Volatility is the window to opportunity

In the past fortnight we have seen the markets swing from a focus on interest rates and inflation, to the prospect of the stability of the Global Financial System post the failure of Silicon Valley and Signature Banks in the U.S. This has also made its way to Europe with turmoil surrounding Credit Suisse, and a subsequent financing package being supplied by the Swiss Central Bank to calm short term nerves around their stability and also a demonstration of Government’s willingness to act.

Further to this we have also seen a move by UBS who has entered talks with Swiss authorities about a possible acquisition of Credit Suisse. This deal has started taking shape over the weekend, UBS are offering additional liquidity for Credit Suisse depositors, seeking support on costs from the Swiss Central Bank in exchange for purchasing the business at a significant discount. This move is taking shape quickly in further efforts to stabilise the Global Financial System.

This coupled with action earlier last week from several major banks in the U.S. to help shore up the balance sheet of the First Republic Bank (who at one stage was considered to be the next most likely casualty in the current chain of events) marking the fact that the private sector is also prepared to act to ensure the stability of the banking sector.

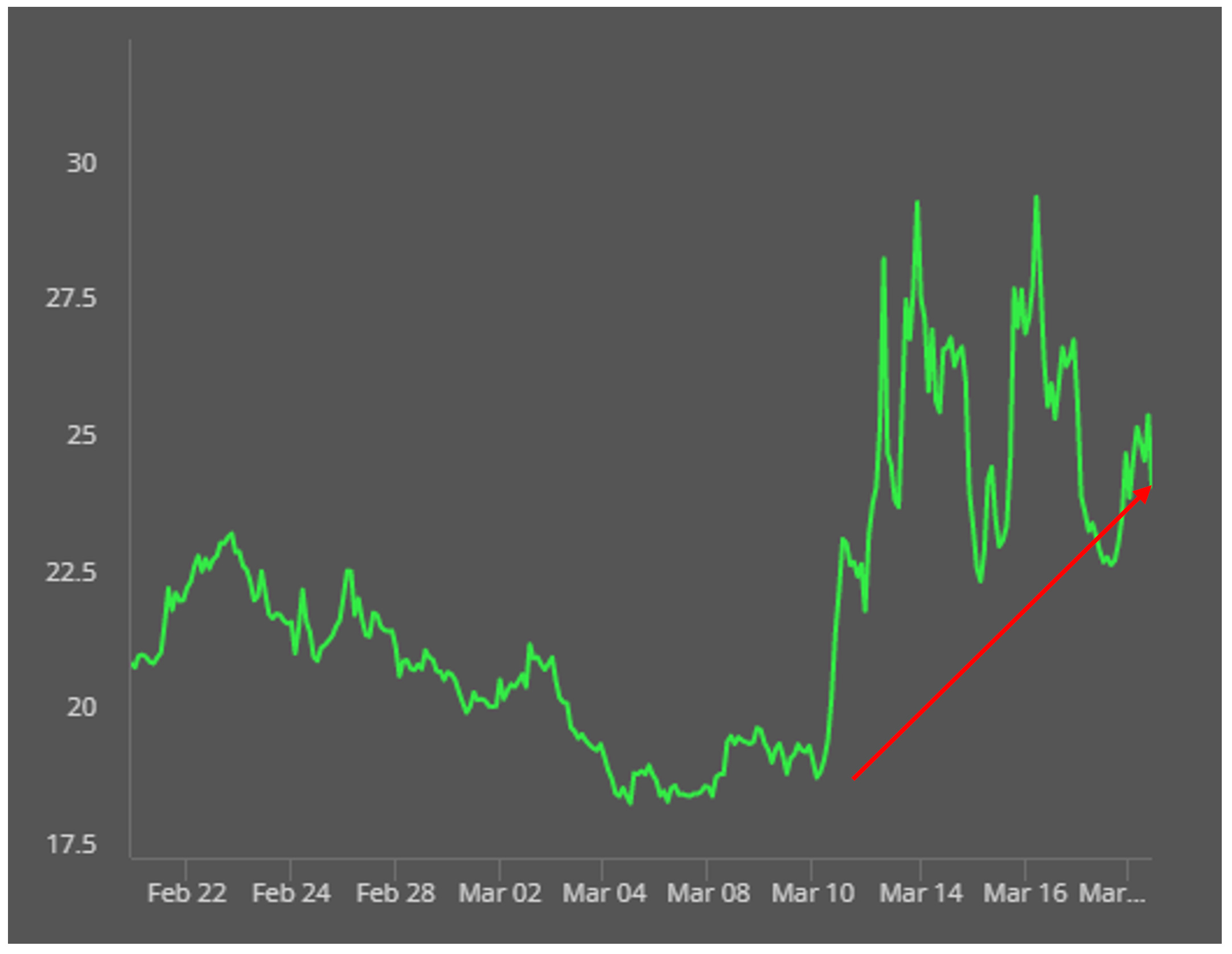

As this dynamic has unfolded we have also seen a significant spike in the volatility of both the stock and bond markets. Presently the Bond market in the U.S. is pointing to a recession occurring in the near future which has been met with a material increase in share market volatility over the last month (noted in the graph below).

Share market volatility

Source: CBOE: VIX

Of course, with the heightened levels of risk and uncertainty, we have also seen a response in markets with the Dow Jones off 4.4 per cent last week and the S&P 500 off 4.55 per cent. The Australian Market performed noticeably better with the ASX-200 down 2.1 per cent and the Small Ordinaries off 2.6 per cent respectively for the same period.

An interesting observation, currently there is immaterial bank exposure in the small cap index in Australia. Which leads us to the following questions, why is this part of the market demonstrating additional volatility and is there an opportunity from this for investors.

