Who’s really doing the coal mining?

PORTFOLIO POINT: Delta SBD is weaker than its peer Mastermyne in many respects, but with an expansion in Queensland on the cards, things “might” change.

PORTFOLIO POINT: Delta SBD is weaker than its peer Mastermyne in many respects, but with an expansion in Queensland on the cards, things “might” change.

Spec.u.li.tis (noun) 1. Inflation of one’s speculative stock-picking abilities.

In my line of work, I meet many finance industry professionals who generously forward their speculative tips unsolicited. A couple of them – the professionals, not the tips – are very good and have regularly mentioned stocks that have risen substantially. They tell me that some of these stocks will continue to rise substantially and because their track record is reasonably good – I believe one has funded an exotic car habit through speculation – and their research more in-depth than I would ever consider conducting on such speculative ventures, given the small amount of money involved for me, I occasionally weaken and succumb to their ‘trust me’ pleadings. Rarely does this end well for me, hence the small amounts of money involved and very infrequent ventures. I never expect to make anything from their high-risk speculative tips and I don’t view their current crop (NSE, COE, SEA, VMG and BTR, if you must know) any differently.

I do expect to do well building and maintaining a portfolio of extraordinary businesses bought at discounts to intrinsic value and that’s the philosophy I describe in detailed steps in Value.able, which you can only purchase online here.

I cannot value a company that currently makes no money, so my own brand of speculation (if that is what it should be called) would still need a business. That business needs to be generating a profit too and it needs to produce a reasonable return on equity, while trading at a discount to intrinsic value. This is as speculative as it gets for me (and it doesn’t sound much like speculation at all).

On a hiding to nothing, a refresher on intrinsic value is appropriate.

I use a proprietary model for calculating intrinsic value which you can learn by reading Value.able. In essence, if I have a bank account with $10 million and that bank account earns an interest rate return of 20%, and I decided to auction off the bank account in the public market, I am reasonably certain I would be able to secure more for that account than the $10 million of equity in it. Further, if I have two such accounts and one account pays all the interest out each year and the other pays no interest out but retains it, and each continues to earn 20% per annum, the account that paid no interest out would be worth more. Provided I cannot achieve a 20% return elsewhere, the latter account’s ability to compound earnings at 20% ensures its higher value.

But imagine a bank account that had $10 million of equity and was earning, say 12%, retaining and compounding 65% of that return, and was available for $9 million. That’s right, a discount to equity. I think I have found just such a company. It’s not perfect, as there is debt and arguably unjustified goodwill on the balance sheet involved. It’s both too small (about $100,000 worth of trades per month on average) and too risky for The Montgomery [Private] Fund, but it ticks a few boxes to warrant some speculative exposure for members of the Montgomery team, given its price.

Delta SBD (ASX: DSB) is a mining contractor and a peer to Mastermyne (MYE) – a company whose shares we do own, in very small quantity, through The Montgomery [Private] Fund and which I wrote about last week and which you can read about by clicking here.

Figure.1 Skaffold Line screenshot of Mastermyne’s (ASX: MYE) share price and intrinsic value.

(Skaffold displays intrinsic value charts like Figure.1 for every ASX listed company and they are automatically updated for the latest information announced by companies every single day. To access Skaffold for 30 days click here)

Analysts have recently become very excited about the coal sector if not the entire mining services sector because it is enjoying healthy tender activity, contract wins and filling, if not full, order pipelines. Attention has turned to coal, not because there is any shortage of supply but because the nuclear disaster in Japan last year (which was indeed a tragedy for Japan and her extended family) caused many countries to rethink their nuclear power generation strategies. Cheap and with infrastructure in place, coal is once again a preferred if not desired source of energy. Australia also enjoys a reputation for relatively clean coal (note ‘relative’)

Coal 101:

There are two types of coal; Metallurgical or Coking Coal and Thermal coal. Thermal is used often to heat water to produce steam that turns turbines for power generation. Metallurgical or Coking coal is used in steel production. The impact on the price of both will be determined by demand from Japan, China and India.

Australia is the largest exporter of coal in the world, with most of that going to Japan. Total production of raw black coal in Australia in financial year 2010-11 was 405 million tonnes (Mt.), down from 471 Mt. in 2009-10. This drop was largely as a result of the Queensland floods of January 2011 where production fell by some 30%.

According to the Australian Energy the reserves to production ratios for black and brown coal in Australia are 111 years and 539 years respectively, however these figures do not account for growth in production. Growth of Black coal exports in Australia has been growing at a rate of 5% (on average of the last 20 years). If this rate of growth was maintained to extinction all black coal in the country would be depleted in around 25 years, with the peak in production occurring in 2014.

