What is HFT and Algo trading?

Facebook floated last week and amazingly it has been holding above its IPO price of $38 per share. I say amazingly because I reckon its value to be substantially lower. I will publish my completed calculations in the near future

Facebook floated last week and amazingly it has been holding above its IPO price of $38 per share. I say amazingly because I reckon its value to be substantially lower. I will publish my completed calculations in the near future

Here’s a taster: “For a purchaser of Facebook shares today and wanting 15 percent per year over the next five years (doubling your money), Facebook’s market capitalization has to double to $200 billion without any additional shares being issued (options to be exercised will put paid to any fairy tale notions about that). Google is valued by the market today at $200 billion. Both businesses are similar in terms of margins etc so arguably Facebook needs to increase its sales tenfold in the next five years to achieve the same valuation as Google today. But keep in mind, Google has about $40 billion of cash in its accounts. Facebook has nothing like that.”

For now I thought the trading in Facebook on its first day was a useful entrée to the world of High Frequency and Algorithmic trading and I also thought that comic Andy Borowitz’s tongue-in-cheek look at Facebook provided a welcome break from the doom and gloom pervading investment markets.

From: http://www.borowitzreport.com/

MENLO PARK, CA (The Borowitz Report) – On the eve of Facebook’s IPO, Founder and CEO Mark Zuckerberg published the following letter to potential investors:

Dear Potential Investor:

For years, you’ve wasted your time on Facebook. Now here’s your chance to waste your money on it, too.

Tomorrow is Facebook’s IPO, and I know what some of you are thinking. How will Facebook be any different from the dot-com bubble of the early 2000’s?

For one thing, those bad dot-com stocks were all speculation and hype, and weren’t based on real businesses. Facebook, on the other hand, is based on a solid foundation of angry birds and imaginary sheep.

Second, Facebook is the most successful social network in the world, enabling millions to share information of no interest with people they barely know.

Third, every time someone clicks on a Facebook ad, Facebook makes money. And while no one has ever done this on purpose, millions have done it by mistake while drunk. We totally stole this idea from iTunes.

Finally, if you invest in Facebook, you’ll be far from alone. As a result of using Facebook for the past few years, over 900 million people in the world have suffered mild to moderate brain damage, impairing their ability to make reasoned judgments. These will be your fellow Facebook investors.

With your help, if all goes as planned tomorrow, Facebook’s IPO will net $100 billion. To put that number in context, it would take JP Morgan four or five trades to lose that much money.

One last thing: what will, I, Mark Zuckerberg, do with the $18 billion I’m expected to earn from Facebook’s IPO? Well, I’m considering buying Greece, but that would still leave me with $18 billion. LOL.

Friend me,

Mark

Following that lighthearted distraction, if you are interested in how High Frequency Trading and [some examples] of Algorithmic (Algo) Trading looks in the real world, watch this:

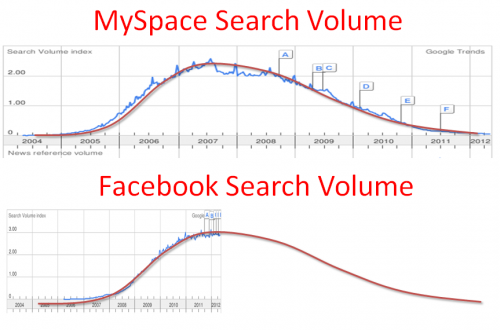

As the following chart reveals (you will have to suspend reality and imagine that the future always looks exactly the same as the past) some analysts think Facebook’s growth will mimic that of other high profile social networks. No doubt the underwriters of Facebook will hope they’re wrong.

Either way it will be more than a little interesting to watch. Did you buy shares in Facebook? If not, why not? And if you did, what were the reasons?

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 21 May 2012.

Didn’t Facebook only recently pay $1B for a less than two year old company (Instagram) with no revenue? I’ve got other businesses to research.

Roger,

If facebook doesn’t re-discover it’s mojo (I mean revenue streams) within next couple of years, it’s going end up being a take over target by either Apple, Google or Microsoft as the share price continues to decline once the growth centric investors start to abandon the company.

Imagine rather than going to http://www.facebook.com you have to go to http://www.google.com/facebook. :)

The Facebook Search Volume and how it might go the way of MySpace is really interesting. I think Facebook has peaked in popularity and the Internet user is on the lookout for the next bit of excitement. The novelty has worn off and to be honest if I want to locate someone or a product on the Internet I don’t use Facebook. I think the only people to make a lot of money out f it were Mark and his friends. I mean why would he want to share his wealth unless he had been advised that the writing was on the wall that these great times won’t last forever.

