The next Black Swan

One of my favourite finance books was given to me by Mark Carnegie after a meeting where we discussed markets and valuation. That book is called The (Mis)behavior of Markets and its author was none other than Benoit Mandlebrot – the father of fractal theory.

Mandlebrot’s idea is that the traditional normal distribution does not properly capture empirical and “real world” distributions and there are other forms of randomness that can be used to model extreme changes in risk and randomness.

A somewhat humorous example of this failure of the normal distribution is the once-in-a-hundred-year flood, which we all regularly joke seems to happen every couple of years.

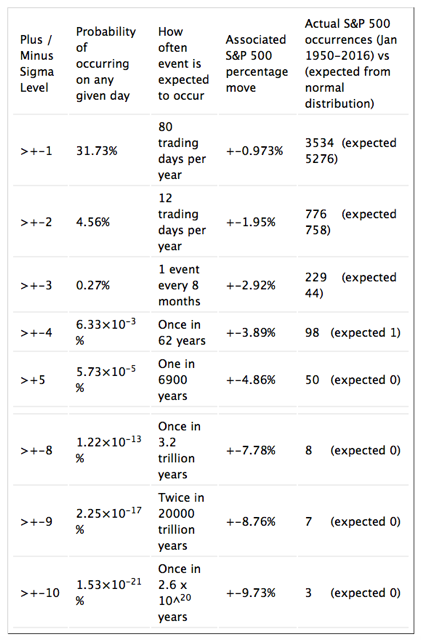

In finance, experts have adopted the ‘sigma’ notation to help put big market moves or valuation extremes into context. For example, if the S&P 500 drops 4.86 per cent in a day we can determine the sigma level of this event by dividing the percentage drop (4.86 per cent) by the S&P’s historic standard deviation of about 0.973 per cent. A 4.86 per cent move would be described as a five-sigma event.

The Normal Distribution Curve is a convenient tool to explain the distribution of many things, but to a man with a hammer, all problems look like a nail, and today the normal distribution is used to help describe a plethora of observations.

It doesn’t fully inform an investor about the risks of investing in the market.

For example as the table shows, according to the normal distribution model, a five sigma event in the S&P500 is expected to occur once every 6900 years. However between 1950 and the 24th of June 2016, the S&P500 recorded a 4.86 per cent move fifty times. Source: Vance Harwood

Source: Vance Harwood

Mandlebrot instead observed that randomness can become quite “wild” if the requirements regarding finite mean and variance are abandoned. Wild randomness corresponds to situations in which a single observation, or a particular outcome can impact the total in a very disproportionate way.

Now to Nassim Taleb, the man who popularized the “The Black Swan” theory with his book of the same name. His book Fooled by Randomness states that the past cannot predict the future – invalidating technical analysis.

Reading Taleb and Mandlebrot one cannot help but arrive at a point where tail risk hedging to limit losses from an outsized market moves makes sense.

In a recent interview with Julia La Roche, a finance reporter at Yahoo Finance. Taleb was asked for what he believes is the biggest risk that exists right now.

NT: “The fact that the world, as a result of quantitative easing, has seen an asset inflation that benefited the uber-rich, and that nothing has been cured. One cannot cure debt with debt, by transferring from private to public sectors. The markets will ultimately crash again, although this time it will hurt a lot more people”.

YF: A lot of people throw around the phrase ‘black swan’ haphazardly. What do people most commonly get wrong when talking about black swans?

NT: They don’t get that what matters is to be protected against those tail risks, something easier to do than trying to predict them. The idea is to focus on portfolio robustness rather than forecasts.

You can read the full interview here.

A bit of nitpicking. It appears that the normalised percentage change (z score) in the index you mention uses a constant value (averaged over the 50 years) for the standard deviation of daily change in percentage. This obviously is not best practice. Volatility is probably increased, even in percentage terms, compared to 1950. Ideally the standard deviation of daily change should be calculated for every year. That would probably result in a considerably larger std dev for recent years, making large swings look less unlikely. Also, are others struck by the irony of referring to “black swan” events when a black swan is actually not uncommon in Australia?

Perhaps Pink Ibis for Aussie investors?

