Will Qantas be Taken Over?

Who would have thought a little comment at the end of my 17 August Value.able column for Alan Kohler’s Eureka Report on Qantas’ strategic direction announcement would cause such a stir!

Who would have thought a little comment at the end of my 17 August Value.able column for Alan Kohler’s Eureka Report on Qantas’ strategic direction announcement would cause such a stir!

It appears I wasn’t the only Value.able Graduate wondering aloud about the coincidental timing of the strategic change of direction, coming as it did whilst the share price was trading at near record lows.

My Value.able column started like this: “Sick of losing money, Qantas CEO Alan Joyce revealed a long-overdue change of strategy for the airline earlier this week, which included cutting jobs, delaying the delivery of six A380s until 2019, buying smaller aircraft, launching two new Asia-based airlines and an attempt to turn around the fortunes of Qantas International.”

And ended like this: “This may not disturb parties that have taken notice of the share price trading below NTA and considered mounting a takeover. You may recall that back in 2007 a consortium that included former CEO Geoff Dixon and former chairman Margaret Jackson had a bid of $5.45 share on the table. At yesterday’s closing price of $1.525 I think it’s safe to say they dodged a bullet.

“If there’s a way to get around the Qantas Sale Act and increase aircraft utilisation rates with an offshore hub, I reckon someone out there in the world of institutional finance has thought of it and run the ruler over Qantas

“…if there was ever a second tilt at Qantas, now would be as good a time as any…”

Have a quick look at the Balance Sheet.

Ignoring the $470 million ‘investments accounted for using the equity method’, QAN has twenty billion of assets (only $593 million are intangibles – landing slots, brand and software). There is $3 billion of cash and $13.8 billion of property, plant and equipment. Now add to that $14 billion of liabilities, some of which is represented by Redemption Revenue*, a portion of which may never be claimed.

For the moment, put aside the Qantas Sale Act (a small thing to do here because it suits this discussion!), now imagine…

You mount a bid for $3.5 billion (funded largely by the cash in the company’s bank account). You sell all the planes, the property and all the equipment to pay off the liabilities, but keep the frequent flyer business, which then cost you nothing.

While it is true my scenario is embarrassingly simplistic (and not nearly as obvious as bidding for ING during the depths of the GFC) it may also be true that the most profitable frequent flyer program in the world (and Qantas’ most profitable Operating Segment) could be in the sights of an audacious bidder.

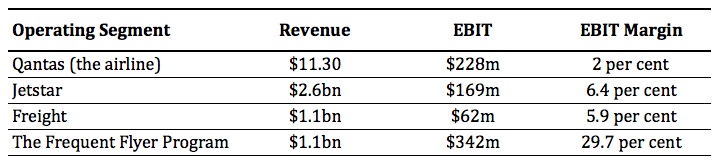

Let’s compare the Revenue, Earnings Before Interest and Tax (EBIT) and resulting EBIT Margin of Qantas’ four core operating segments:

I know which segment I want to own!

In 2007 Qantas was the target of a takeover attempt by APA (Airline Partners Australia) – a consortium put together specifically for that purpose. They were willing to pay $11 billion.

At the time, fears around the impact of a highly leveraged owner on Australian superannuation funds were added to the national interest concerns. The bid was not supported by employees or the community. Interestingly, the government of the day didn’t intervene in the bid because of undertakings that the company would remain Australian owned and headquartered in Australia. We are a proud nation.

A bid today at, say $4.5 billion, and with the same undertakings, would either make the current bidders look very wily, or those involved in the previous attempt very silly.

Many analysts now have buy recommendations on Qantas. Whilst I agree that the shares are at a discount to tangible equity, I don’t believe the discount is as great as being stated. This is because retained earnings in equity were never really earned. The economic profit of the airline is, as I have stated on many occasions over the years, much lower than the accounting construct that produced the retained earnings entry. But a discount to NTA does appear to exist.

If you were a bidder, and can overcome all the obstacles, with the share price well below NTA and the imminent prospect of the company committing to acquire another 100 planes, you’d want to get a move on.

Of course this is a purely economic discussion and does not take into account the impact on the jobs and livelihoods of QAN’s 34,000 staff and their families. Nor have I taken into account Australia’s national interest.

