Montgomery Small Companies Fund and investing over the longer term

We all know that equity markets don’t travel in a straight line, and that has been the case for equity markets over the last couple of years. Looking back at some of the major events that investors and equity markets have had to contend with, and we can list a global pandemic, massive monetary and fiscal stimulus in response, lock-downs like never seen before, then re-opening, supply constraints coupled with strong demand, a Russian invasion on Ukraine, now inflationary pressures across the globe, interest rates on the rise and meanwhile companies are adapting to the changing environment but ultimately trying to execute on delivering the best products or services to their customers and generate growing profits.

I call out this last two-year period as the Montgomery Small Companies Fund (the Fund) has been managing client money for a little over this period (inception 20/09/19). What a roller coaster ride it has been. More recently the Fund has underperformed the S&P/ASX Small Ordinaries Total Return (TR) index over the last six months by around 9 per cent. The performance over the longer-term is pleasing as it has delivered a 43.94 per cent return against the benchmark of 23.26 per cent, after fees.

However, two and a half years it still not long-term and only halfway of the recommended five-year plus time frame equity investors should be looking to hold an investment of this kind.

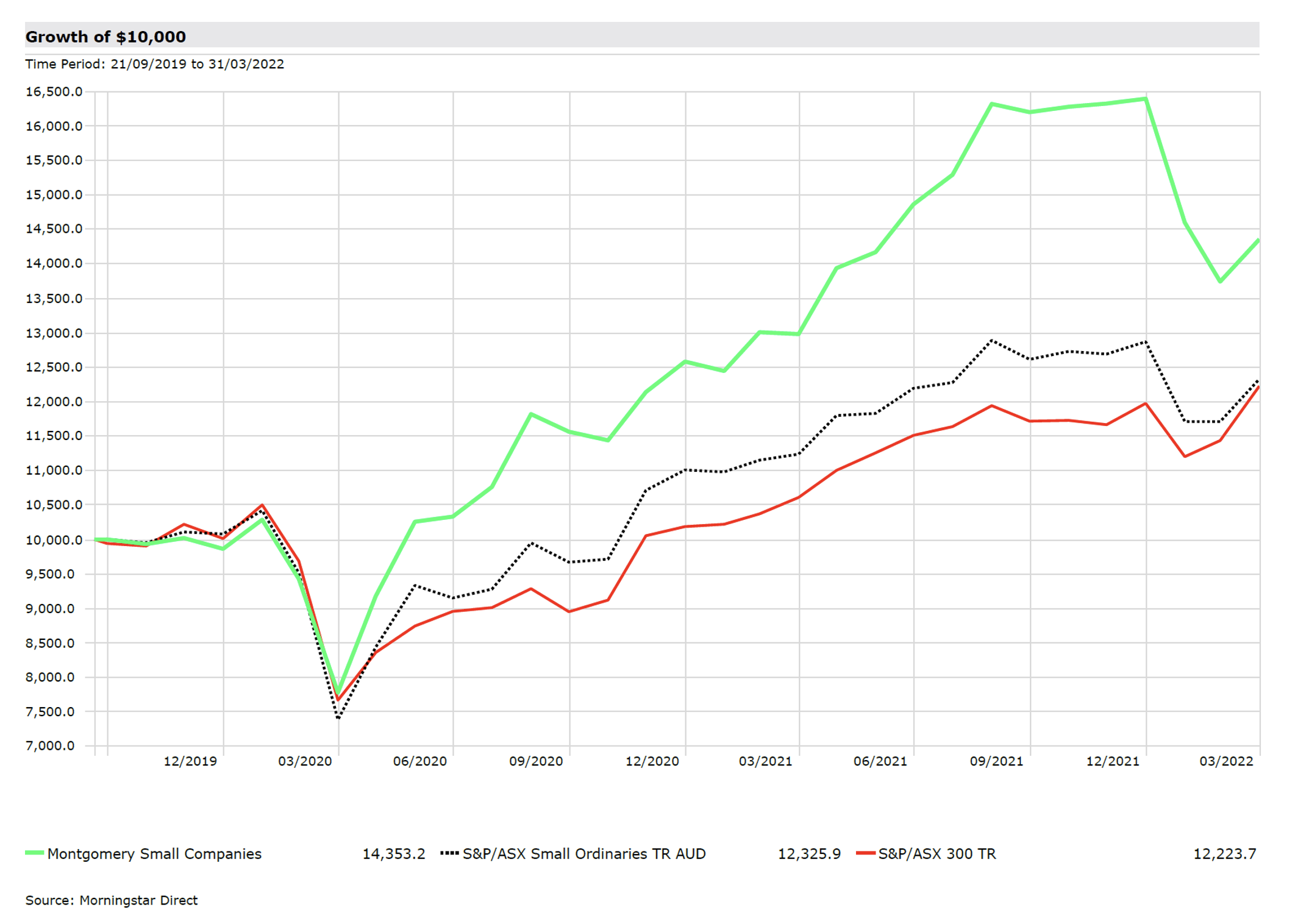

If we look at figure 1 below, we can see that the returns for the Fund have been strong in an absolute sense and on a relative basis. Included in the comparison chart are both the S&P/ASX Small Ordinaries TR index and the commonly known S&P/ASX 300 TR index, which is the total return (TR) for the top 300 stocks in the ASX with dividends re-invested. Interestingly, both the small cap index and the top 300 index have performed roughly the same over this period.

Figure 1. Total Return of $10,000 invested at the inception of the Fund (20/9/2019)

