Skaffold Features Get Richer…

As many of you know Skaffold is one of the tools we use at Montgomery and I have got to give credit where it’s due. Chris Batchelor and his team over at Skaffold are doing an amazing job. Chris, you are doing an incredible job! Well done!

The latest Skaffold releases (there have been more than 20 since launch – one of the benefits of having an in-house development team) have launched incredible features with benefits that will make my investing even simpler again.

Here’s just a small selection of some of the amazing updates the highly focused team at Skaffold have just launched…

Update 1: Bearish and bullish case valuations

Roll your mouse over JB Hi-Fi’s Intrinsic Value Screen and the valuations based on consensus are still there but now you’re also delivered Bullish case and Bearish case valuations based on the full range of analysts forecasts. This is essential if you believe analysts are being overly optimistic or pessimistic. It will help identify the true bargains with more detail than ever before.

Update 2. Personalised Alerts

For over a year Skaffold investors have received a Daily Alert email before the market opened with a list of companies whose intrinsic values have risen or fallen and a list of growing or disappearing margins of safety.

Now you can customize your alerts. Set filters that you would like to be alerted about, Set alerts for the stock in your portolio or for a favourite sector and create multiple alerts. With this feature you can say goodbye to spreadsheets forever.

Update 3. Investor Sentiment… The short run voting machine…

In the long run, the market is a weighing machine but in the short run…

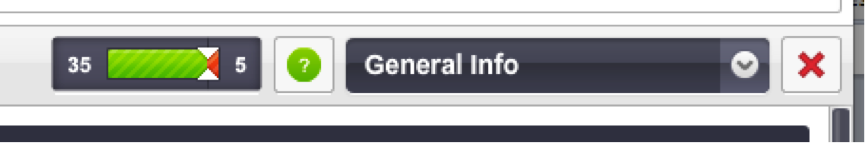

Skaffold investors can now see and participate in the market for knowledge, awareness and popularity. If you are wondering whether other investors are fans of, for example JB Hi-Fi or you’d like to know if anyone doesn’t, Skaffold reveals Thirty-five people JB Hi-Fi’s prospects…

Update 4. Backdate and backtest your portfolio

Select the date you purchased the shares in your existing portfolio and Skaffold will start building performance information from that date.

Suppose you entered your portfolio into Skaffold’s portfolio feature and it returned an intrinsic value for your portfolio much lower than the current market price.

My response?

There’s clearly some work to do considering whether I continue to hold the expensive and or poorer quality stocks.

In addition to providing intrinsic values for individual listed companies globally, Skaffold’s Portfolio function produces one intrinsic value for your entire portfolio. Clearly and instantly see whether your portfolio is good quality or not. If you are an adviser or financial planner imagine how simply and clearly you could explain to your clients why their portfolio needs a tune up!

Update 5 – 100 Stay Tuned!!!! Become a Skaffolder today.

Hey Andrew,

Thats the current project of the development team…

Some interesting improvements Roger. I liked the investor sentiment idea, i have been working on a few things for my own personal use which is similar. Value is more important than price but i also think there is a lot of information that can be gained by breaking down the price and seeing what lies behind it as well as looking at other screening criteria.

Although in the case of JBH you don’t even need to look at the price, it is still one of if not the most shorted stocks on the market and has been for ages, not hard to see what some people think of that. I have been a fan of JBH over that time and not surprised by how they have been performing, either some people have lost a fair bit or they were able to borrow the shares for a long period of time.

Have to say, althogh i am not a member i have always been a fan of skaffold. The fact you are continuing to develop it and not rest on your laurels to stay ahead of everyone is a positive mood for those that are. Not surprised that you have more in the works it is a very versatile aid for investors and you and your team should be congratulated.

Thank you Andrew for your encouraging words.