The Polen Capital Global Growth Fund receives a “Recommended” rating from Lonsec

We are pleased to announce that Lonsec, in their second year of coverage, has upgraded the Polen Capital Global Growth Fund (Class B Units[1]) to ‘Recommended’. This is the second highest rating available for strategies they research.

To summarise some of Lonsec’s comments, “Lonsec views positively the leadership exhibited by Head of Team and Portfolio Manager Damon Ficklin, and his track record in implementing the firm’s investment philosophy and process. Additionally, Lonsec highlights the strong, collaborative culture of the team and has gained conviction in their research output.”

While the Fund was only established and made available to Australian investors in partnership with Montgomery in March 2021, the underlying strategy boasts a track record of more than eight years offshore, outperforming its benchmark (the MSCI ACWI Accumulation Index) by two per cent per annum post fees in Australian dollar terms[2]. This represents an accumulated annualised return of 12 per cent per annum post fees since the strategies inception, also in Australian dollar terms.[3]

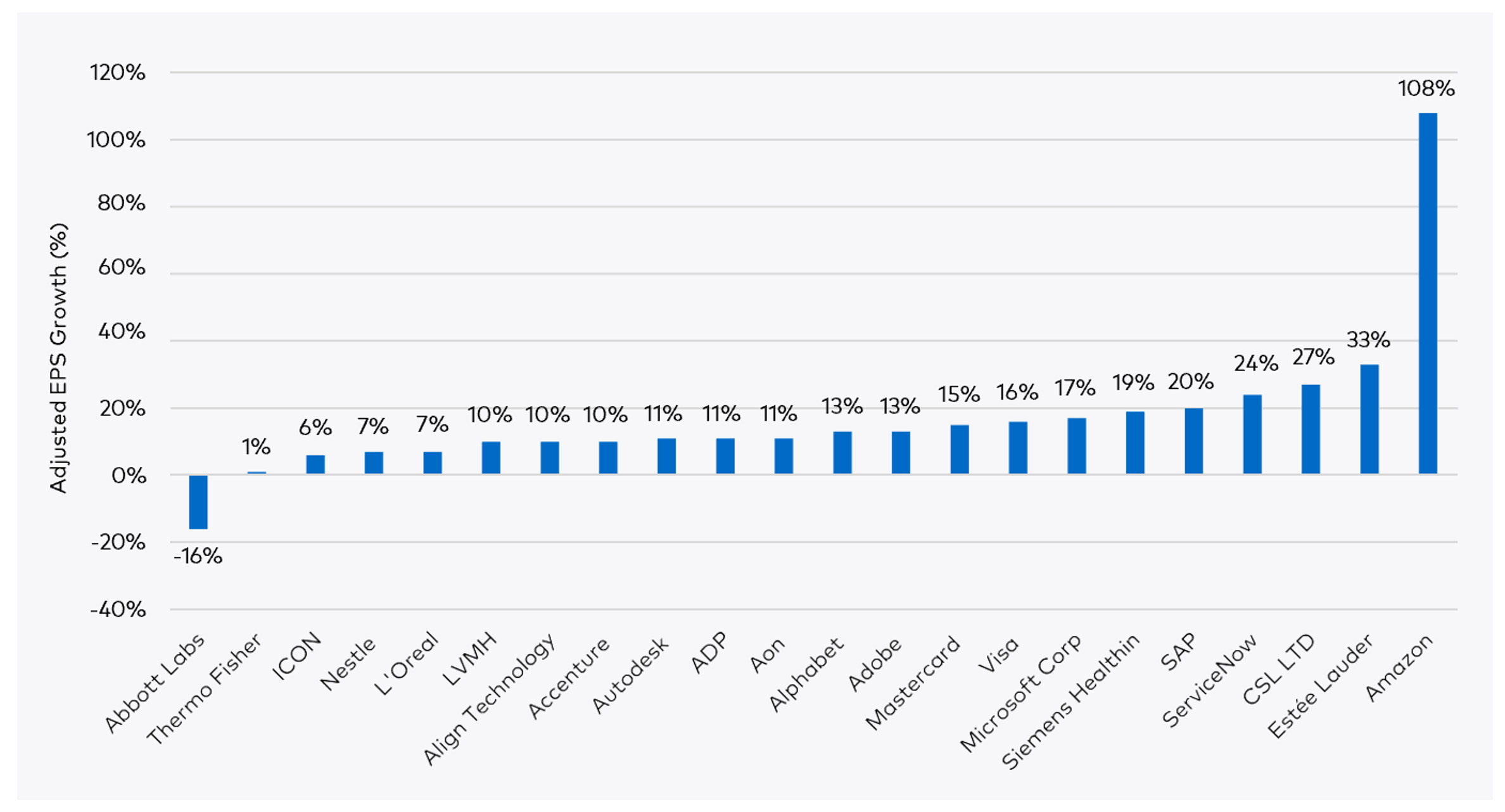

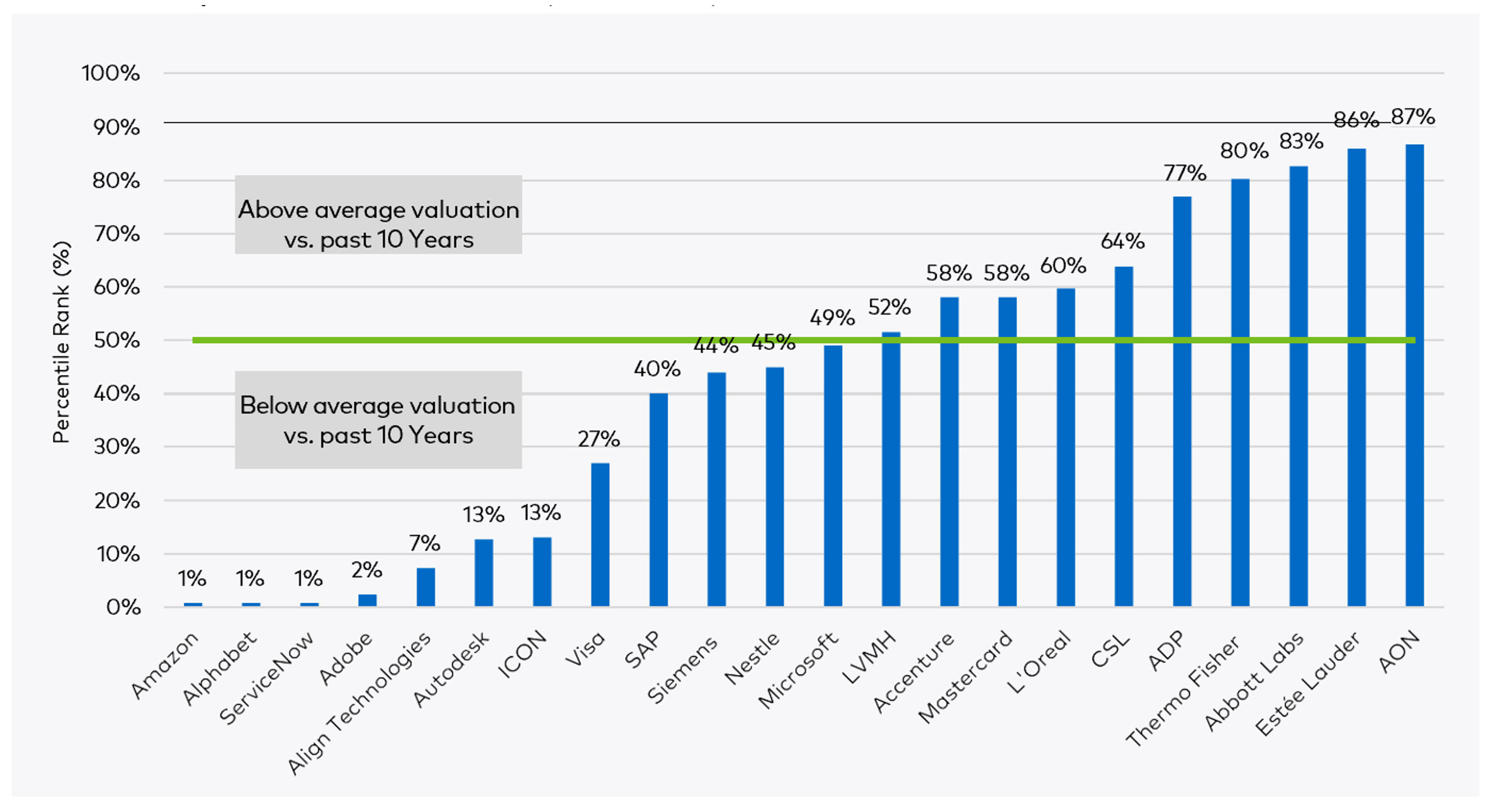

We also think the quality of the portfolio remains resilient in more challenging times, with the Bloomberg median expectation for earnings growth (change in a companies reported net income over a period of time) still at 12 per cent for 2023 – whereas Polen’s long- term earnings growth estimates across the portfolio are closer to 16 per cent. This is accompanied by many of the companies in the portfolio trading at near 10-year share price lows from a price to earnings perspective, namely Amazon, Alphabet, ServiceNow and Adobe. Both of these observations are captured in Chart’s 1 and 2 below.