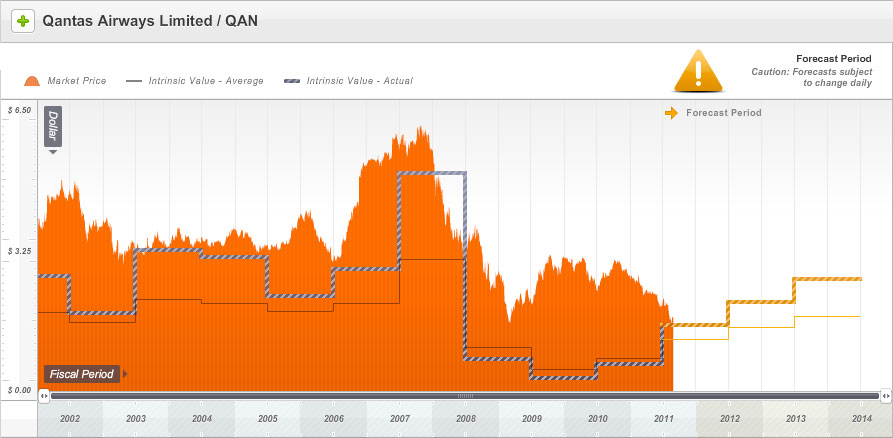

There haven’t been many occasions when QAN shares have traded below my estimate of the company’s Value.able intrinsic either.

Ten days ago Qantas was trading at intrinsic value. Based on recent results and current expectations, our estimate of intrinsic value is forecast to rise by as much as 30 per cent over the next three years.

Sneak Peek #2: Ten years of historical intrinsic value and three years of forecast valuations for Qantas, compared to the current market price. Why is the price chart orange, I hear you ask? Because Qantas scores a B for quality. In our next-generation A1 service B = Adequate Quality and Adequate Quality = orange. Amazing, incredible, simple.

There are just two requirements to ensure you receive an invitation to become a founding member of our next-generation A1 service.

1. Read Value.able

2. Change some part of the way you think about the stock market

You may also like to submit your photograph to the Value.able Graduate album at my Facebok page, however this is optional. If you haven’t yet secured your copy of Value.able and joined the Graduate Class, click here.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 1 September 2011.

*The company’s notes states; “Unused tickets are recognised as revenue using estimates regarding the timing of recognition based on the terms and conditions of the ticket. Changes in these estimation methods could have a material impact on the financial statements of Qantas.” Some have suggested that more can be made from unused tickets than those actually claimed/uplifted.

Redemption revenue received for the issuance of FF points is deferred as a liability (revenue received in advance) until the points are redeemed or the passenger is uplifted in the case of flight redemptions. Redemption revenue is measured based on management’s estimate of the fair value of the expected awards for which the points will be redeemed. The fair value of the awards are reduced to take into account the proportion of points that are expected to expire (breakage). The accounting steps are [a current liability if they will be earned within one year] debit to the asset Cash for the amount received and a credit to the liability account such as revenue received in advance.

As the amount received in advance is earned, the current liability account will be debited for the amount earned and the Revenues account reported on the income statement will be credited. This is done through an adjusting entry.

Hi Roger & Adam….I took exception to the tone of your comments Adam re Roger”s new service. He has provided much information for us not just in his book by any means but also an enormous amount of time reading & replying to our blogs. .for little monetary gain I would think.He is a very busy person with interviews & now his managed fund & the responibilities that brings.

He has no need to do anything more for us but yes he has offered & mentioned this new service several times…very good of him. I would not be at all surprised if his intention was/is to wait for company results & now for some visibily to appear before offering his service…so I am quite content to wait until he is ready & has the time.

Thanks Roger….rob.

Hi Roger,

Im just curious as to why lynas (LYC) has dropped considerably since the review of the malaysian plant? once the report was released nothing appeared to be any different (no delays in production) however there is 10 requirements that need to be achieved which dont seem to be hard task for LYC.

Are people hesistant about the licence approvals of the company? or is it a bundle of issues surrounding the business? i.e carbon tax etc, fear of double dip recession.

Cheers, Alex

Clearly there is disagreement with your conclusion about the probability of success. That does not mean the market is right, of course.

Roger,

Colour coding is common in pretty much anything you can buy – baby formula, shoes, car tyres and foods for example. Colour coding an ‘adequate’ business orange is hardly amazing or incredible. The only adjective which really applies is simple.

