Why are we Celebrating?

Congratulations are in order at our office.

Congratulations are in order at our office.

Not to Forge or ARB for their full year results released today but to Chris B. our resident Albert Einstein, data integrity guru and valuation formula genius. Chris became a CFA today.

Well done Chris.

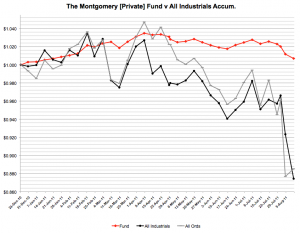

Thanks for all your hard work and keep it up – its working! Just look at the chart.

We are all excited to have you on the team.

(note: Yes everyone the results ARE due to significant amounts of cash (inflows) that the process Chris helped developed DID NOT deploy into the market) Well done Chris and on behalf of our investors thank you.

Posted by Roger Montgomery, 17 August 2011, with sincere thanks.

WARNING: This publication has been prepared by Montgomery Investment Management Pty Ltd ABN 73 139 161 701 AFSL 354 564 (“Montgomery”) for the purpose of providing general information, without taking into account your particular objectives, financial circumstances or needs.

An Information Memorandum (“Offer Document”) for the Fund(s) is available from Montgomery. Potential investors should consider the Offer Document in deciding whether to acquire, or to continue to hold, units in the Fund(s). Montgomery, its officers, employees and agents believe that the information is correct at the time of compilation, but no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by Montgomery, its officers, employees or agents. This online blog contains general information only and is not intended to represent general or specific investment or professional advice. The information does not take into account an individual’s financial circumstances. An assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial or other professional adviser before making an investment decision. No guarantee as to the capital value of investments in the Fund(s) nor future returns is made by Montgomery.

Matrix will be reporting on the morning of 23 August. I rang up the company and left a voicemail and the company secretary emailed me back the date.

MCE represents 50% of my portfolio which probably is bad asset diversificaton but as Warren Buffett says in the excellent BBC documentary (search on Youtube – World’s Greatest Money Maker) it’s better to watch a few companies really well than trying to look after 50.

My congratulations to Chris as well.

This is perhaps a bit off-topic, but worth a ponder.

You know how you often read of parents buying some shares for their children etc – but what a simple idea it would seem to provide, say, $10,000 in a trust, on the birth of the child – and this money would be put into one or two blue-chip shareholdings, with all dividends etc reinvested. The child/adult would be able to access it at, say, age 50.

I’ve been trying to work out what $10,000 in BHP or CBA shares would be worth invested over 50 years – but I suspect it’d be an amount that would put your superannuation to shame.

Such a trust, over such a long time, would need someone to overlook it – just for some intervention if there was any major hiccups, but it sure is such an attractive idea isn’t it? And the initial $10,000 seed money is such a trivial amount – more or less to celebrate the birth of the newborn.

Hi Roger

I was wondering whether your opinion of MCE had changed with the falling oil price?

And when are they due to report?

No change, still waiting for the full year results to look closely at the cash flow before we consider buying anything meaningful.

Cash Flow Statement

The Company generated cash flows of $9.3 million from operations (before payment of income tax) as compared to an inflow of $27.5 million last year (before payment of income tax). The difference between FY2011 and FY2010 is represented by an increased working capital requirement resulting from the significant amount of deposits and advanced invoicing on projects that took place

during FY2010.

The Company had drawn down bank borrowings of $33.7 million, which assisted in funding plant and equipment purchases and development of the Henderson plant. The Company repaid bank debt of 6.5 million

Mark I believe it is August 23 that the MCE preliminary report will be released.

HI Mark

MCE IV in the valuable portfolio(eureka report 17082011) is priced at $10.88.

At the price at the end of todays trade was $5.26, giving it a MOS of greater than 50%.

Not sure if this is a great buying opportunity yet or not.

cheers

darrin

You’ll find out this morning, darrin…

Cash flow is not that flash and neither is the second half profit.

Expecting increase in revenue of 20 percent next year. A bit on the low side I would have thought.

Dropped nearly 10 percent today. I think this is an over reaction but results not really meeting market expectations.

I think the cashflow will get better but all in all I was expecting a better result.

Still holding but it could take quite a while with better results to climb back up again.

