Why small businesses can grow at a faster rate than large businesses

While small company shares demonstrate greater volatility than big company shares, over longer time frames they tend to deliver higher returns. Over the short-term they can involve more risk because of their lower liquidity, their sensitivity to management’s decision-making and their sensitivity to general economic conditions. For that reason, an investment in the Montgomery Small Companies Fund is recommended as a long-term proposition.

Small businesses can occupy profitable niches and have the potential to grow at a faster rate than large businesses; small companies are often operated by dynamic founders (or their hand-picked successors) who are focused on building wealth for themselves and their fellow shareholders; and small capitalisation shares are not subject to the same close and continuous analysis by the investment community, with the result that they are sometimes under-priced.

The Montgomery Small Companies Fund was launched on 20 September 2019 and is coming around for its first anniversary in a few weeks. In the period to 31 August 2020, the Portfolio Managers of The Fund, Gary Rollo and Dominic Rose, have done an excellent job turning the original $1.00 into $1.1854 whilst the benchmark, the S&P/ASX Australian Small Ordinaries Index, has turned $1.00 into $0.9951. Hence, out-performance of 19 per cent, after all expenses.

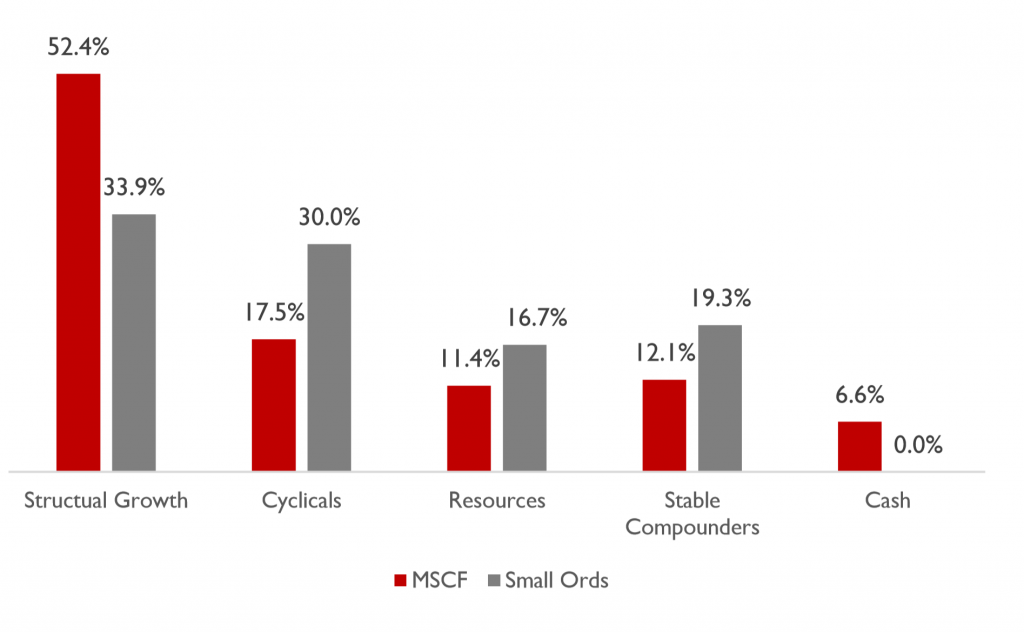

Gary and Dominic break down their audience of stocks into four categories – Structural Growth, Cyclicals, Resources and Stable Compounders and the bar chart below illustrates the current positioning of the Montgomery Small Companies Fund versus the benchmark. Readers will notice the strong over-weight to the Structural Growth category.

From a growth perspective over the next two financial years (FY22 on FY20), the Montgomery Small Companies Fund, which currently comprises 48 stocks, has forecast annual sales growth of well over double the benchmark (13 per cent versus 5 per cent) and annual EBITDA growth of 13.5 per cent versus the benchmark’s 10.6 per cent.

From a valuation perspective, the Montgomery Small Companies Fund appears cheaper than the benchmark using both prospective Enterprise Value/ EBITDA and Price/Earnings ratios.

And from a Liquidity and Risk perspective, the Montgomery Small Companies has more attractive attributes than its benchmark. These comparisons are tabled below.

| Montgomery Small Companies Fund | S&P/ASX Australian Small Ordinaries Accumulation Index | |

| 2 Year Sales Growth (p.a.) | 13.0% | 5.8% |

| 2 Year EBITDA growth (p.a.) | 13.5% | 10.6% |

| 2 Year EPS growth (p.a.) | 10.6% | 17.5% |

| 2 Year DPS growth (p.a.) | 1.8% | 16.8% |

| Forecast EV/EBITDA | 9.6X | 10.7X |

| Forecast PE | 14.7X | 16.9X |

| Forecast Dividend Yield | 1.2% | 2.5% |

| Liquidity | 6.9 | 6.7 |

| Risk (1). | 2.4 | 3.1 |

(1). 3 Year rolling standard deviation of price indicates the Montgomery Small Companies Fund is approximately 20 per cent lower risk than the benchmark’s constituents.

If you would like more information on the Montgomery Small Companies Fund, please contact David Buckland or Toby Roberts on 02-8046 5000.

Do you have any exposure to small caps? While small company shares demonstrate greater volatility than big company shares, over longer time frames they tend to deliver higher returns. Here's why. Share on X