Speaking of adjectives – does ‘next generation’ actually refer to anything? Or is it empty marketing language?

I was enjoying this blog, but the constant spruiking of your new ‘investing for dummies’ business, without any actual business to investigate yet, is quite an irritating marketing technique and is really putting me off.

Thanks for the feedback Adam,

You are right, it is pretty simple. Thats exactly what the service will be – very, very simple to use and very simple to understand. It was actually one of the country’s largest institutions that saw it and called it ‘the next generation platform’. My ‘mini’ marketing department liked it so started using it too. Sorry its putting you off, I will let them know they should tone it down. Feel free to look away if you don’t want to be soiled by such unbridled commercialism and focus on other parts that are full of free insights from some very handy Graduates!

I think simple in the investing world could possibly be seen as “next generation” and “amazing”. A lot of people seem to spend too much time on trying to work out equations, ratios and formulas whilst ignoring the main thing which is the qualtiy of the company you want to buy.

Roger – “Feel free to look away if you don’t want to be soiled by such unbridled commercialism”

Have recently heard that turn of phrase elsewhere… it’s a goodie :)

Referring to Dylan Grice’s piece on macro, is your own approach to asset allocation something that you’ll discuss publicly?

You sent it to me Aaryn! I liked it too. Thanks. Yes I might.

Hi Roger,

I have been ‘absent’ for a while, having just returned from a short holiday in Vietnam – where I saw Buddhists in their bright orange gowns; the same colour as your price chart. I like it! It’s great.

Cheers,

PeterB

Based on the Qf reporting model, the FF flyer business is the ‘jewel in the crown’. But it is important, under the context of this takeover talk, to understand how the FF program works.

When you go shopping at say, Woolworths, the amount you spend is correlated to an amount of miles and Woolworths pays Qantas the corresponding amount. The first thing to understand is that QF gets that money straight away but of course the customer does not redeem the points as expeditiously.

FF program profitability is derived from a few main components.

1. As shown above QF gets the money straight away but the person takes a longer time to use the points, if ever.

2. More importantly, and this is the big one; lets say the points required to fly from SYD to MEL correlates to $150. That charge is not applied to the frequent flyer business. Instead an arbitrary amount closer to cost is charged against the FF business, and this leaves a difference which the FF business claims as profit.

3. Profit margin is easily maintained by the FF business by diluting the value of the points as needed.

It is highly unlikely that there will be a takeover offer (at least based on this idea) because the ‘jewel in the crown’ is not what it’s cracked up to be. It cannot exist in isolation because should it be sold off, QF will straight away increase the arbitrary charge to reflect the true value of the ticket. Unless a commercial agreement could be settled the profitability of the FF business dramatically reduces to its actual worth. Why do airlines structure their FF business this way? Because having a strong popular FF business is free money in the bank to the airline. The more people involved, the more business’ want to be involved and the more money comes into QF and in turn more people show loyalty to a particular store such as Woolworths. So it’s a win win for everyone involved….Except the divisions of QF of course, that have to wear the true costs that the FF business avoids.

It should be said that I am a big QF fan.

1. QF is one of only a very few airlines, the only?, with an investment grade credit rating.

2. QF has remained profitable every year over the last decade. I challenge knockers to create a list of international airlines in this category. Australians’ are far too quick to bash QF when they have operated quite amazingly under the global conditions and local environment.

3. QF is a great airline…. but it’s not an investment option for me.

A bit of balance,

Cheers,

ps. Thanks for this great resource you provide Roger

Delighted and thanks for your insights about the accounting of ff program…

No one suggested it would exist in isolation – a jewel IN a crown. Fascinating insight Anthony. Thank you for sharing. When you say “an arbitrary amount closer to cost” Is it truly arbitrary if approximating cost? Do you mean the cost of supplying the flight. Nevertheless let me endeavour to report back with the actual margin. I’ll start with the Accounting stdrds. What’s your estimate Anthony?

Correct Roger, cost of supplying the seat on the flight not the value of the seat as if it was sold on the open market

Is it possible that perhaps its volatile (depending on the break even yield on a particular flight being reached) but not arbitrary?

