The demographic boom investors must follow

The combination of a growing cohort entering salaried employment for the first time, a very high proportion of that salary being disposable, and the first generation to be comfortably and familiarly globally connected through social media can have a stratospheric impact on the revenues of companies that drop a product that becomes a smash hit with Gen Z.

If you’re a Gen Z born between 1997 and 2012, you’d better pay attention because the framework this blog post alludes to could make you a lot of money.

And if you are in your 50s or 60s and have some twenty-something kids still loitering around the house, you could make a handy return by paying attention to what they’re buying.

For all the talk of recession, high interest rates and belt-tightening right now, it must be remembered the vanguard of Gen Z have just left university, are gainfully employed, many still live at home and therefore don’t have a mortgage nor pay rent (although they’d like to), and they don’t have kids. Proportionally, nearly 100 per cent of their cash is disposable.

The children of Generation X and Gen Z make up the bulk of the students in our world today, represent 22 per cent of the global population, and already makeup 27 per cent of the global workforce.

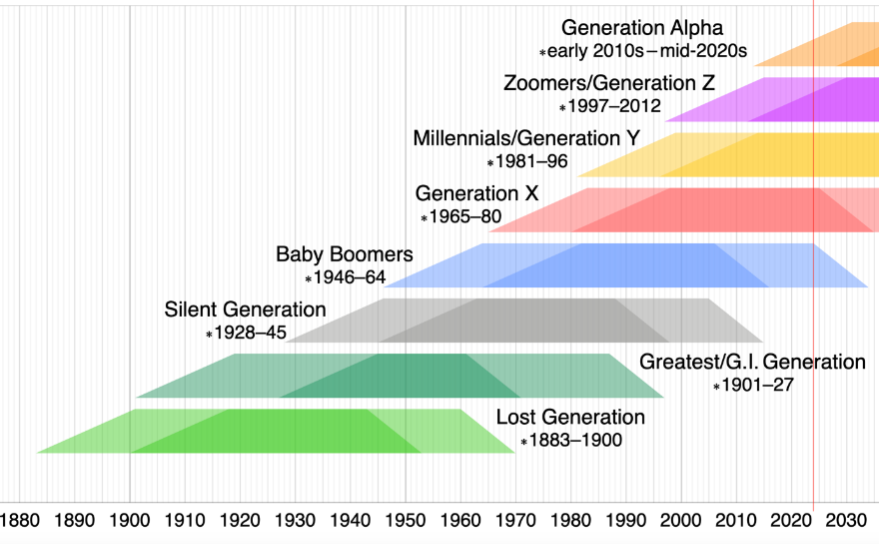

Gen Z were born between 1997 and 2012, which makes the oldest Gen Z 27 years old and the youngest 12 years old. It is worth acknowledging that within this cohort there are some massive differences. For example, the oldest Gen Z would have only started using their first ‘device’ towards the end of high school, while the youngest wouldn’t know a world without devices. I have three Gen Z kids, spanning the width of the demographic, and I am truly fascinated by the differences between the eldest and youngest.

Figure 1. Developed world demographics  Source: Wikipedia

Source: Wikipedia

Nevertheless, Gen Z are the first fully global generation, shaped in the 21st century, connected through digital devices, and engaged through social media.

The combination of a growing cohort entering salaried employment for the first time, plenty of disposable income, and being globally connected through social media can have a stratospheric impact on the revenues of companies that hit on a product Gen Z loves.

Take, for example, the story of the foam clog known as Crocs (NASDAQ:CROX). In 2002, Crocs unveiled their first model, the Beach, at the Fort Lauderdale Boat Show in Florida, and all 200 pairs produced quickly sold out, demonstrating the instant popularity of the footwear revered for prioritising practicality and comfort over fashion.

