Are Zero Interest Rates Working?

Writing in The Wall Street Journal, David Malpass said; “A year ago the International Monetary Fund projected world GDP at $82 trillion in 2015, but it will likely end up at only $72 trillion, a $10 trillion shrinkage. There’s lots of blame to go around, but the Fed’s seven-year zero-rate trap is a big part of the problem”.

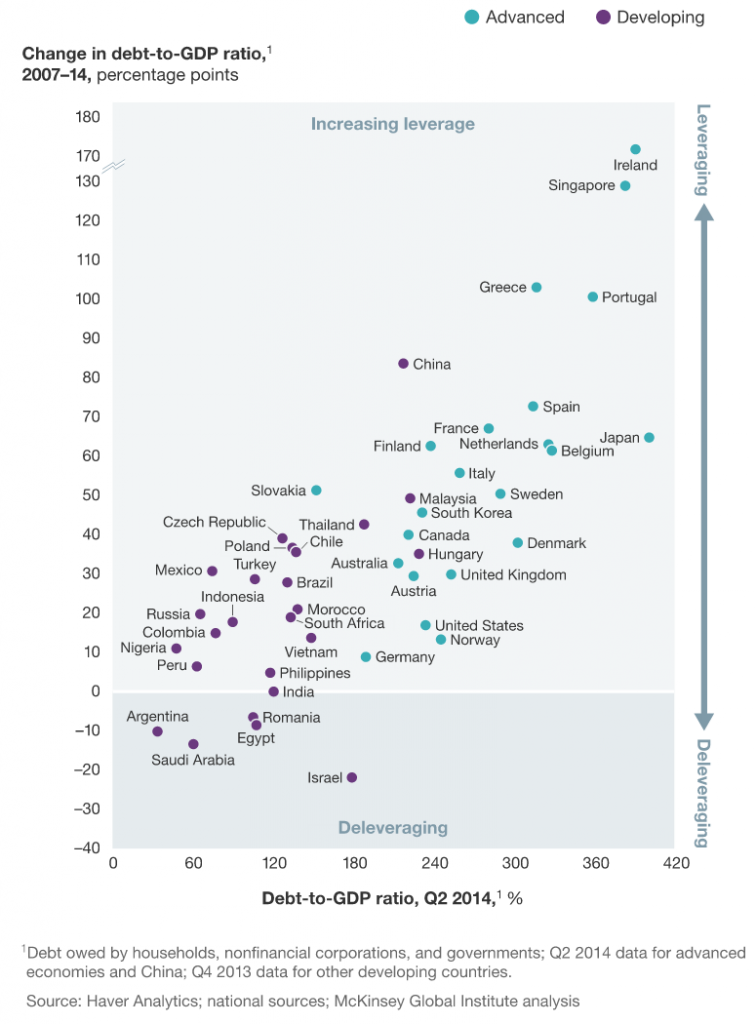

In a study by McKinsey Global Institute entitled “Debt and (not much) deleveraging”, the global stock of debt outstanding has jumped $57 trillion over the 2007-2014 period from $142 trillion or 269 per cent of GDP (of $53 trillion) to $199 trillion or 286 per cent of GDP (of $70 trillion).

There were 47 countries in this study – 22 advanced and 25 developing. Every one of the 22 advanced economies has seen their debt to GDP ratio increase over the seven-year period, and many countries by more than 50 per cent.

Apart from Ireland, Singapore, Greece and Portugal, China came in fifth position in terms of the increase in its debt to GDP. McKinsey claims China, fueled by real estate and shadow banking, has seen its total debt quadruple from $7 trillion to $28 trillion over the 2007-2014 period.

That means China’s debt grew at 21 per cent per annum or more than double the growth rate of its nominal GDP; and at 282 per cent of GDP (of $10 trillion) investors have become increasingly cautious given “half the loans are linked, directly or indirectly, to China’s overheated real-estate market; unregulated shadow banking accounts for nearly half of new lending; and the debt of many local governments is probably unsustainable”.

As Malpass concluded “its hard to see how a continuation of past (zero interest rate) policies will generate more loans and faster economic growth. Let’s hope the next time Fed officials tee up a rate increase, they don’t pull it away again and do further damage”.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.