What’s powering Bitcoin’s bull case?

Bitcoin recently hit another new all-time high just above US$124,000, reflecting a bull story that has matured from a niche tech narrative into a macro thesis with institutional support.

Let me explain.

Two forces are powering the Bitcoin narrative, and investors need to decide whether they have enduring merit or are just the best current excuses for why Bitcoin has run so hard. First, a global tide of central bank liquidity is forming part of a cycle that lifts (and sinks) all risk assets. Second, the opening of a mainstream gateway via U.S. spot Bitcoin exchanghe traded funds (ETFs) has converted pent-up demand into regulated, high-capacity pipes for capital.

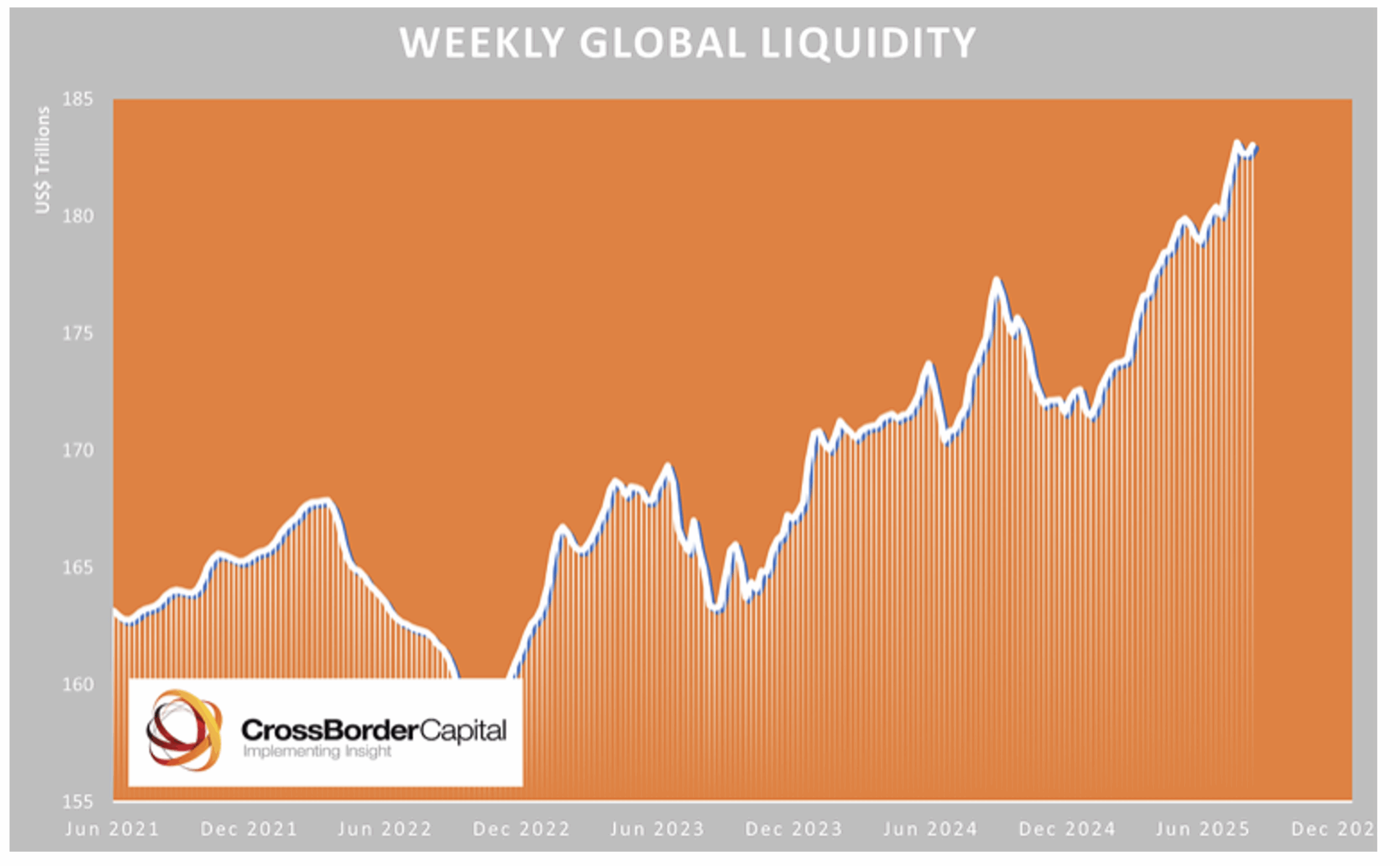

Figure 1. Global Central Bank liquidity is rising

After bottoming around October 2022, which was also the low point for equity markets, global liquidity has been rising. Not coincidentally, a two-year upswing across risk assets, from equities to gold, has also occurred. This is because markets respond primarily to the availability of balance-sheet capacity – “funding liquidity” – and when that expands, assets with sensitivity to flows respond the most. Bitcoin, by construction, is one of those assets.

