The importance of thinking about stocks as businesses

Successful business owners are often said to be able to feel the pulse of the companies they lead. For instance, great restaurateurs know what dishes are most popular on the menu, who their regular patrons are, when food suppliers will deliver fresh ingredients, and how much revenue is needed to cover operational expenses such as salaries and rent.

While a thorough understanding of a business’ financial health and long-term strategy may seem logical for the success of any investment, we often see cases where investors forget that shares of a company represent an ownership interest in an underlying business and instead treat them as digital lottery tickets seeking to capture the latest market rally or trend. As a result, they overlook a company’s fundamentals and behave like speculators, buying shares with the hope that someone else will pay a higher price down the road.

The rise in popularity of speculative assets over the past decade—including unprofitable companies, cryptocurrencies, and nonfungible tokens (NFTs)—are examples of how some investors can get caught up in the enthusiasm and momentum of market rallies. Notably, the heavy losses incurred in some of these asset classes following their market tops should remind us that speculative ebullience rarely leads to sustainable long-term wealth creation.

Having a business owner’s mindset

Famed investor and writer Peter Lynch is quoted saying that one of the most important investing principles is to “know what you own and why.” According to Lynch, most market participants cannot explain in a few sentences why they own a stock aside from expecting its share price to increase. One common misconception is looking at stock prices and thinking that they reflect the actual value of a business.

In reality, a company’s share price is determined by what the market is willing to pay at a given time, while its value reflects its true worth based on its underlying characteristics. While prices can fluctuate daily due to short-term fluctuations or investor sentiment, the intrinsic value of a business is independent of its market price and, hence, doesn’t fluctuate very often unless there is a material change in the company.

However, in today’s world, it is easy to become distracted by the daily barrage of news, data reports, predictions, and investment advice. Therefore, we believe it is vital to approach investing from the lens of a business owner rather than a speculator, separating the signal from the noise. The graphic below shows what we view as some differences between investors and speculators.

Figure 1: What differentiates investors from speculators?

Source: Polen Capital

What does investing like a business owner mean?

In our experience, investors who navigate markets through the lens of a business owner tend to favour high-quality companies with sustainable cash flows and enduring competitive advantages. After all, very few people would likely justify allocating capital to a cash-burning business with weak growth prospects over an industry-leading company with robust financials and a long growth runway.

Furthermore, while the fear of missing out and the daily ups and downs of the market might tempt us to behave impulsively by acting first and thinking later, we believe that exercising patience and conducting thorough due diligence before making decisions are vital components of any long-term investment strategy. Rather than trying to be the first to hop on a new trend or hot company, we believe that taking our time to truly understand a company’s prospects is critical in assessing the sustainability of its competitive advantages.

In our view, a business owner’s mindset and a long investment horizon are inextricably linked. In contrast to speculators who seek to buy low and sell high, business owners rarely have an incentive to sell their stakes in great companies. Warren Buffett once stated that when he owns portions of great businesses with outstanding management teams, his favourite holding period is forever. According to our research, exceptional companies can compound their intrinsic value over several decades, not just years, maximizing their potential to generate superior earnings growth.

This is why we think knowing what you own—and why—is critical in today’s market environment. During periods of elevated uncertainty, speculators who lack a business owner’s mindset will attempt to time the market, possibly diminishing profits or incurring losses along the way. In contrast, investors who own great companies tend to feel more comfortable staying the course when volatility strikes the market, increasing their likelihood of reaping the rewards typically associated with long-term investing, as seen in Figure 2.

