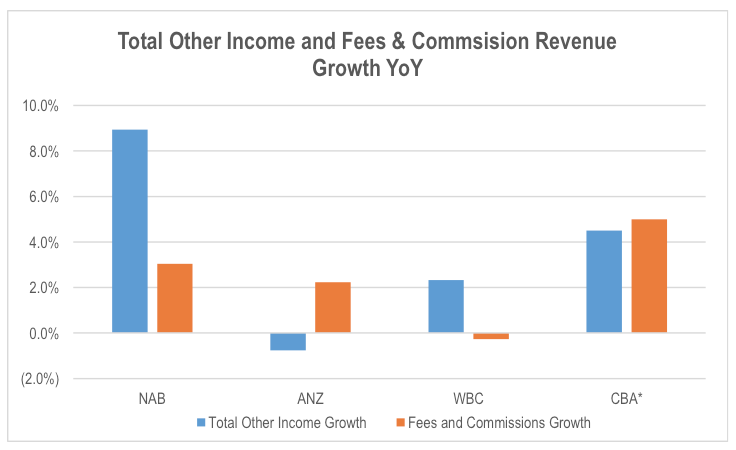

In terms of other income growth, ANZ was negatively impacted by losses in its trading book during the period of market volatility in the last 6 weeks of the period. Trading revenues were more normal for WBC and NAB. Overall income growth for CBA in 1Q16 was similar to FY15 implying around 5 per cent growth year on year.

Of more interest is the growth in the other more stable income lines such as fees. This was an area of concern in the WBC result, where fee revenue growth has stalled in recent periods. This is important given the returns generated and therefore the value of fee income.

The figures for CBA are only estimates given the limited detail provided in the quarterly update, but the results imply a better rate of growth for fee revenues than the other three banks.

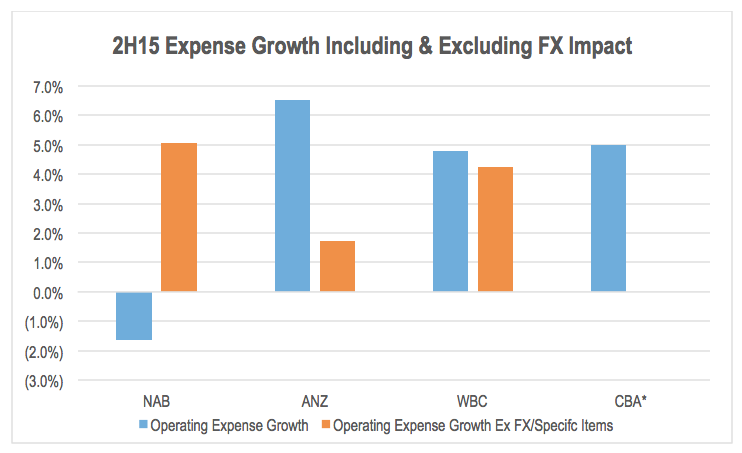

Where ANZ performed better was on expense growth. While the reported 6.5 per cent growth in operating expenses year on year appeared to be a poor outcome on the surface, excluding the impact of the depreciation of the AUD (Australian dollar), cost growth was just 1.7 per cent in 2H15.

WBC’s cost growth was also overstated by the depreciation of the AUD, but positively impacted by the deconsolidation of BTIM. We estimate that operating expenses increased 4.2 per cent year on year in 2H15 on an underlying basis. This was still below underlying revenue growth of 4.5 per cent, resulting in margin improvement.

NAB’s headline operating expense decline of 1.6 per cent in 2H15 appeared to be a positive, but this was mainly due to movements in one off items. Excluding this and the impact of exchange rates, underlying operating costs grew 5 per cent. This is concerning given our estimate that excluding the impact of exchange rate movements, 2H15 income grew 4 per cent year on year.

The last area of interest was the change in bad and doubtful debt impairment charges. Net impairment charges generally started to rise in the period, it was mainly as a result of reductions in write backs from prior periods. Gross impairments remained relatively benign with domestic asset quality generally surprising on the upside.

For WBC and NAB, new provisions were relatively flat as a percentage of credit risk weighted assets. CBA’s provisions in 1Q16 were also lower than the market expected, increasing 11 per cent from a low base in the prior year.

The negative surprise came from ANZ. While the company had prepared the market for a jump in provisions in 2H15, the increase in provisioning in Asia caused some concern regarding future risk given its exposure to the deterioration in the Asian regional economy.

New loan impairments increased 34 per cent for ANZ in 2H15 or A$455 million. This compared to 3.9 per cent for WBC and a significant fall for NAB. New impairments in ANZ’s Asian business increased around A$650 million. The results highlighted that the negative surprise from ANZ’s announcement in August was more stock specific.

So while capital generation and requirements have been a major focus for the market throughout this year, the result shifted the markets attention back toward growth and risk to some extent, with a resulting divergence in the performance of the big 4.

The Montgomery Fund and the Montgomery [Private] Fund hold positions in WBC and CBA.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Stuart, thanks, that’s very helpful. I will have a think about this a bit more, but have trimmed my position slightly to de-risk, and will keep an eye out on how the pricing power and low loan loss issue plays out in the coming months.

Hi Stuart, thanks for that post, did you exit ANZ at a loss and if so what % loss on your average buy price? A few of us hold ANZ and are thinking of doing the same I’m sure. Also, why do you persist in owning WBC and CBA given your overall assessment of the banks near term prospects (from what I’ve read/seen)? I can understand it for retail shareholders who are relying on bank dividends to do the heavy lifting of paying interest and expenses, but why do you guys do it? Aren’t these funds better off sitting in cash? Is there a portfolio construction reason? Eg. Do you use bank dividends to pay the expenses of the fund or help manage redemptions?