And the morning reveals a lower IV

Roger, i believe you are incorrectly using the term ‘cfa’. please reword it to, ‘charterholder’

hahahhaa.. o god.

…a rose by any other name….

Congrats Chris,

Any chance you can put your skills into working out the QBE results, (i am buggered if I can work it out).

cheers

Keep in mind no increase in profits since 2006 despite a doubling of equity. Due in no small part to declining margins every half since then bar one.

Additionally over the same period- QBE share price has fallen more than 50 per cent – compared with a 25 per cent fall for the ASX 200. ROE has declined from 30 per cent to 14 per cent.

CFA exams

I am only just starting the process!

Can anybody that has done or is doing the CFA study recommend any of the “prep providers” ?

thank you

Peter

Congratulations Chris.

I imagine achieving the certification required many hours of hard work and study.

I think it is terrific having a very good oarsman like you in the team rowing a durable boat captained by a highly skilled captain -navigator .

Keep up your great work Chris

Regards

Ron

Great Stuff Chris,

Totally of topic hear(sorry guys).

I am currently listening to the sky business channel and everyone is going on about WES results today so I made a fatal mistake of having a look and wasting 30 minutes.

The first thing I noticed was I had not updated my value since 11 February when forecast earnings were $1.88 per share. The actual figure is $1.66 ish.

I must be gluten for punishment because I have been tracking WES for a number of years but I have noticed that they get downgraded throughout the year.

Despite the noise I think they are worth $17 for 2011 and if the very unrealistic analyst forecasts are right then mid $22 for 2012.

Not sure why all the spruiking in happening but I will not be dragged in.

I hope you all do the same but please do your our research.

Hi Ash

Just read John Durie’s article about WES in The Australian. Very sobering for WES shareholders- Coles may never make a return for WES.

Gluten for punishment-LOL

Cheers

Jim

Why the spruiking?

I think people just want Wesfarmers to be a good company so much due to it owning coles. Not sure why, think it might be because they are the challenger to woolworths (might be an underdog thing if you could call them that).

This means that they will jump on any positive new for them.

Don’t worry Ash, we all have our guilty pleasures, yours is looking at Wesfarmers results. We know it is no good for us but we just can’t help ourselves.

LOL

Thanks Andrew good comments

the underdog story. I am sure we won’t make money from that.

Congratulations Chris,

Can I suggest that Roger goes out and buys some Credit Corp and Decmil shares as a present for you. You both win, Roger gets them cheap and you get a great present!

Congratulations Chris, another talented member of the Montgomery brains trust.

Roger can I please ask a question about the new A1 service?

I have been following a couple of companies that I know you are pretty lukewarm on, such as IDL and TOX. The companies have now reported, the market seems to like the results as the ROE continues to improve, debt continues to be paid down, dividends are up and forward orders are strong.

My question is, how dynamic will be the A1 to C5 ratings be in the new system? In other words once the results are out, when will users be able to see the new MQR that reflects new results, cash flow and debt levels etc?

I am very much looking forward to it, it would be really useful right now.

All the best

Scott T

Yes. Many in 24 hrs! And remember you are investing for years not hours.

Just completed my IV for Reject Shop ( TRS ) using 12% RR and forecasts from broker of 50% pay out ( on basis that cash will be required for working capital, store roll out and debt reduction ) and profit of $22.4m 2012 and $29.4m in 2013

2011

Equity per share $2.04

EPS .62 cents

POR 50%

ROE 31%

IV $7.85

2012

Equity per share $2.47

EPS .86 cents

POR 50%

ROE 38%

IV $13.45

2013

Equity per share $3.04

EPS $1.12

POR 50%

ROE 41%

IV $18.39

any comments would be appreciated as these are my first attempts and learning!

Hi Peter, 2011 looks ok but the other IVs are way too optimistic. you are talking about some serious eps growth. What makes you think they can turn it around so easily?

Hi Ron,

The EPS in my calcs were extracted from a Bell Potter piece of reserarch that was published after the 2011 results. They argue that putting the flood disruption behind them, opening of new stores and the effeciences to be optained from the Brisbane wharehoues will allow TRS to return to good EPS growth.

