Virtuous and Viscious Cycles

For the past decade, the energy sector and Emerging Markets have been fuelled by a growing China. Now, as China slows and the oil price plummets, the feedback loop has turned decisively viscious. But after having it so good for so long, have today’s market participants fully understood the downside risk?

In Andrew’s recent video insight, it was put forward that a material fall in the oil price would have a greater impact on new investment in the US rather than existing production. The multiplier effect from falling investment on the broader economy can be profound, and according to a recent article by Reuters, it seems that this thesis is already playing out:

- The West South Central division, comprising Texas, Louisiana, Oklahoma and Arkansas, had seen the strongest growth for four years, but in October [the] survey lagged the rest of the nation, with economic gauges improving in six regions and two recording no change. “The fact that the economic index is in decline in this region signals that the economy in these oil states is heading for an economic slowdown” said Jerry Thomas, president of Decision Analyst.

- Responding to a more than 40 per cent drop in crude prices since June, at least a dozen US energy companies have cut spending plans for next year.

- The number of well permits fell almost 40 per cent nationwide in November, according to industry data firm Drilling Info Inc., which means fewer jobs and less related business.

- For Karr Ingham, whose firm Ingham Economic Reporting monitors rig counts, permits and the oil economy in Texas, there is no doubt that hard times are just round the corner. “A slowdown is coming, period. It’s just a matter of time.”

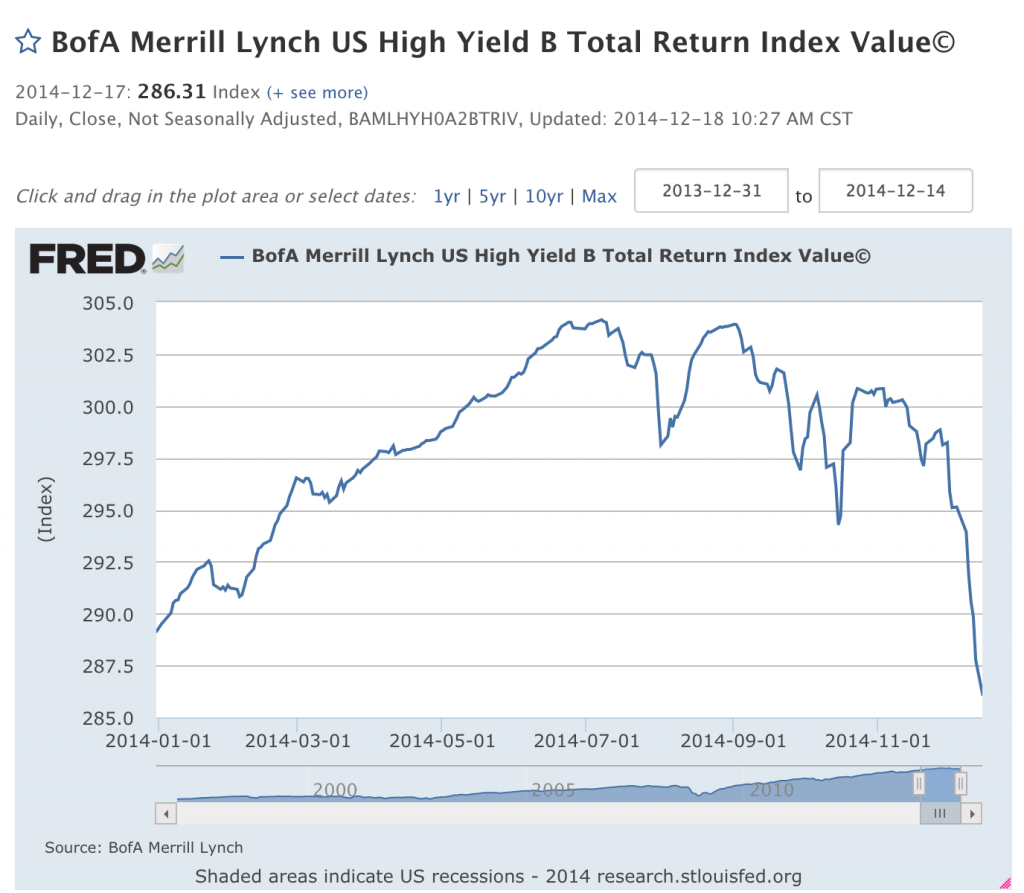

The last time oil was at US$56/bbl was during the GFC, over six years ago. A prolonged period of strong growth in emerging economies has caused the global market to underestimate the risk that a serious correction could occur, as evidenced by the significant fall in the high-yield bond market.

