Which retail sectors are in fashion?

Colonial First State has just released their quarterly results to March 2013 for their Retail Property Trust. This retail-specific Australian Real Estate Investment Trust (A-REIT) comprises shopping centres, department stores, supermarkets and specialty stores.

Included in the results are the sectoral sales of the outlets within these centres, which can provide compelling indicators for the performance of the major retail companies on the ASX.

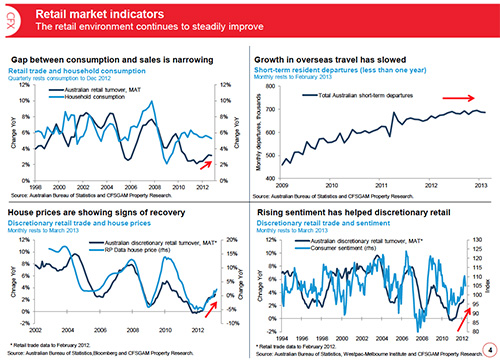

Overall, sentiment in the retail space appears healthy, with Australians still willing to open their wallets after the holiday trading period.

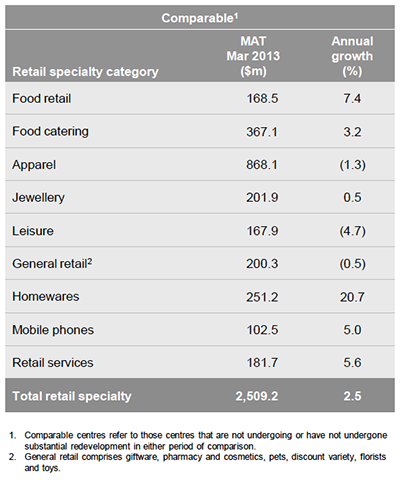

But it appears that the spending is being directed disproportionately across the specialty sectors. For the 12 month rolling period to March 2013, food, homewares and mobile phone retailers have been the strongest performers, while sales in the fashion and leisure sectors has contracted.

Retail specialty sales by category

We are going to let these numbers speak for themselves, but these trends may result in a few retailers announcing earnings surprises for the full year (be they positive or negative).

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

So the message is

“Don’t reject The Reject Shop”

Interesting post Ben, those stats paint a pretty good picture. In apparel, it has been easy to see by visiting shopping centres that it has been a bit quiet. What should be noted that although overall the growth has been negative, some have been doing quite well.

Another issue is that those apparel stores that are doing quite well are either in private hands, on overseas markets or part of a group where other poorer-performing businesses are. This is an area i will continue to watch though as i believe there are some quality companies.

The economy does look like it is starting to “recover” a bit which can only be good for retailers and i think you guys at Montgomery Investments have it pretty spot on with a retail recovery as one of your themes.

My tip to find quality apparel retailers is to look for those that are either at the affordable fashion level or at the luxury level. I can’t see much attractive with a retail company “stuck in the middle”. Also, and this might be easier for some, pay attention when in shopping centres, you will see which brands and types of businesses are still going well.

I would have liked to see a particular cosmetics item rather than it falling into general retail, i think there are some interesting movements in this market place and this could impact for starters DJ’s and Myer either negatively or positively.

These graphs provide some things to think about for a retail investor interested in investing in retail.I like it because it is easily observable and if you pay attention can spot some themes. One issue is that it is an ever changing and competitive landscape.