Since doing my calcs other research that I have read indicates more sedate EPS going forward of :

2012 .85 and .72

2013 1.05 and .88

Maybe I redo my calcs usiing a consesus EPS

Prior to the 2011 result TRS had a good history of EPS growth:

2007 35%

2008 35%

2009 14%

2010 23%

Thanks for your comments which helps a great deal in my learning.

regards,

Peter

Just completed my IV for Forge using 12% RR and forecasts from broker of constant dividend ( on basis that cash will be required for working capital ) and profit of $43m 2012 and $46.7m in 2013

2011

Equity per share $1.50

EPS .47 cents

POR 24%

ROE 35%

IV $8.85

2012

Equity per share $2.02

EPS ..52 cents

POR 22%

ROE 29%

IV $9.27

2013

Equity per share $2.58

EPS .56 cents

POR 20%

ROE 24%

IV $8.80

any comments would be appreciated as these are my first attempts and learning!

Hi Peter N,

My IVs for FGE are:

2012 – $10.12

2013 – $9.99

Using 12% RR.

Looks like my EPS forecasts are different to yours which would explain the small IV differences we get. My EPS forecasts are from my Suncorp Trading account, so I don’t know how reliable they are:

2012 – $0.489

2013 – $0.543

I am also using POR of 0.2 and 0.15 respectively.

Peter, I get $8.87 for FGE for 2011 using 12% and using 14% I get $6.83 for 2011 so we are using the same figures. Haven`t seen any forcasts for 2012 yet.

Hi Ken. Citigroup are forecasting 51.4 & 53.5 cents per share EPS for 2012 and 2013 respectively. DPS forecasts are 16 & 17.5 cents per share.

Personally I think these estimates are a little conservative, however that is probably preferable to the alternative. My 2012 IV estimate has fallen to $8.09 using 12% RoR.

Thanks Darren and Ken for your comments

The EPS I used were from Bell Potter research published after the 2011 results

Subsequent to then Morningstar have estimates as follows:

2012 .49

2013 .54

( same as Suncorp so probably same ultimate source )

Reflecting on my future FGE IV valuations I have made a fundamental error when forecasting the equity and average equity by not takimg into account the dividends expected to be paid in the 2012 and 2013 years!

This should result in higher ROE and hence higher IV’s as Dareen has arrived at

Will re-do them using correct values

Peter

Just completed my calcuations of IV for Wesfarmers following release of the 2011 results:

• Equity per share $21.62

• EPS $1.66

• Payout ratio 90.32%

• ROE 7.68%

• RR of 12%

Comes out with a 2011 IV of $12.95

Not at all bright and would confirm what Roger has been saying that WES overpaid for Coles and it will be a slow grind to get the ROE up to something decent that will then reflect in a better IV

Last time I looked Mr Market was excited with the result and marked up the price, yet value has not changed!

Hey Peter,

With a 10% RR I get $15.96, while with a 12% RR I get $13.71. When you consider that the market is now valuing WES at $30, then our IV’s for this company are a big red flag to stay away. ROE very low.

I think Ash has a value of $17.00 for this year, I’m assuming based on 10% RR, so would be interesting to see what other values surface.

Inputs:-

1/ Book Value 21.91 (share holders equity 25,329 divided by shares on issue 1,156)

2/ EPS $1.663 (net profit of 1,922 divided by 1,156 shares on issue)

3/ DPS $1.35 (1,562 dividend pay out divided by shares on issue 1,156)

3/ POR 81.18% (being dps of 1.35 divided by eps of 1.663)

4/ ROE 7.6% (being eps 1.663 divided by book value of 21.91)

Cheers,

PaulS.

Thanks Paul for confirming I am on the right track.

Our POR differs as I am taking the the Final ( .65 ) and the interim ( .85 ) for the 2011 year total $1.50, whilst you are taking the Final ( .70 ) 2010 and interim ( .65 ) 2011 year total $1.35

On reflection I am sure you are correct as it is only the $1.35 that has been paid out and reflected in the equity of WES

Peter

Ohhhh-Ahhhh Chris B.

Welcome to the CFA club – I would think your wife is glad that’s behind you!