To answer the first question we need to consider that any event that creates ripples in global markets will also cause stress here. Secondly, as a general rule of thumb smaller companies are not considered as stable and as resilient as some of their larger counterparts. Generally, they also tend to be less mature businesses that are earlier in their lifecycle than larger companies. These characteristics mixed with lower liquidity (relative to large caps), and a general risk off stance by investors will almost certainly see more selling pressure in Small Companies at times of market stress.

Keeping all of this in mind the events outlined above are also likely to take an impact on the trajectory at which central banks increase rates. Given financial duress in markets generally always fuels a broader knock in confidence for both businesses and consumers it is not out of the realms of reality that many take a pause here to watch what further unfolds.

This week will be an important one with FOMC (Federal Open Market Committee) meeting to discuss the next move in interest rates in the U.S., this meeting and the subsequent statements from Jerome Powell and his colleagues will no doubt impact the market narrative this week.

So, what does this mean for Small Cap investors?

As we have mentioned in previous posts we focus on companies we feel have a competitive advantage, strong balance sheets, and bright prospects. While we have immaterial banking exposure in our index our market is still heavily impacted by the ripples events like this create. The Montgomery Small Companies Fund performed well over reporting season providing evidence we are invested in some of the best companies for a softening economic outlook. These recent results give us the belief that the portfolio is in good shape for the volatility ahead of us.

Presently we continue to hold a slightly elevated level of cash in the portfolio at 7.5 per cent. This is the dry powder that we like in moments like what we have before us. Our portfolio is also more liquid than the market, we have less debt than the market and more earnings growth than the market (industrials). Finally, our portfolio is trading at a discount further adding to its attractiveness.

Given these characteristics coupled with our ability to utilise our cash position, we will continue to nibble away at building positions in businesses we believe will shine through in the medium term.

When investing in small companies we are mindful of the risk but also aware there will be more volatility in this sector of the market. We do see that as an opportunity for us, as active stock pickers constructing a bottom-up portfolio, moments like these can present some of the best opportunities for future returns and alpha generation.