The Montgomery Fund – a nice 13.44 months

The Montgomery Fund was designed for retail investors with a minimum initial investment of $25,000.

The daily unit price can be viewed here.

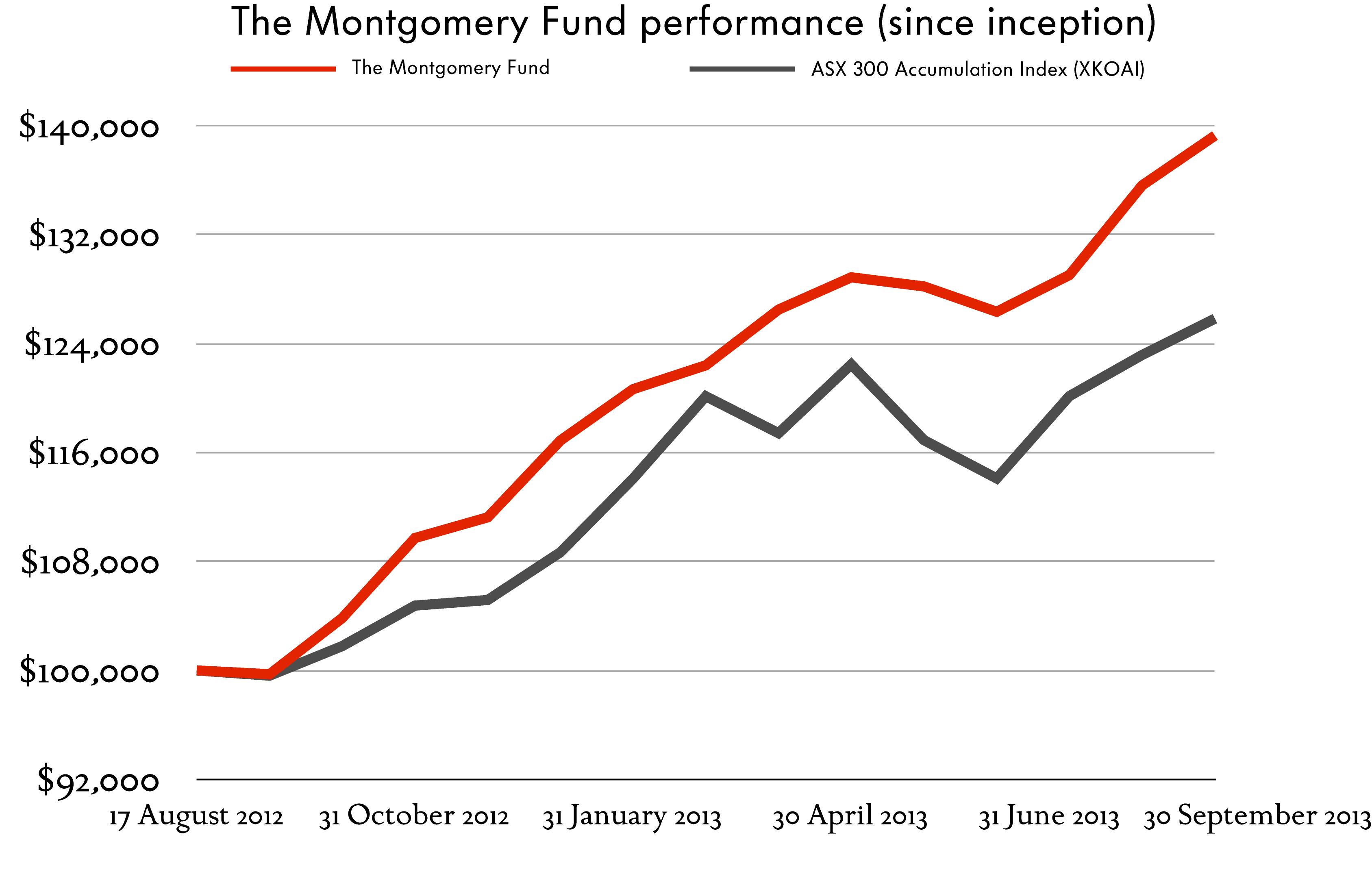

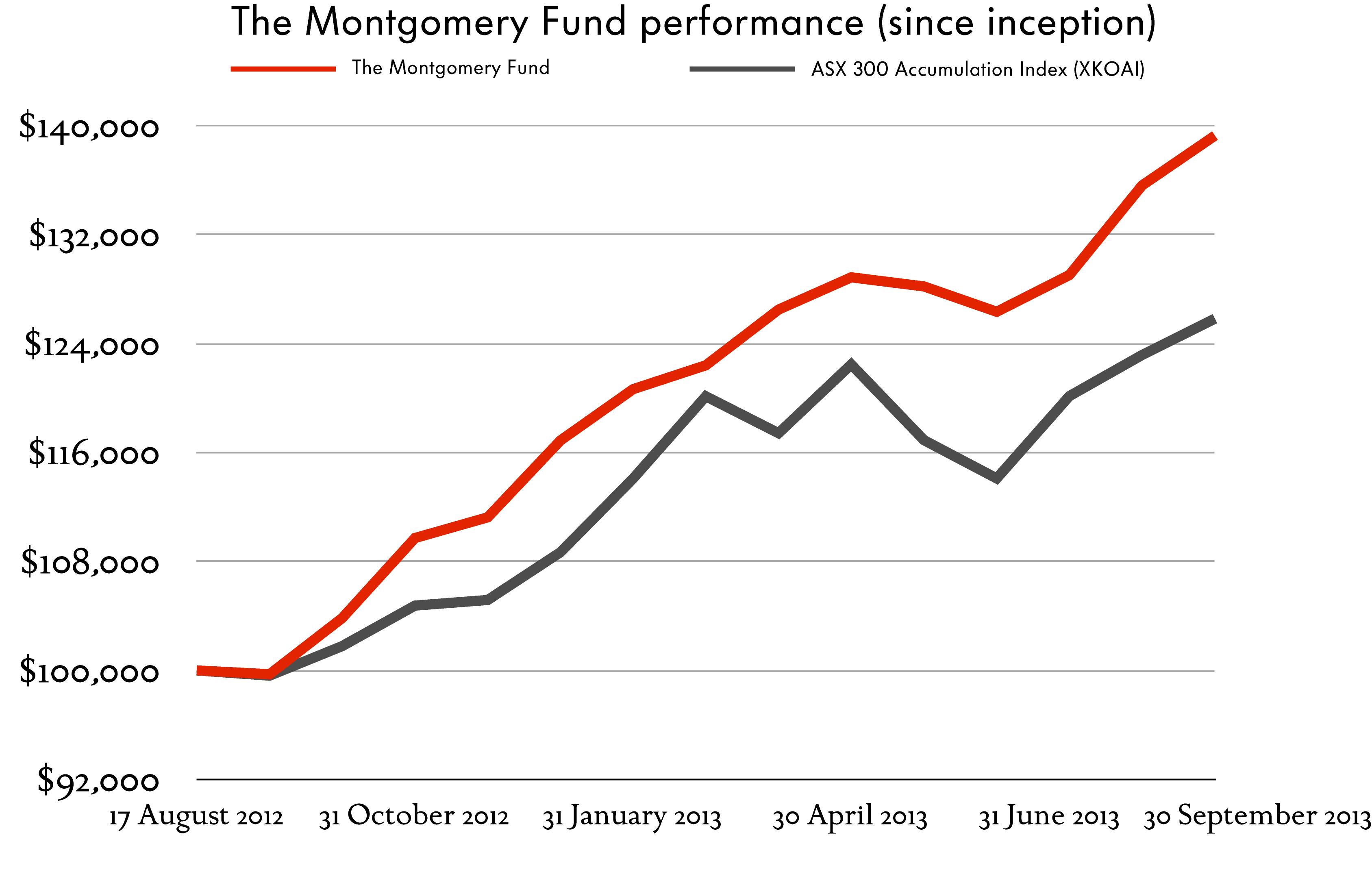

$100,000 invested in The Montgomery Fund on the day of launch, 17 August 2012, would be worth $139,260 (assuming reinvestment of the 7.2834 cents per unit distribution on 30 June 2013 and after expenses) at 30 September 2013.

$100,000 invested in the S&P/ ASX 300 Accumulation Index would be worth $125,820 over the same period.

In summary, The Montgomery Fund has out-performed its benchmark, the S&P/ ASX 300 Accumulation Index, by 13.44 per cent (after expenses) in the first 13.44 months of its life.

To find out more about The Montgomery Fund, click here.

Returns are since inception of The Montgomery Fund, 17 August 2012. Past performance is not a reliable indicator of future performance.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Great job guys, music to my ears.

thanks for looking after the funds so well , and you have got there with out bank stocks, as I have over 70% of my portfolio in the big 4 your fund also helps to spread risk for me and many others I suspect

Good point Michael and thanks for the encouraging words!

What a fantastic effort by all of you – thank you. More cash for the fund in the post.

Delighted on both fronts Michael.