CHRIS, ” CONGRATULATIONS” – Celebrate your success, you are in a wonderful space to have Roger now show you how to apply the theory to Value Investing in fabulous companies – you have a big future in front of you – enjoy it and have a glass of champagne for me

Regards

Kent

Roger and team, congratulations are also in order for the Fund, I believe. As an investor, going through the inveitble ‘down’ and volatile times without really losing any of your investment, and then being able to take advantage of the ‘ups’ is like a dream. I think that’s exactly what fund managing is all about; anyone can make money in a rising market, but being able to protect your investors during volatility is the half of the equation that most managers miss

Hi Stephen,

I am just getting into the IV calcs and used your work to check my maths – thank you for putting them up as helps me to work through my assumptions

My calcs are different to yours due to:

· Equity per share $1.66029 being Avg equity of $120,340,000 divided by shares on issue 72,481,302

· EPS of .52226 being net profit $37,854,000 divided by shares on issue 72,481,302

· Payout ratio of 44.039% being dividends of 23 cents per share divided by EPS of .52226

I arrive at an IV of $7.75 accepting your RR of 10%

Will have a go at forward IV calcs and put them up

Peter

Hi Stephen,

Just realised my error in assumptions above when preparing for future IV

Your equity per share is of course correct as I should not be using average equity but actual !!!!

Got mixed up in my recipie and of course average equity is only applicable to calc of ROE

Peter

Just looking at the Credit Corp (CCP) result they’ve done well, debt also decreasing and cash flow still good. My estimated value is $5.20 (RR 13%) for the year gone.

Looking at next year, comments WRT competition and at the initial guidance of $21-23M NPAT my FY2011 estimate has value slightly declining to $5 (factoring in 2 x 10c divs).

Anyone have thoughts on CCP’s future and/or estimated value?

Regards, Matt

Of course, next year should read “FY2012”!

Hey Matt,

The purchase of ledger book was down % wise and as Roger has pointed out they are going into mobile phone collections as well. They run a good business so they should have taken the collection risks into account on this purchase so I am not worried.

Given that they make their money from the purchased ledger book going forward I am getting mid $5 for 2012.

Looks cheap

But this is just my view and I own the stock so I might be biased

Cheers Ash. In hindsight their august outlook last year did got some upgrades as the year progressed. I am comfortable as well that they know their business.

Congrats Chris. As you mentioned it Roger, what a cracker of a result for ARP…. will there be a unique blog post on this fantastic example of an A1 business?

I suspect we’ll get something up about the world’s biggest Bull Bar manufacturer soon.

Well done to Chris. Roger, did you manage to get his A1 service under the IV, or did you have to pay a little more? And looking at his earnings potential further out, is it rising at a good clip?

Seriously though I had a look at the ARB (ARP) results and post the following for those interested:

Current Equity: $129,275,000

Previous years equity: $111,406,000

Average equity used: $120,340,000

Shares on issue: 72,48,1302 (EQ/Share = $1.784)

NPAT: $37,854,000

Divs: $15,946,000

POR: 0.4212

ROE: 31.46% – stable

RR: 10

Table 11.1: Using 2.75 (RR10% – ROE 27.5%)

Table 11.2: Using 6.177 (RR10% – ROE 27.5%)

IV: $8.44

I have elected with ARP to use a RR of 10%. This is based on my assessment of its past performance, its competitive advantage, and stability of ROE. The ROE has been stable at about 30% so I have used 27.5% in my calculations in a bid to be conservative.

My analysis of cash flow leads me to believe that the company made a cash profit of $25.7 million (less the $15.9 million paid out as dividends).

The company highlighted a number of positives going forward and I also noted that whilst revenues increased by 11.4%, NPAT increased 16%. My calculations showed that EPS grew by 18.3% demonstrating a business that is able to streamline profits in a competitive environment.

The only negative that needs to be noted is a tightening of margins. I’m prepared to accept this given the difficult year they have had to contend with.

Interested in others comments.

Hi Stephen,

Good work on ARB. Regarding Chris’s intrinsic value, it is off the charts. We couldn’t afford to pay it and so we have requested a discounted placement.

The ARB result was a continuation of the consistently excellent performance of the company. If it’s not the best company in Australia, then I’m not sure what is. If only one company was rated A1, it should be this one. Its around fair value at the moment. If it becomes cheap, I will back the truck in and load up.

Congrats to Chris B and to the whole office. Congrats also to the Fund participants.

Cheers

Jim

Roger,

Just wondering what your Capital Gains issues are investing as a business.

Do you get the same discount as individuals, 50% after 12 months?

Or is it different?