I think you are exactly right, i look today and there is an article talking about a possible class action against the underwriters due to what they believe is selective release of information about future revenue declines etc.

I don’t know how they will go, i am no US securities law expert and i seem to remember them actually saying in their ipo document that revenues will likely decline.

I am just looking forward to seeing their next full year accounts after the instagram purchase. ROE was already declining and paying $1 Billion for instagram i believe will make it drop even more. I can only imagine what the goodwill charge is and not real sure as to how much it will send to Facebooks bottom line.

Hi Benjamin,

Regarding the possible class actions, all I can say is, how absurd. Anyone entering the stock-market to place their money have to have their eyes wide open and realise that the stock-market is all about the assessment of risk.

I’ve heard only in passing about that analyst’s report which was apparently released very late (just prior to the IPO) and was slightly negative on the company’s prospects. This may have been a concern for these so-called experts, but at the end of the day, the responsibility lies with the investor on whether to buy or not to buy. Anyone who doesn’t do at least some due diligence are really exposing themselves to loss in highly-priced issues (such as this one). Class action? Seriously. My message to any class action participants: get over it and get an education on investing in the stock market. You’ve suffered capital loss because you overpaid and forgot, or never knew, Warren Buffet’s two golden rules on investing. Geez.

Roger,

I’d rather put some of my money on a Greek index share fund than on Facebook shares..

Indeed. Or perhaps a Japanese Bond?

No I did not buy shares in them, I calculated with all the hype they would probably be a one day event of an overpriced over spin investment. I use Facebook but I am very wary of any .com. I like substance in what I invest in. Ah but I admit to holding Telstra!

As our valuation is closer to $40 billion than $100 billion, we think substantial declines could occur. Of course the share price could double from here if new revenue streams are implemented and accepted by 901 million users.

I have been watching the facebook float not because i think it is a great investment opportunity but because i believe the hype and perception was evry different from the reality of the business.

Facebook is essentially an advertising company and their success will depend on two things. The number of people using facebook and the effectiveness of it as an advertising platform. I have doubts about both elements.

Just last week a major car company (ford or GM i think) announced it was going to stop advertising on facebook as they didn’t consider it an effective platform and the context of the article suggests that there are more along the way. As for the number of people using, i seem to remember eading in the initial IPO document that Facebook expexcts this number to decline as well.

I was reading a newspaper article where it was explaining why companies go public, the rationale was that “high growth” companies like FB go public to raise capital so they can grow. My opinon on this IPO was that it wasn’t about growing but to allow the early private investors a chance to “monetize” their shares. Thats why they were trying to achieve as high a valuation as possible. This float was never going to be about business fundamentals. Perhaps i am just being cynical though.

It will be interesting to watch over the long term, the stock took one day without underwriter support to fall below the IPO price. The industry is extrmeley volatile and as soon as something fancier or cooler comes along facebook could easily become the next myspace.

These are just some basic thoughts. The story behind the company is phenomenol and really interesting but that doesn’t make it a compelling investment to me. As dominant as they see i don’t see enough of a long term competitive advantage there and the price would have to drop dramatically (i haven’t done a valuation on it but i know they are not worth more than McDonalds and a PE of 100x is dot com boom fantasy stuff)

Look forward to your post Roger.

Floats are not altruistic. They are ‘selling’ shares. Never forget. And you are also right on another point ANdrew, plenty of technologies changed the world and bankrupted their founders.

You are right with your float comment Roger. I was thinking the exact same thing. I am highly sceptical of IPO’s at the best of times. I think there are some really good .com businesses out there and some that have significant advantages over their physical and online competition but Facebook isn’t one.

For example my wife was telling me whilst we were discussing the business of fashion designing and retailing and also the facebook float (don’t we all discuss such things?) that internet bloggers now outnumber the magazine editors at fashion weeks around the world and an online fashion retailer who did deals so that they could live stream the runway show and as the clothes came down the runway a person could purchase it in real time. The designers know that these online companies can move so much quicker than any traditional retailer or magazine with their monthly issues.

I think internet businesses need to be paid attention too but an investor needs to be wary and do good research to see whether any true sustainable competitive advantage exists.

Lots of technologies have been released that have changed the world – not only the way business is done or the way we communicate. And yet in many if not most cases only a relative few investors profited.

Great video on hft and FB IPO thanks!

There’s some amazing stuff on YouTube. I can see why media fragmentation is such an issue…

I got some lotto money I was gonna buy facebook shares with but I arksed my dad and dad sed no it sounds like faceache to me, thats wot he calls my mum so i bought a Datsun Skyline turbo GT instead with 20 inch chromies and a 24 inch sub woofer in the boot I rekon thats cooler than facebook shares anyway. Now I still got facebook and the car as well. How cool is that.