Despite the success of its “ugly can be Beautiful” campaign the popularity of the footwear didn’t render the company immune from collapsing sales revenue during the global financial crisis (GFC) and the company’s share price fell to as low as U.S.$0.79. The allure of Crocs began to fade. Announcements the shoe may cause foot issues compounded the impact of consumers growing tired of the unchanged, no-frills design that originally seemed so sensible. By now, Crocs had become an emblem of resignation. A dad wearing Crocs symbolised a man who’d given up on life. In 2010, Times magazine listed Crocs as one of the world’s “50 Worst Inventions”, and the Facebook group “I don’t care how comfortable crocs are, you look like a dumbass” added fuel to the disparaging narrative gaining traction on talk shows, in movies and in comedy sketches. Rumours Crocs verged on bankruptcy.

Enter Gen Z. In the mid-2010s, with the first Gen Z becoming adults, public perception of Crocs began to shift. In 2015, Prince George was photographed at a charity event wearing navy blue Crocs. The royal validation saw sales soar 1,500 per cent. Collaborations with esteemed fashion designers, musicians and ateliers followed and pushed the brand to the forefront of acceptability and even desirability. Celebrities like Questlove and Nick Cannon have sported the clogs on red carpets at award shows and the musician Post Malone refers to “thousand dollar Crocs” in his song “I’m gonna be”. Crocs went from near bankruptcy to re-emergence as a stylish, “must-have” shoe amongst Gen Z.

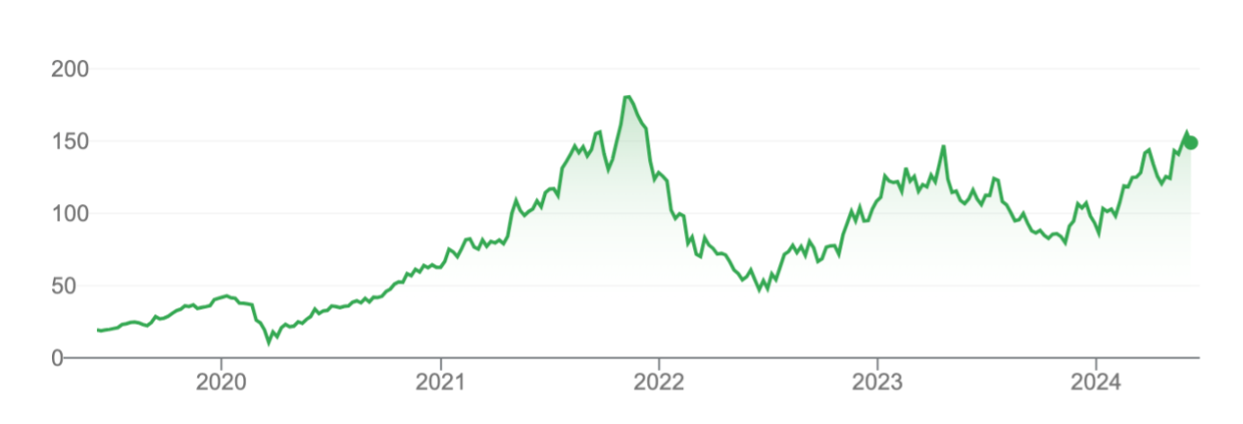

Consequently, while as other COVID beneficiaries like Peloton (NASDAQ:PTON), Etsy (NASDAQ:ETSY), and Zoom (NASDAQ:ZM) have seen post-pandemic sales decline, sales of Croc’s clogs between 2019 and 2023 have almost quadrupled to just under U.S.$4 billion.

Figure 2. Crocs share price (U.S.$)

Fashion is notoriously fickle, and footwear is a category that relies on the popular apparel of the moment, such as the latest jean cut. But the point remains; Thanks to their global connectedness, anything Gen Z latches onto can have a phenomenal impact on sales, profits and share prices.

Fashion is notoriously fickle, and footwear is a category that relies on the popular apparel of the moment, such as the latest jean cut. But the point remains; Thanks to their global connectedness, anything Gen Z latches onto can have a phenomenal impact on sales, profits and share prices.

You will note the opportunity presented by Crocs during the global stock market sell off in 2022, when the shares were trading on a price-to-earnings (P/E) of just 5.5 times.