Or should I be asking Chris (nice one mate)?

cheers

My understanding is that the discounted capital gains is not dependent on the entity. What changes is the tax rate of the entity.

I tried typing ‘thanks’, and then ‘thanks Roger’ but both were rejected as being too short, so I’ll say this instead, as its something I’ve been wondering about – surely, a market correction during reporting season is a dream scenario for the value oriented investor, as it throws up fantastic prices just at a time when the most up to date – and audited – information becomes available.

The planets align!

Yes. Fear of further declines however pervade. Meanwhile Buffett buys $9 bln in equities…

Congratulations Chris on your achievement.

Am I right in understanding that for every $1 invested in the Montgomery fund in December 2010 would now be worth just under $1.01? Well done on outperforming the market Roger although if my understanding of your graph is correct you have significantly underperformed my ‘NetBank Savers Account’ provided by the wonderful people at The CBA.

Yes, we have underperformed cash but we are an equity fund in the middle of a process of deploying the funds in a market that has fallen substantially. It would simply be impractical to keep switching the benchmarks every time our weighting changed.

I was only joking with you Roger. Best of luck for the future.

Congratulations, very well done and all the best for the future Chris.

In your humble opinion (ie. not advice, do your own research, interest disclosure etc etc) is the CFA accreditation a necessary evil for aspiring fund managers?

Congratulations Chris! I know it’s a lot of hard work to achieve the certification so well done.

Congratulations Chris,

A magnificent achievement! It must feel like reaching the top of Everest. I sit the Level 1 exam this December.

I’m sure Chris would rather be referred to as a CFA charterholder…

Hey Christopher,

He is so delighted he hasn’t heard anything we have been calling him all day!

Hi all,

All the best Chris and congratulations on the CFA.

Roger you mentioned briefly FGE’s annual results and after a quick look at the report I would be grateful if you or anyone on the blog had time to quickly confirm their TRUE cash flow results for year end June 2011, to make sure I’m on the right track in calculating cash flow correctly. Many thanks….here’s my input.

CASH (2010, 2011) 51.92m, 78.28m – start with # +26.3m

CURR LIAB – loans/borrowings (2010,2011) 2.78m, 3.27m

NON-CURR LIAB – borrowings (2010,2011) 3.5m, 4.9m # -1.86m

EQUITY (share capital 2010,2011) 42.83m, 44.29m # -1.45m

DIV PAID (2011) # +7.25m

TRUE CASH FLOW made up of ((26.3 – 1.86 – 1.45) + 7.25))

$30,297,086.00

Cheers,

PaulS

Spot on Paul. Well done!

Thanks very much Peter, appreciate the feedback.

Cheers,

PaulS

Hi Paul,

I see that you’ve used the balance sheet to determine the change in borrowings and have calculated an increase in borrowings of 1.86M. I’ve always used the cashflow statement to determine this ( I think this is how Roger suggested to do it although I dont have the book in front of me) and that shows a repayment of 3.46M. Not sure why the difference.

Hey Dave,

I’ll need to revisit the book to confirm, (unless one of the Value-Able gurus can assist in the meantime), but from what I understand the statement of cashflow borrowings represents the level of borrowings repaid during the period as part of the overall statement of cashflow, not the level of newly added Current or Non current debt (Current / Non current liabilities), which are the figures I’ve used.

I’ve found a link from the blog which outlines the cashflow inputs to use so I hope this helps.

http://rogermontgomery.com/what-did-the-company-really-earn-in-2011-2/

Could any gurus out there confirm this for Dave.

Cheers,

PaulS

G’day Paul,

Your numbers are good.

Stephen

Thanks for checking this Stephen.

The out performance (or lack of decline) I believe is based on holding 90% cash prior to the down turn and then deploying another 20% during the recent falls. From my understanding the Montgomery Fund is still 70% cash.

Not exactly a fair comparison to a 100% share portfolio (All Ords). The stability or lack of decline is due to the cash holdings in the fund not due to outperformance of the shares

Having said that, I do think being patient and waiting for the market to present significant discounts is better than buying shares simply because the fund has substantial cash holdings.