Maybe, Roger. Maybe it is break even yield for the FF business. The important point is that the costs attributed to the FF business are less (and maybe rightly so) and readers (and potential buyers) should be aware that any sale of the FF business would result in diminishing margins for that division. QF would demand a proportion of the capital costs of aircraft, buildings and rights be covered by the FF division should it be sold. The alternative would mean a weakening of the remaining QF divisions as less passengers exist to share the burden of the aircraft purchase and leasing costs.

…or another airline(s). I dont know the answer to this question; Would an owner of an independent frequent flyer business be tied exclusively to one airline? If not, would an owner care if the other (unowned) divisions were weakened? All hypothetical of course. Nice to have the luxury to discuss it without the worry of ownership.

The real beauty of a frequent flyer program is the ability for the airline to discriminate redemptions based on marginal cost. Essentially, airlines are all about passenger yield. The plane is going to fly no matter how many people are on board. Depending on the route, the aircraft, and the time of day, the first 65% to 80% of passengers will cover the cost of the flight (ie the break-even yield). Any passenger numbers above this yield provide the high-margin profit.

This is where the frequent flyer program discrimination comes in. If the airline has not forward sold many seats on a particular flight, then the marginal cost of giving one away for free is minimal – there will be no shortage of seats to sell at a premium for cash at the last minute. So the airline allows frequent flyer redemptions on these flights at a much higher perceived value to the frequent flyer than the cost to the airline.

Conversely, on flights that are quite full, the airline can charge a very high cash premium for the last remaining seats. By blocking redemptions for frequent flyers on these flights (or making frequent flyers sacrifice their points at the higher cash equivalent) they are able to maximise cash profit margins on these flights. You cannot add more seats to a full aircraft.

So, the frequent flyer program has a massive ROE advantage in that it discriminates between cost and profit as a monopoly player for its parent airline. It could not operate this way as a separate entity.

Another excellent insights for the blog. Thanks Ray.

Roger, you mentioned recently in relation to MCE that you will be assessing it over coming weeks – presumably to either get out, hang on or buy.

Are you waiting for an announcement or lack of announcement so as to assess its forward orders / revenue and profit targets, etc.

I was just curioius to undersatand what you felt was likely to change.

I note that since their financials were lodged there has been no noises in relation to announcements either via the ASX or on their Web site in relation to new business.

The discosure or lack of it is a worry – perhaps one of the biggest changes a company has to deal with from when they move from a private family company to public.

On another issue – while i appreciate the timing of director purchases and sales can often mean nothing – Aaron Begley did sell 350,000 shares (April 4) at what would have been close to its high under the “illusion” of increasing liquidity at the same time as a capital raising at $8.50 was announced.

Clearly no Chinese walls there!

David

Hi David, yes I would like to see a large order announced keeping in mind it could take 8 months to fill and then paid. Booked and banked this financial year would be ideal.

No noise, should there be? If there is none, does that mean the company is doomed? That they have no ‘bright prospects’? (or just that they operate in an industry with long lead times?)

Come on everyone – panic some more! Drive those SHAREprices down!

So that the non panickers can buy more of the COMPANY cheaply :)

It does not mean they’re doomed. I hope my stressing of that point has made it through. Long lead times are indeed the conclusion. More than 8 months in some instances from Booked to Banked. Provided an investor is prepared to wait and the discount is big enough, then no problem. Obviously if this year’s targeted 20% increase in revenue is not met, and the year after it rises by more, then merely expect the lumpy changes in revenues, then profits and then annual valuations to be mimicked by the price.

Roger, what is your obsession with Qantas, you are and have been giveing this company a great deal of attention over the years?

Yes we can see they are a company we Gradustes would not invest in but wouldn’t the blogs time be better spent on great companies after the reporting season and where you see them heading in the next 5 years so we don’t fall into the Matrix traps in future.

By the way I fly on any line other than Qantas after my last flight and a 24 hour delay..

Thanks Kent. Fortunately on my blog…Theres a variety of posts to interest you and others.

Roger has already answered you Kent, but I’m going to chip in his ‘defence’ not that he needs any …

Qantas, like them, loathe them, or somewhere in between them, is one of Australia’s largest companies, a ‘national icon’ and often mentioned as a ‘defensive’ or ‘blue chip’ company – it therefore has all sorts of great educational properties :)

Not to mention that learning about what not to invest in is sometimes more important than learning what to invest in.

