The quality quotient in long-term alpha

Investors are generally taught that highly concentrated portfolios mean taking on more risk, but that may not always be the case. In Polen Capital’s experience, the perceived risk of holding a concentrated portfolio can be offset by owning high-quality investments. By owning a concentrated portfolio containing only the highest quality companies, investors can potentially take meaningfully less risk than the market while generating greater long-term performance.

Data shows that owning financially superior and competitively advantaged businesses can offer a margin of safety in almost any market. By seeking to build active, quality growth portfolios containing no more than 20 to 35 of what Polen Capital think are the best businesses globally, Polen Capital believe they are favourably positioned to generate sustainable, above-average earnings over the long term.

A powerful differentiator: quality at the market level

Markets have shown how quality can be a powerful differentiator. Polen Capital examined the performance of the MSCI USA, ACWI, ex-USA, and Emerging Markets Quality indices. These indices, which are mechanically constructed around three objectively defined fundamental factors, have outperformed their broad market counterparts over the long term and, in Polen Capital’s view, illustrate how even modest improvements in portfolio quality can be worthwhile.

MSCI Quality indices select the top 20 per cent to 30 per cent of U.S. and international companies using three measures: high return on equity, low financial leverage, and stable year-over-year earnings growth.

MSCI’s fundamental factors of quality

- Return on equity (ROE): Measures a business’s profits relative to the equity its shareholders have contributed.

- Debt-to-earnings (D/E) ratio: Evaluates a business’s debt level.

- Earnings variability: Identifies earnings stability over time.

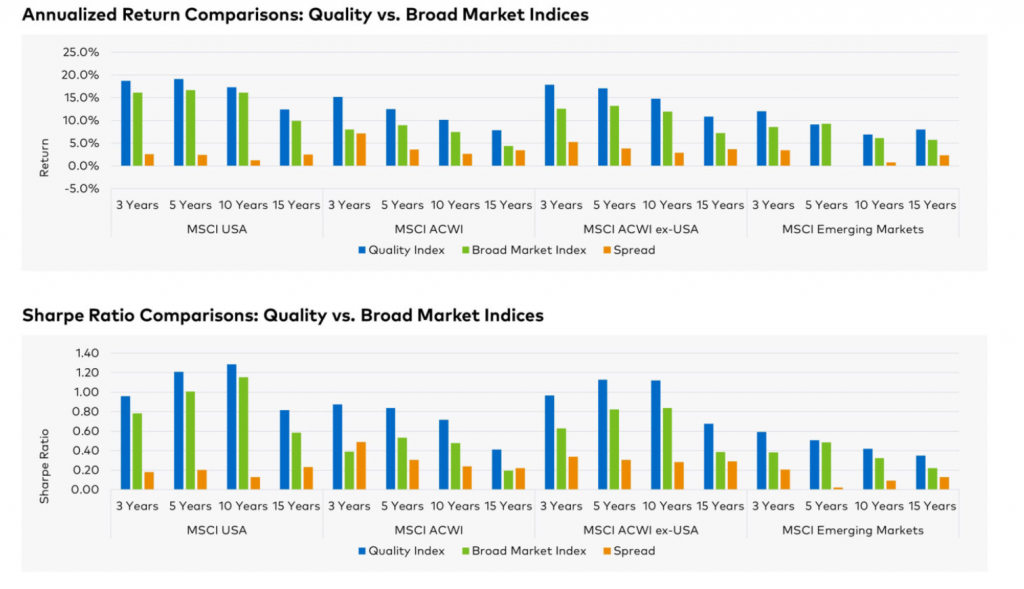

The historical performance differentials between MSCI’s broad market indices and the MSCI Quality indices across geographies and investment horizons provide, in Polen Capital’s view, a strong case for owning quality, shown in Figure 1. Over 15 years, MSCI USA, ACWI, ex-USA, and Emerging Markets Quality indices provided a 3 per cent higher annualized return on average—with less risk (as measured by Sharpe Ratio).

Figure 1: Quality vs. Broad Market Indices

Past performance is not indicative of future results. Data as of 9-30-2021. Source: eVestment. Data based on monthly returns.

For illustrative purposes only. MSCI USA, ACWI, ex-USA, and Emerging Markets Quality indices consistently outperform their broad‐based counterparts in absolute terms and when adjusted for risk (Sharpe Ratio). Sources: eVestment. Data based on monthly returns.

Setting an even higher bar for quality

Polen Capital has executed the same time-tested investment philosophy and process for more than 30 years. They think the process sets an even higher bar for quality by considering additional factors beyond MSCI’s standard quality fundamentals: ROE, debt-to-equity, and earnings variability.

Once Polen Capital apply their five investment guardrails to identify the quality universe of companies, they layer on additional research and their careful stock selection process to build a portfolio that they think offers long-term staying power.