Hey Kristian,

One the one hand you are absolutely correct. And I am delighted. Wouldn’t you be delighted that you invested with an equity manager who is NOT fully invested? …and that is the bottom line isn’t it? Patience and absolute returns… The return of the fund is better than the market because our process told us DON’T INVEST in the market. I had been saying on TV for some time in march and April that the market was expensive and I recall being alongside one broker in April suggesting that “things feel a little frothy”. Look, while we wait we can’t keep switching our benchmark from ‘cash’ to ‘equity index’ and back again and then to something ‘in between’ every time we change our weighting. I don’t know of any fund that does that. We are an equity fund that can go to 100% cash when we please. As an investor I am looking for absolute returns. If my manager has a process that tells him to be 100% cash and the market gets hammered I am delighted. When the market turns, his fund starts off a much higher base. The alternative is to fall into the trap of being fully invested at all times and leave the capital allocation to someone else? That might work for some but I think what most investors should look for is absolute returns not relative.

Quite simply we are an equity fund with a positive return in a period where the index is negative. Thats the bottom line. And I am thrilled with the results. To can see older historical results (admittedly a different method and process) elsewhere.

Hi Roger,

I just wondered if you thought that the average retail investor should also be active to make this decision of being fully invested or all cash or somewhere in between? Is there a danger of missing out on the good times because you are waiting for a bottom before you invest again or perhaps the economy continues to fire and earnings improve more or for longer than expected if you sell too early.

My general philosophy was to increase the cash component as the good times roll on with a core holding of good A1’s purchased at discount if possible. But now I am wondering if that is a good idea at all. Perhaps this has something to do with my memory finding it a little hazy trying to recall the good times. Perhaps I need to be more active on the Chapter 13 – “Getting out” – front.

Good work Chris and enjoy the bubbly at Montgomery HQ Roger,

Matty

Hi matty,

Yes there is a danger of missing out if you aren’t invested. I published some research years ago that showed how dramatically your return would have fallen if you had missed just the ten best days over the last decade. Our intention is to be fully invested but only when sufficient opportunities that meet all our criteria are presented. In the meantime we will not participate fully if the market were to bounce dramatically. The chart is really very short term and I published it to say thanks to a vital member of our team.

To Roger and the A Team

Congrats on the fund performance. Looking forward to the new service!

Congratulations Roger and the team over there. There’s no doubt, judging from the shape of the red line, about being patient in investing rather than deploying funds too quickly.

Hi Chris B

Congratulations on becoming a CFA.

Looking forward to the new valuation service.

cheers

darrin

Chris,

Congratulations…those exams are bloody tough!!

I have all three exams in front of me…very excited about joining the CFA ranks.

Have you used any third parties like Stella at all??

Congratulations Chris!

I passed Level 2 and will probably do level 3 next year.

Wish me luck :-)

Congrat Chris, although i don’t know you from a bar of soap. I hope to join him in those ranks one day, looking forward to puttin gin the hard yards over the next medium term period to work my way up to that level.

On another note that 29 July to 5 august chart should be a great little ad for your fund.

Congrats on your success Roger as well.

Thanks Andrew. We are delighted for our clients, many of whom were fully invested elsewhere when they invested in the Montgomery [Private] Fund. No need for an ad though as the Fund is CLOSED to new enquiries.

Maybe its time to open a Montgomery (private) Tiddler Fund, minimum entry $20K with initial invitations to graduates….

Hi Marion,

I am delighted you asked. We are working on a joint fund with another highly reputable fund manager and will be donating 50% of all fees to charity. Services such as brokerage, admin, unit pricing and legals are being provided to the fund pro-bono by the biggest and best players in town. I can’t wait to share it so stay tuned for that one too.

Hi Roger,

For the All Ords and All Industrial charts above, are they charted at the value they would be if an All Ords/All Industrial fund was 100% invested or are they equally matched to the percentage of cash invested in the Montgomery Fund? ie at present, 70% in cash and 30% invested in an All Ords/All Industrial Fund! This would be more relevant.