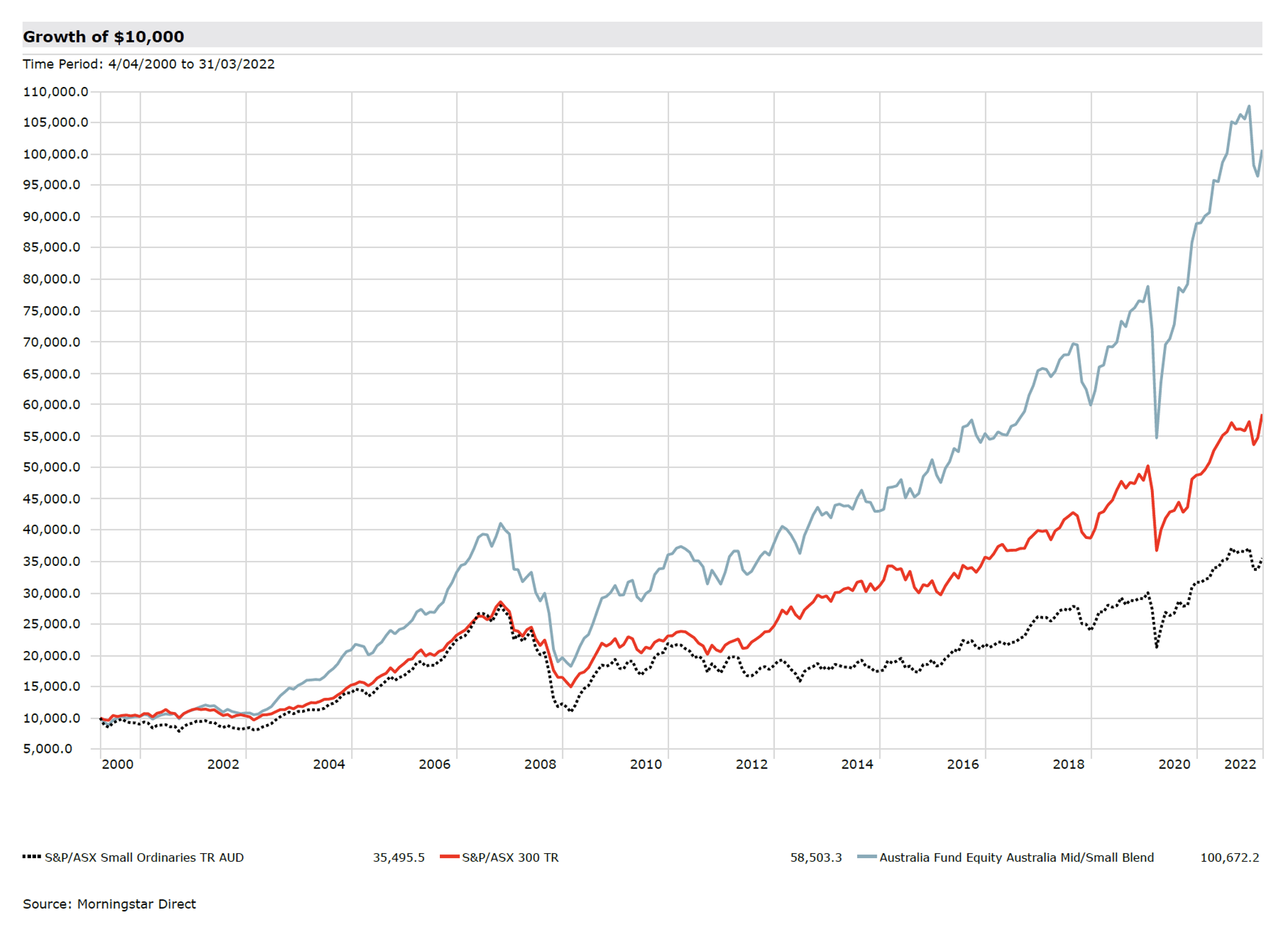

These returns from the Fund since inception have placed it in the top half of all managers in Morningstar’s category group of Australian small/mid cap managers who sit in a “blend” category, which means they can have some growth and value characteristics. The reason this is interesting becomes apparent when we look at Figure 2, which illustrates the returns of both the S&P/ASX Small Ordinaries TR index and the S&P/ASX 300 TR index as well as the average return from the managers in the Morningstar peer group of Australian small/mid cap Blend managers over a 22 year period (the longest data available).

Figure 2. Total Return of $10,000 invested at back on 4/04/2000

Now it’s important to note that past returns are not a good indicator of future returns and I’m sure the next 22 years will be different but what is observable is that the average manager in Morningstar Australian Mid/Small Blend category substantially out-performed the small cap index and the big cap index (S&P/ASX 300 TR index) over this 22-year period.

In fact, investors in the average manager in this category earned a x10 return on a $10,000 investment to achieve a $100,672 return. So, while there have been significant market events over the last 22 years including the most recent six month challenging period, investors have been well rewarded by their average active manager in this category.