Chart 1 – Bloomberg Consensus Estimated 2023 Adjusted EPS Growth (%)

Source: Polen Capital, Bloomberg[4]

Chart 2 – Forward 1-Yr P/E, Current vs. Past 10 Years (or IPO date)—Percentile Rank

Source: Polen Capital, Bloomberg[5]

It is true Australian investors are yet to receive the full fruits of Polen Capital’s long-term process, with two of their strategies being launched on our shores only in 2021. In fact, 2022 was the worst calendar year of absolute and relative performance that Damon and his team have experienced in managing money in the Polen Capital Global Growth strategy since its inception. Despite this, it is important to remind investors that the Polen Capital team have seen many cycles in their 34-year stewardship of their flagship capability, the Polen Focus Growth strategy, which has outperformed both the Russell 1000 Growth and S&P 500 Index’s by over two percent per annum post fees in U.S. dollar terms.[6] As such, we are pleased ratings agencies like Lonsec in Australia are also starting to take notice of Polen Capital team.

The rating issued 04/2023 for the Polen Capital Global Growth Fund – B Class is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2023 Lonsec. All rights reserved.

[1] B Class Units is available to institutional investors only. The underlying strategy between A Class and B Class Units is identical.

[2] The Fund’s inception date is 15 March 2021. Performance for prior periods is based on the actual performance of the Polen Capital Global Growth strategy managed by Polen Capital since 31 December 2014, adjusted for Class B fees and converted to AUD and assumes all distributions are reinvested. The Fund invests using the identical strategy to the Polen Capital Global Growth Strategy and is advised by the same investment management team managing to the same investment objectives. Past performance is not a reliable indicator of future performance.

[3] As above.

[4] Reflects all Global Growth portfolio holdings as of 12-31-2022. Chart shows Bloomberg analyst consensus EPS growth forecasts for 2023. EPS growth is calculated dividing Bloomberg analyst consensus adjusted earnings per share for 2023 by the 2022 estimate. Earnings estimates always have the potential to be revised up or down. This is for illustrative purposes only.

[5] Reflects all Global Growth portfolio holdings as of 12-31-2022. Chart shows how Fwd 1-Yr P/E on 12-31-2022 compares to monthly observations going back 10 yrs, or to a given company’s IPO date. Data is expressed as a percentile rank, where 0% would indicate the least expensive a company has been vs the past 10 years and 100% is the most expensive. Please note Siemens Healthineers data goes back to 03-31-2018 when it was spun out of Siemens AG. All other securities go back 10 years.

[6] Source: https://www.polencapital.com/strategies/growth-sma. Data as of recent calendar quarter end. The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Periods over one year are annualized. Performance figures are presented gross and net of fees and have been calculated after the deduction of all transaction costs and commissions and include the reinvestment of all income.