As a recent article from Bloomberg explains, many of today’s traders and investors are yet to experience the effect of mass capital outflows from Emerging Markets. According to Stephen Jen, a prominent foreign currency strategist comments:

- Many became EM specialists after the term ‘BRIC’ was coined in 2001 and don’t know any serious crisis.

- My long-standing view on [Emerging Market] currencies is that they could melt down because there has simply been way too much cumulative capital flows. Nothing the EM economics can do will stop these potential outflows as long as the U.S. economy recovers.

- At some point, the risk of fractures in parts of EM will rise sharply.

It is unfortunate that human beings are predisposed with short-term memories. Since the GFC, the market has been enjoying a virtuous cycle. But just because a crisis has not occurred in recent memory, does not mean that it will not occur again.

To get a sense of the potential fallout from the plunging oil price, take a look at the breakeven prices of the major oil producing countries in order to balance national budgets, according to the IMF.

It is because of these risks that Montgomery Investment Management has a sole focus on investing in quality companies with bright prospects and sufficient margins of safety. While even the best quality companies can experience price declines when markets capitulate, their earnings are better shielded from the effects of a viscous cycle than the broader market. The Montgomery funds are also somewhat protected with relatively large cash holdings.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Saudi Arabia don’t want to reduce oil production because they want to keep the oil price low for the short to medium term. They want to starve the US shale oil producers who are debt funded in the hope they will drop out because of low oil prices and therefore production will come down again and the oil price will go up again.

It will be interesting to see how the energy sector plays out. Germany and Portugal have 60-70% of their energy from renewables, the government gave subsidies for solar panels and wind.

Solar and wind is a lot cheaper now than it was 5 years ago.

France get 60% of their energy from nuclear.

Australia will supply a lot of gas to Asia soon.

Interesting you say this! I have been keeping up with oil and if my memory serves me well, Saudi Arabia thinks that the actual price is not reflecting current supply and demand. But they also said that OPEC would happily let prices go to $40 a barrel.

I would have to agree speculators are a big blame for this huge decrease in oil prices.

US’s new extraction methods is pumping more oil into the market which has been a reason for decline. They usually didn’t sell in Europe hence why Brent Oil cost more but now the difference is shrinking which is a bit of evidence that America is increasing supply pressures in other major markets.

I know I’m a bit thick, but I don’t know what a viscous cycle is.

Oils ain’t oils Greg!

This just in: “OPEC won’t cut production even if the oil price drops to $US20 a barrel and it’s unfair to expect the cartel to reduce output if non-members don’t, Saudi Arabia said.

“Whether it goes down to $US20 a barrel, $US40, $US50, $US60, it is irrelevant,” the kingdom’s Oil Minister Ali al-Naimi said in an interview with the Middle East Economic Survey (MEES), an industry weekly.

In unusually detailed comments, Mr Naimi defended a decision by the Organization of the Petroleum Exporting Countries, whose lead producer is Saudi Arabia, in November to maintain a production ceiling of 30 million barrels per day.

The decision sent global crude prices tumbling, worsening a price drop that has seen them fall by around 50 per cent since June.

Saudi Arabia has traditionally acted to balance demand and supply in the global oil market because it is the only country with substantial spare production capacity, according to the International Monetary Fund.

The kingdom pumps about 9.6 million barrels per day but Naimi said it is “crooked logic” to expect his country to cut and then lose business to other major producers outside OPEC.

The increasingly competitive global oil market has seen daily United States oil output rise by more than 40 per cent since 2006, but at a production cost which can be three or four times that of extracting Middle Eastern oil.

“Is it reasonable for a highly efficient producer to reduce output, while the producer of poor efficiency continues to produce?” Mr Naimi asked during the interview with MEES.

“If I reduce, what happens to my market share? The price will go up and the Russians, the Brazilians, US shale oil producers will take my share.”

He added that it was “unfair” for the cartel to reduce output because it was not the world’s major oil producer.

“We produce less than 40 per cent of global output. We are the most efficient producer. It is unbelievable after the analysis we carried out for us to cut.”

In Asian trade on Tuesday, prices nudged higher on hopes of improved economic figures from the United States.

US benchmark West Texas Intermediate crude for February delivery gained US64c to $US55.90 while Brent crude for February was up US33c to $US60.44 in afternoon trade.

Prices were above $US100 a barrel earlier in 2014.”