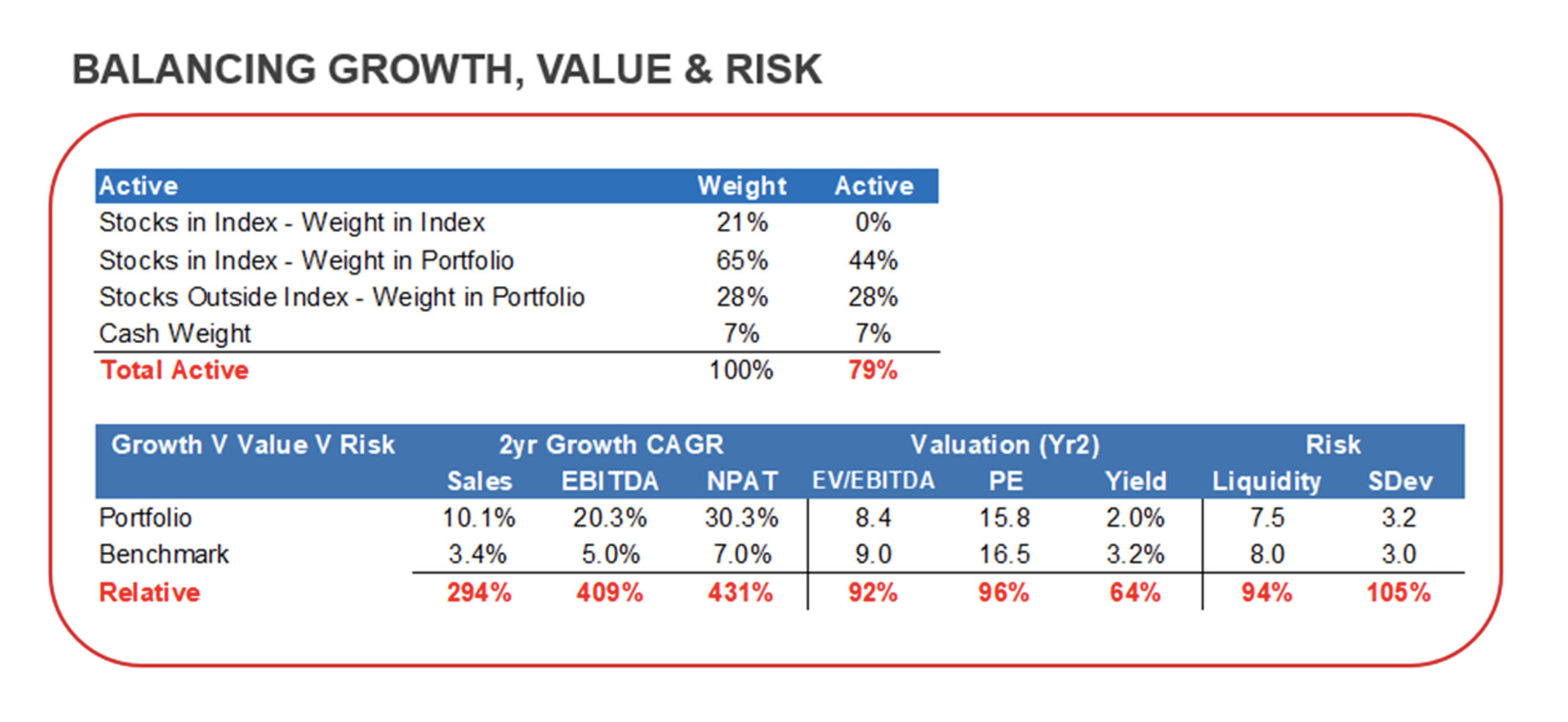

Finally, when we look at the fundamentals of the Fund at the end of March 2022 as shown in Figure 3. We see the sales growth in our portfolio is nearly three times higher than the market. Our earnings before interest, taxes, depreciation, and amortization (EBITDA) and net profit after tax (NPAT) are growing over four times faster than the market (up from 1.9 and 1.7 respectively 6 months ago). However, what is more interesting is that our Enterprise Value and Price Earnings have moved from being at a slight premium to the market to now coming in at a discount to the market.

Figure 3. Montgomery Small Companies Fund portfolio characteristics

Based on the portfolio metrics above, we believe that the Fund’s portfolio represents a compelling level of value based on its historical standards. Investors can gain an exposure to what Montgomery believe is a portfolio of quality, growing companies at a discount to the market. So even though the portfolio has underperformed the benchmark in recent times, we see latent value in our underlying holdings which should set it up for a good opportunity to out-perform in the future.

Robert Warren

:

Would like to hear the teams comments on Aeris Resources on the sale agreement of Round Oak Minerals it seems like a good fit for Aeris but what do the team think about the price they are paying.

Do you guys at the small companies fund believe that this resource will take Aeris to another level or will the dilution of shareholders in which Aeris already had a large number of shares make this a good investment and add value for the future

Roger Montgomery

:

Hi Robert, David Buckland has written on your question and published today.