Australia is the world’s largest exporter of coking coal – accounting for over one-half of global export supply, and the second largest exporter of thermal coal (see Table below). Some other countries are larger producers of these commodities than Australia, but they typically consume the bulk of their domestic production and hence have a less significant role in the global resource export market. This is particularly noteworthy for China, which is the largest producer of coking and thermal coal but also the largest global consumer of these commodities. Similarly, the United States and India are the second and third largest producers of thermal coal, but are significant consumers of their own coal as well.

Table 1. Global Market for Coal. Source: RBA Bulletin 2011

Coal mining in Australia is the subject of strident criticism from the environmental movement, because burning coal releases carbon dioxide, which is generally understood to contribute to climate change, global warming, sea level rise and the effects of global warming on Australia. Coal burning produces 42.1% of Australia’s greenhouse gas emissions, not counting export coal. As a result, coal is a politically charged subject and the proposed Carbon Pollution Reduction Scheme which followed the draft report of the Garnaut Climate Change Review has put a price on carbon. This would be likely to impact most heavily on brown coal usage within Australia (particularly in the Latrobe Valley in Victoria) for power generation.

Why the heightened activity in coal?

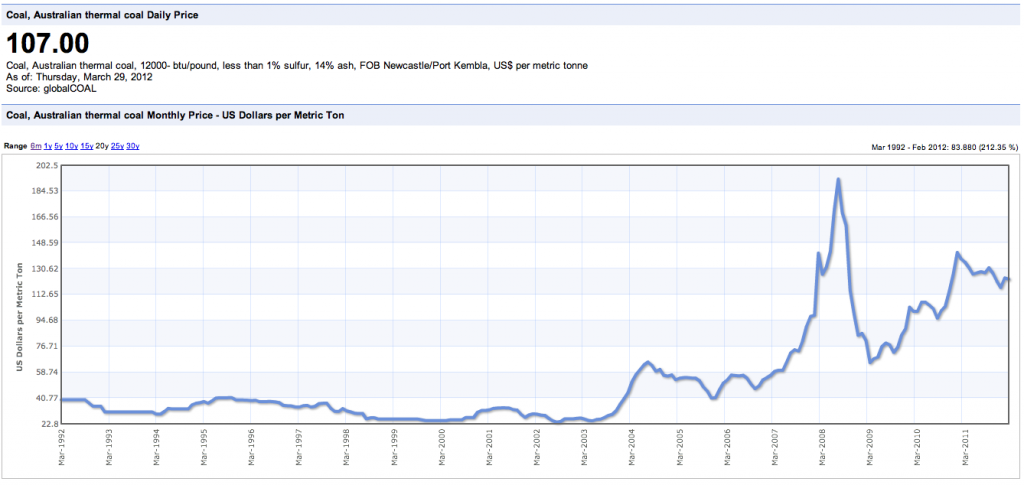

This 20 year price chart of Thermal Coal may help answer the question…

The chart for coking coal looks similar. In the near term however, US domestic demand is falling due to competition from shale gas for power generation and lower coking coal demand from steel mills. Consequently, central and inland US coal mines are seeing sales and prices weaken. Europe is looking even worse. South African cargoes, much of them destined for Europe, fell to $100 per ton in late 2011 from up to $120 per ton earlier last year.

China, on the other hand, has remained a robust importer of thermal and coking coal. Imports reached 13.3 million tons in August 2011 from 6.1 million tons in March that year.

HSBC expects India to be the fastest-growing importer of thermal coal with imports rising 32 percent to 79 million tons in 2011 and 19 percent or 94 million tons expected in 2012 despite rising domestic production.

In 2011 China has cut coking coal imports from Australia, due to the flooding in Queensland, and then because Mongolia – China’s large source – has lower delivery costs than Australia.

Weak demand in the rest of the world and stable yet slowing growth in China will put a cap on further price rises.

DSB’s mining contracting segment specialises in the provision of services for the underground coal mine industry, whole of mine operations, roadway development, longwall relocations and support, conveyor installations and maintenance, plant hire and maintenance, supplementary labour, and mine service. The latter includes secondary support installation, excavation, ventilation device installation and services/utility installation/recovery. In other words DSB provides labour and equipment for large blue chip coal miners. Its clients include BHP, Boral and Xstrata, some of whom have been clients for over a decade.

The company’s description sounds a lot like Mastermyne and the regions it operates in are also the same- providing mining services in the Illawarra, Hunter Valley and the Western regions of NSW (Gunnedah), and the Bowen Basin in Queensland.