Meanwhile, the structural backdrop strengthens the cyclical case. With roughly US$350 trillion of global debt and an average maturity of close to five years, the system must refinance approximately US$70 trillion annually. That refinancing needs balance-sheet room – liquidity – so policymakers keep creating it. Understandably, in such an environment, portfolios sensibly tilt toward monetary hedges – gold and, increasingly, Bitcoin.

At the same time, the rails allowing investors to put this hedge on have been smoothed. For a decade, investors waited for a regulated, simple vehicle to hold spot Bitcoin. The U.S. Securities and Exchange Commission finally approved eleven spot Bitcoin products on January 10, 2024 – a watershed that made bitcoin accessible in brokerage (and soon retirement accounts) alongside stocks and bonds. The significance wasn’t just signalling; it was plumbing. And pipes matter.

The results have been brisk. Within a year of launch, U.S. Bitcoin ETFs amassed well over US$100 billion in assets, led by BlackRock’s iShares Bitcoin Trust (IBIT). That haul is not crypto-native momentum money; it represents the migration of traditional capital markets infrastructure into digital assets. The Financial Times recently noted the ETF complex’s success and the likelihood of further innovation as the category broadens.

There will be more to say about innovation in this space soon.

Today, a conga line of former Bitcoin critics is converting. Larry Fink, BlackRock’s Chief Executive, has switched camps, calling Bitcoin “digital gold” and a legitimate portfolio instrument.

Macro veteran Paul Tudor Jones continues to tie the case for Bitcoin to fiscal arithmetic – debt, and the policy impulse to inflate it away, by printing money.

Elsewhere, Stanley Druckenmiller has praised bitcoin’s “brand” as a store-of-value asset for younger cohorts – even as he prefers to hold gold himself.

All the while, Bitcoin’s supply schedule is algorithmic. In April 2024, the network’s fourth “halving” cut new issuance to 3.125 Bitcoin per block. It was a predictable supply shock that historically coincided with higher forward returns. This time it intersected with rising liquidity and expanding distribution and ‘institutionalisation’ through ETFs.

That institutionalisation isn’t theoretical. Beyond asset managers, university endowments have begun to tiptoe in: Harvard Management Company recently disclosed a US$116 million position in BlackRock’s IBIT ETF in its disclosure filing.

And while it has the scent of a bubble forming, an increasing number of listed corporations are moving to include Bitcoin in their treasury strategies. For example, MicroStrategy’s ongoing use of equity and preferred debt to accumulate bitcoin –controversial to some equity holders – nonetheless reveals that treasury adoption can be systematic and significant, especially when the board and financing departments are aligned.

By putting the pieces together, Bitcoin’s bull case reads like a flow-of-funds map. It begins with global funding liquidity rising since late 2022, remembering that Bitcoin’s sensitivity to that tide is high. Then, debt refinancing requirements and large fiscal deficits bias policy toward ongoing liquidity support, which elevates the appeal of scarce, non-sovereign monetary assets like Bitcoin. Next, ETFs solve the custody and compliance frictions for those with larger pools of capital by creating an on-ramp that is now built and being used. Further, endorsement from establishment allocators and billionaires shifts the narrative from curiosity to acceptance, and bitcoin becomes “digital gold”, demanding a stake in your portfolio. And finally, as demand grows, supply slows post-halving.

Of course, there are risks. Bitcoin will remain volatile; it can and will gap both ways. Regulatory regimes can tighten again, particularly around market structure, leverage and stablecoins that transmit flows into Bitcoin. Energy use remains a reputational and, in some jurisdictions, policy risk, and don’t forget, currently-rising liquidity, which is cyclical, can and will eventually slow down.

To provide investors with access to this asset class, but without the directional risk associated with investing, we have partnered with a manager who generates returns from Bitcoin and Etherum futures spreads between exchanges. It doesn’t matter whether the cryptocurrencies rise or fall, the fund our partner run, makes money from the differences between futures and the underlying currencies converging.

And they’ve been running the Fund for four years (51 months to be exact) and only one month was negative.

To find out more, speak to David Buckland or Rhodri Taylor at our office on (02) 8046 5000.