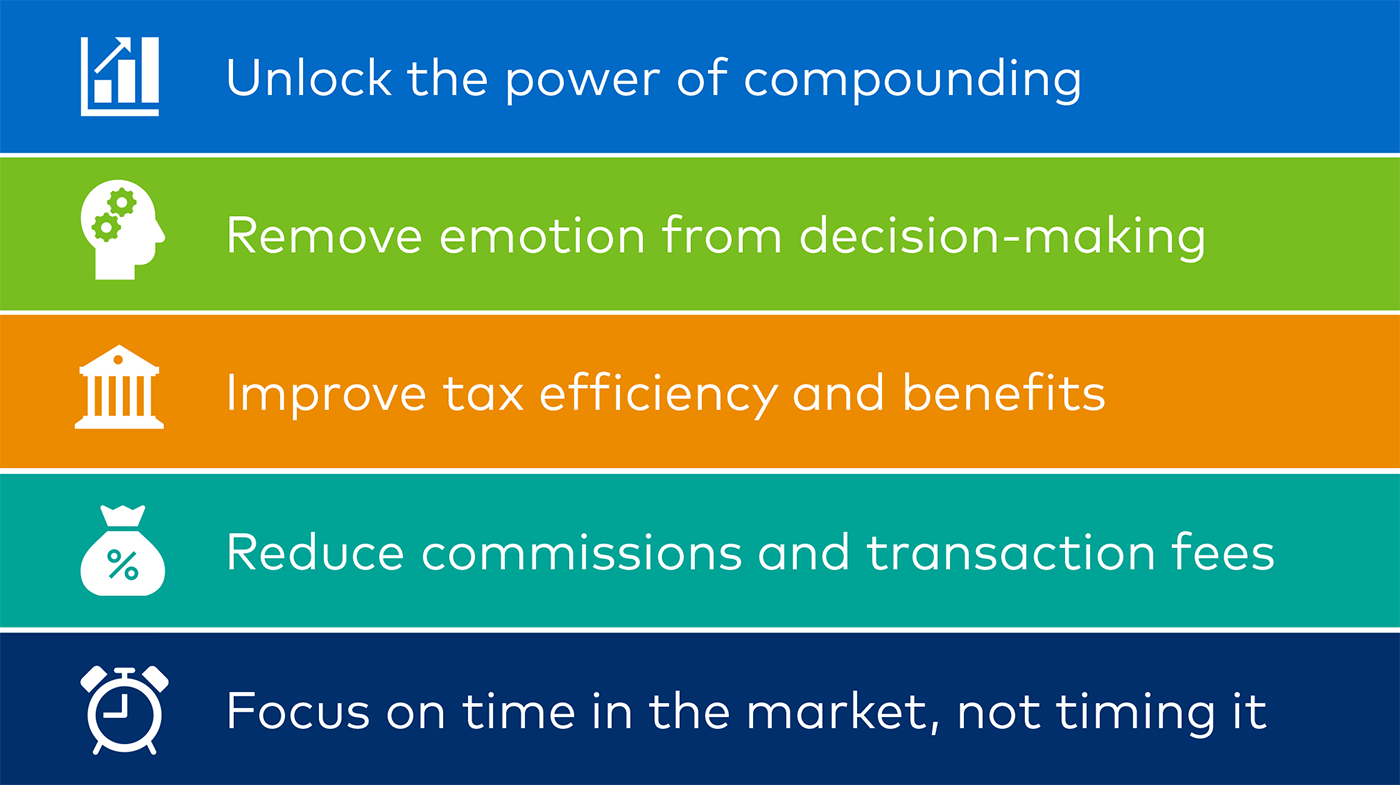

Figure 2: The potential rewards of long-term investing

Source: Polen Capital

We also believe that thinking like a business owner supports the case for maintaining a concentrated portfolio consisting only of high-conviction ideas since it is more difficult to fully understand and closely monitor a strategy with many companies compared to only focusing on 20 or 25 high-quality businesses.

Lastly, investors should be discerning and exercise critical thinking instead of depending on screens and models when making decisions. After all, some of today’s leading businesses are driven by a combination of moats that are hard to identify simply by looking at quarterly reports and spreadsheets, such as powerful cultures, high-performing talent, and brand loyalty.

This short article is spot on as far as I’m concerned. A lot of market analyst/commentators talk about trading in and out of shares. This isn’t how big gains are made. Following that practice has many elements working against you and means you won’t compound gains into “multi-baggers”. Trying to find great shares to invest in is difficult because the future is unknown, but it is the best way and then you have to be strong and exercise patience to allow it to work. Patience is one of the most difficult aspects, particularly for young people with nothing who want things to happen quickly.

Wes.

Thanks for the encouraging words Wes. I was once told; you get rich buying and selling but you get wealthy buying and holding.