The story on iron ore

Since the beginning of 2014 the iron ore price has declined by around 20 per cent, from US$130-$135/tonne, to US$105-$110/tonne. Unusually, the Australian dollar to US dollar exchange rate has, over this period, appreciated slightly to just over US$0.90.

In the December 2013 quarter, Australia exported 151.5 million tonnes of iron ore, or an annualised 606m tonnes. While a US$25/tonne price reduction would compress the annual export value by US$15 billion, this should be partially made up from expanding volumes.

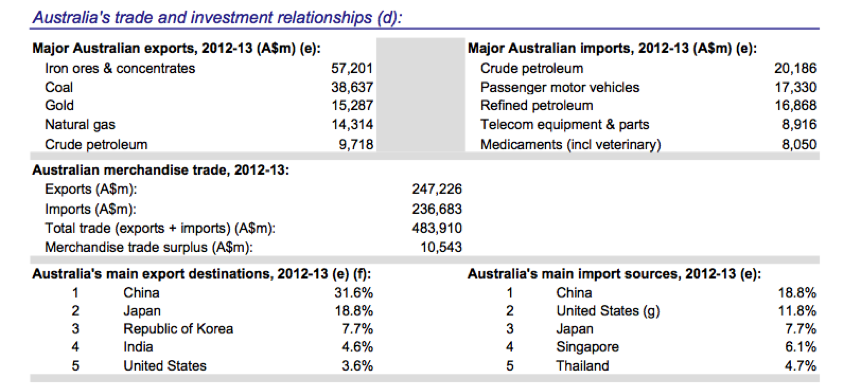

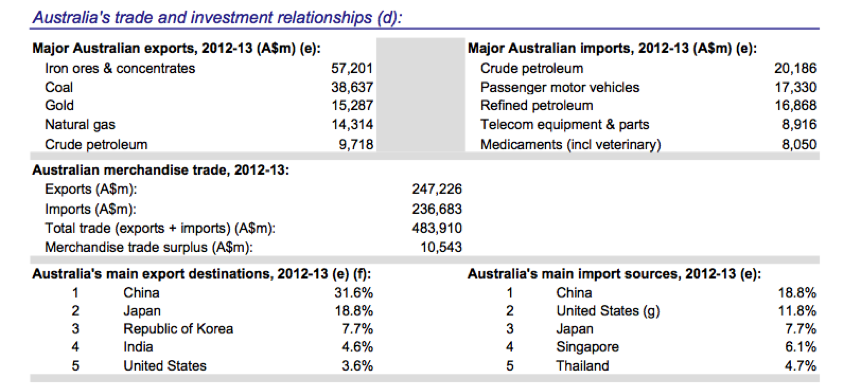

For context, Australia exported $247 billion of goods in the year to June 2013, and iron ore accounted for $57.2 billion or 23 per cent. The fiscal 2012/13 merchandise trade surplus was $10.5 billion, and this looks set to come under pressure.

Readers will be interested to see China and Japan accounted for a combined 50 per cent of Australia’s exports, while China, Japan, South Korea, India and the USA accounted for a combined two-thirds of Australia’s exports.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.