SMSF cost analysis

The success of the Australian superannuation system, envied by most governments around the world has now grown to encompass close on $3 trillion of assets. This is broadly split between three different types of fund – Public Sector/Industry/ Corporates, Retail and Self Managed Super Funds (SMSF). The proponents of each type often battle it out in the court of public debate as to the merits of each type and one of the fronts of attack is often on the topic of cost!

Recently, the SMSF Association engaged Rice Warner (a well respected firm offering consulting advice, research on products and markets, as well as our financial technology services) to update their analysis on the costs of running a SMSF and the minimum cost effective balance for SMSFs. I summarise some of the key findings here which may surprise you and if you indeed do have a SMSF of your own then how does your experience compare to the findings?

For this report, Rice Warner were also given access to anonymised expense, cash flow and balance information for approximately 100,000 SMSFs. This enabled the research to be based on actual costs incurred.

SMSFs have been segmented into funds of different types including separation into funds by number of members, funds in accumulation and/or pension phase, and funds by size of investments.

From this segmentation, comparable APRA regulated products were considered, and fees have been modelled to show at what size a cost saving can be made via a SMSF. These fees include investment and administration components.

Investment structures which cannot be replicated easily under an APRA regulated product have also been considered. For example, a SMSF might hold a direct property. Under these structures, the cost is less important than the required investment strategy.

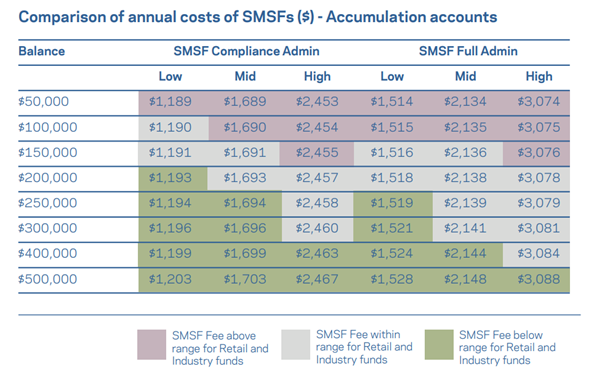

Costs for simple funds with little complexity and the Trustee seeking only transactional services will generally be at the low end of the range. Funds with more complexity and/or where the Trustee requires more assistance will generally be at the high end of the range.

The findings of the report are neatly summarised in the table below:

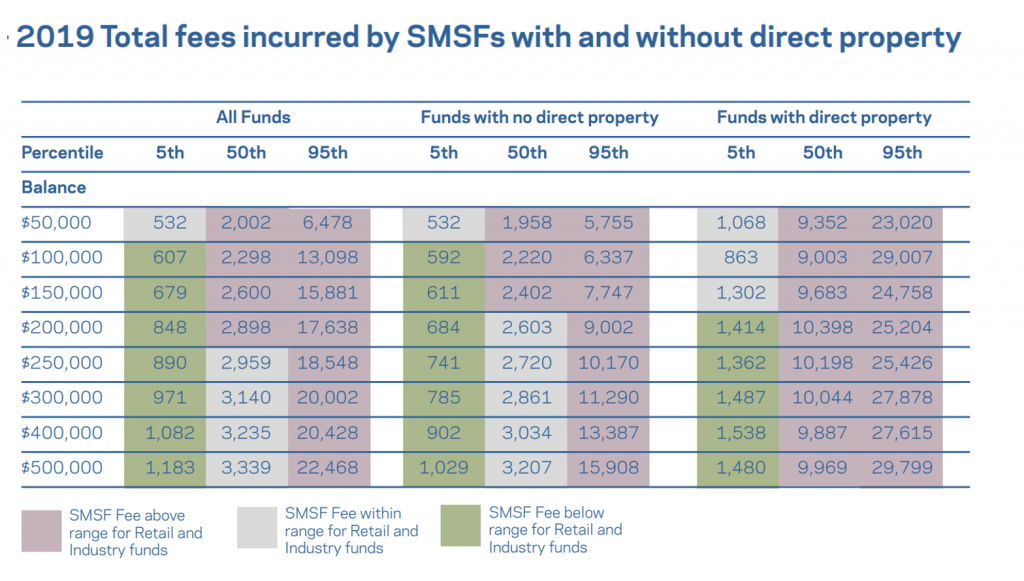

Comparing the actual costs paid by SMSFs and the fees of Industry and Retail Funds, we can observe the following:

- The low fees being paid are cheaper than fee schedules indicate.

- These low fees are cheaper than the APRA regulated alternatives for balances of $100,000 and above.

- Median fees for SMSFs without direct property are competitive for balances of $200,000 and above.

- Median and high fees for SMSFs with direct property are higher than the highest fees for APRA regulated funds for all balance sizes.

This research from Rice Warner now clearly highlights that SMSFs with a low complexity, can begin to become cost-effective at $100,000. This is a significant departure from what many had believed to be the case. For simple funds, $200,000 is a point when SMSFs can become cheaper in some situations. These comparison tables may be useful not only for advisers and regulators in understanding the market, but also for potential and current SMSF trustees. Grasping the ranges, they fall into based on the level of complexity and compliance needs they have, should open the door for many individuals to explore taking more control of their own superannuation. It also enables individuals to compare their own fees.