Seven global companies with bright prospects

Since the beginning of the year, the Polen Capital Global Growth Fund has traded, or adjusted positions in, a number of portfolio holdings and as some of the names are those you are likely familiar with, Polen Capital thought it would be more than a little interesting to shed some light on the reason for the changes.

Before embarking on examining each change individually, it is worth remembering that Polen Capital adheres to a set of guardrails each company must meet or exceed. Those guardrails include a strong balance sheet, abundant free cash flow, robust returns on equity and preferably above 20 per cent, stable or improving margins and organic revenue growth in preference to acquired growth.

The most recent changes are as follows:

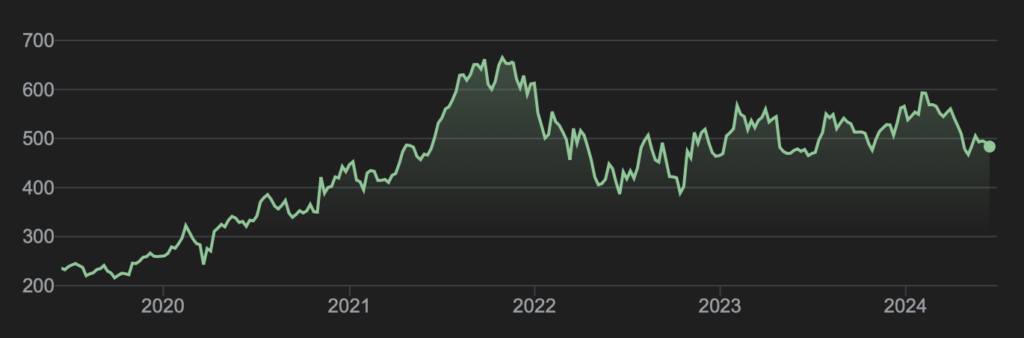

Louis Vuitton Moet Hennessy (EPA:MC)

Figure 1. LVMH share price (U.S.$)

Polen Capital recently held 2.6 per cent of the Polen Global Growth Fund in this global luxury fashion leader. The position has recently been reduced to one per cent after a period of excellent business performance. Polen Capital believes the business may see some slower growth in both revenues and margins over the next few years. While they think a portion of Louis Vuitton Moet Hennessy’s demand is durable due to its leading luxury position, it will still likely prove cyclical in an economic downturn. Given those expectations, Polen Capital thought it prudent to allocate this capital to a business with more safety-like characteristics in Zoetis (NYSE:ZTS). However, Polen Capital kept a 1 per cent position in Louis Vuitton Moet Hennessy because they think it remains a business with durable advantages that are hard to replicate and, in the long run, may display a high single-digit to low double-digit growth profile. The team at Polen Capital noted they hope to own more of Louis Vuitton Moet Hennessy again someday when the business fundamentals and valuation are more attractively combined in their view.

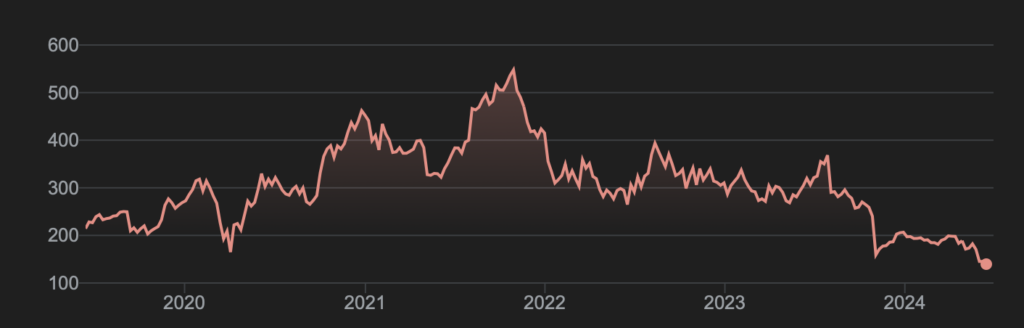

Zoetis

Zoetis Inc. is an American drug company and the world’s largest producer of medicine and vaccinations for pets and livestock.

Figure 2. Zoetis share price (U.S.$)

The Polen Capital team re-established a new two per cent position in pharma company Zoetis after holding a position from late 2017 to late 2021. Back then, Polen Capital earned an attractive rate of return and sold solely based upon valuation, which was stretched at the time. This time Polen Capital is re-establishing a position at a lower price than that at which the shares were sold in September 2021, despite Zoetis having a roughly 25 per cent higher earnings base. In short, they seek to take advantage of the recent dip in price to about 28x earnings to buy back what they believe is an attractive defensive grower. They believe the company should grow earnings per share at low double-digit rates, which at the current valuation could produce the defensive growth characteristics sought.

Regarding guardrails, Zoetis’ Q1 2024 revenue grew 12 per cent operationally to $2.2. billion. Operational net income grew 15 per cent in Q1 2024 despite a $31 million headwind to growth from the nonrecurring benefit of a prior year royalty settlement.