The use of VaR is ubiquitous (in some form or another) where historical volatility is assumed to be a proxy for future risk. However, if volatility starts to spike VaR estimates rise and positions get liquidated adding to the volatility spike.

The danger from a negative black swan will more than likely be in the bond markets as positions there have grown enormously and supposedly “low” risk assets like bonds are seen as a safe haven leading to complacency (not to mention the widespread use of leverage to try and turbo charge returns from movements in spreads . Their almost universal inclusion in bank liquidity and insurance company prima assets will precipitate further vicious cycle selling.

“Fractals & Scaling in Finance” is the expanded version of your answer. Heavy going, but interesting. Today’s market action shows many “six-sigma” events (APO / VRL etc etc). Your point Rodger, that interest rates have created many many bubbles is worth repeating.

And we’ll keep repeating the warnings until all our friends have heard.

Hi Roger,

Thanks for the informative article once again.

You’ve recommended reading materials in your blogs and in the comments sections previously. I’ve recently tried to track down some of these titles by searching the blogs but haven’t had much luck.

Would it be possible for you to compile a list of your recommended reads for new investors? Value.able is obviously at the top of the list and having completed that, I’m now searching for additional material to help in the investment journey.

Thanks

Sure Nathan. And what were the titles you had trouble tracking down?

By the way Roger, the market has reacted very positively to Isentia and Altium. Just wondering if you are going to do an update? Thanks.

Kelvin

Indeed. We have written extensively about these companies and they are delivering on the thesis we have previously articulated. Stay tuned and expect something after reporting eason.

Well done on these calls!

One way to bolster portfolio robustness in times of elevated equities prices is to ensure one’s portfolio does not contain stocks whose earnings are affected by various market prices, such as resources stocks, banks, investment banks, and wealth managers (unless their valuations are outstandingly compelling, e.g. perhaps Henderson at the current price).

Watch out for the high-yield/stable-income/low-volatility stocks that have benefitted the most from the migration to equities. “Stable Growth companies, by definition are stable and have little or no incremental growth. In a rising interest rate environment stable companies P/Es contract sharply because the “P” goes down because “E” is stable.”

The normal distribution is a sampling distribution of a finite population. The stock market is not finite viz the total of money in the market is not constant therefore long term std deviations are a nonsense plus the market is not stationary the variance of the market is constantly changing viz indexes of market volatility. I think it was Twain who coined the phase “lies, damned lies and statistics” the reality is statistics is a language few understand and many use to promote statistically invalid conclusions. Trading = risk, investing requires buying an asset when it’s predicted future value is better than today’s value it’s still risk but you try to get the probability of being right better than the toss of a coin by research and understanding.

Would any of the Montgomery funds look to hedge against tail risks? Obviously the cash component already does that, with deep out of the money put options and the like you’ll want to find good counterparties.

Very interesting article.

Not sure if this would be intellectual property, but how would your funds protect themselves (or benefit) from “fat tails”? Keeping a large portion of the fund in cash? Shorting particular companies? I have been keeping a large % in cash because of this very reason, it seems like picking up pennies in front of a steamroller sometimes. Many assets in the sharemarket and property seem to have been bid up to unsustainable levels through QE, and it just seems a matter of time before central banks run out of money to print and asset prices tumble.

I am reading The Black Swan now and it is so true that many people place way too much reliance on bell curves, extrapolate the past into the future and “mistake the map for the territory”. It is easy to forget that the future is entirely unknowable and investing is not as simple as checking out historical RoE, EPS, DPS growth etc. and assuming increases of 5-10% per year for the next 5 years.

It would be good to guard against “unknown unknowns”. Can you recommend a particular fund to invest in (TMF, Montaka) to guard against this type of fat tail risk?

Hi David,

It’s what we do. One option is to hold case – that’s The Montgomery [Private] Fund, The Montgomery Fund and The Montgomery Global Fund. Another option is protection via short selling and that’s why we offer The Montgomery Alpha Plus Fund (A market Neutral Fund) and Montaka (a global Long/Short Fund).

Cool, I will look at these closely in the next few days. And thanks for making yourself so available to the average punter.