What Polen Capital look for in a business: Five guardrails needed to invest

- Strong balance sheet with little to no debt and net cash

- High ROE

- Better than average earnings/free cash flow

- Stable or widening profit margins

- Real, organic revenue growth

These guardrails mark the beginning of the Polen Capital process by identifying the universe of quality companies. From this pool, Polen Capital select what they think are the best candidates for additional research and possible inclusion in a portfolio seeking to deliver outsized returns with minimal risk. Polen capital also integrate material ESG factors into their process – assessing risks based on materiality through the lens of all company stakeholders. Evaluating ESG factors is a natural part of Polen Capital’s overall process of considering all material risks and opportunities, and they believe a core component in assessing long-term resiliency and stability.

Quality as a safety net even in challenging markets

Polen Capital believe investing exclusively in growing, well-managed companies with strong balance sheets offers a smoother path to returns across market environments. In periods of market decline, earnings stability and financial strength can serve as a “margin of safety” that typically offers resilience amid downturns. Characteristics like earnings power, financial stability, and competitive moats can allow companies to weather tougher times and can enable them to power through a crisis faster and stronger than competitors.

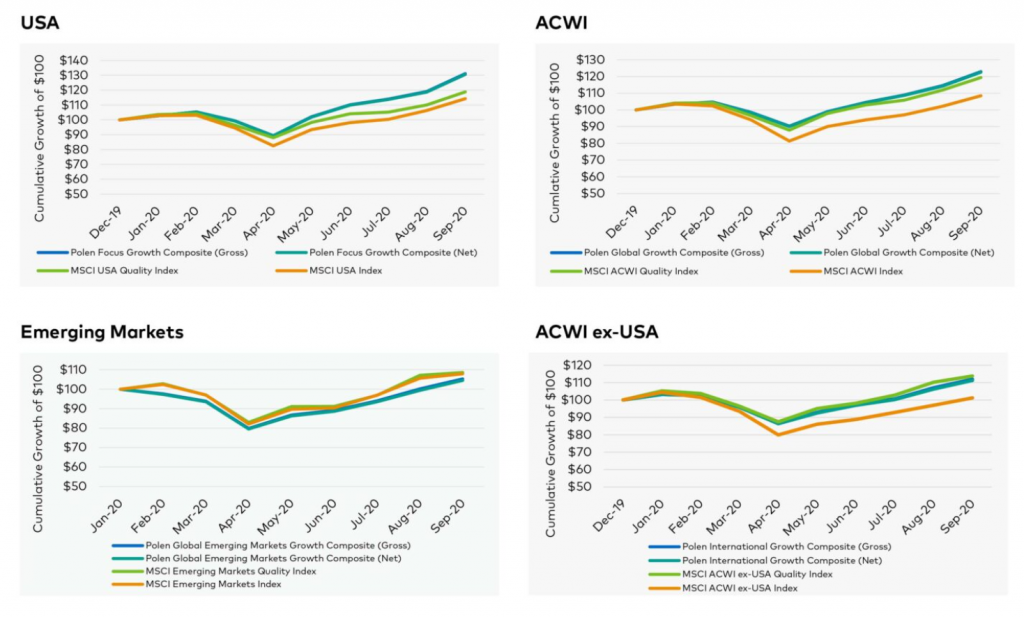

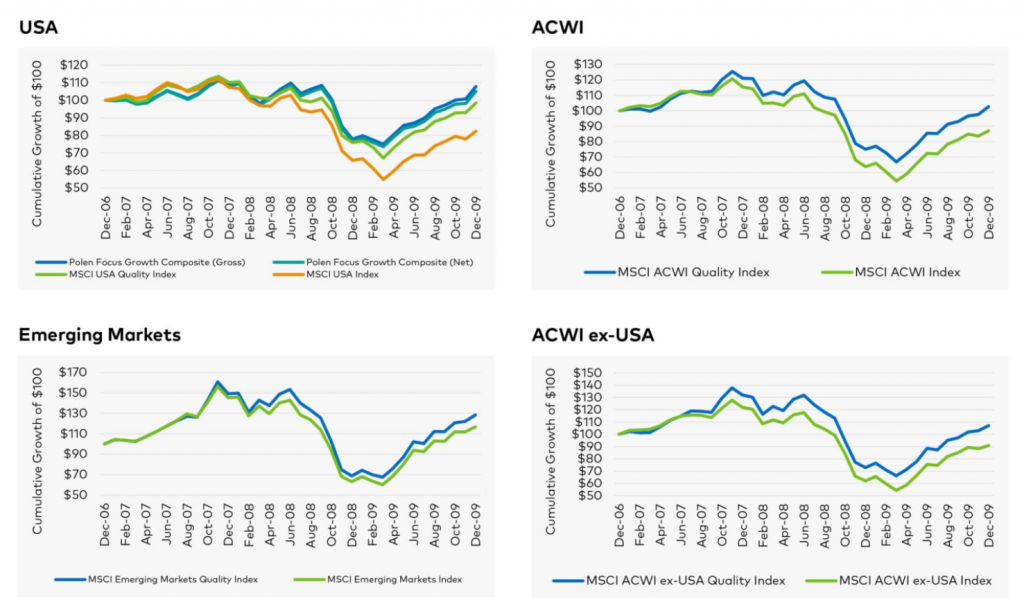

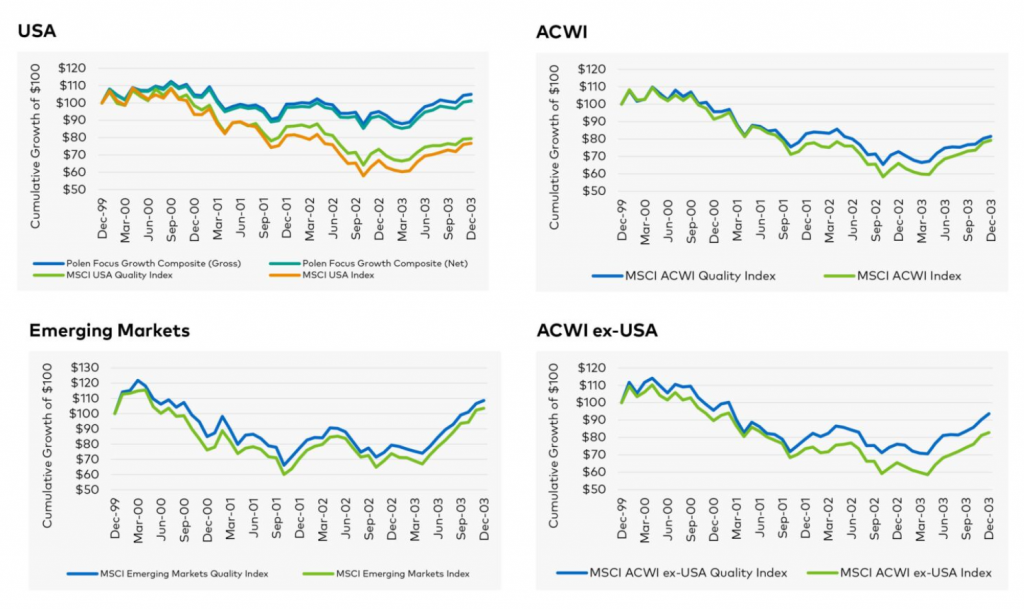

Consider the performance across four geographic universes: U.S., global, international, and emerging markets. Figures 2-4 depict the growth of $100 across three crisis environments for the MSCI Quality Indices, Broad Market Indices, and applicable Polen Portfolios where available. In all three scenarios – the Tech Bubble, the Global Financial Crisis, and the COVID-19 Crisis – quality better protected capital and rebounded stronger than the broader market. For the COVID-19 Crisis in particular, Polen Capital acknowledge this represents a short period of performance, with the drawdown and recovery occurring within an unusually compressed window. The COVID-19 recovery across regions has been ongoing and uneven to date. Longer term, we expect that Polen’s higher bar for quality will continue to provide a clearer path to compelling long-term outcomes.

Figure 2: COVID-19 Crisis