Thanks,

Brad S

Hi Brad,

We are benchmarked to the accumulation index. Our process not only tells us what stocks to purchase but also whether to be in stocks at all. That decision – to stay in cash is a function of our valuation methodology. If there is nothing of high quality presenting a margin of safety, then cash is the default and preferred investment. That is a decision in the process – a process we are paid to implement. The conventional argument might go that with so much in cash we should benchmark against a term deposit. What utter nonsense that argument is. Should we keep switching our benchmark from cash to equity index and back again and then to something in between every time we change our weighting? I don’t know of any fund that does that. Or should we fall into the trap of being fully invested at all times and leave the capital allocation to someone else? That might work for some but I think what most investors should look for is absolute returns not relative. We are an equity fund with a positive return in a period where the index is negative. By the way the performance (in the public domain) of the previous firm to 31 May 2009 was: (Fund/S&P300 Accum) 1yr (-1.3%/-28%), 2yr (-29.4%/-41.7%), 3yr (+0.9%/-21.6%) 4yr(+24.4%/-10%). The outperformance was +26.7%, +12.3%, +22.5%, +14.4% respectively. Using the LIC share price chart to measure the old performance is nonsense 1) because the manager cannot control the price at which investors buy and sell shares and 2) because it doesn’t take into account bonus shares and dividends. More importantly the process and method is very different now.

some seem to be quite focused on trying to find negatives in your past Roger, you must be getting popular. I know your aim is not to be popular and you only want to do the best job you can for your clients and be successful in your other areas of business.

I don’t quite get the critiscism of staying so much in cash. Yes if you were invested more in equities your return would not be as good as it is in the chart (thats pretty obvious), but isn’t that what you want from a fund manager. To make the best decisions regarding investments and to try and grow your money.

If there is nothing worth buying around, than i don’t want my fund manager buying anything. Especially as he probably knows that it is a company that isn’t quality and if he didn’t have a mandate he would never touch it with a 50 foot pole buit it is the best one around at the moment.

It just makes sense to me.

And don’t forget we also want our preferred selections to fall by MORE than the market. A lot more! So suggesting an 8 month window is a sufficient period just reflects something other than common sense. Moving on…

Hi Roger,

Thanks for clarifying.

If you could do a chart that matched your investment ratio of cash to stock in an All Ords fund, it would highlight your superior stock selecting ability.

The charts above clearly highlight your ability to select stocks and invest the appropriate amount/percentage of funds. Portfolio structure, cash weighting and knowing what percentage to invest is just as hard as knowing which stocks to invest in. Will the new A1 service help in this area?

The All Ords chart reminds me of where I would have been if still with our broker….. fully invested with a portfolio of BSL, SGM, TLS, AQP, RIO, BHP, CBA, QBE, AIO, TEN

Thanks,

Brad S

PS Thanks again and well done to Chris.

Not sure 8 months would be a valid measure of stock picking ability unless you subscribe to the short termism of those who lurk in forums behind self professed trading expertise. With more cash to invest we hope that our preferred stocks fall by significantly more than the market. Fortunately many have!!!

In addition to Roger’s response, the timeframe doesn’t really suit comparison of the equity component of the fund either since he isn’t investing with an 8 month timeframe in mind (buying quality companies at big discounts, time being the friend of good companies and all that), although it would be interesting but only as a matter of curiosity. His Valueable portfolio in ER does keep that statistic for what it’s worth, albeit with a different portfolio.

I do think though that investors who had handed over their hard earned to Roger’s team and see a 2% return while the market has dropped 18% would be very happy with that result, irrespective of weightings. Almost without exception, I suspect those in the fund would otherwise have been more highly invested in the market through that period and would have fallen with everyone else.

Consider it this way – was the market a safer place to be when it dropped 500 points last week or when it was considerably higher in April? Many people’s instinct would tell them that they felt safer in April when the market was less volatile and prices were higher when the reality is that the opposite is the case (with anything other than the shortest of short term views) given that margins of safety will be higher after prices fall. That being the situation, should an investor be happier being more fully invested when the market is higher and margins of safety lower, even if it does seem ‘stable’ at the time? Well they shouldn’t, but human nature is a funny thing – and a good thing for those of us with a contrarian streak.

Congratulations Chris B, Roger M and all the staff at HQ. It really works!!! I hope you celebrate with some great fiz.

Thank you Michael. I know Chris is chuffed and I am sure his family our very proud of their Dad.

CFA ? He joined the Country Fire Authority ? Became a member of the Continence Foundation of Australia ? What, exactly, is a CFA ?

David

Hi David,

Chris is one of a happy band of analysts that can hold the CFA post nom. (Certified Financial Analyst). He deserves a lot of praise.