The tough September 2015 Quarter

The S&P 500 -6.9 per cent; the Australian All Ordinaries Index -7.2 per cent; the Nikkei 225 -14.1 per cent; the MSCI Emerging Markets Index -19 per cent; the Shanghai Composite Index -28.6 per cent – it sure was a tough September 2015 Quarter.

In this context we are pleased to report the relatively good performance from Montgomery Investment Management during September 2015 Quarter with The Montgomery Fund down 1.5 per cent; the Montgomery [Private] Fund down 1.1 per cent; and the Montgomery Global Fund, which was assisted by the falling Australian dollar, up 1.9 per cent.

Montaka*, which is designed to provide “wholesale investors” the benefit from both gains of extraordinary businesses and the declines of deteriorating businesses, with greater capital protection when share markets turn down, was up a very pleasing 13.87 per cent for the Quarter. This was also assisted by the falling Australian dollar.

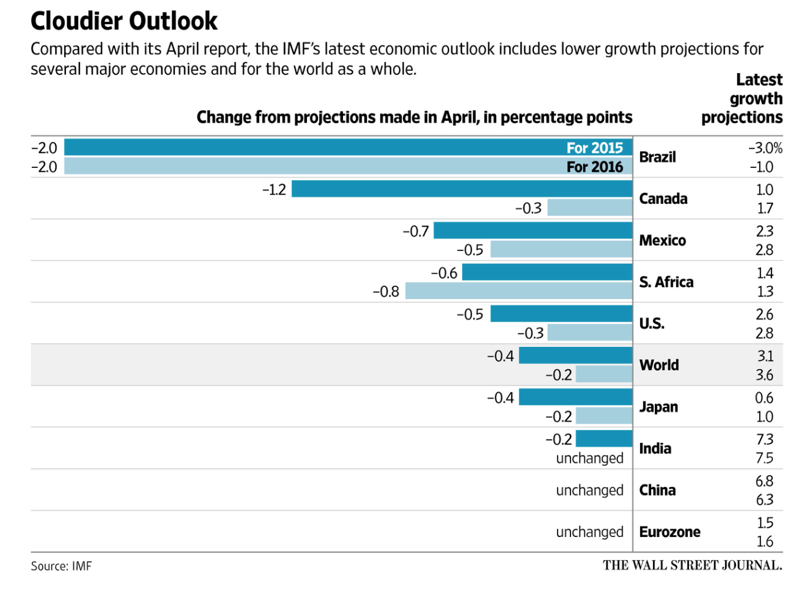

The International Monetary Fund (IMF) again lowered its global growth forecasts to 3.1 per cent for 2015, the weakest expansion since the global financial crisis. Emerging economies have been downgraded with Brazil and Russia expected to contract 3.0 per cent and 3.8 per cent, respectively. The Institute of International Finance, an industry group, estimates 2015 will mark the first net exodus of capital out of emerging markets in 27 years. Continuing soft commodity prices, the result of China’s slower forecast growth, has hit a number of commodity-based economies and a coming wave of corporate defaults seems likely. Academics Carmen Reinhart and Kenneth Rogoff claim that if a country’s external debt to GDP ratio exceeds 30 per cent, there is a material risk of a credit default. Based on information from Joint External Debt Hub, there are 25 countries believed to exceed this ratio. Interestingly, 19 of them are based in Eastern or Southern Europe, with Greece easily winning the gold medal with a gross external debt to GDP ratio of 210 per cent.

Academics Carmen Reinhart and Kenneth Rogoff claim that if a country’s external debt to GDP ratio exceeds 30 per cent, there is a material risk of a credit default. Based on information from Joint External Debt Hub, there are 25 countries believed to exceed this ratio. Interestingly, 19 of them are based in Eastern or Southern Europe, with Greece easily winning the gold medal with a gross external debt to GDP ratio of 210 per cent.

Countries like Romania, Ukraine, Poland, Belarus and Turkey have a combination of high current account deficits and high external indebtedness and with the Federal Reserve’s planning to raise cash rates, a stronger US Dollar is putting pressure on both corporate and national balance sheets.

*The Product Disclosure Statement for the Montaka Global Access Fund which invests directly into the Montaka Global Fund is now available. To receive these documents please click here.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Hi David, is the 13% figure quoted for the Montana fund before or after performance fees?

Hi Carlos this is after all fees and expenses.

Surely more then 25 countries have an external debt to GDP ratio exceeding 30%, maybe it would be 25 countries if we are just talking public debt.

External debt as defined by offshore borrowings usually in US dollars and hence any currency depreciation is detrimental.

The title of the graph above should be: ‘A Bright Outlook’. Most nations and the whole world predicted to grow more strongly in 2016! Given the recent pull back, an obvious ‘Buffet moment’ had presented itself. If you take a helicopter view of the world economy, it is chugging along nicely post GFC, green shoots prevalent for the last 3 years, and still the vast majority of the financial media choose to print gloom (because it sells). Luckily a few such as Switzer are persistently positive about Global Growth based on evidence (shown above in the graph). Buy, buy, buy!!!

Thank you for that Ben. It’s also good to remember Peter Switzer was “bullish” on the Australian market seven months ago, just prior to its 1000 point decline to below 5000 points. Regards, David