As of Q1 2024, its volume growth was five per cent, and price growth was seven per cent.

Zoetis continues to invest in research and development, which grew 13 per cent. Adjusted diluted earnings per share (EPS) grew 17 per cent operationally for Q1 2024.

The Polen Capital investment team believes Zoetis could deliver circa 12 per cent EPS growth on an annualised basis. Zoetis is a business with a leading and increasing market share, a broad and diversified portfolio, and an extendable total addressable market – thus rendering it a potential durable grower to produce attractive shareholder returns.

Unlike typical pharma companies, Zoetis has enjoyed diversified growth across its products in recent years. In terms of geography, the growth is from both the U.S. and international markets, with further opportunities to expand the presence of each product.

Amazon (NASDAQ:AMZN)

Figure 3. Amazon share price (U.S.$)

This company requires no introduction. Polen Capital has trimmed the weight in the Global Growth Funds portfolio from 10.7 per cent to 9.5 per cent for position size management reasons. The Polen Capital team remains confident about Amazon, its competitive advantages, growth runway, management team, and valuation relative to its long-term growth prospects, hence why it remains the largest position in the fund as of this blog.

MSCI Inc. (NYSE:MSCI)

Figure 4. MSCI Inc. share price (U.S.$)

Polen Capital recently increased its position in MSCI Inc. from 2 per cent to 3.5 per cent. The stock declined after a decrease in net new subscription sales during the first quarter of 2024. Although new subscription sales were up modestly compared to the prior year, there were significant cancellations due to “business events,” particularly UBS acquiring Credit Suisse and adjusting their subscriptions to the service. Despite the softness in net new subscription sales, retention rates remain high for this highly profitable business that has enjoyed substantial recurring revenues. The current softness in net new subscription sales does not change Polen Capital’s view on the competitive advantages or long-term growth profile of the business. Polen Capital used the selloff as an opportunity to increase MSCI to a full-sized position.

Microsoft (NASDAQ:MSFT) and ServiceNow (NYSE:NOW)

Both ServiceNow and Microsoft were trimmed for valuation reasons. Polen Capital remains confident in both businesses and their long-term prospects.

Paycom (NYSE:PAYC)

Figure 5. Paycom share price (U.S.$)

Polen Capital has established a new two per cent position in Paycom, a leading cloud-native payroll and human capital management (HCM) software provider. Polen Capital believes Paycom is a well-run, high-quality business operating in an attractive sector with many winners. Polen Capital have researched the payroll and HCM software sector after owning ADP for many years and, more recently, Workday. While a recent go-to-market snafu with their new BETI product and some macro weakness has led to a deceleration in their near-term growth, Polen Capital believes the company’s leading position in an attractive market remains, with Paycom providing mission-critical software, earning highly recurring revenue, enjoying 90 per cent+ retention rates, and high returns on capital. Polen Capital believes the company’s leading product should be able to continue to grow faster than the market and move up-market.

At the end of Q1 2024, Paycom guardrails included U.S.$300 million in cash with no debt, free cash flow margins in the high teens and increasing toward mid-20s over time. Return on equity (ROE) and return on total capital (ROTC) were both well over 20 per cent and, in Polen Capital’s view, sustainable. Non-GAAP operating margins are circa 30 per cent and stable, while organic revenue growth is in the double-digits even in a tough year. Over the last decade the company has enjoyed circa 32 per cent compound annual growth rate (CAGR), with the number of clients compounding at 15 per cent, average recurring revenue per client compounding at 16 per cent.

Disclaimer

The Polen Global Growth Fund owns shares in Louis Vuitton Moet Hennessy, Zoetis, Amazon, MSCI Inc., Microsoft, ServiceNow and Paycom. This article was prepared 25 June 2024 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Louis Vuitton Moet Hennessy, Zoetis, Amazon, MSCI, Microsoft, ServiceNow or Paycom, you should seek financial advice.

The information provided should not be construed as a recommendation to purchase or sell Polen Capital’s products or services. The content posted is for informational purposes only. Where indicated, the opinions and views expressed by Polen Capital constitute the judgment of Polen Capital as of the date the content was published and may involve a number of assumptions and estimates which are not guaranteed, and are subject to change without notice. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness or accuracy. Where indicated, Polen Capital’s opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute its judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions.

The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. There is no assurance that any securities discussed are in a Polen Capital portfolio, will remain in a Polen Capital portfolio or that securities sold will not be repurchased. It should not be assumed that any of the securities, transactions, or holdings discussed were or will prove to be profitable, or that any investment recommendations or decisions Polen Capital makes in the future will be similar to or equal to the investment performance of any securities discussed. For a complete list of Polen Capital’s past specific recommendations for the last year, please contact info@polencapital.com.

This disclosure does not identify all the risks (direct or indirect) or other considerations which might be material when entering a financial transaction. Investing involves inherent risks and any particular investment is not suitable for all investors; there is always a risk of losing part or all of your invested capital.