The Polen Capital Global Growth Strategy is now available via BT Panorama

Our partnership with the U.S. based Polen Capital has evolved since we formally announced the relationship in March last year. Since then, we have launched two of their strategies in Australia with a third, the Polen Capital Global Emerging Markets Growth Fund, in the works. The first strategy, the Polen Capital Global Growth Fund, is now accessible to investors via the BT Panorama platform. The fund is accessible to investors via Netwealth and HUB24 IDPS and Super/Pension.

Whilst the strategy has had a tough 12 months on a relative basis since being launched in Australia, the Polen Capital Global Growth strategy importantly has a long-term track record of delivering to investors. Since launching in March 2021, it has delivered a return of 0.11 per cent after fees which alone looks underwhelming. When compared to other global equity managers in its Morningstar category (Australia – Equity World Large Growth), the average return across this cohort over the same period of time to the end of March 2022 has actually been -0.04 per cent, also after fees. It has indeed been a challenging period for a lot of growth focused global equity managers in Australia!

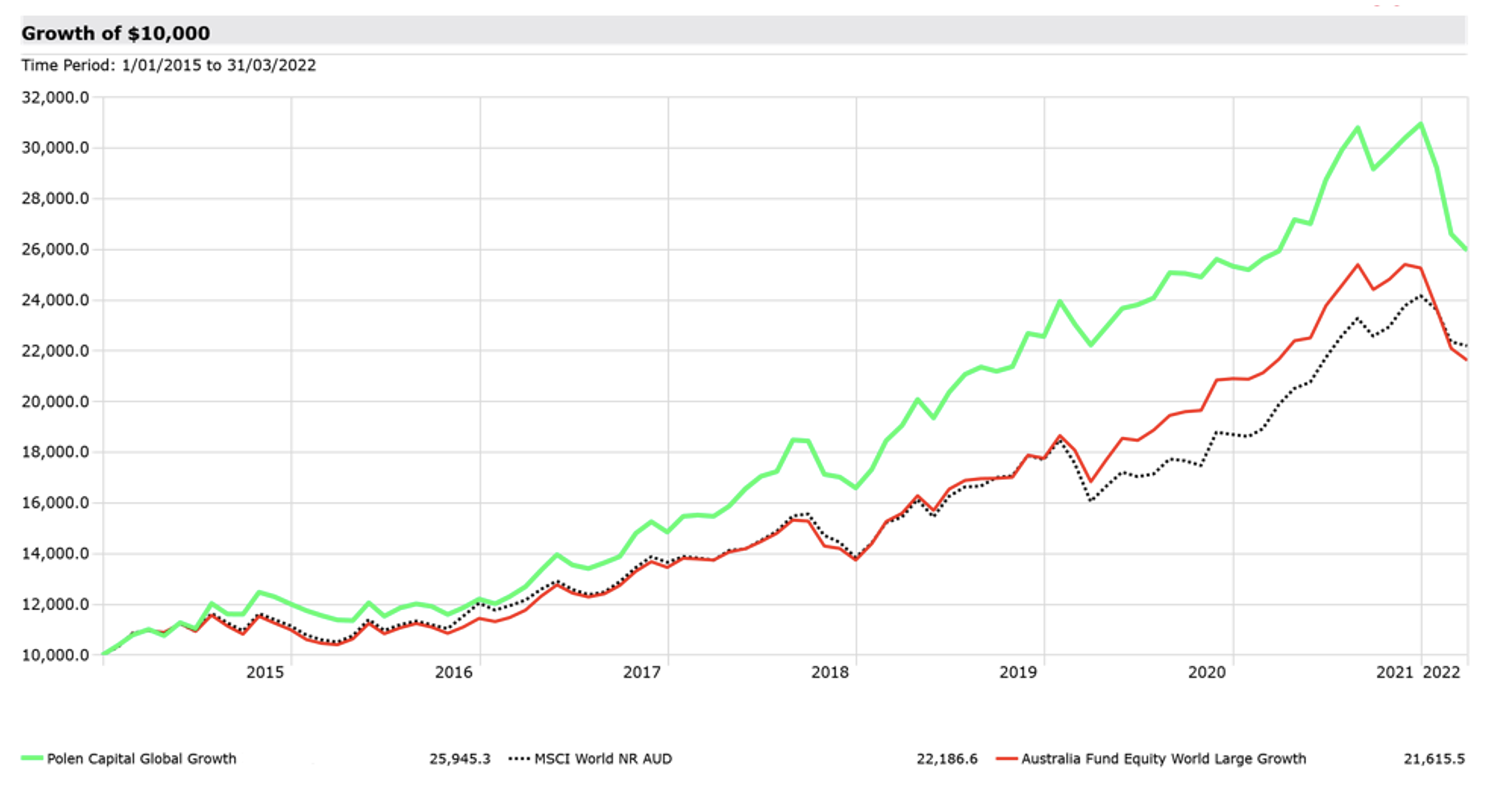

It is important to recall that since the strategy’s US inception at the end of 2014, the Polen Capital Global Growth (B Class) strategy has delivered a compound annual return of 14.06 per cent p.a. after fees in Australian dollar terms.* This represents outperformance of over 3 per cent above MSCI ACWI Index in Australian dollars (10.98 per cent p.a.). Conversely, it’s corresponding Morningstar peer-set over the same period of time has delivered just under 12 per cent p.a. compound annual return, also on an after fees basis.

Just as Polen Capital do with the businesses they own, it is best to take a longer-term view on the strategy and it’s performance outcomes as a prospective investor.

Source: Montgomery/Morningstar

As an aside, the Polen Capital Global Growth strategy also screens as one of the top-rated strategies available in its category from an Environmental, Social and Governance perspective on Netwealth.

If you would like to see any of the other Polen strategies available on a platform, please don’t hesitate to lodge your interest at office@montinvest.com.

You can also access the full platform availability of strategies across the Montgomery stable here: Montgomery platform availability

*Source: Montgomery/Archer. The Fund’s inception date is 15 March 2021. Performance for prior periods is based on the actual performance of the Polen Capital Global Growth strategy managed by Polen Capital since 31 December 2014, adjusted for fees and converted to AUD and assumes all distributions are reinvested. The Fund invests using the identical strategy to the Polen Capital Global Growth Strategy and is advised by the same investment management team managing to the same investment objectives. Past performance is not a reliable indicator of future performance.