These similarities do highlight an important risk – the relatively low barriers to replication and competition, which in turn are reflected in DSB’s lower returns on equity. Further, like Mastermyne, limited ‘through-the-cycle’ performance transparency means investors are right to be cautious about a company that is either new or newly-listed. Delta DSB floated was formed after the merger of two companies in 2007 and while services have been provided for 16 years, the company floated in Dec 2010 after raising $2.85 million, $750,000 of which paid for float costs, $570,000 went into the company’s bank account and $1.53 million was used to repay shareholder loans (went into incumbent’s pockets).

The founder and CEO Steve Bizzaca, own 33% of the business and collectively directors own 67.7% of the stock making the usual illiquidity of a small company even more accute.

Some of the differences between Matsermyne and Delta SBD are found in their price and operations. Mastermyne has almost three quarters of its contracts by number based in Queensland. It enjoys higher margins there. Delta SBD, on the other hand, has three-quarters of its contracts based in New South Wales. DSB is also more capital and labour-intensive than Mastermyne, reflecting its current capital expenditure programme. And the capital expenditure program has also caused divergent balance sheets. Mastermyne’s debt is falling and it generates positive free cash, while DSB has more debt and (currently) negative free cash flow.

You can see why Mastermyne is a small position in the Montgomery [Private] Fund and DSB is not. But as the company expands in Queensland, some of these price-limiting issues may abate. And that’s where any value could, with the low liquidity, quickly disappear just as the valuation starts rising.

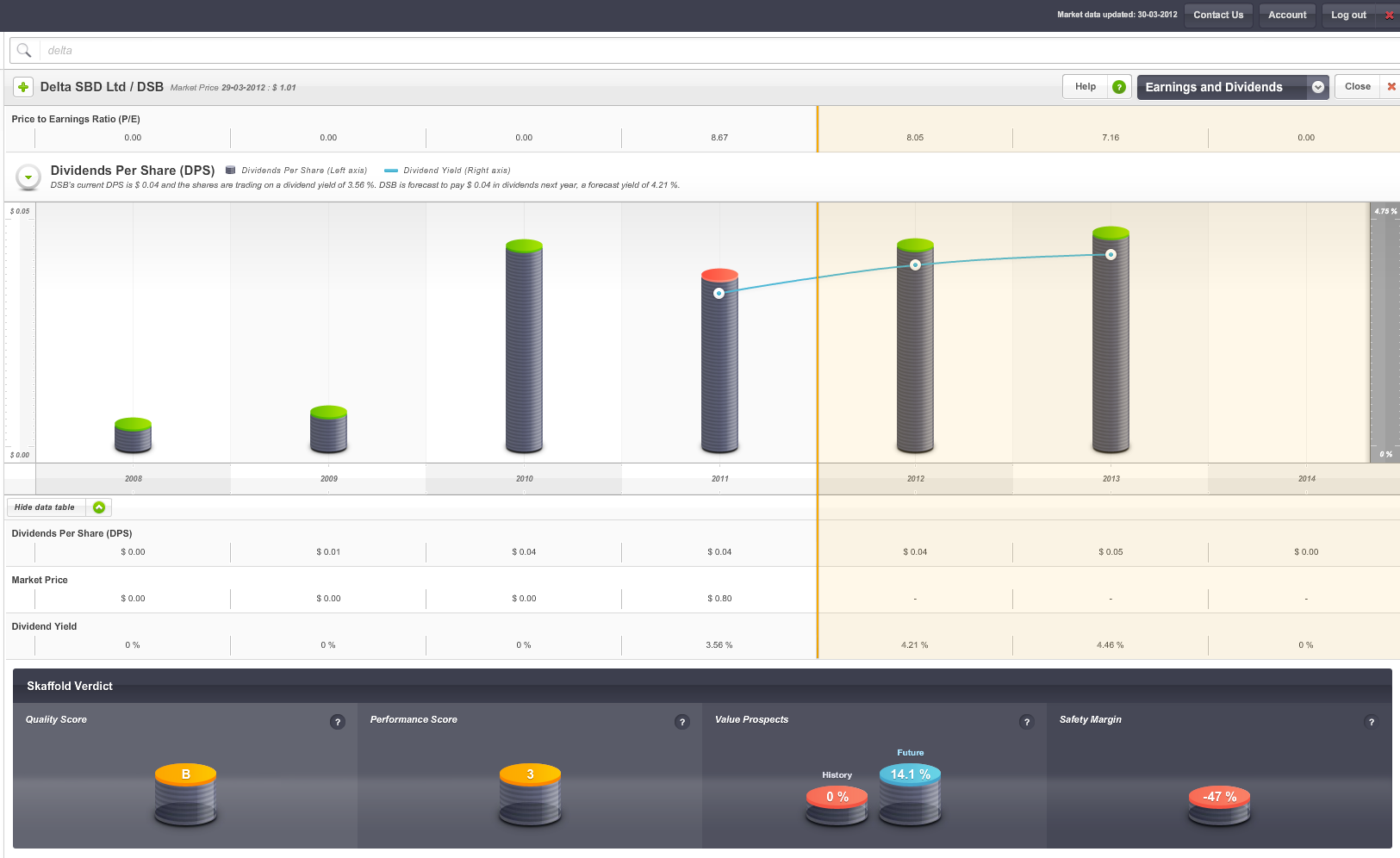

For the first half of 2012, DSB reported revenue up 40% and a normalised net profit of $3.5 million, up 61.0% on the first half of 2011. Importantly, EBITDA margins improved compared to the previous corresponding period and the company announced a 1.5 cent dividend.