The performance data quoted represents past performance and does not guarantee future results. Based on monthly returns. Current performance may be lower or higher. Please reference the following GIPS reports: Global Growth, International Growth, Global Emerging Markets, Focus Growth. Source: eVestment. Data from 12-31-2019 to 9-30-2020 and 1-1-2020 to 9-30-2020.

Figure 3: 2008 Global Financial Crisis

The performance data quoted represents past performance and does not guarantee future results. Based on monthly returns. Current performance may be lower or higher. Please reference the following GIPS reports: Focus Growth. Source: eVestment. Data from 12-31-2006 to 12-31-2009.

Figure 4: Tech Bubble

The performance data quoted represents past performance and does not guarantee future results. Based on monthly returns. Current performance may be lower or higher. Please reference the following GIPS reports: Focus Growth. Source: eVestment. Data from 12-31-1999 to 12-31-2003.

By focusing on identifying quality companies that have the potential to weather challenging market environments, Polen Capital believe they can provide a favorable foundation for their portfolios to generate attractive relative performance. Polen Capital’s time-tested investment process is reinforced by our more than 30 years of data and research that they think shows concentrating on quality, principal protection, and long holding periods are key characteristics of a strong investment discipline that can work over time and across geographies.

Montgomery in partnership with Polen Capital currently make available two global equity strategies employing the time tested approach.

To learn more about the Polen Capital funds, please visit the fund web pages:

Wesley Horn

:

Many years ago I thought ROE was the most important element in selecting good investments. This was what I was led to believe. But it is only a first screen. It’s a bit like looking for a new car to buy. ROE equates to the style of the car. If you like the look of it, you then look under the bonnet and other features to see whether it really is a good buy.

In a nutshell, if a company isn’t getting bigger through increased EPS at an acceptable ROE it’s going nowhere. To match that you want to see increased revenue, and not just cost cutting or product price increases. Although all of these can be significant contributors.

What is a given is if EPS grow at an acceptable rate with strong ROE, the share price will automatically follow. One of the worst examples of high ROE failing to produce a worthwhile investment is Platinum Asset Management. It simply has not grown EPS because it hasn’t grown funds under management. I was an investor and lost money on it.

ROE is an important element and you shouldn’t invest if it is low, but never invest on that basis alone.