SAE it ain’t so

Companies that can reinvest large amounts of capital at high rates of return are a rare breed. Such companies must be careful to preserve value when pursuing growth outside of their core competency, especially if management becomes distracted by new business opportunities.

It is on this point that we turn to Navitas (ASX: NVT), a company that we have been watching with interest for a number of years. At its core, Navitas provides ‘pathway programs’ to students who wish to gain tertiary education but may not qualify for direct entry into university.

In years gone by, management was largely focused on the University Programs division, which was not only highly profitable, but required minimal reinvested capital to grow both the business and its cash flows – two highly desirable investment characteristics.

Yet in 2011, management was lured into pursing growth outside of their core competency and acquired SAE, a global media technology training institute.

At the time, management justified the purchase on the basis that it would diversify the earnings base and leverage the company’s existing network of marketing and student recruitment. In the calendar year of 2010, SAE generated $33 million in Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), for which it paid $289 million, or a multiple of 8.75x.

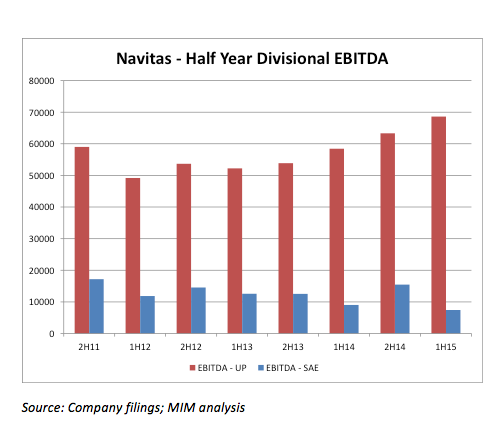

Fast-forward four years, and we find that SAE has proven disappointing. Navitas has just released its results for the December 2014 half-year and our calculations reveal the SAE division generated EBITDA of $22.9 million, which is 30 per cent lower than when the division was purchased.

In contrast, the core University Programs division has continued to grow EBITDA almost like clockwork. We note that from 2016, one of Navitas’ major clients, Macquarie University, has decided to cease its pathways program with the company. While the acquisition of SAE has served to diversify earnings, as originally intended, it has been less than prosperous.

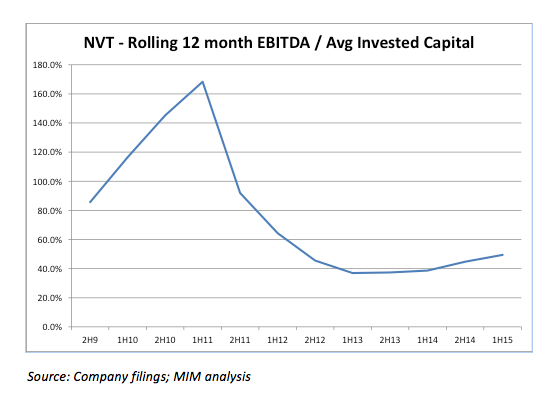

As it is clear that Navitas has been unable to replicate its success with the University Programs division, as shown below, the effect on Group returns has been dramatic.

Keep in mind that Navitas originally purchased SAE on an EBITDA multiple of 8.75x – if this multiple is applied to the most recent earnings, SAE would be worth $200 million today. This represents a loss of $89 million in capital if management is unable to restore historical earnings.

In conclusion, it is important to remember that acquisitions are not guaranteed to add value to a business. Investors must exercise caution when management raises or reinvests capital in non-core businesses in the pursuit of growth.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Duncan Lenton

:

Hi

Do you see the change in Vocus strategy in the same way as above? i.e. joining with spark.

I thought it was a positive move if expansions in plant and labour were to be expected and thus a reduced cashflow? Market doesn’t seem to like it.

Cheers for now

Dunc

Roger Montgomery

:

Thanks Dunc,

Interesting, but don’t thinks so. Keep well and look forward to hearing and seeing more comments Dunc.