Figure.2 Skaffold screenshot, Delta SBD (ASX:DSB), Dividend Per Share including forecasts.

Like Mastermyne written about earlier, you have to watch cash flow, because capital expenditure increases in anticipation of equipment demand for new contract wins, but the ramp-up in the number of staff, from 418 to 489, indicates optimism on this front. DSB’s forward order book confirms work in hand for the second half of FY12 is $60M. $93M has is locked in for FY13 and $69M for FY14. DSB says it has also been “short listed” for a further $70M in new contracts, is negotiating about $7M and is tendering for an extra $333M.

While inexperienced and amateur investors may get excited by all this ‘activity’ and especially when a little company has big ‘blue-chip’ clients, experience has shown us time and time again that tender pipelines can dry,up or even mysteriously disappear when prices or economics are no longer attractive. This is best highlighted by a recent note in the Sydney Morning Herald:

Sydney Morning Herald – 5th Mar 2012 – Paddy Manning

“HUNTER VALLEY miner Gloucester Coal is struggling to shift stockpiles worth almost $40 million as demand for its semi-hard coking coal softens.

Gloucester, which will this week release details of its proposed $8 billion merger with Chinese-owned firm Yancoal, disclosed in its half-year earnings presentation that stockpiles at its Gloucester Basin operations remained high at the end of last year due to difficulty in shifting its coking product.

“In response to this sharp decline in demand for metallurgical coals, management took steps to change its production profile towards producing a higher percentage of thermal coal,” Gloucester said.

Gloucester would not comment on Friday but it is understood the soft demand is due to global economic uncertainty having an impact on Asian steel mills, which are themselves stockpiling coking coal.

A representative with coal industry analysts IHS McCloskey, Bruce Jacques, said Gloucester’s situation could be “atypical, because the type of coal they produce is sometimes not as easy to sell.”

Mr Jacques said transport bottlenecks could also be responsible at the “pretty congested” Newcastle port.

“There’s the best part of 40 vessels waiting off the terminal,” he said. “Companies are sitting on some allocation through Newcastle that they’re not going to be able to use.”

“It’s no secret that demand is easing. In fact, demand for both thermal and coking coal is easing. The coking coal price has been falling for three quarters and it’s likely to fall for the next quarter as well.”

It therefore makes sense to be conservative rather than optimistic in your estimates of value for DSB and remember high operating leverage and exposure to commodities means profits can quickly turn to sharp losses in this industry.

For now DSB enjoys a strong tender pipeline and the momentum from a generally rising tide in coal production. At the current price of 80 cents (APril 1 Price update: $0.99), the shares are trading at just seven times earnings and more importantly, at a discount to forecast 2012 equity, even though that equity generates a positive return of circa 12 per cent.

So there you have it – the first and last time you will hear about speculation from me.

This column was first published on March 21, 2012. Not a recommendation. Be sure to seek and take personal professional advice. Be sure to read the warnings.

P.S. The featured Chinese 1972 poster reveals China has been trying to solve the problem of coal transportation for more than 35 years. The inscription along the bottom reads, “Strive to eliminate the need to transport coal from North to South.”

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 31 March 2012.

If you enjoyed this post and would like to see more, and you are on Facebook be sure to click ‘like’ below. Thank you in advance for feeding the flame of value investing.

Ash Little

:

Hi Roger,

This one looks good in my view; good thermal coal exposure and they seem to have a reputation for the underground stuff.

Can I add some more to your speculation.

Given its position and thermal coal exposure, if I was a larger rival I would be certainly be running the ruler over DSB

Cheers

Roger Montgomery

:

Speculative but I hear you. if they’re running the ruler over BBG anythings possible.

Pat Riley

:

How is it Australia produces 16 Coking coal but exports 54?

Roger Montgomery

:

Australian produces 16% of global production. Not all of global production however is exported. Australia produces a far higher proportion of the amount of coal produced globally that is actually exported. Note for example in 2011 2800mt was produced and China produced 1071mt. China however was a net importer. This can be seen in the third column.