I am sure we are all more than capable of finding companys to invest in but one good thing about this blog is that it paints a clearer picture of what does not fit into the definition of quality and why.

Thankyou for your constructive feedback, I was not attacking Roger and would never do that as I find this blog very educational and a credit to Roger and his team for the amount of time they spend on it, therefore he need no defending, it was just an observation and recommendation.and I also appreciate we need to look into the rear view mirror!

I was curious to read of the recent takeover by the Commonwealth Bank of Count financial services.

Whilst I have no intimate knowledge of either organisations, on the surface I could not imagine a more culturally unaligned combination.

The Commonwealth Bank is both a product manufacturer and distribution arm where the majority of their planners are salary based employees selling insurance and other commissioned products. Most of their investment and superannuation product would be on the Colonial First platform where the true beneficiaries are the shareholders of the bank as it profits from every part of the product – the initial sale, the funds management and the ongoing platform fees.

Count on the other hand was a financial planning practice whose roots are firmly entrenched within the accounting network. By their very nature, accountants were amongst the first to adopt a fee-based financial planning service and their “independence ” is probably the thing that is most important to them.

Whilst there is no doubt they will continue to trade under their original name, there will be a focus by the bank to push their product and platforms. Trying to get these guys and direct them into recommending new investments and platforms would be akin to trying to herd cats . Independent beings don’t like losing their independence.

As stated I have no knowledge of either organisation but having been involved with in the financial services industry for a very long time, I imagine that those who are not going to benefit by the takeover will probably seriously question their future.

Roger.

When?

Jeff

Hey Roger,

Agree that the Frequent Flyer program is the Jewel.

The problem with a takeover though is you have to find a patsy to buy the airline business

Maybe a Cigar butt

A Frequent Flyer Programme is only a jewel so long as what it represents is worth something – I had/have a reasonable number of points, but am not interested in redeeming or adding to them if it involves the current level of Qantas service. What is it worth if everyone starts to feel that way?

The trouble I see with the scenario above is that the current direction of Qantas is for it to become part of the “Jetstar Group”. I imagine once the Qantas brand is trashed beyond recognition the value of the FFP will very quickly erode.

On the subject of potential takeover for anyone thinking of putting a “non-value.able” bet down on takeover speculation, make sure you read the “Inquiry into Air Navigation and Civil Aviation Amendment (aircraft crew) Bill 2011”. It’s a bill proposed by Senator Nick Xenophon which essentially makes it more difficult (expensive) for Australian airlines to set up subsidiaries in other countries.

Whether or not that will give any “APA consortium #2” pause I don’t know.

My final note is that roughly 25% of the QF group’s costs are jet fuel which this FY amounted to $3.627 billion. One reason Qantas (international) is under-performing is the fact that they are flying predominantly Boeing 747’s which guzzle fuel at a rate about 30% more than what most of the competition is using, which is the Boeing 777. Qantas have had opportunities to acquire 777’s at super cheap rates numerous times over the not too distant past but instead syphoned all efforts into expanding Jetstar. Likewise, the Boeing 787 will represent a 30% fuel cost saving over the ageing Boeing 767, but instead of transforming Qantas into a newer leaner company, they will syphon these assets into further expansion of Jetstar.

Sorry for a fairly long rant for my first post but I am not too keen on Qantas to become part of a “Jetstar Group”.

Hi Roger,

Sorry to change the subject, but do you have any thoughts on the VOC result?

Apart from the supposed cross-selling capabilities, what benefit is VOC intending to get out of its dark fibre and data centre acquisitions?

I would’ve thought that the outlook for internet traffic is blue sky enough! Accordingly I would’ve thought it would be best to keep their eye on this part of the business.

Just a thought that if the assets were broken off and sold the businesses shut down or sold that the liabilities in the 35000 employees entitlements could be as high as 1.75 Bil.

Could be something to look into in making assumptions. Not sure if this is in the last End of year report.

redundancy & leave.

Any news on Mce Roger?? Are there any new orders they desperately need???

If MCE win contracts, expect to see market announcements.

Another seek peek, and another example of simple, clear visuals, helping make quality decisions based on sound principles.

Many thanks for preview, no more sneek peeks Mr. M lets roll it out.

All the best

Scott T