Hi Gav,

We moved out of ANZ prior to the results period as a result of our view of the return Vs risk outlook for the stock given issues around the returns being earned on incremental capital being invested for growth, combined with ANZ’s competitive positioning in meeting the next round of likely revisions to capital adequacy requirements regarding liquidity and leverage. Interestingly, the new MD Shayne Elliott has flagged a reversal of Mike Smith’s policy of aggressive reinvestment of capital in Asia at the FY15 result with a rationalisation of low return loans. While this will improve the marginal return generated by ANZ and free up capital (and therefore a positive for value), it will also be a headwind for overall earnings growth.

In terms of CBA and WBC, we believe there is an attractive balance of risk and return at the current respective share prices given their mix of businesses and exposures, returns generated, opportunities to reduce costs and reprice products. The decision to include or not include a stock in the portfolio has nothing to do with near term cash generation from dividends to meet liquidity requirements. It purely is a function of the company’s prospects and outlook for total return relative to risk.

Thanks Stuart, that seems like a sensible strategy. I am still holding onto ANZ for the time being with a long-term view and given its structural importance in my portfolio for its dividends to pay expenses/interest and complement lower yielding holdings, and given that it is my only exposure to this sector anyway. I thought also that although they are reducing exposure to low return loans, they may put greater focus on higher margin products like cash management to offset the impact on overall earnings growth. Did you get the opportunity to speak to the new CEO before you exited ANZ? I am curious if this kind of chat can gave you extra insights to avert impending threats to your capital.

Hi Gav,

The thing to remember is that future dividends are a function of earnings as well as the outlook for growth combined with the marginal return on capital in delivering that growth. This determines what proportion of earnings needs to be retained to fund the growth opportunity. The increased capital requirements being imposed by APRA reduce the future marginal return on capital meaning more capital needs to be retained to generate 1 percentage point of future earnings growth. This means a lower dividend payout ratio for a given rate of earnings growth relative to what the major banks have been able to sustain in the past. Additionally, more onerous liquidity and stable funding requirements will increase funding costs and pressure net interest margins for the banks. We view ANZ as being relatively more vulnerable in this area which would negatively impact its competitive position and earnings generation in future.

The offset for ANZ is that in pulling back in Asia, its growth will be curtailed in the medium term, resulting is reduced need to retain earnings to fund that growth. This will help sustain its dividend payout ratio, but as I pointed out previously, the offset is lower earnings growth.

In terms of refocusing capital on higher margin products, the share market shares held by the major banks in most segments mean that to move the needle on overall growth, they need to drive overall category growth. This is generally difficult (in any industry). The amount of share points they would need to capture in an individual product to make a material difference to overall company growth would be large. The only way to do that quickly is through pricing, which inevitably destroys the margins that were attractive in the first place.

The decision to exit ANZ did not come from any discussions with the company, but rather more broad in-house research on the industry, regulatory outlook and risks.

Hi Stuart, thanks, I see you what you’re saying about earnings growth coming before dividend growth. And if there is lower earnings growth then dividend growth will also be lower, unless they stretch their already high payout ratios. But if you’re getting 10% grossed-up yield today that is helping you meet an objective/outcome, and you can bear a certain % of unrealised capital loss in the short-medium term, then as long as earnings are at least stable that is ok I would have thought. Unless of course you think there is going to be significant falls in earnings in the coming years rather than just flat/low/slow growth. Do you think that is likely? For example I wouldn’t invest in a high yielding BHP or WOW because of this. So if you conclude that the dividends are at least sustainable, then that is not such a bad thing for the stock on the whole.

Hi Gav,

There are two things that put that investment thesis at risk. The first is asset values. Any correction in asset values resulting in increased loan losses that requires incremental capital retention or raisings. While the market perceives the banks to be defensives, anyone with enough experience to remember the impact last Australian recession had on the share prices of the major banks will know that they are essentially a leverage business that has sold a put option of asset prices in the economy.

Current earnings are being generated on historically low rates of loan loss provisioning relative to credit risk weighted assets. We don’t believe that it is wise to effectively project this situation into perpetuity when valuing the bank stocks using current earnings.

The second is the risk of earnings reductions from a contraction in net interest margins as a result of increasing funding costs. ANZ’s net interest margin should increase on the back of exiting low return loans in Asia, but this will be required to offset the negative impact on the growth of its loan book. If it is also unable to fully recover any increase in funding costs resulting from lengthening the duration of its funding, earnings growth could be negatively impacted. EPS growth is further reduced by the dilution from recent equity raisings to meet increase capital requirements from APRA.

While most of these risks also apply to the other banks, we believe ANZ is more exposed than CBA and WBC.

The last factor is that the higher risk mix of assets in ANZ (ie institutional, Asia etc) means we require a slightly higher return from the stock than WBC and CBA. Higher risk demands a higher expected return.

Hi Stuart, I see your point about earnings, but what about free cash flow? The Morningstar research guy said in AFR the other day that yields for banks are sustainable based on free cash flow, do you agree with that?

Hi Gav,

Free cash flow generation that is distributable as dividend is a function of the ROE. With ROE having reduced from almost 20% to 14-15% (management admitted that the previous target of 16% is now too optimistic), distributable free cash flow generation is significantly lower than in the past. No matter how you look at it, the combination of growth and the sustainable dividend are lower than 5-10 years go due to the increased capital requirements. The sustainability of the dividend depends on the sustainability of earnings at current levels, and the rate of balance sheet growth slowing relative to history. The sustainability of earnings depend on bank pricing power in the face of margin pressure, cost reduction potential and loan losses remaining a historic lows. We question the last of these variables, and believe the first also needs active monitoring.