Another example of Gen Z’s global influence on a retail company’s fortunes is the Japanese company Asics (TYO:7936).

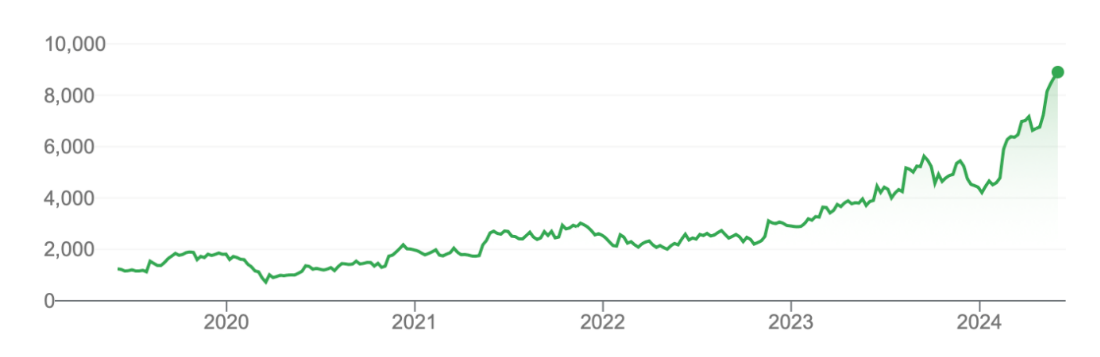

Figure 3. ASIC (TYO:7936) share price up 616 per cent in 5 years

While undoubtedly also helped along by Japan’s renewed appeal among global investors, Asics share price surge has reflected revenue growth of 73 per cent over the last three years.

That revenue growth is due in no small part to Gen Z’s love of ‘dad sneakers’.

Asics has long been a lauded brand among professional and amateur runners. According to some reports, not only did both the men’s and women’s winners of the Paris Marathon wear a pair of ASICs, but so did as many as a quarter of the 54,000 runners who completed the race.

And as it did for Crocs, Covid produced a spike in sales as more people picked up running as a hobby, while, working from home began saw people prioritise comfort in their footwear.

But outside of runners and the Covid working-from-home phenomena, Asics’ Onitsuka Tiger brand is better known for its “dad sneakers” with the old Asics designs becoming another fashion symbol among Gen Z.

Now, to be clear, only Gen Z can get away with rocking drab, typically grey, mono-tone comfortable sneakers as dad sneakers. Seen on Gen Z, dad sneakers are the epitome of vintage sartorial elegance. If I were to wear them, however, that’d just be a middle-aged dad wearing boring shoes.

Putting my own youthful longings aside, the Asics Onitsuka Tiger brand has been represented by celebs, including Prince William, Bella Hadid and Kaia Gerber. The brand has also collaborated with designers including Vivienne Westwood and Cecilie Bahnsen. Both the celeb stamp of approval and the collabs create buzz on social media, which, of course, is the trigger and fuel for Gen Z purchases.

By way of example, when Asics redesigned its 2008 Gel-Kayano 14 sneaker with Canadian design studio JJJJound it became an instant smash hit. That shoe resells for more than U.S.$1,000 on online marketplace StockX. Asics is now the fifth most-traded brand on StockX, while revenue for the company’s more fashion-minded SportStyle division grew 52 per cent year over year in the last reported quarter.

We have long spent time analysing the behaviour of baby boomers and its impact on the revenue prospects for property, healthcare, travel and retirement related businesses, but post pandemic, it’s time for investors to pay extra special attention to Gen Z.

For Gen Z, I also offer some advice. The next time you spot something blowing up on your socials, or buy something fashionable and trending, ask yourself who owns that product and whether the company is listed. Your investment in the company might pay for the product you purchase and help you make other more significant purchases in the future.

I saw a 20 something AFL footballer present at a press conference in Crocs. These footballers are well paid and can afford much better shoes than Crocs.